Penn Libraries FAQ

- Penn Libraries

Q. How do I find analyst reports (investment bank research)?

- Exhibitions

- Fisher Fine Arts

- General Information

- Phased Library Services

- Rare Books & Special Collections

- Systematic Reviews

- University Archives & Records Center

Answered By: Lippincott Library Last Updated: Apr 21, 2024 Views: 180445

Use LSEG Workspace (formerly Refinitiv).

- To find analyst reports (also known as sell-side, broker, or equity research reports) for a specific company, search for that firm's ticker symbol or name in the top search box. Then, on the News & Research menu, click on Company Research . Use filters near the top of the page to refine your search.

- To screen for analyst reports based on a set of criteria, type ADVRES in the search bar and select the Research Advanced Search app, or click on Research in the main menu. then, click on Advanced Research . You can filter for reports by industry, geography, contributor, keywords, and more.

Note: LSEG Workspace has a 150-page daily limit for viewing and downloading research content. This limit is in lieu of retail prices listed on reports and resets at 12:00 AM Eastern Time daily.

Bloomberg (see access details ) contains some analyst reports.

- Type your company's ticker symbol, then hit the yellow EQUITY key, then type DSCO and hit the green GO key.

- To find reports by industry or keyword, type RES and hit the green GO key.

Morningstar equity research reports and analyst cash flow models can be found in PitchBook .

Hoovers contains some analyst reports as well.

- Type in a company name and select the company you want.

- Scroll down the screen; if available, analyst reports appear under Advanced on the left side.

- Share on Facebook

Was this helpful? Yes 0 No 0

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in an Equity Research Report?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Even though you can easily find real equity research reports via the magical tool known as “Google,” we’ve continued to get questions on this topic.

Whenever I see the same question over and over again, you know what I do: I bash my head in repeatedly and contemplate jumping off a building…

…and then I write an article to answer the question.

To understand an equity research report, you must understand what goes into a stock pitch first.

The idea is similar, but an ER report is a “watered-down” version of a stock pitch.

But banks have some very solid reasons for publishing equity research reports:

Why Do Equity Research Reports Matter?

You might remember from previous articles that equity research teams do not spend that much time writing these reports .

Most of their time is spent speaking with management teams and institutional investors and sharing their views on sectors and companies.

However, equity research reports are still important because:

- You do still spend some time doing the required modeling work (~15%) and writing the reports (~20%).

- You might have to write a research report as part of the interview process.

For example, if you apply to an equity research role or an equity research internship , especially in an off-cycle process, you might be asked to draft a short report on a company.

And then in roles outside of ER, you need to know how to interpret reports quickly and extract the key information.

Equity Research Reports: Myth vs. Reality

If you want to understand equity research reports, you have to understand first why banks publish them: to earn higher commissions from trading activity.

A bank wants to encourage institutional investors to buy more shares of the companies it covers.

Doing so generates more trading volume and higher commissions for the bank.

This is why you rarely, if ever, see “Sell” ratings, and why “Hold” ratings are far less common than “Buy” ratings.

Different Types of Equity Research Reports

One last point before getting into the tutorial: There are many different types of research reports.

“Initiating Coverage” reports tend to be long – 50-100 pages or more – and have tons of industry research and data.

“Sector Reports” on entire industries are also very long. And there are other types, which you can read about here .

In this tutorial, we’re focusing on the “Company Update” or “Company Note”-type reports, which are the most common ones.

The Full Tutorial, Video, and Sample Equity Research Reports

For our full walk-through of equity research reports, please see the video below:

Table of Contents:

- 1:43: Part 1: Stock Pitches vs. Equity Research Reports

- 6:00: Part 2: The 4 Main Differences in Research Reports

- 12:46: Part 3: Sample Reports and the Typical Sections

- 20:53: Recap and Summary

You can get the reports and documents referenced in the video here:

- Equity Research Report – Jazz Pharmaceuticals [JAZZ] – OUTPERFORM [BUY] Recommendation [PDF]

- Equity Research Report – Shawbrook [SHAW] – NEUTRAL [HOLD] Recommendation [PDF]

- Equity Research Reports vs. Stock Pitches – Slides [PDF]

If you want the text version instead, keep reading:

Watered-Down Stock Pitches

You should think of equity research reports as “watered-down stock pitches.”

If you’ve forgotten, a hedge fund or asset management stock pitch ( sample stock pitch here ) has the following components:

- Part 1: Recommendation

- Part 2: Company Background

- Part 3: Investment Thesis

- Part 4: Catalysts

- Part 5: Valuation

- Part 6: Investment Risks and How to Mitigate Them

- Part 7: The Worst-Case Scenario and How to Avoid It

In a stock pitch, you’ll spend most of your time and energy on the Catalysts, Valuation, and Investment Risks because you want to express a VERY different view of the company .

For example, the company’s stock price is $100, but you believe it’s worth only $50 because it’s about to report earnings 80% lower than expectations.

Therefore, you recommend shorting the stock. You also recommend purchasing call options at an exercise price of $125 to limit your losses to 25% if the stock moves in the opposite direction.

In an equity research report, you’ll still express a view of the company that’s different from the consensus, but your view won’t be dramatically different.

You’ll spend more time on the Company Background and Valuation sections, and far less time and space on the Catalysts and Risk Factors. And you won’t even write a Worst-Case Scenario section.

If a company seems overvalued by 50%, a research analyst would probably write a “Hold” recommendation, say that there’s “uncertainty around several customers,” and claim that the company’s current market value is appropriate.

Oh, and by the way, one risk factor is that the company might report lower-than-expected earnings.

The Four Main Differences in Equity Research Reports

The main differences are as follows:

1) There’s More Emphasis on Recent Results and Announcements

For example, how does a recent product announcement, clinical trial result, or earnings report impact the company?

You’ll almost always see recent news and updates on the first page of a research report:

These factors may play a role in hedge fund stock pitches as well, but more so in short recommendations since timing is more important there.

2) Far-Outside-the-Mainstream Views Are Less Common

One comical example of this trend is how all 15 equity research analysts covering Enron rated it a “buy” right before it collapsed :

Sell-side analysts are far less likely to point out that the emperor has no clothes than buy-side analysts.

3) Research Reports Give “Target Prices” Rather Than Target Price Ranges

For example, the company is trading at $50.00 right now, but we expect its price to increase to exactly $75.00 in the next twelve months.

This idea is completely ridiculous because valuation is always about the range of possible outcomes, not a specific outcome.

Despite horrendously low accuracy , this practice continues.

To be fair, many analysts do give target prices in different cases, which is an improvement:

4) The Investment Thesis, Catalysts, and Risk Factors Are “Looser”

These sections tend to be “afterthoughts” in most reports.

For example, the bank might give a few reasons why it expects the company’s share price to rise: the company will capture more market share than expected, it will be able to increase its product prices more rapidly than expected, and a competitor is about to go bankrupt.

However, the sell-side analyst will not tie these factors to specific share-price impacts as a buy-side analyst would.

Similarly, the report might mention catalysts and investment risks, but there won’t be a link to a specific valuation impact from each factor.

So the typical stock pitch logic (“We think there’s a 50% chance of gaining 80% and a 50% chance of losing 20%”) won’t be spelled out explicitly:

Your Sample Equity Research Reports

To illustrate these concepts, I’m sharing two equity research reports from our financial modeling courses :

The first one is from the valuation case study in our Advanced Financial Modeling course , and the second one is from the main case study in our Bank Modeling course .

