Resume Worded | Career Strategy

14 credit manager cover letters.

Approved by real hiring managers, these Credit Manager cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Credit Manager

- Assistant Credit Manager

- Senior Credit Analyst

- Credit Risk Manager

- Alternative introductions for your cover letter

- Credit Manager resume examples

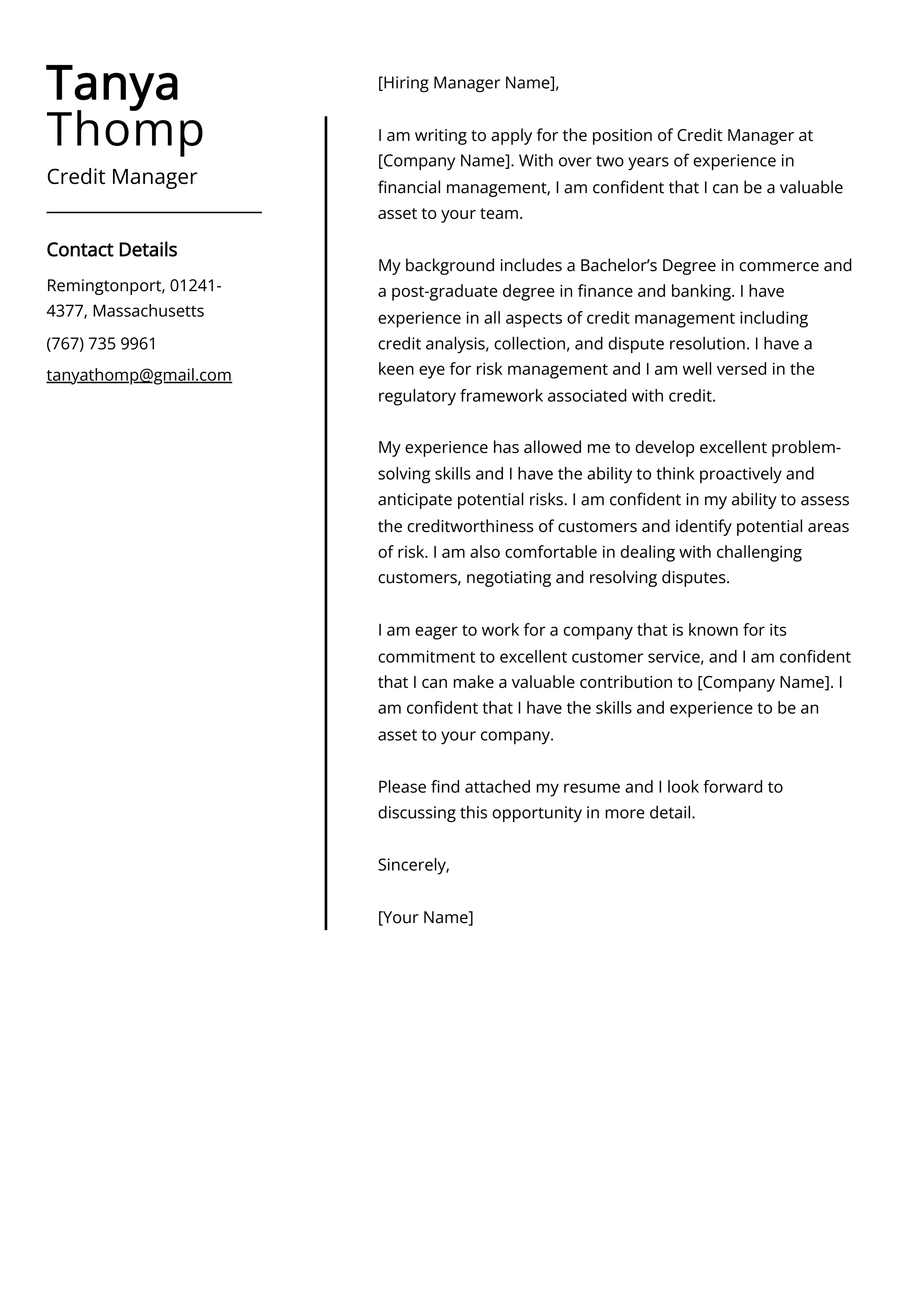

Credit Manager Cover Letter Example

Why this cover letter works in 2024, highlighting relevant experience.

This sentence emphasizes the candidate's years of experience in credit management and implies their expertise in the field. It's important to highlight your relevant experience so the hiring manager can quickly see your qualifications.

Specific Accomplishments

By providing specific numbers and accomplishments, this sentence demonstrates the candidate's ability to make a positive impact in their previous roles. Make sure to include quantifiable achievements that showcase your skills and expertise.

Expressing Gratitude

A simple, genuine thank you goes a long way. It shows appreciation for the hiring manager's time and consideration, and leaves a positive impression. Make sure to include a brief, heartfelt thank you in your cover letter.

Link your professional experience to the job role

In your cover letter, it's crucial to directly tie your current or past roles to the position you're applying for. Here, you're showing that you've already mastered similar responsibilities in your current role as a Senior Credit Analyst - and that's exactly what the hiring manager wants to see. This gives me confidence that you're already familiar with the tasks you'll be undertaking and won't need a lot of hand-holding.

Highlighting successful negotiations

By mentioning a specific project where you successfully negotiated credit terms with over 50 clients, you're showing that you're not just a credit analyst, but also a savvy negotiator. It's essential to highlight such 'extra' skills that may not be explicitly mentioned in the job description but are incredibly valuable in the workplace. It also shows that you're proactive and you can handle challenging tasks.

Highlighting Proven Abilities

This cover letter does a fantastic job of highlighting the candidate's proven ability to transform credit management strategies into tangible results. It's not just about saying you have a knack for something, but backing it up with concrete examples and achievements from previous roles.

Expressing Enthusiasm to Apply Existing Skills

What I appreciate here is the excitement expressed about applying existing skills to a new role. It's essential to communicate that you're not just looking for any job, but specifically excited about what you can do in the role you're applying for.

