- Company Reports

Britannia Industries Limited - Strategy, SWOT and Corporate Finance Report

SWOT Analysis

- September 2023

- ID: 5483692

- Description

Table of Contents

Related topics.

- Purchase Options

- Ask a Question

- Recently Viewed Products

Key Highlights

- Detailed information on Britannia Industries Limited required for business and competitor intelligence needs

- A study of the major internal and external factors affecting Britannia Industries Limited in the form of a SWOT analysis

- An in-depth view of the business model of Britannia Industries Limited including a breakdown and examination of key business segments

- Intelligence on Britannia Industries Limited's mergers and acquisitions (MandA), strategic partnerships and alliances, capital raising, private equity transactions, and financial and legal advisors

- News about Britannia Industries Limited, such as business expansion, restructuring, and contract wins

- Large number of easy-to-grasp charts and graphs that present important data and key trends

Reasons to Buy

- Gain understanding of Britannia Industries Limited and the factors that influence its strategies.

- Track strategic initiatives of the company and latest corporate news and actions.

- Assess Britannia Industries Limited as a prospective partner, vendor or supplier.

- Support sales activities by understanding your customers' businesses better.

- Stay up to date on Britannia Industries Limited's business structure, strategy and prospects.

- Company Snapshot

- Britannia Industries Limited: Company Overview

- Britannia Industries Limited: Overview and Key Facts

- Britannia Industries Limited: Overview

- Britannia Industries Limited: Key Facts

- Britannia Industries Limited: Key Employees

- Britannia Industries Limited: Key Employee Biographies

- Britannia Industries Limited: Major Products and Services

- Britannia Industries Limited: Company History

- Britannia Industries Limited: Management Statement

- Britannia Industries Limited: Locations and Subsidiaries

- Britannia Industries Limited: Key Competitors

- Britannia Industries Limited: Company Analysis

- Britannia Industries Limited: Business Description

- Britannia Industries Limited: SWOT Analysis

- Britannia Industries Limited: SWOT Overview

- Britannia Industries Limited: Strengths

- Britannia Industries Limited: Weaknesses

- Britannia Industries Limited: Opportunities

- Britannia Industries Limited: Threats

- Britannia Industries Limited: Corporate Financial Deals Activity

- Britannia Industries Limited: Financial Deals Overview

- Britannia Industries Limited: Top Deals 2019 - 2023YTD*

- Britannia Industries Limited: Advisors

- Britannia Industries Limited: Top Legal Advisors

- Britannia Industries Limited: Capital Raising

- Britannia Industries Limited: Divestments

- Britannia Industries Limited: Recent Developments

- Britannia Industries Limited: News and Events Summary

- Britannia Industries Limited: Business Expansion

- Britannia Industries Limited: Corporate Governance

- Britannia Industries Limited: Financial Deals

- Britannia Industries Limited: Financial Performance

- Britannia Industries Limited: Red Flags/DistressSignals

- Contact the Analyst

- Methodology

- About the Analyst

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

| License | Format | Properties | Price |

|---|---|---|---|

| The product is a PDF. | This is a single user license, allowing one user access to the product. | EUR$175USD£138GBP | |

| The product is a PDF. | This is a site license, allowing all users within a given geographical location of your organization access to the product. | EUR$350USD£276GBP | |

| The product is a PDF. | This is an enterprise license, allowing all employees within your organization access to the product. | EUR$525USD£414GBP |

DOWNLOAD SAMPLE

Please fill in the information below to download the requested sample.

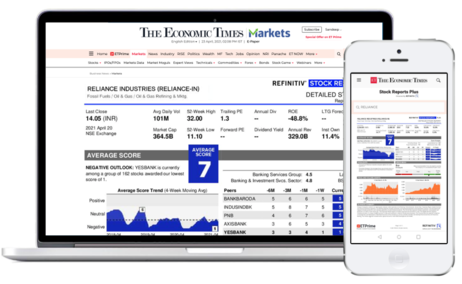

Stock Research Report for Britannia Industries Ltd

Stock score of Britannia Industries Ltd moved up by 1 in 6 months on a 10 point scale (Source: Refinitiv). Get detailed report on Britannia Industries Ltd by subscribing to ETPrime .