These are comprehensive examples, backed by industry data and outside research, but if you want a shorter/simpler example you can recreate in a few hours, the Core Financial Modeling course has just that.

In each case, we started by creating traditional HF/AM stock pitches and valuations and then made our views weaker in the research reports.

The Typical Sections of an Equity Research Report

So let’s briefly go through the main sections of these reports, using the two examples above:

Page 1: Update, Rating, Price Target, and Recent Results

The first page of an “Update” report states the bank’s recommendation (Buy, Hold, or Sell, sometimes with slightly different terminology), and gives recent updates on the company.

For example, in both these reports we reference recent earnings results from the companies and expectations for the next fiscal year:

We also give a “target price,” explain where it comes from, and give our estimates for the company’s key financial metrics.

We mention catalysts in both reports, but we don’t link anything to a specific valuation impact.

One problem with providing a specific “target price” is that it must be based on specific multiples and specific assumptions in a DCF or DDM.

So with Jazz, we explain that the $170.00 target is based on 20.7x and 15.3x EV/EBITDA multiples for the comps, and a discount rate of 8.07% and Terminal FCF growth rate of 0.3% in the DCF.

Next: Operations and Financial Summary

Next, you’ll see a section with lots of graphs and charts detailing the company’s financial performance, market share, and important metrics and ratios.

For a pharmaceutical company like Jazz, you might see revenue by product, pricing and # of patients per product per year, and EBITDA margins.

For a commercial bank like Shawbrook, you might see loan growth, interest rates, interest income and net income, and regulatory capital figures such as the Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) ratios:

This section of the report explains how the analyst or equity research associate forecast the company’s performance and came up with the numbers used in the valuation.

The valuation section is the one that’s most similar in a research report and a stock pitch.

In both fields, you explain how you arrived at the company’s implied value, which usually involves pasting in a DCF or DDM analysis and comparable companies and transactions.

The methodologies are the same, but the assumptions might differ substantially.

In research, you’re also more likely to point to specific multiples, such as the 75 th percentile EV/EBITDA multiple, and explain why they are the most meaningful ones.

For example, you might argue that since the company’s growth rates and margins exceed the medians of the set, it deserves to be valued at the 75 th percentile multiples rather than the median multiples:

Investment Thesis, Catalysts, and Risks

This section is short, and it is more of an afterthought than anything else.

We do give reasons for why these companies might be mis-priced, but the reasoning isn’t that detailed.

For example, in the Shawbrook report we state that the U.K. mortgage market might slow down and that regulatory changes might reduce the market size and the company’s market share:

Those are legitimate catalysts, but the report doesn’t explain their share-price impact in the same way that a stock pitch would.

Finally, banks present Investment Risks mostly so they can say, “Well, we warned you there were risks and that our recommendation might be wrong.”

By contrast, buy-side analysts present Investment Risks so they can say, “There is a legitimate chance we could lose 50% – let’s hedge against that risk with options or other investments so that our fund does not collapse .”

How These Reports Both Differ from the Corresponding Stock Pitches

The Jazz equity research report corresponds to a “Long” pitch that’s much stronger:

- We estimate its intrinsic value as $180 – $220 / share , up from $170 in the report.

- We estimate the per-share impact of each catalyst: price increases add 15% to the share price, more patients from marketing efforts add 10%, and later-than-expected generics competition adds 15%.

- We also estimate the per-share impact from the risk factors and conclude that in the worst case , the company’s share price might decline from $130 to $75-$80. But in all likelihood, even if we’re wrong, the company is simply valued appropriately at $130.

- And then we explain how to hedge against these risks with put options.

The same differences apply to the Shawbrook research report vs. the stock pitch, but the stock pitch there is a “Short” recommendation where we claim that the company is overvalued by 30-50%.

And that sums up the differences perfectly: A Short recommendation with 30-50% downside in a stock pitch turns into a “Hold” recommendation with roughly equal upside and downside in a sell-side research report.

I’ve been harsh on equity research here, but I don’t want to disparage it too much.

There are many positives: You do get more creativity than in IB, it might be better for hedge fund or asset management exits, and it’s more fun to follow companies than to grind through grunt work on deals.

But no matter how you slice it, most equity research reports are watered-down stock pitches.

So, make sure you understand the “strong stuff” first before you downgrade – even if your long-term goal is equity research.

You might be interested in:

- The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

- Private Equity Regulation : 2023 Changes and Impact on Finance Careers

- Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

15 thoughts on “ What’s in an Equity Research Report? ”

Hi Brian, what softwares are available to publish Research Reports?

We use Word templates. Some large banks have specialized/custom programs, but not sure how common they are.

Is it possible if you can send me a template in word of an equity report? It will help the graduate stock management fund a lot at Umass Boston.

We only have PDF versions for these, but Word should be able to open any PDF reasonably well.

Do you also provide a pre constructed version of an ER in word?

We have editable examples of equity research reports in Word, but we generally only share PDF versions on this site.

Hey Brian Can you please help me with coverage initiated reports on oil companies. I could not find them on the net. I need to them to get equity research experience, after which only I will be able to get into the field. I searched but reports could not be found even for a price. Thanks

We have an example of an oil & gas stock pitch on this site… do a search…

https://mergersandinquisitions.com/oil-gas-stock-pitch/

Beyond that, sorry, we cannot look for reports and then share them with you or we’d be inundated with requests to do that every day.

No worries. Thanks!

Hi! Brian! Do u know how investment bankers design and layout an equity research? the software they use. like MS Word, Adobe Indesign or something…? And how to create and layout one? Thanks

where can I get free equity research report? I am a Chinese student and now study in Australia. Is the Morning Star a good resource for research report?

Get a TD Ameritrade to access free reports there for certain companies.

How do you view the ER industry since the trading commission has been down 50% since 2007. And there are new in coming regulation governing the ER reports have to explicitly priced and funds need to pay for the report explicity rather than as a service comes free with brokerage?

In addition the whole S&T environment is becoming highly automated.

People have been predicting the death of equity research for over a decade, but it’s still here. It may not be around in 100 years, but it will still be around in another 10 years, though it will be smaller and less relevant.

Yes, things are becoming more automated, but the actual job of an equity research analyst or associate hasn’t changed dramatically. A machine can’t speak with investors to assess their sentiment on a company – only humans can do that.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

Seeing Is Believing

Sell-side Equity Research in a Nutshell

Updated: April 2 2023

By: Noah Edis

There’s a reason Wall Street banks are known as “The Sell-Side” – it’s because their primary business is to help companies raise money by selling stocks and bonds. And the people who work in this division are called equity researchers, or just “analysts.”

Their job is to study individual companies and figure out whether they’re a good investment. They track things like earnings, revenue, and profit margins, and then make reports for their clients to guide them about whether or not to buy or sell shares of that company’s stock.

But it’s not just about picking winning stocks. Equity researchers are also responsible for coming up with new investment ideas and helping to shape the overall market outlook. To do that, they need a solid understanding of financial statements and accounting concepts, as well as experience in fundamental analysis and valuation.

But how does this impact your investment choices? Let’s take a closer look.

What Do Sell-Side Equity Research Analysts Do?

Sell-side equity research analysts are responsible for providing analysis and reports for clients, typically institutional investors such as hedge funds, mutual funds, and pension funds.

The sell-side equity research department is responsible for the generation of new ideas and the production of high-quality analysis. The department is usually divided into sector teams, each of which covers a particular industry or group of companies.

These are analysts and associates. Analysts are the people who produce the actual research reports, while associates support them by conducting fieldwork, gathering data, and performing other tasks.