Emphasizing Role Alignment

This line does an excellent job of expressing why the role is a good fit. It's important to tell your potential employer that you understand what the role entails and why it suits you. This shows you have a thoughtful approach to your job search.

Polite and Gracious Sign-Off

Ending with a note of thanks shows consideration and leaves a positive impression. It may seem like a small thing, but it can differentiate you from candidates who fail to express gratitude for the opportunity to apply.

Show your enthusiasm for the credit manager role

Expressing excitement about the job and how the company's goals match yours makes your cover letter feel personal and genuine.

Demonstrate your credit analysis expertise

Detailing your specific achievements and how you improved your past employers' operations shows you have the skills necessary for the job.

Highlight your asset to the team

Talking about your experience in ways that show you can bring value to the new team reassures employers of your potential impact.

Share your passion for innovation in credit

When you mention looking forward to working with a team to drive innovation, it shows you're ready to contribute and grow with the company.

Close with a strong call to action

Ending on a note that invites further discussion about your fit for the role shows confidence and eagerness to move forward in the hiring process.

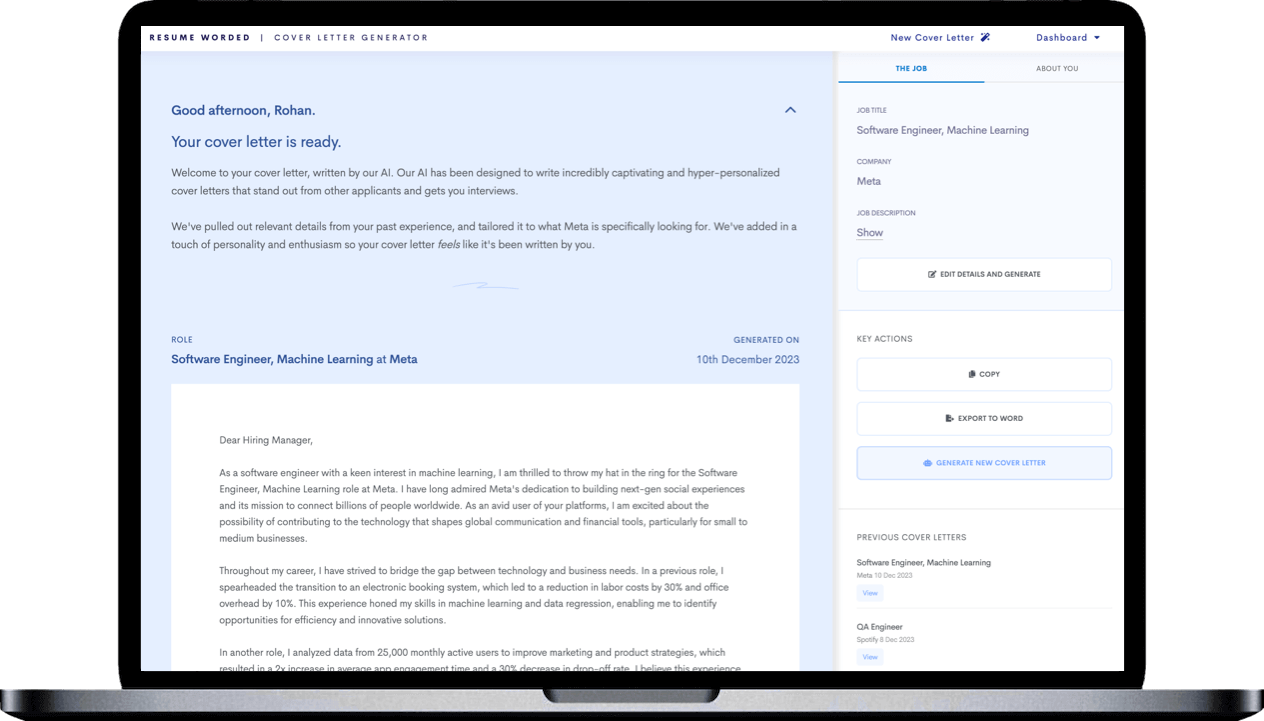

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Show enthusiasm for the company's financial leadership

Starting your cover letter with admiration for the company's financial excellence not only shows you've done your homework but also that you're genuinely interested in contributing to its success.

Detail your credit management expertise

Describing your proficiency in core tasks like credit analysis and risk assessment sends a clear message: you have the skills necessary to manage and improve the company's credit operations.

Highlight successful negotiations and risk reduction

Discussing specific achievements, like negotiating payment plans and reducing bad debt, demonstrates your ability to handle challenging situations and contribute to the company's financial health.

Express interest in the company's global and diverse operations

Your excitement about managing risks in a complex, international context shows you're ready for the challenges unique to a global company like PepsiCo.

Connect your passion with your potential contribution

Closing by linking your experience and enthusiasm for the role with how you can help the team signifies you're not just looking for a job but aiming to make a difference.

Show your enthusiasm for the credit management role

When you express excitement about applying for the position and acknowledge the company's strengths, it builds a good first impression. It shows you have done your homework about the company's mission and values.

Quantify your achievements in credit risk management

By stating how your efforts led to a decrease in default rates and supported portfolio growth, you effectively showcase your direct impact on business outcomes. This makes it easier for employers to visualize your potential contribution to their team.

Align your skills with the company’s goals

Mentioning how your ability to manage risk while focusing on business growth fits with the company’s objectives demonstrates you understand their key priorities. It suggests you can seamlessly integrate into their strategic vision.

Highlight your commitment to team growth

Discussing your passion for nurturing talent and enhancing a team's skill set emphasizes your leadership qualities and your value beyond just technical skills. It aligns with companies looking to build strong, supportive cultures.

Express eagerness for a follow-up

Concluding with a polite thank you and a look forward to discussing your application further shows professionalism and reiterates your interest in the position. It keeps the door open for future conversations.