Get 4000+ Stock Reports worth ₹ 1,499* with ETPrime at no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

Britannia Industries Limited is an India-based food products company. The Company is primarily engaged in the manufacturing and sale of various food products. The Company's product categories include biscuits, dairy, breads, rusk, cakes and snacking. Its biscuit products include Good Day, Marie Gold, NutriChoice, Milk Bikis, Tiger, 50-50, Jim Jam, Treat, Little Hearts, Pure Magic, Nice Time and Biscafe. The Company's dairy products include cheese, Winkin' Cow, Come Alive Paneer, Come Alive Dahi, ghee and Dairy Whitener. Its bread products include gourmet breads, white bread and wheat flour breads. Its gourmet breads include Fruit Bun, fruit bread, Choco bread and Choco Bun. The Company's white breads include Healthy Slice Bread, Sweet Bread, Vitarich Bread and Sandwich Bread. Its cake products include Gobbles, Fudge, Muffils, Nuts and Raisin Romance Cake, Roll Yo ! and Tiffin Fun. Its snacking products include Treat Croissant, Treat Creme Wafers and Time Pass Salted Snacks.

Britannia Industries 2022 Annual Report Analysis- Top-Line Growth Across All Business, Channels: KRChoksey

- KRChoksey Research

- X (was Twitter)

Choose a plan

DOWNLOAD THE APP

- SECTOR : FMCG

- INDUSTRY : PACKAGED FOODS

- BRITANNIA INDUSTRIES LTD.

Britannia Industries Ltd. NSE: BRITANNIA | BSE: 500825

5855.25 23.85 ( 0.41 %)

Near 52W High of ₹6005.00

525.5K NSE+BSE Volume

NSE 30 Aug, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Detailed Stock Analysis for Britannia Industries Ltd. with Real-time Stock Report

IMAGES

VIDEO

COMMENTS

Britannia Industries Ltd. share price target. Britannia Industries Ltd. has an average target of 6023.33. The consensus estimate represents an upside of 2.87% from the last price of 5855.25. View 20 reports from 7 analysts offering long-term price targets for Britannia Industries Ltd.. Reco - This broker has downgraded this stock from it's ...

Exhibit 1: Volumes from BRIT's base business grew 8% in 4QFY21. BRIT's base business volume growth (%) pany, MOFSLStandalone performance Standalone sales/EBITDA grew 9.7%/13.4% in 4QFY21. while adjusted PAT fell 7.3% YoY. EB. 5%.Imputed subsidiary performance Imputed subsidiary sales grew 1.3% in 4QFY2.

Page | 5 | PHILLIPCAPITAL INDIA RESEARCH BRITANNIA INDUSTRIES QUARTERLY UPDATE Financials Income Statement Y/E Mar, Rs mn FY23 FY24E FY25E FY26E Net sales 159,801 169,836 186,721 205,560 Growth, % 14.6 6.3 9.9 10.1 Other operating income 3,157 2,588 2,770 2,963 Raw material expenses - - - - ...

dy in which they examined Britannia's financial performance over a five-year span (2014-2018). According to the research, the co. pany's net profit increased at a CAGR of 11.8% while its revenue increased at a CAGR of 11.3%. Britannia's robust distribution network, effective supply chain manageme.

Britannia Industries Annual Report Round-Up 15th June 2022. KRChoksey Research is also available on Bloomberg KRCS<GO> Thomson Reuters, Factset and Capital IQ Phone: +91 -226696 5555, Fax: +91 6691 9576 www.krchoksey.com Research Analyst Vikrant Kashyap, [email protected], +91 -22 6696 5413

7 February 2024 Britannia Industries7 February 2024 3QFY24 Results Update |. our estimate; margin levers limitedBritannia Industries (BRIT) reported muted revenue growth in 3QFY24, hit by price cuts and. a slow recovery in the rural market. However, volume growth at 5.5% (pack growth was at 3%) was better than our expectation of 3% due to ...