Their work process can be categorized into three main tasks:

- Information Gathering

Sell-side equity analysts are responsible for gathering information about the companies that they cover. This includes both financial information and non-financial information.

Research analysts can obtain financial information from a variety of sources, including company filings, earnings calls, and analyst presentations. On the other hand, they can gather non-financial information through fieldwork, such as meeting with company management or visiting factories.

Once the necessary information has been gathered, it must be analyzed to make investment reports. This analysis typically takes the form of financial modeling, which is used to forecast a company’s future performance.

- Report Writing

Sell-side equity research reports contain information on companies’ past performance, current situation, and future prospects. It also includes the analyst’s rating (e.g., buy, hold, or sell) and price target for the stock. The reports are then distributed to the firm’s clients to help them make investment decisions.

Buy-Side vs. Sell-Side Analysts: What’s The Difference?

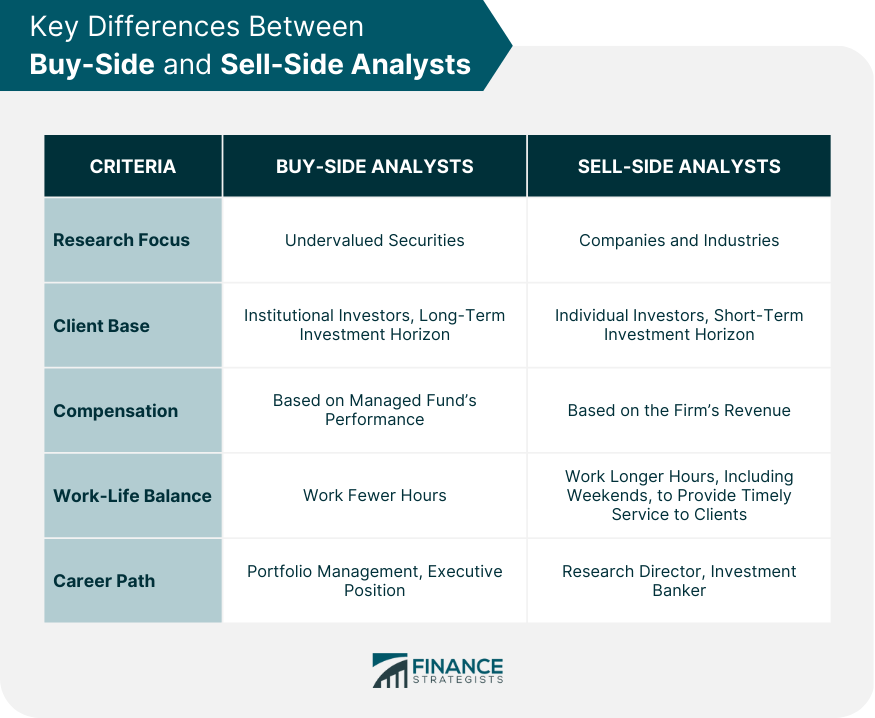

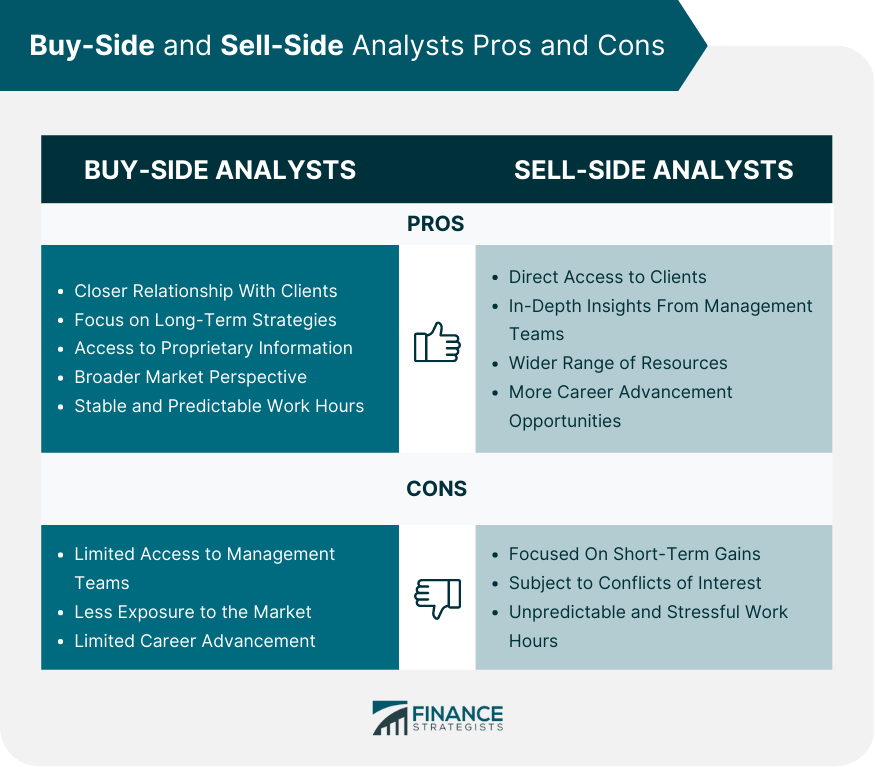

The main difference between buy-side and sell-side analysts is the type of client that they work for. Buy-side analysts work for institutional investors, such as hedge funds and mutual funds. Meanwhile, sell-side analysts work for banks and other financial institutions.

Another difference is the type of research that they produce. Buy-side analysts tend to produce more in-depth, fundamental research. In contrast, sell-side analysts tend to produce shorter, more concise research reports.

A final difference is the compensation structure. Buy-side analysts are typically paid a salary plus a bonus based on their performance. On the other hand, sell-side analysts are typically paid a salary plus a commission based on the number of research reports they sell.

What Is The Difference Between Equity Research And Investment Banking?

There is some overlap between equity research and investment banking, as analysts at investment banks may also do research on companies. However, the two functions are separate, and analysts typically specialize in one or the other.

Basically, investment bankers are responsible for helping companies raise money by issuing and selling securities. Equity researchers, on the other hand, provide analysis of publicly traded companies.

What Is The Difference Between An Analyst And An Associate?

An analyst is typically the title given to someone who has been working in equity research for a few years and has gained some experience. In contrast, an associate is someone new to the field and still learning the ropes.

Analysts typically have more responsibility than associates, such as creating reports and making client presentations. They may also be involved in meeting with company management and other investors.

Associates typically assist analysts in their work and learn from them. They may also have some responsibility for creating reports, but their primary role is to learn about the industry and the market.

What Is a Sell-Side Equity Research Report?

An equity research report is a document that provides an in-depth analysis of a particular stock. The report typically includes a company overview, financials, valuation, and analyst commentary.

The main purpose of an equity research report is to help investors make informed decisions about whether or not to invest in a particular stock. The report should provide an objective overview of the company’s financials and valuation, as well as the analyst’s opinion on the stock.

Here are the typical components of an equity research report:

- Company overview – This section provides a brief overview of the company, including its business model, key products and services, and competitive landscape.

- Financials – This section includes a detailed breakdown of the company’s financial performance, including revenue, operating income, net income, and EPS.

- Valuation – This section provides a valuation of the company, including its price-to-earnings (P/E) ratio and enterprise value-to-EBITDA (EV/EBITDA) ratio.

- Analyst commentary – This section includes the analyst’s opinion on the stock, including whether or not it is a buy, sell, or hold.

- Investment risks – This section discusses the key risks associated with investing in the company.