Assistant Credit Manager Cover Letter Example

Showcase your achievements with hard data.

Using specific, quantifiable achievements is a great way to make your case. Here, you've shared that you managed a substantial portfolio and maintained an impressively low delinquency rate. This tells me two things: firstly, you can handle the responsibility of managing large sums of money, and secondly, you're effective at what you do. It's one thing to say you're good at your job, but showing me with solid data convinces me.

Illustrate your ability to leverage technology

Sharing an example of a time when you used technology to improve performance is brilliant. It lets me know that you're not stuck in old ways of doing things and that you're open to leveraging technology to enhance efficiency and accuracy. In a rapidly evolving industry like finance, this willingness to adapt and innovate is highly appreciated.

Senior Credit Analyst Cover Letter Example

Presenting past achievements.

I like how this cover letter zeroes in on the writer's past achievements. Mentioning a specific project or initiative that you contributed to significantly provides a strong proof of your abilities. It's always a good idea to quantify your successes when possible.

Expressing Eagerness to Contribute

It's good to show enthusiasm for the potential role, and this sentence does that well. It shows that the candidate is not just interested in the job, but is looking forward to bringing their skills to bear in a new environment.

Aligning with Company Values

Here, the writer expresses their excitement about working in an environment that values the same things they do. It's always a good idea to show that you've done your homework about the company's culture and values.

Appreciating the Opportunity

Again, ending with a note of gratitude is a nice touch that shows consideration and polite professionalism. It leaves a positive impression and signals that you're someone who understands the value of appreciation.

Expressing Confidence

This last line effectively communicates the candidate's confidence in their ability to contribute to the team. It's important to convey your belief in your ability to succeed in the role, without sounding arrogant or overconfident.

Connect your passion with the company's mission

Starting your cover letter by aligning your professional interests with the company's goals makes a compelling introduction.

Showcase your impact as a senior credit analyst

Providing examples of your past successes gives concrete evidence of your ability to perform well in the role.

Translate data into results

Illustrating how you can turn complex data into actionable insights demonstrates critical thinking and problem-solving skills.

Express excitement about contributing to risk management solutions

Your enthusiasm for the opportunity to bring your skills to a new team highlights your motivation and dedication to the role.

End with gratitude and a forward-looking statement

Thanking the reader for their time and expressing interest in further discussing your fit for the role leaves a positive, lasting impression.

Show enthusiasm for the company's values

Talking about your respect for a company’s way of doing things makes your interest in the job feel more real and shows you've done your homework.

Demonstrate impact with numbers

Mentioning specific outcomes like reducing payment terms or increasing sales by certain percentages provides solid proof of your effectiveness in previous roles.

Highlight key credit analysis skills

Detailing your experience with financial modeling and data analysis directly relates to core senior credit analyst responsibilities and shows you have the technical skills needed.

Connect skills to company needs

By expressing excitement to apply your analytical skills and business understanding at the company, you effectively link your strengths to how you can contribute to their success.

Value alignment enhances fit

Stating your appreciation for a company’s culture of innovation and improvement suggests a natural fit, making you a more appealing candidate for the role.

Connect your admiration with the company’s methodology

Starting by mentioning your respect for the company's approach to credit risk management instantly creates a connection. It shows you're aligned with their values and methodologies, making you a potentially great fit.

Balance risk management with operational efficiency

Detailing your success in optimizing processes while upholding standards of credit quality illustrates your ability to contribute to both operational efficiency and strategic risk management. Employers will value this dual capability.

Emphasize your commitment to staying updated on industry trends

Your passion for keeping abreast of industry developments and applying them to your work speaks volumes about your proactive nature and dedication to excellence. It suggests you will bring valuable insights and innovations to the team.

Share your enthusiasm for innovation in finance

Expressing excitement about bringing your innovative mindset to a company known for its forward-thinking is compelling. It shows you not only admire the company's achievements but are eager to contribute to its future successes.

Close with a courteous follow-up invitation

Ending your cover letter with gratitude and an openness to discuss how you can add value underscores your professionalism and eagerness to engage further. It's a positive note that encourages a response.

Credit Risk Manager Cover Letter Example

Show your passion for the credit risk sector.

Expressing admiration for a company's mission, like financial inclusion, shows you're not just looking for any job, but you're passionate about making a meaningful impact in the credit risk field.

Highlight your experience in credit risk management

Talking about your skills in risk assessment and leadership directly tells me you're not starting from scratch. You have a solid foundation that's ready to be put to use in new ways.

Demonstrate the impact of your analytical skills

By detailing your achievements with data and analytics, you're showing that you understand the key challenges in the credit industry and have practical solutions to offer.

Express eagerness to innovate in credit management

Highlighting your excitement to join a company known for innovation makes you stand out as someone ready to contribute fresh ideas and help the company stay at the forefront.

Convey readiness to contribute to financial inclusion

This wraps up your cover letter on a high note, reinforcing your enthusiasm to use your skills for a cause that aligns with the company's goals.

Express genuine admiration for the company

Starting with a personal connection to the company sets a positive tone and demonstrates that your interest goes beyond just the job.

Showcase a track record in credit risk management

Describing your comprehensive experience and success in the field establishes your credibility and suggests you can achieve similar results for Coca-Cola.

Negotiation skills are a plus

Detailing successful negotiations with suppliers not only highlights your skills in credit management but also your ability to positively affect supply chain costs.

Illustrate leadership in process improvements

Mentioning your role in leading teams to enhance accounts receivable processes underscores your leadership skills and your impact on financial health.

Emphasize adaptability and global perspective

Your enthusiasm for working in a diverse and dynamic environment like Coca-Cola’s indicates your readiness to handle the complexities of a global role.

Show your enthusiasm for the credit risk manager role

Starting your cover letter by expressing genuine excitement for the job and the company makes me feel you're truly interested. This is a good way to begin.

Highlight your data analytics expertise in risk management

You should tell us about specific projects where you used your skills to make a big difference. Mentioning the use of advanced analytics is especially valuable in the credit risk field.