Volumes grew ~2% for the quarter. Thecompany is making investments in both greenfield and brownfield projects to expand its capacities, which

Britannia Industries Limited - Strategy, SWOT and Corporate Finance Report, is a source of comprehensive company data and information. The report covers the company's structure, operation, SWOT analysis, product and service offerings and corporate actions, providing a 360˚ view of the company.

pdf. Annual Report Mar-2013. pdf. Britannia Industries Limited:Ratings reaffirmed at 'CRISIL AAA / Stable / CRISIL A1+ '; rated amount enhanced for Bank Debt. Britannia Industries Limited:Ratings reaffirmed at 'CRISIL AAA/Stable/CRISIL A1+'. Britannia Industries Limited: Rating withdrawn for Commercial Paper Programme and Unplaced Non ...

Britannia Q4 FY22 Results: Net sales up 13.41%, beats estimates For the quarter ending March 2022, consolidated net sales (including other operating income) ... Disclaimer: This Research Report is for the personal information of the authorized recipient and doesn't construe to be any investment, legal or taxation advice to the investor. ...

This document provides an overview of Britannia Industries Limited's annual report for the financial year 2021-2022. Some key highlights include an increase in revenue from operations but a decrease in profit after tax compared to the previous year. The company faced challenges from high inflation and supply chain issues but focused on cost efficiency, innovation, and distribution. Digital ...

KRChoksey. For Q1FY25, BRIT's revenue was INR 42,504 Mn, up 6.0% YoY (+4.4% QoQ), which was in line with our estimates. The sales growth was driven by high -single-digit volume growth. Britannia Industries Ltd. has gained 29.27% in the last 1 Year. Britannia Industries Ltd.

income) of Britannia Industries has increased 5.51% to Rs 3607.37 crore compared to quarter ended september 2020. Operating profit margin has declined from 19.75% to 15.48%, leading ... The Research Report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied ...

Britannia Industries Ltd is India's largest manufacturer of biscuits and bakery products, with a market share of 38%. It was established in 1892 in Kolkata. Britannia produces biscuits, bread, cakes, rusk, dairy products including milk, butter, cheese, and ghee. In recent quarters, India's GDP growth has slowed significantly due to the COVID-19 pandemic, with Q2 GDP contracting by 23.9% year ...

Results Update | Sector: Consumer. Britannia Industries. Britannia Industries. 2 February 2023 2. Valuation and view. We raise our EPS forecasts between 4% and 6% due to better-than-expected profitability and likely gradual easing of material cost pressures. Our forecasts already factor in the highest ever annual EBITDA margin going forward ...

Britannia Inds Q3FY23 results: NP up 151.20%, beats estimates For the quarter ending Dec 2022, consolidated Net sales (including other operating income) of ... Disclaimer: This Research Report is for the personal information of the authorized recipient and doesn't construe to be any investment, legal or taxation advice to the investor. ...

Britannia Industries, journals, books, and p ublished research thesis. There are 100 Sample respondents are taken for in this research paper t hrough Convenience Sampling Method.

We now build in EBITDA margins of 17.6% & 17.9% in FY24/25 (18.8% & 18.5% earlier) vs 17.4% in FY23 (one time PLI gains of ~50bps for FY23 and 240bps in 4Q23). BRIT's long term growth drivers are intact with 1) 28k rural preferred dealers 2) rising share of MT sales with improved mix 3) higher growth in focus states and 4) cost efficiency ...

Britannia Industries Ltd reported a consolidated net profit of Rs 457.55 crore for the June quarter of FY24, registering a growth of 36 percent from Rs 337.44 crore posted a year back. The company's revenue increased 8 percent to Rs 4,010.70 crore from Rs 3,700.96 crore a year ago. Other income up 3% to Rs 56.92 crore.

Stock Research Report for Britannia Industries Ltd. Stock score of Britannia Industries Ltd moved up by 1 in 6 months on a 10 point scale (Source: Refinitiv). Get detailed report on Britannia Industries Ltd by subscribing to ETPrime. Get 4000+ Stock Reports worth₹ 1,499* with ETPrime at no extra cost for you.

BQ Prime's special research section collates quality and in-depth equity and economy research reports from across India's top brokerages, asset managers and research agencies. These reports offer BQ Prime's subscribers an opportunity to expand their understanding of companies, sectors and the economy. ... Britannia Industries 2022 Annual ...

A real time stock report for Britannia Industries Ltd. with fundamental analysis, technicals, estimates and shareholding for better decisions. Markets Today Top Gainers ... All News Earnings Calls Corporate Announcements Research Reports. Reports;