- Catalyst – This section includes a discussion of the key events or factors that could impact the company’s stock price.

Different types of sell-side equity research reports

There are three main types of equity research reports:

- Top-down analysis – This type of report starts with a macroeconomic overview of the market, then drills down to individual sectors and companies.

- Bottom-up analysis – This type of report starts with a detailed analysis of individual companies, then drills up to sector and market level.

- Hybrid analysis – This type of report combines elements of both top-down and bottom-up analysis.

Why Sell-Side Equity Research is Valuable

Sophisticated professional investors.

The main customers of sell-side equity research are professional investors, such as money managers, hedge funds, and pension funds. These investors rely on research reports to help them make informed investment decisions. Outside suggestions may be of limited value because you will almost definitely do your own due diligence before investing.

Mitigate Risk

One of the primary goals of sell-side equity research is to help mitigate risk for investors. By providing accurate and timely information, analysts can help investors avoid making costly mistakes in their stock picks.

Get an Edge on the Competition

Many professional investors subscribe to multiple research reports to get a broad overview of the market. This gives them an edge over investors who only rely on their own analysis.

Get Unbiased Information

Remember that analysts are not always right about their analyses. However, by subscribing to a variety of research reports, you can get a more balanced view of the market and make better investment decisions. In addition, sell-side equity research informs investors of the latest news and developments in the constantly changing equity market.

Enhanced Corporate Access

Regulations make it impossible for corporate management teams to selectively provide important information to investors, posing a problem for huge fund managers who frequently require precise information when appraising a stock.

To get around this, fund managers frequently attend meetings sponsored by sell-side companies with contacts with executives of their research subjects, where they may meet company management teams.

Sell-side businesses’ institutional customers can also convey the most important issues they wish to see addressed by corporate management in quarterly earnings conference calls and reports.

Idea Generation

Sell-side equity research reports can be a valuable source of investment ideas. By reading these reports, you can get a better understanding of the companies that interest you and the stocks worth watching.

Creating Context

For skilled investors, reports may be most valuable as a way to establish a meta viewpoint. Short-term variables significantly impact stock values, so investors may learn about price fluctuations by keeping an eye on the whole research environment.

Consuming research also enables investors to assess the temperature of the sector and compare current conditions to previous happenings. In the market, history tends to repeat itself, thanks in part to the industry’s inclination to shake during collapses and attract new professionals during bull runs.

Having a detached viewpoint can help illuminate cyclical tendencies, making it simpler to spot alarming signs that might otherwise go unnoticed by the untrained eye. As a result, new investment possibilities are generated.

That said, investors should avoid research that just reinforces their own prejudice – a powerful factor that has undoubtedly contributed to market booms and collapses in the past.

Challenges When Choosing a Sell-Side Equity Researcher

Many analyst reports are available for free on the internet. The sheer number of firms providing sell-side equity research can be overwhelming for investors.

So how can you determine which research reports are worth your time and money?

Here are a few factors to consider when choosing a sell-side equity research analyst:

- Consider the firm’s reputation

First is the reputation of the sell-side equity research firm. Does the firm have a good track record? Are its reports well-regarded by other investors?

- Consider the analyst’s experience

Second, consider the experience of the analyst who wrote the report. How long has the analyst been covering the stock? Does the analyst have a good track record?

- Consider the firm’s coverage universe

Third, consider the firm’s coverage universe. Does the firm cover a lot of stocks or just a few? If the firm only covers a few stocks, is your stock one of them?

- Consider conflicts of interest

Fourth, be aware of any potential conflicts of interest. Does the firm have a banking relationship with the company? Does the firm’s parent company have a business relationship with the company?

- Consider the price

Finally, consider the price. How much does the report cost? Is it worth the price for the information it provides?

These are just a few factors to consider when choosing a sell-side equity research analyst. Ultimately, you should use your own judgement to decide which reports are worth your time and money.

However, what if there’s a way to view all these analysts’ price targets and ratings in one place?

Welcome to AnaChart. AnaChart is the only website that shows analysts’ past and present action. Other sites present current price targets, but none show previous ones for users to get context other than AnaChart.

Easily find and follow any analyst that outperforms the market. AnaChart assists you in determining which analyst price goals and ratings are essential so that you can feel more confident in your investments and spend less time worrying.

AnaChart’s simple, elegant design makes it easy to find and track the analysts you care about. Simply enter a ticker symbol to view an interactive chart of the stock price over time.

By comparing it to the previous day’s close, you can also see how much the stock has risen or fallen above and below the strike price over time.

You can also view the price target history for each analyst. This way, you can quickly and easily see how accurate the analyst has been in the past and get an idea of whether or not their current ratings are likely to be accurate.

In addition to price targets, you’ll also see analyst ratings (strong buy, buy, hold, underperform, sell) on the chart. This lets you quickly see how bullish or bearish the analysts are on a particular stock.

Also, outside ratings and price targets, you will get the following:

- Line per analyst per stock — separately and together

- Duration since the last posted price target

- The frequency of stock prices realizing price targets

- The average time it takes for price targets to be realized

- Performance scores for stocks so you can identify which analyst model works best

- Statistics regarding average success on analysts price targets fulfillment and average duration in doing so

AnaChart is the only website that provides all this information in one place. So, if you’re looking for an easy way to find and follow the best sell-side equity research, AnaChart is the place to go.

An Ultimate Guide to Equity Research

This post was originally published on August 15, 2019 and was updated for relevance on July 29, 2024.

Equity research is a specialized field within the finance industry that analyzes public companies, industries, and the overall economy. It helps investors make informed decisions about buying, holding, or selling investments.

In this guide, we’ll explore equity research, its definition, how to conduct research analysis, what goes into a research report, the various roles involved, key considerations when selecting an equity research firm, career pathways into the equity research industry, and more.

With that, let’s get started.

What is equity research?

Before we discuss equity research, it’s important to understand the concept of equity. Equity is the full ownership of an asset once its associated debts have been settled. Equity research, or “securities research,” refers to the process investment banks use to understand a company's overall equity or value.

Equity analysts, often working within an investment bank, lead this process. They create documents that delineate the equity in question within the context of the business, its management, the broader industry, and the economic landscape.

The larger the investment bank, the more reports an equity research team will tend to produce, and the analysis included will be more detailed. Examples of analysis include:

- Review of how the macroeconomic picture is likely to affect the company

- Operational changes or investments that are likely to affect the company’s performance

- Review the company’s financial statements and explanation of changes

- Projections on the status of the company’s revenue (and share price) and where it’s headed

- Recommendations on whether to buy, hold, or sell the company’s equity

How to conduct equity research analysis

Research is the name of the game. An Equity Research Analyst is responsible for providing vetted and trusted insights to make sound and informed investment decisions. This process is typically broken into four stages:

1. Thorough Research

Equity Research Analysts focus on specific regions and sectors. They leave no stone unturned in conducting extensive research, thoroughly reviewing financial reports, balance sheets in Excel, earnings releases, industry trends, regulatory changes, macroeconomic factors, and more that could impact the companies they are analyzing.

2. Financial Modelling & Valuation

Financial modeling involves creating mathematical representations of a company's financial performance by forecasting future results based on historical data and assumptions. Valuation is used to determine the fair value of a company's stock using methods such as discounted cash flow analysis and comparable company analysis. These tools help evaluate a company's financial health and growth potential to advise on investments.

3. Creating Equity Research Reports

Equity Research Analysts are responsible for condensing their findings into easily understandable reports for investors. We'll expand on this more in the next section.