Demonstrate leadership in credit risk teams

Talking about your experience in leading teams shows you're not just good on paper but also in guiding others to success. This is important for roles that need teamwork.

Link your values to the company’s culture

When you talk about your commitment to helping team members grow, and connect it with the company’s commitment to its employees, it tells me you've done your homework about what we value.

Ending your cover letter by expressing a clear desire to discuss how you can contribute shows confidence and proactiveness, which are qualities I look for in a candidate.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Credit Manager Roles

- Commercial Credit Analyst Cover Letter Guide

- Credit Analyst Cover Letter Guide

- Credit Manager Cover Letter Guide

Other Finance Cover Letters

- Accountant Cover Letter Guide

- Auditor Cover Letter Guide

- Bookkeeper Cover Letter Guide

- Claims Adjuster Cover Letter Guide

- Cost Analyst Cover Letter Guide

- Finance Director Cover Letter Guide

- Finance Executive Cover Letter Guide

- Financial Advisor Cover Letter Guide

- Financial Analyst Cover Letter Guide

- Financial Controller Cover Letter Guide

- Loan Processor Cover Letter Guide

- Payroll Specialist Cover Letter Guide

- Purchasing Manager Cover Letter Guide

- VP of Finance Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

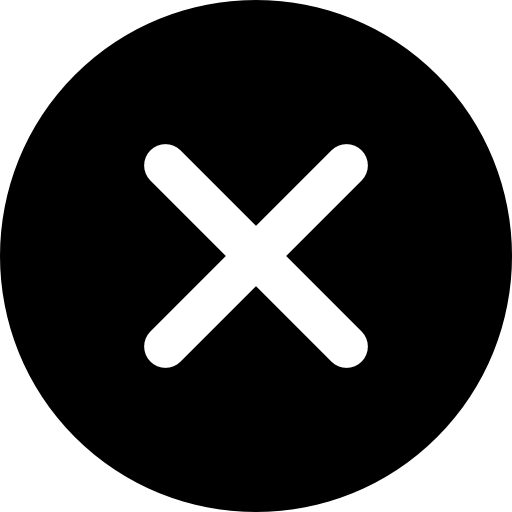

Credit Manager Cover Letter Example

Get more job offers & learn how to improve your new cover letter with our free, professionally written Credit Manager cover letter example. Copy and paste this cover letter sample at no cost or alter it with ease in our simple yet powerful cover letter maker.

Related resume guides and samples

How to build a professional executive resume?

Handy tips on how to build an effective product manager resume

How to build an effective project manager resume

How to craft an appealing risk manager resume?

How to write a top-notch strategy manager resume

Credit Manager Cover Letter Example (Full Text Version)

Saara rootare.

Dear Head of Talent,

I am writing to express my interest in the Credit Manager position with your organization. With over 4 years of experience in credit and risk management, I am confident in my ability to contribute positively to your team.

Currently, I hold the position of Senior Credit Specialist at BR Bank, where I oversee the credit granting process and lead a team of 10 individuals across various branches. My responsibilities include assessing client creditworthiness, managing financial documents, and implementing new corporate financing programs.

I am known for my strong communication and analytical skills, as well as my problem-solving abilities. Last year, I was honored to receive the Manager of the Year Award for exceeding targets and objectives.

In addition to my professional experience, I hold a Bachelor of Business Administration from Stanford University. During my time at the university, I was a top-performing student and served as President of the FinTech Society.

I have attached my resume for your review and consideration. Thank you for taking the time to consider my application. I am looking forward to hearing from you regarding next steps.

Sincerely, Saara Rootare 555-555-5555 | [email protected]

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Project Manager Accountant Finance Analyst Executive Manager Investment Advisor Tax Services Risk Manager Strategic Manager Product Manager Bookkeeper Insurance Agent Auditor

Related accounting / finance resume samples

Related management cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Credit Manager Cover Letter Examples

Use these Credit Manager cover letter examples to help you write a powerful cover letter that will separate you from the competition.

Credit managers are responsible for the financial well-being of their company. They work with clients, lenders, and other financial institutions to ensure that the company has the funds it needs to operate.

In order to be considered for a credit manager position, you’ll need to submit a well-written cover letter. Use these examples to create a credit manager cover letter that stands out from the competition.

Formal/Professional Writing Style Example

With over 10 years of experience in the financial industry, I believe I possess a strong skill set and extensive knowledge that make me an ideal candidate for the role of Credit Manager. I hold a Bachelor of Commerce degree in Finance and have completed relevant certifications, such as the CFA Level II examination.

Throughout my career, I have worked diligently to manage and mitigate credit risk while maintaining a focus on achieving profitability and growth. I have a proven track record of developing comprehensive credit policies and procedures, as well as implementing robust credit and collection strategies. My experience includes performing in-depth financial analysis, implementing strict credit controls, and effectively managing a diverse team of professionals to meet strict deadlines.

My communication and negotiation skills have been instrumental in maintaining strong relationships with both internal and external stakeholders. This has resulted in minimizing credit risk exposure, executing successful credit management plans, and maintaining alignment with our organization’s strategic goals.

I am confident that my strong work ethic, commitment to excellence, and ability to work well under pressure make me a perfect fit for the Credit Manager position at your organization. In addition to my solid financial background, I possess excellent analytical skills and am well-versed in financial software applications and ERP systems.

Thank you for considering my application. I am excited about the opportunity to contribute to your team and believe that my expertise will make a significant impact on your organization’s success. Please find my resume enclosed for your review. I look forward to the opportunity to discuss my suitability for the position in more detail at your earliest convenience.

[Your Name]

Entry-Level Writing Style Example

As a recent graduate with a Bachelor’s degree in Finance from XYZ University, I am eager to apply my academic knowledge and passion for credit management to a dynamic and reputable organization like yours. I believe that my strong analytical skills, attention to detail, and collaborative nature make me a perfect candidate for this role.

During my academic career, I excelled in courses such as Financial Statement Analysis, Risk Management, and Credit Control, which have helped me to build a strong foundation in credit management concepts and best practices. In my final semester, I completed an internship at ABC Bank, where I gained hands-on experience in assessing customers’ creditworthiness, managing client relationships, and supporting credit risk-related tasks.

In addition to my academic and professional experiences, I am proficient in Microsoft Office applications and possess excellent communication and interpersonal skills. I am confident in my ability to effectively communicate with clients and resolve any credit-related issues that may arise. I have also developed a keen sense of responsibility and adaptability, which I believe will allow me to thrive in the fast-paced and ever-changing environment of credit management.

I am excited about the opportunity to bring my skills and enthusiasm to your esteemed organization and contribute to its continued success. I would welcome the chance to meet with you and discuss my suitability for the Credit Manager position in more detail. Thank you for considering my application.

Networking/Referral Writing Style Example

I was referred to this opportunity by my close associate, Ms. Jane Smith, who is a Senior Analyst in your finance department. Jane and I have worked together on multiple projects in the past, and she believes that my skills and experience align well with the requirements of the role. She has spoken highly of the company’s work culture and the potential for growth, which has further fueled my enthusiasm to join your team.

As a highly skilled credit professional with over 7 years of industry experience, I possess a strong background in managing credit risk assessments, analyzing financial statements, and implementing effective credit control policies. In my previous role at XYZ Corporation, I successfully managed a diverse credit portfolio of over $100 million and reduced outstanding receivables by 15% within my first year. I am also adept at fostering collaboration within cross-functional teams to achieve organizational goals.

I am confident that my extensive knowledge in credit management, along with my ability to build and maintain strong client relationships, make me a suitable candidate for this role. I am eager to contribute to your company’s success and expand my skill set while working alongside your accomplished team.

Thank you for considering my application. I would welcome the opportunity to further discuss my qualifications in an interview setting. Please feel free to contact me at your earliest convenience.

Enthusiastic/Passionate Writing Style Example

From the moment I came across this opportunity, I knew that it was the perfect fit that aligns with my deep-rooted passion for finance and my extensive experience in credit management.

Having dedicated more than 7 years to honing my skills in credit analysis, risk management, and underwriting, I am ecstatic at the prospect of bringing my expertise to your organization to contribute to its growth and success. I am confident that my commitment to staying up-to-date with industry trends and my ability to excel in dynamic, fast-paced environments makes me the ideal candidate for this position.

What truly sets my passion for this role apart is my unwavering belief in the power of sustainable credit management practices to drive economic growth and improve the lives of individuals and businesses alike. I am inspired by your company’s dedication to helping customers achieve financial stability through innovative credit solutions, and I am eager to contribute to this mission.

Not only am I excited to collaborate with your talented team, but I am also enthusiastic about the prospect of embracing new challenges and learning opportunities this role presents. I am driven to continuously improve both personally and professionally to exceed the expectations of my colleagues and our clients.

In conclusion, I genuinely believe that my passion, expertise, and work ethic closely align with the values and objectives of your organization. I am thrilled at the possibility of joining your team as Credit Manager and am confident that I can make a meaningful impact on your company’s continued success. I would be honored to further discuss how my skills and background will be an asset to your team.

Thank you very much for considering my application.

Yours sincerely,

Problem-Solving Writing Style Example

I have closely followed your company’s impressive growth and achievements in the financial industry, and I am keen on joining your team to contribute my skills and experience towards tackling the challenges of credit management in the current economic climate. In my research, I have noted that balancing risk and credit availability has become an increasing concern for many firms, particularly in the midst of market uncertainties. I believe that my expertise in credit risk management and financial analysis can be instrumental in effectively addressing these issues and supporting your company’s continued success.

With over eight years of experience in credit management and a strong background in financial analysis, I have the necessary skills to assess potential borrowers and manage credit risk. In my previous role as a Credit Manager at XYZ Company, I successfully managed a large and diverse portfolio of corporate clients, ensuring that credit risk levels were within acceptable limits without hindering sales growth. My ability to analyze complex financial data and identify potential red flags has helped minimize losses and maintain a healthy loan portfolio.

Additionally, I have led various initiatives aimed at improving credit management processes, such as implementing data-driven decision-making and adopting advanced credit scoring methodologies. These efforts have resulted in more accurate credit decisions, reduced processing times, and better overall customer experience. I am confident that my technical expertise and strong leadership skills can bring similar improvements to your organization.

As an adaptable problem-solver, I am eager to tackle new challenges that come with the Credit Manager role at your company. I believe that my hands-on experience in credit risk management and track record of achieving positive results make me an excellent fit for this position.

Thank you for considering my application. I am looking forward to the opportunity to discuss further how my skills and experiences can contribute to your company’s growth and success.

Storytelling/Narrative Writing Style Example

As I strolled through the busy streets of New York City on a crisp autumn morning, I couldn’t help but be drawn to the vibrant energy of the bustling financial district. Amidst the sea of suits and briefcases, I found my passion for the world of finance, and more specifically, credit management. It was there, in the shadow of towering skyscrapers, that I realized the impact that effective credit management could have on the success and growth of a business.

With over seven years of experience in the credit management industry, I have honed my skills in credit analysis, risk assessment, and financial decision-making. My time spent working at XYZ Financial Services allowed me to develop a keen eye for detail and a strong sense of responsibility, both of which are crucial in credit management. There, I successfully managed a portfolio of over $150 million and consistently exceeded performance goals by 15%.

In my most recent role at ABC Corporation, I led a team of credit analysts, driving them to exceed their productivity targets by an average of 20%. My leadership style emphasizes open communication, fostering a collaborative environment where team members feel heard and valued. This approach has proven to be effective in both maximizing team performance and maintaining a healthy, motivated work atmosphere.