4. Communication Skills & Publication

Equity Research Analysts in senior or lead positions often present their findings to their organization or client base. These individuals must be able to simplify complex financial data, so strong communication and presentation skills are essential.

What is an equity research report?

Buy-side or sell-side, an equity research report typically includes the following:

- An industry research overview that covers trends and news related to competing companies.

- A company overview that includes any recent business developments and quarterly performance results.

- The equity analyst provides an investment thesis explaining the reasons behind their prediction of the stock's performance. This section also includes the target share price, which many consider the most critical aspect of the report.

- A financial model-based forecast of the company's income, cash flow, and valuation.

- Risks associated with the stock.

Difference between a career in equity research and investment banking

Investment banking and equity research are similar but have clear distinctions in their intended outcome. Investment banking is all about helping companies raise money through stocks and bonds, offering mergers and acquisitions services, and managing significant financial deals.

Equity research involves evaluating individual stocks and providing investment advice based on their potential value and performance.

In essence, investment banking focuses on managing financial transactions, while equity research focuses on analyzing and valuing individual stocks.

When considering a career between the two, it's imperative to evaluate the following factors:

1. Educational Background

Both career paths require a bachelor's degree in economics, accounting, finance, or engineering. For career growth, a Chartered Financial Analyst (CFA) designation is often required for Equity Research Analysts, while investment banking can require a Master of Business Administration (MBA). Additionally, investment bankers must pass the Series 79 exam , which measures the knowledge needed to perform the critical functions of an investment banking representative.

2. Career Path

In investment banking, the career path is straightforward. It starts with being an analyst, then an associate, and climbing to higher positions. In equity research, the career path could be more transparent. Typically, it involves transitioning from associate to analyst, senior analyst, and then to the role of vice president or director of research. Investment bankers have better opportunities to reach top positions because of their involvement in making deals and managing clients. They often go on to work for private equity firms for venture capitalists. Research analysts are frequently seen solely as number crunchers and not thought of as being able to drive substantial business growth.

3. Skill Set

It should come as no surprise that Equity Research Analysts require strong analytical and mathematical skills to handle complex calculations, build predictive models, and prepare financial statements. They must also be proficient communicators capable of simplifying complex financial data. As for investment bankers, financial modeling and industry analysis are crucial early in their careers. However, as they advance, they transition to a sales-oriented mindset, excelling at closing deals and managing client relationships.

4. Work-Life Balance

Equity research is known for long hours, particularly during earnings season, but there are periods of relative calm. Investment banking is another beast, typically requiring brutal hours, often up to 100 hours per week. A recent article in Forbes highlighted that work-life balance has become a significant concern in investment banking. This is particularly after the reported deaths of two Bank of America employees who were said to be working up to 110 hours per week.

5. Recognition

Equity research reports offer visibility to associates and junior analysts. Senior analysts are sought after by the media for comments on the companies they cover. Junior investment bankers work in obscurity but gain visibility as they progress in their careers. Visibility for investment bankers significantly increases when they work on large, prestigious deals.

6. Compensation

Investment banking generally offers higher earning potential compared to equity research. For example, according to Wall Street Oasis (WSO), investment banking associates earn between $150,000 and $200,000 with substantial bonuses, while senior vice presidents or managing directors earn over $400,000 annually. WSO also says entry-level analysts start between $50,000 and $80,000 and have the potential to make up to $500,000 as they grow to leadership positions.

Roles in equity research

In the world of equity research, it is crucial to understand the distinction between a buy-side and sell-side Equity Research Analyst. Below, we'll outline their respective areas of focus and ultimate objectives.

1. Sell-side analysts

Sell-side Equity Research Analysts work for investment banks and provide their clients with sell-side research and recommendations on stocks and other financial instruments. Their primary goal is to generate trading commissions and investment banking business for their firm.

2. Buy-side analysts

A buy-side Equity Research Analyst works for institutions that buy and sell securities, such as mutual funds, hedge funds, and pension funds. Their role involves researching and making investment recommendations for their firm's portfolios.

Best Equity Research Firms

Below are some of the top-ranking equity search firms.

- JP Morgan —J.P. Morgan’s Research team uses state-of-the-art technologies and innovative tools to provide clients with top-notch analysis and investment advice.

- Barclays —The equity research teams cover hundreds of stocks across the Americas and Europe, delivering event analysis, stock ideas, and sector themes. They collaborate with other teams to offer clients unique, cross-asset perspectives on industries and markets.

- Credit Suisse AG —The team has original research on over 3,000 companies with thought-provoking thematic analysis, differentiated trading ideas, and coordinated global views.

- Bank of America Financial Center —The company offers comprehensive research and analysis for both institutional and retail clients. It encompasses over 4,000 companies across 35 global sectors in developed and emerging markets. Its research involves fundamental and technical analysis as well as hedging strategies.

- Morgan Stanley —Through timely, in-depth analysis of companies, industries, markets, and world economies, Morgan Stanley has earned its reputation as a leader in investment research.

Things to consider when hiring an equity research firm

When evaluating an equity research firm, it’s essential to consider the experience and reputation of its analysts, the firm’s track record of accurate stock picks and recommendations, the depth and quality of their research reports, the firm's access to company management and industry experts, their industry specialization, the firm's coverage universe, the timeliness of their research, and the overall transparency and integrity of their research process.

How to get into equity research

If you are considering entering the equity research space, you will likely need a finance, accounting, or economics background. Many professionals in this field begin with a bachelor's degree in finance or a related field. Those seeking career advancement often pursue a master's degree or a CFA designation to enhance their resume.

Research assistant, junior analyst, or equity research associate are common entry-level roles. Advancing in your career will require gaining experience in financial analysis, modeling, and report writing. Developing a solid network of connections within the industry is also crucial for discovering new opportunities in equity research. Like all areas of business, networking is critical.

Staying up to date on the latest trends and news within the equity research space is important for understanding the workings of the stock market and developing strong analytical and critical thinking skills. This is crucial for ensuring high-quality, long-lasting success in equity research.

The Importance of Equity Research

As we've discussed, equity research is essential for investors as it provides valuable information and investment recommendations. It involves digging into company finances, creating financial models, and meeting with industry experts.

Equity research supports investment decisions, evaluates securities, and guides investors and fund managers. For example, it helps predict the future growth potential of tech companies, find investment opportunities in the pharmaceutical industry, and understand how macroeconomic trends affect different sectors and stocks.

Final Thoughts

Equity research is crucial in empowering investors to make informed investment decisions. Through comprehensive analysis of financial data, market trends, and company performance, equity research provides valuable insights that enable investors to identify attractive opportunities and manage their portfolios effectively. By leveraging the expertise of research analysts and utilizing robust analytical techniques, investors can gain a deeper understanding of the risks and potential returns associated with specific investment opportunities. Ultimately, equity research is a fundamental tool for institutional and retail investors, helping them navigate the complexities of the financial markets with confidence and clarity.

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

Search Broker Reports From 1,000+ Sources In Seconds with AlphaSense

Explore the many ways broker research and reports on the AlphaSense platform can power faster, smarter insights and decision-making for your organization.

of the top consultancies

of the top asset management firms

largest pharmaceutical companies

of the S&P 100

Traditionally considered a source of insight for sell-side firms, broker research and reports now provide critical insight for corporate and consulting professionals . In addition, corporate strategy professionals are increasingly turning to broker research to analyze market landscapes and better understand analyst assessments of market and industry trends, as well as performance of competitive peers.

However, manually finding broker reports and extracting the insights they contain requires significant time and effort—think multiple search engine queries and hours of combing through countless documents to identify important information. And even when you locate the right reports, broker research is often stuck behind frustrating paywalls.

The AlphaSense platform transforms the research experience by providing you with access to top broker research and other premium content and data sources , such as Wall Street Insights® , all within a single, centralized platform.

With AI search technology supporting your research, you’ll also be able to quickly identify insights to uncover new opportunities, stay one step ahead of your market competitors, and deliver exceptional results for your clients.

Wall Street Insights®

AlphaSense provides global reports from 1,000+ research providers (comprised of sell-side analysts, strategists, and research teams) that cover companies, industries, asset classes, and economies.

Our default proprietary offering Wall Street Insights® features equity research from the world’s leading brokerage firms including, but not limited to:

- Goldman Sachs

- Morgan Stanley

- Credit Suisse

Wall Street Insights® showcases both real-time and after-market research, is sourced from both broker partnerships and vendors, and covers North America, EMEA, APAC, and LATAM regions.

With Wall Street Insights®, you can conduct more comprehensive competitive analysis , improve client interactions, enhance internal research and strategy, and save your organization time and money with AI and automations.

Broker Reports You Can Access on the AlphaSense Platform

On the AlphaSense platform, users can access several critical types of equity research reports, including:

- Upgrades/downgrades: published when a stock analyst changes their opinion of a stock, and subsequently, their investment recommendation

- Estimate / price target revisions: published when an analyst revises their previous price target (their prediction of the future price of a security)

- Initiation reports: published when a broker first begins covering a company

- Credit research

- All other company reports

- Industry reports – Analyze a set of companies within the same industry

- Fixed income reports – Demonstrate maturity distribution of portfolios

- Economic/macro reports – Shares analysts’ views on growth expectations, inflation, stock market volatility, and global market trade

- Commodities reports – Provide analysis of commodities within a particular industry, published weekly or monthly

Unlock Market Moving Insights Faster with AI & Automation

When you rely on an equity research platform that utilizes the power of AI search technology, you can be more confident in your research, knowing you are no longer at the mercy of human error. AlphaSense also allows you to automate certain research processes that previously would have required hours of manual work, streamlining your entire process so you can take action and make mission-critical decisions faster than ever.

Here’s how our semantic search and smart automations can transform your workflow:

Smart Search

Smart Search technology doesn’t just recognize the keywords included in your query—it understands the intent behind your search, delivering content sources with the highest relevance and value to your search. It allows you to find all relevant data points with a single search, saving countless hours and increasing precision in your research.

Additionally, broker research is often inconsistently tagged because different firms may use different classification taxonomies, or include their own terms to define industries and trends. In addition to recognizing relevant language patterns, Smart Search assigns correct tagging to reports from thousands of analysts and research firms, regardless of which analyst published the report.

Smart Synonyms , our proprietary element of Smart Search, weeds out the sources that may include similar keywords but are not topically significant to your research, meaning you’ll never have to cut through excess noise to find the insights you need.

Relevance Rankings

AlphaSense automatically ranks results by their relevance to your research using a number of algorithmic factors, including search term proximity, Smart Synonyms, and document decay. You can be confident that the content sources at the top of your search results page are the ones most aligned with your current research needs.

Smart Alerts

Without a centralized search system, analysts are left to perform multiple manual searches and parse through Google Alerts for the ones with real relevance. On the AlphaSense platform, real-time alerts are customizable and can be set up for a particular company, industry, keyword, or topic (or a set/list of any of the above).

Customized alerts and watchlists give analysts real-time notifications about important news and updates while also ensuring they aren’t bogged down with alerts that are not in tune with what they really need (i.e. Google Alerts and other public search engine options).

Generative AI

AlphaSense’s generative AI is purpose-built for business professionals, leaning on 10+ years of AI tech development. Our proprietary genAI tool, Smart Summaries , generates insights across all four key perspectives—company documents, news, expert calls, and broker research.

Sourced from across all broker research you are entitled to, published within the past 90 days, and covers sections including:

- Upgrades and downgrades – Covers which brokers have upgraded/downgraded this company within the past 90 days and why

- SWOT analysis – Covers the topics/trends identified as strengths/opportunities or threats/weaknesses from across broker reports about this company

- Competitive landscape – Covers the competitive landscape for this company from across broker reports

The Missing Perspective

Here at AlphaSense, we talk about market research in terms of the four perspectives . For every market-moving event, what are the perspectives of companies, news outlets, industry experts, and analysts on the topic?

Historically, the latter has been the most challenging to access because companies needed to have existing relationships with specific brokerage or investment banking firms to get those insights. But with AlphaSense, you get easy access to multiple firms’ equity research, which allows you to take your research and strategic decision-making to the next level.

Broker research reports have always been used by investors and hedge fund managers to come up with lucrative investment ideas and make smarter investment decisions. Now it is commonplace for cutting-edge corporations to utilize analyst perspectives in order to quickly get smart on market landscapes and understand analysts’ expectations on market trends, industry, and peer performance.

Here are just a few of the ways AlphaSense users rely on broker research to navigate ever-evolving market conditions and stay in the know about important trends:

Forecasting for the Future

In the interconnected world we live in today, economic, socio-political, and natural events that occur continents away can impact the success of your business. You need to know what market experts are saying about what’s happening in the world.

One of the biggest developments from the COVID-19 pandemic was the rise of virtual healthcare, or telemedicine. Using AlphaSense, our users were able to monitor rising mentions of the topic across all four perspectives, but it was specifically broker research that proved to be the most abundant source of information in the platform discussing the future of telemedicine, with analysts unanimously agreeing that healthcare systems will have no choice but to adopt telemedicine into their practices going forward.

Using broker research and our platform, we can forecast the trends and outlooks in the healthcare tech space for the future , based on current trends and analysis in areas like AI, medical robotics, and digital therapeutics

Following the Evolution of a Market Trend

ESG has been a dominant force in the investment world over the past several years. It was a trend that arrived forcefully and showed no signs of slowing down in importance to investors and consumers alike—until it did.

Using AlphaSense, we were able to track the trajectory of the ESG movement—from its meteoric rise to the forefront of corporate discourse to its suddenly uncertain future as public scrutiny and distrust continue to build .

Armed with the four perspectives, AlphaSense users were able to follow changing ESG dynamics and clearly understand the trend’s evolution, including shifting public and company sentiment and expectations. Broker research, in particular, was critical for staying ahead of these shifts. It not only informed users on all relevant information early on, but also gave interpretations and expert analyses of this information, allowing them to manage risk, capitalize on new opportunities, and gain a competitive edge.

Peer Analysis

Peer analysis is critical for organizations to achieve and maintain dominance in their respective fields. This means accurately identifying and interpreting industry trends, opportunities, and threats, so you can respond quickly and effectively. AlphaSense helps you stay informed on your peers with customizable watch lists and alerts that notify you whenever a new investment research piece is published featuring one of the companies in your industry.

When analyzing competitors, it is also important to understand what growth areas those companies are anticipating. By benchmarking competitors’ R&D investments , you can gain valuable insight into companies’ strategies and use that knowledge for your own strategic decision-making.

Broker research provides instant access to sales revenue forecasts for specific products, as well as R&D percentage of sales for specific companies, and you can find every relevant equity research piece quickly and easily in AlphaSense.