The Credit Manager position at your organization seems to be the perfect opportunity for me to continue growing in my career and contribute to the success of a leading company. I am confident that my combination of experience, passion, and strong values aligns well with your company’s mission and objectives.

Thank you for considering my application. I am eager to discuss my qualifications further and learn more about the exciting opportunities that await at your organization. I look forward to the possibility of joining your team and contributing to its continued growth and success.

Handyman Cover Letter Examples

Site engineer cover letter examples, you may also be interested in..., laborer cover letter examples, assistant basketball coach cover letter examples & writing tips, chinese teacher cover letter examples & writing tips, broadcast journalist cover letter examples & writing tips.

Professional Credit Manager Cover Letter Examples for 2024

When drafting your credit manager cover letter, it's essential to highlight your expertise in credit risk analysis. Demonstrate your ability to evaluate financial data efficiently and accurately. In your cover letter, emphasize your success in managing credit and collections teams. Show examples of how you've improved processes and mitigated risks, proving your value as a strategic credit manager.

Cover Letter Guide

Credit Manager Cover Letter Sample

Cover Letter Format

Cover Letter Salutation

Cover Letter Introduction

Cover Letter Body

Cover Letter Closing

No Experience Credit Manager Cover Letter

Key Takeaways

Crafting a credit manager cover letter can seem as daunting as crunching complex financial data. You've polished your resume and you're ready to apply, but now you face the challenge of discussing your achievements without echoing your resume. It's crucial to weave a compelling narrative around your proudest professional moment in a formal yet original tone, steering clear of tired clichés. Remember, brevity is key—a powerful story fits neatly in a single page. Let's begin your cover letter journey.

- Including all the must-have paragraphs in your structure for an excellent first impression;

- Learning how to write individual sections from industry-leading cover letter examples;

- Selecting the best accomplishment to tell an interesting and authority-building professional story;

- Introducing your profile with personality, while meeting industry standards.

And, if you want to save some time, drag and drop your credit manager resume into Enhancv's AI, which will assess your profile and write your job-winning cover letter for you.

If the credit manager isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Credit Manager resume guide and example