Groundbreaking Insights from Industry Experts

Monitoring macro trends and conditions is essential for smart investing and apt decision making for any company. The broker research on AlphaSense provides consistent expert insight and direct commentary on economic trends, opportunities, and challenges, so that you can avoid being caught off guard by an unexpected market-shifting event.

When the popular stationary bike company, Peloton Interactive, first announced its decision to partner with industry giant Amazon, many were blindsided. But those who were relying on the four perspectives available through AlphaSense were able to spot the telling signs and key milestones that led up to this deal .

In particular, broker research in the AlphaSense platform showed that this decision was not unexpected at all, but rather played into Peloton’s overall strategy to recoup lost capital by spending less on digital advertising and relying instead on Amazon’s massive customer base.

Broker Research (also called Equity Research or Sell-Side Research) is developed by sell-side firms to help investors and hedge fund managers discover market opportunities and make informed investment decisions. Broker Research consists of detailed reports, models and estimates, videos, and podcasts covering companies, industries, fixed income, currencies and commodities, strategy, and economics. These reports focus on company financials, investment products, business strategies, potential deals, competition/peer analysis, and industry, country, or regional themes.

Broker research is developed by sell-side firms to help investors and hedge fund managers discover market opportunities and make informed investment decisions. Increasingly, this expert analysis is also being identified by forward-looking corporations as a highly valuable tool for informing strategic decision-making. With AlphaSense, corporations receive a best-in-class broker list, while financial services firms have access to an extremely competitive broker list.

You can subscribe to have access to a specific broker’s research content, and/or you can often purchase individual reports or documents you want to access. With a platform solution like AlphaSense, however, you can bypass individual subscriptions and paywalls to access research in a single, centralized place.

The “best” brokerage report depends on your specific needs and research goals. Top brokers in the research field include JP Morgan, Credit Suisse, Morgan Stanley, Barclays, and HSBC (among others) — all accessible on the AlphaSense Platform.

Check that the broker is registered with the SEC . You can also use FINRA’s BrokerCheck Database to research broker track records and credentials in-depth.

AlphaSense’s premium research database (including exclusive Wall Street Insights® ) offers comprehensive data combined with in-depth capital market expertise.

Coupled with advanced AI-powered semantic search capabilities, analysts and researchers are able to access information faster, analyze market sentiment across multiple sources, and pinpoint the exact insights they need to inform decisions.

When you’re on the AlphaSense platform, you can say goodbye to individual subscription expenses, the need for manual, time-consuming research, and a reliance on outdated search methods (like CTRL-F) to find important insights.

AlphaSense provides access to many types of broker reports — industry analyses, flash reports, commodities reports, company analyses and more — from top names in the research field, including:

- Morningstar

- Deutsche Bank

Try AlphaSense for Free

The AlphaSense platform offers access to premium content that powers confident research—you’ll have the tools, resources, and support you need to execute a full-scale strategy to drive results.

If you’re ready to level up your research for smarter investing, start by exploring all that AlphaSense has to offer.

5 Critical Content Sources for Conducting Market Research

Alternative Data

What’s The Best Way To Consume Broker Research?

Equity Research Reports: What’s In Them & How to Access

Private Equity Trends and Outlook for 2024

What is a Sell-Side Analyst?

Why is having sell-side analysts beneficial for firms, access to sell-side analyst investment research, how does a sell-side analyst impact the market, caution on sell-side analyst research, additional resources, sell side analyst.

An equity research analyst who produces investment research for clients

A sell-side analyst is an equity research analyst who works for an investment bank or brokerage firm and produces investment research that is circulated to the firm’s clients. The investment research is later used by the client to make a decision on whether to buy or sell stock or another financial instrument.

The investment research done by a sell-side analyst will assist the client with making an informed decision on their investment, which will stimulate the process of buying or selling financial instruments. Buying and selling of financial instruments will produce commissions for the brokerage.

Aside from stimulating buying and selling, the reliability of the research will help the client make a better decision and remain in the market for a longer period of time. The longer the client stays in the market, the more commission generated.

A sell-side analyst usually issues a rating for a stock, such as “Overweight”, “Hold”, “Buy”, “Strong Buy”, or “Sell”. The ratings are also sometimes accompanied by a price target.

Some investment research has limited access, depending on the size of a client’s account – how much money he/she has on deposit with the investment company – and/or on the service chosen when opening a brokerage account. Investors might need to pay for a subscription before they can access some investment research. Below is an image of an equity research report from Morgan Stanley .

When a sell-side analyst releases a rating for a company, the company’s stock price might experience sharp movement, depending on the rating and the popularity of the analyst. An analyst can change its rating from “Buy” to “Sell” and the market might slam the share price in response.

Investors need to think twice before taking a sell-side analyst’s recommendation, as the analyst is working for the brokerage, not for the individual investor. When a brokerage is also a market maker for the stock being rated, it might use its analyst to influence the price of shares and ultimately reap the benefits.

The recommendation of a sell-side analyst is also considered general investment advice, not advice specific to an individual investor. Generally speaking, investors should rely more heavily on their personal investment strategy and their own research than on taking a trade based solely on an analyst’s recommendation.

Thank you for reading CFI’s guide to sell-side analysts. To learn more, see the following free resources.

- Buy-side analyst

- Buy-side vs. Sell Side

- LBO transaction

- What is financial modeling?

- See all career resources

- See all capital markets resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- Search Search Please fill out this field.

Buy-Side Analyst vs. Sell-Side Analyst: An Overview

Buy-side analyst, sell-side analyst, key differences, special considerations, buy-side analyst vs. sell-side analyst example, is goldman sachs buy-side or sell-side, is private equity buy-side or sell-side, how much do buy-side analysts make, is blackrock buy-side or sell-side.

- Career Advice

Buy-Side Analyst vs. Sell-Side Analyst: What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/Dr.JeFredaR.Brownheadshot-JeFredaBrown-1e8af368a1ea4533a21868d8a951895a.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

The main differences between these two types of analysts are the type of firm that employs them and the people to whom they make recommendations.

A sell-side analyst works for a brokerage or firm that manages individual accounts and makes recommendations to the clients of the firm. A buy-side analyst usually works for institutional investors such as hedge funds , pension funds, or mutual funds. These individuals perform research and make recommendations to the money managers of the fund that employs them.

Key Takeaways

- The main differences between buy-side and sell-side analysts are the type of firm that employs them and the people to whom they make recommendations.

- Investment banks, market makers, and broker-dealers are typical sell-side firms. They provide investment services to the rest of the market.

- Buy-side firms consist of asset managers, hedge funds, and other firms that buy or sell securities on behalf of their clients.

- Buy-side analysts will determine how promising an investment seems and how well it coincides with the fund's investment strategy.

- Sell-side analysts are those who issue the often-heard recommendations of "strong buy," "outperform," "neutral," or "sell."

Buy-side analysts will determine how promising an investment seems and how well it coincides with the fund's investment strategy; they'll base their recommendations on this evidence. These recommendations, made exclusively for the benefit of the fund that pays for them, are not available to anyone outside the fund. If a fund employs a good analyst, it does not want competing funds to have access to the same advice. A buy-side analyst's success or talent is gauged by the number of profitable recommendations made with the fund.

A buy-side analyst is much more concerned about being right than a sell-side analyst is. In fact, avoiding the negative is often a key part of the buy-side analyst's job, and many analysts pursue their job from the mindset of figuring out what can go wrong with an idea.

Buy-side analysts, in general, have broader coverage responsibilities. It is not uncommon for funds to have analysts covering the technology sector or industrials sector, whereas most sell-side firms would have several analysts covering particular industries within those sectors (like software, semiconductors, etc.).

Sell-side analysts are those who issue the often-heard recommendations of "strong buy," "outperform," "neutral," or "sell." These recommendations help clients make decisions to buy or sell certain stocks. This is beneficial for the brokerage because every time a client makes a decision to trade stock, the brokerage gets a commission on the transactions.

The job of a sell-side analyst is to convince institutional accounts to direct their trading through the trading desk of the analyst's firm—the job is very much about marketing. In order to capture trading revenue, the analyst must be seen by the buy-side as providing valuable services. Information is clearly valuable, and some analysts will constantly hunt for new information or proprietary angles on the industry.

Since nobody cares about the third iteration of the same story, there is a tremendous amount of pressure to be the first to the client with new and different information.

This is not to say that sell-side analysts recommend or change their opinion on a stock just to create transactions. However, it is important to realize that these analysts are paid by and ultimately answer to the brokerage, not the clients. Furthermore, the recommendations of a sell-side analyst are called " blanket recommendations ," because they're not directed at any one client, but rather at the general mass of the firm's clients.

These recommendations are inherently broad and, as a result, they may be inappropriate for certain investment strategies. When you are considering a sell-side recommendation, it's important to determine whether the recommendation suits your individual investment style.

While buy-side and sell-side analysts are both responsible for performing investment research, the two positions occupy different roles in the securities market. With respect to investment firms, "buy-side" and "sell-side" do not refer to buying and selling individual investments, but to investment services.

Sell-side firms, such as brokerages and investment bankers, provide market services to other market participants. As registered members of the various stock exchanges, they act as market makers and provide trading services for their clients in exchange for a commission or spread on each trade. In addition, sell-side firms offer underwriting services, helping to launch IPOs and bond issuances for the rest of the market. They also produce research for the consumption of buy-side firms.

On the other side, buy-side firms use sell-side services to make investments. Hedge funds, asset managers, and pension funds are typical examples of funds that buy or sell securities in the hope of earning a profit.

It is also possible for one company to have both buy-side and sell-side wings, especially in large banks. To avoid potential conflicts of interest, these companies must enact Chinese wall policies to separate the two types of departments.

While sell-side analysts create investment research products for sale to other companies, buy-side analysts conduct in-house research intended only for their own firms.

Although the positions are similar, sell-side analysts have a more public-facing role than those on the buy side. Because their work is consumed by outside companies, sell-side analysts must also form business relationships, attracting and advising new clients.

On the opposite side, buy-side analysts have more inward-facing duties. They make investment decisions and manage their clients' money, and do their best to grow the firm's portfolio.

To illustrate the differences between buy-side and sell-side analysts, imagine the interactions between two hypothetical firms. Asset Manager A is a buy-side firm that manages a portfolio of securities on behalf of its clients. On the sell-side, Broker B provides market services, such as access to the stock exchange.

Both firms employ analysts, although these analysts fill different roles. Broker B's analysts will generally produce market research for sale to buy-side firms, such as Manager A. They will evaluate different public companies, conduct technical and fundamental analysis , and deliver research to their clients with a "buy" or "sell" recommendation.

On the buy-side, Asset Manager A's analysts will conduct their own research and compare their findings with paid research, such as that produced by Broker B. However, Manager A's research is intended for internal consumption, rather than sale to other firms. Based on their recommendations, the asset manager will buy, sell, or hold positions in various securities in anticipation of future profits.

As one of the largest investment banks, Goldman Sachs is largely on the sell-side of the market, providing liquidity and execution for institutional investors. However, Goldman Sachs also has some buy-side arms, such as Goldman Sachs Asset Management. In order to prevent conflicts of interest between the buy-side and sell-side, the two bodies are separated by a Chinese wall policy.

Because private equity funds make money by buying and selling securities, they are considered to be buy-side. Like hedge funds, pension funds, and other asset managers, they invest on behalf of their clients and make profits when those assets deliver returns.

According to ZipRecruiter, the average salary for a buy-side analyst is about $108,000 per year, as of August 2021. However, this figure does not account for bonuses or non-salary benefits, which can be considerable. Salary also varies by city, firm, and how many years of experience an analyst may have.

BlackRock is a buy-side firm. BlackRock is the largest investment manager in the world, with $8.7 trillion under management . Because BlackRock's business model consists largely of investing on behalf of its clients, it is considered a buy-side firm.

Goldman Sachs Asset Management. " About Us ."

ZipRecruiter. " Buy Side Analyst Salary ."

:max_bytes(150000):strip_icc():format(webp)/SingleStockFutureSSFMeaningRisksBenefits-cab9de2ded664d899c1150fbb46bab46.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Sell-Side Research

An archive of exclusive equity research from sell side firms

Here’s How to Write an Equity Research Report: The Best Guide

October 17, 2016

Equity Research is a rewarding career.

To keep up, you need a strong foundation with the judgment to think critically, act independently, and be relentlessly analytical.

That’s why I wrote this guide — to empower you with the equity research(ER) report writing skills to stay ahead in the equity research career.

There is almost NO guide available that teaches you how to write an equity research report.

From textbooks to online video tutorials, you can check and let me know if you find one.

And, I felt that I should write a detailed and step-by-step guide— a guide that really starts at the beginning to equip already-intelligent analysts with a healthy balance of conceptual and practical advice.

The Advanced Guide to Equity Research Report Writing takes your writing to the next level.

Who Is This Guide for?

I wrote this guide for an audience of equity research analysts , investment banking professionals, industry analysts, market research professionals, business management students, and freelance writers.

Most of all, I want you to walk away from this guide feeling confident about your equity report writing skill.

What Is an Equity Research Report

This chapter explains what exactly an ER report is.

The questions like—Who makes it? Who reads and uses it? What are the different types of equity research reports?—are answered clearly and elaborately.

It briefly talks about the various key contents of an ER report.

And lastly, it explains the need to provide a disclaimer at the end of an ER report.

So before understanding how to write an ER report, let’s try to understand what exactly an equity ER is.

FINRA , the Financial Industry Regulatory Authority, defines an equity research report, in Rule 2711 (a)(8) as,

“A written or electronic communication that includes an analysis of equity securities of individual companies or industries , and that provides information reasonably sufficient upon which to base an investment decision.

Readers of Equity Research, more so than anything else, identify trends that make investment decisions easier to justify.

In simpler words, equity research is a document written and published by a brokerage house or securities firm for its clients to help them to make better decisions regarding which stocks to choose for profitable investment.

The report should be such that it should convince the client to make a decision.

The report should be crisp; the point of view should be clearly structured and articulated concisely.

In the investment industry, equity reports usually refer to ‘sell-side’ research, or investment research created by brokerage houses.

Such research is circulated to the corporate and retail clients of the brokerage house that publishes it.

Research produced by the ‘buy-side’, which includes mutual funds, pension funds, and portfolio managers, is usually for internal use and is not distributed to outside parties.

a. Different types of equity reports

In the above paragraph, we saw terms such as ‘sell-side’ and ‘buy-side’.

Let’s quickly understand what these terms mean:

There are two main types of equity research reports:

i. Sell-Side reports

Sell-side reports are the most common type of equity research reports in circulation.

They are normally produced by investment banks , typically for their clients to guide their investment decisions.

A sell-side analyst works for a brokerage firm or bank which manages individual clients and makes investment recommendations to them.

Sell-side analysts issue the often-heard recommendations of “buy”, “hold”, “neutral”, or “sell”.

These recommendations help clients make decisions to buy or sell stocks.