- Budget Analyst cover letter example

- Accounts Payable Clerk cover letter example

- Financial Administrator cover letter example

- Forensic Accounting cover letter example

- Billing Manager cover letter example

- Finance Intern cover letter example

- Project Accounting cover letter example

- Financial Counselor cover letter example

- Finance Officer cover letter example

- Bid Manager cover letter example

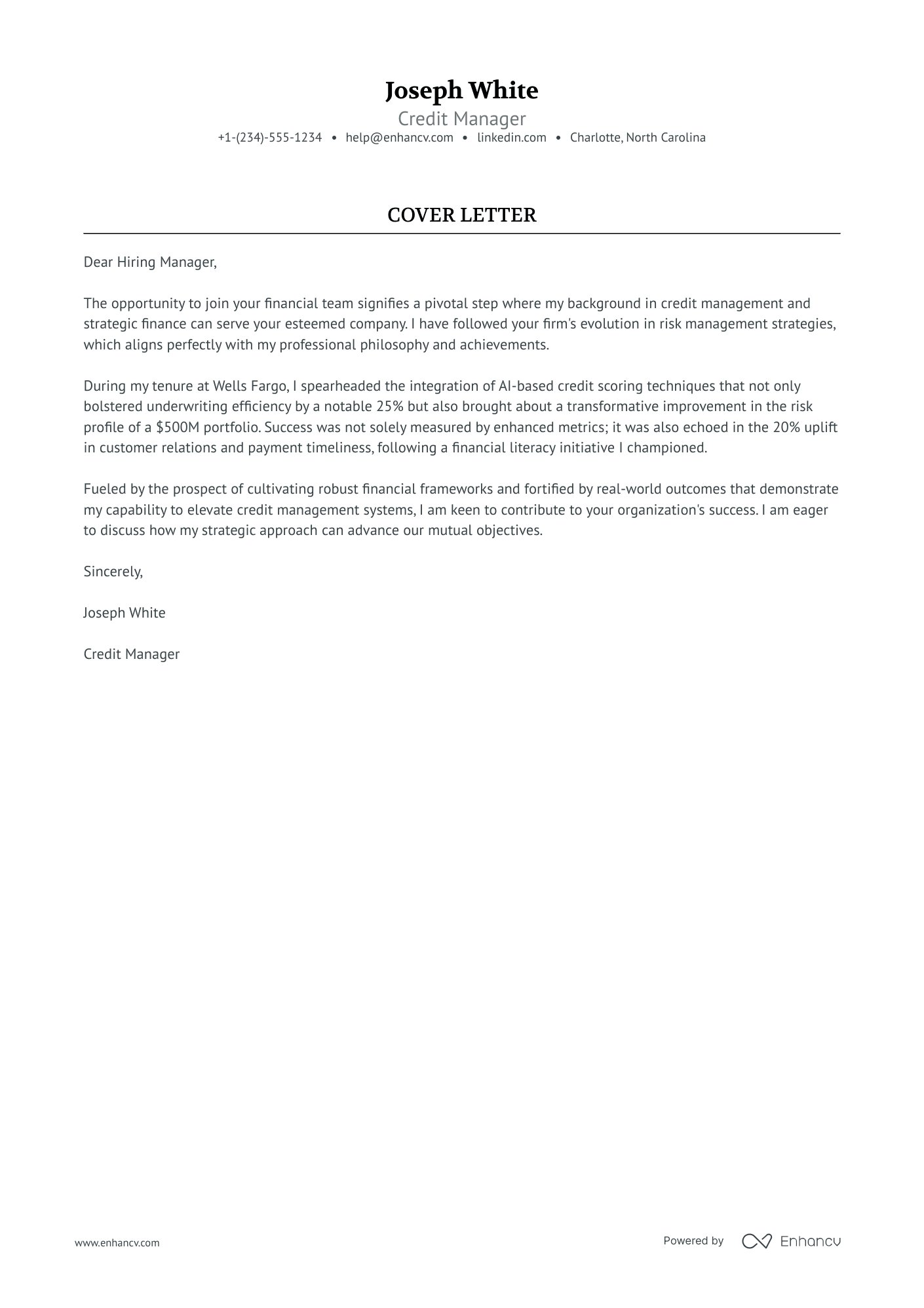

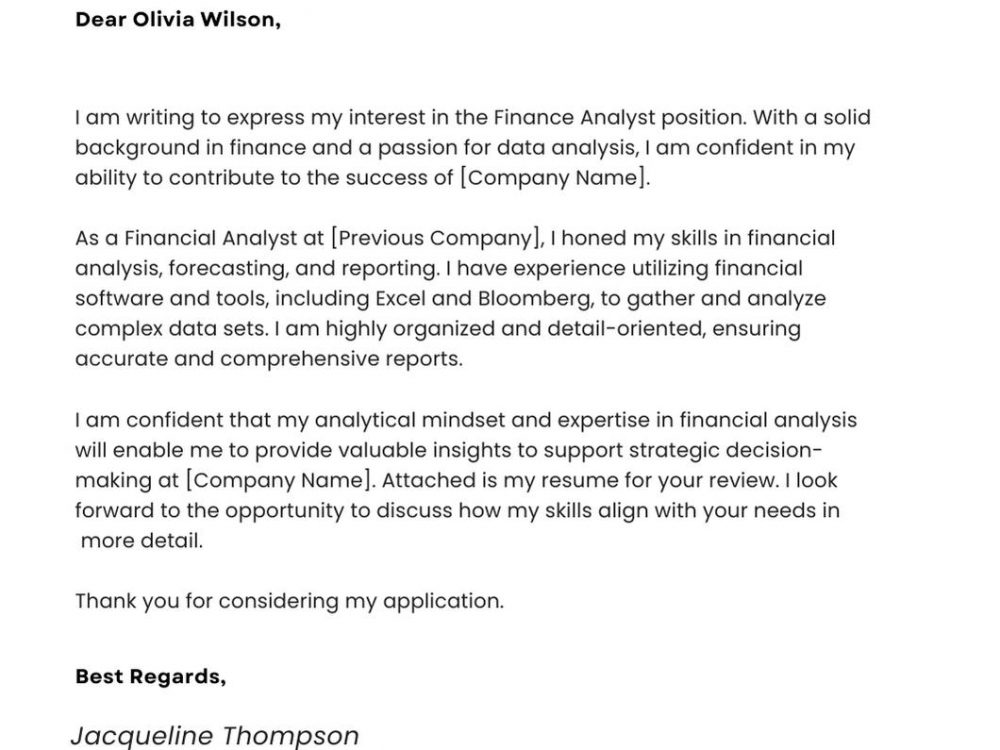

Credit Manager cover letter example

Joseph White

Charlotte, North Carolina

+1-(234)-555-1234

- Highlighting specific contributions such as the "integration of AI-based credit scoring techniques" showcases an ability to implement innovative solutions and improve operational efficiency, which is key for a Credit Manager role.

- Demonstrating measurable success through metrics such as "enhancing underwriting efficiency by 25%" and improving "the risk profile of a $500M portfolio" provides evidence of past success and implies potential future benefits for the hiring company.

- Including an initiative that led to improved customer relations ("20% uplift in customer relations and payment timeliness") illustrates not only strategic competence but also an understanding of the importance of customer service in credit management.

What about your credit manager cover letter format: organizing and structuring your information

Here is one secret you should know about your credit manager cover letter assessment. The Applicant Tracker System (or ATS) won't analyze your cover letter.

You should thus focus on making an excellent impression on recruiters by writing consistent:

- Introduction

- Body paragraphs (and explanation)

- Promise or Call to action

- Signature (that's optional)

Now, let's talk about the design of your credit manager cover letter.

Ensure all of your paragraphs are single-spaced and have a one-inch margins on all sides (like in our cover letter templates ).

Also, our cover letter builder automatically takes care of the format and comes along with some of the most popular (and modern) fonts like Volkhov, Chivo, and Bitter.

Speaking of fonts, professionals advise you to keep your credit manager cover letter and resume in the same typography and avoid the over-used Arial or Times New Roman.

When wondering whether you should submit your credit manager cover letter in Doc or PDF, select the second, as PDF keeps all of your information and design consistent.

The top sections on a credit manager cover letter

Header: This section includes the candidate's contact information, the date, and the employer's contact information, essential for establishing a professional layout and ensuring the cover letter reaches the intended recipient.

Introduction: In this section, the credit manager candidate should clearly state the position they're applying for and briefly mention how their background makes them a strong fit for managing credit analysis and risk assessment functions.

Professional Experience: This section highlights specific past roles and responsibilities, such as credit policy development or debt management, demonstrating the candidate's relevant experience in credit and financial management.

Accomplishments in Credit Management: Candidates should detail how they've improved credit processes or risk mitigation strategies, quantifying achievements if possible to give recruiters clear evidence of their expertise and impact in previous positions.

Closing and Call-to-Action: This is where the prospective credit manager reiterates their enthusiasm for the role, invites the recruiter to review their attached resume for detailed professional history, and suggests setting up an interview to discuss how they can contribute to the company's financial stability.

Key qualities recruiters search for in a candidate’s cover letter

- Proven experience in credit analysis: Recruiters look for candidates who have hands-on experience in analyzing credit data and financial statements to assess the creditworthiness of individuals or companies.

- Strong understanding of credit risk management: Credit managers must be adept at identifying, measuring, and mitigating credit risk to minimize potential losses.

- Excellent negotiation and decision-making skills: In the credit manager role, making informed decisions and negotiating payment terms with clients is crucial.

- Knowledge of relevant laws and regulations: Understanding the legal framework surrounding credit, including fair lending practices and debt collection laws, is essential for compliance and ethical management.

- Experience with credit scoring models and software: Familiarity with the tools and technologies used to evaluate credit risk is important for efficiency and accuracy in credit decisions.

- Leadership and team management ability: Credit managers often lead a team of credit analysts or specialists, so strong leadership skills are important for maintaining team performance and morale.

Personalizing your credit manager cover letter salutation

Always aim to address the recruiter from the get-go of your credit manager cover letter.

- the friendly tone (e.g. "Dear Paul" or "Dear Caroline") - if you've previously chatted up with them on social media and are on a first-name basis;

- the formal tone (e.g. "Dear Ms. Gibbs" or "Dear Ms. Swift") - if you haven't had any previous conversation with them and have discovered the name of the recruiter on LinkedIn or the company website;

- the polite tone (e.g. "Dear Hiring Manager" or "Dear HR Team") - at all costs aim to avoid the "To whom it may concern" or "Dear Sir/Madam", as both greetings are very old-school and vague.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Department Name] Director,

- Dear Mr./Ms. [Last Name],

- Dear [Professional Title] [Last Name],

- Good day [Last Name],

Get creative with your credit manager cover letter introduction

Recruiters are going to assess plenty of candidate profiles for the role. Thus, anything you do to stand out will win you brownie points.

Use your credit manager cover letter introduction to share something memorable about your experience .

But before you go down the rabbit hole of creativity and humor, align your message with the company culture.

For example, if you are applying for a role in some startup, use those first two sentences to tell a funny story (about your experience) to quickly connect with the recruiter.

Choosing your best achievement for the middle or body of your credit manager cover letter

Now that you have the recruiters' attention, it's time to write the chunkiest bit of your credit manager cover letter .

The body consists of three to six paragraphs that focus on one of your achievements.

Use your past success to tell a story of how you obtained your most job-crucial skills and know-how (make sure to back these up with tangible metrics).

Another excellent idea for your credit manager cover letter's middle paragraphs is to shine a light on your unique professional value.

Write consistently and make sure to present information that is relevant to the role.

Final words: writing your credit manager cover letter closing paragraph

The final paragraph of your credit manager cover letter allows you that one final chance to make a great first impression .

Instead of going straight to the "sincerely yours" ending, you can back up your skills with a promise of:

- how you see yourself growing into the role;

- the unique skills you'd bring to the organization.

Whatever you choose, always be specific (and remember to uphold your promise, once you land the role).

If this option doesn't seem that appealing to you, close off your credit manager cover letter with a follow-up request.

You could even provide your availability for interviews so that the recruiters would be able to easily arrange your first meeting.

Keep this in mind when writing your zero experience credit manager cover letter

Even though you may not have any professional experience , your credit manager cover letter should focus on your value.

As a candidate for the particular role, what sort of skills do you bring about? Perhaps you're an apt leader and communicator, or have the ability to analyze situations from different perspectives.

Select one key achievement from your life, outside work, and narrate a story that sells your abilities in the best light.

If you really can't think of any relevant success, you could also paint the picture of how you see your professional future developing in the next five years, as part of the company.

Key takeaways

Winning at your job application game starts with a clear and concise credit manager cover letter that:

- Has single-spaced paragraphs, is wrapped in a one-inch margin, and uses the same font as the credit manager resume;

- Is personalized to the recruiter (using their name in the greeting) and the role (focusing on your one key achievement that answers job requirements);

- Includes an introduction that helps you stand out and show what value you'd bring to the company;

- Substitutes your lack of experience with an outside-of-work success, that has taught you valuable skills;

- Ends with a call for follow-up or hints at how you'd improve the organization, team, or role.

Cover letter examples by industry

AI cover letter writer, powered by ChatGPT

Enhancv harnesses the capabilities of ChatGPT to provide a streamlined interface designed specifically focused on composing a compelling cover letter without the hassle of thinking about formatting and wording.

- Content tailored to the job posting you're applying for

- ChatGPT model specifically trained by Enhancv

- Lightning-fast responses

How To Write Your First Job Resume

What is an enclosure in a cover letter, 12 of the most popular dream jobs, do resume templates work, your personal mission statement guide: why and how to write one (with 10+ examples and 3 templates), star resume template.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- AI Resume Review

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Credit Manager Cover Letter Example (Free Guide)

Create an credit manager cover letter that lands you the interview with our free examples and writing tips. use and customize our template and land an interview today..

Are you looking to apply for a Credit Manager position? Our Credit Manager Cover Letter Guide is here to help. We will provide you with tips on how to create a great cover letter and the key elements to include in your letter. We’ll also share some helpful samples and templates to get you started. Follow our guide and you’ll have a great cover letter that will get you noticed.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Finance Advisor Cover Letter Sample

- Experienced Real Estate Agent Cover Letter Sample

- Experienced Mortgage Advisor Cover Letter Sample

- Compliance Analyst Cover Letter Sample

- Credit Administrator Cover Letter Sample

Credit Manager Cover Letter Sample

- Finance Manager Cover Letter Sample

- Actuary Cover Letter Sample

- Claim Specialist Cover Letter Sample

- Account Administrator Cover Letter Sample

- Account Analyst Cover Letter Sample

- Accounting Analyst Cover Letter Sample

- Accounting Assistant Cover Letter Sample

- Accounting Associate Cover Letter Sample

- Accounting Auditor Cover Letter Sample

- Accounting Consultant Cover Letter Sample

- Accounting Coordinator Cover Letter Sample

- Accounting Manager Cover Letter Sample

- Accounting Specialist Cover Letter Sample

- Audit Director Cover Letter Sample

Dear Hiring Manager

I am writing to apply for the Credit Manager position at [Company Name], as advertised on [Job Site]. With my extensive knowledge of credit management and experience in customer service, I am confident I would be a great asset to the team.

I have six years of experience in credit management and customer service. During my time in this role, I have developed an excellent ability to manage customer accounts and relationships. I have a proven track record of successfully collecting and analyzing customer data, developing strategies to reduce bad debts, and managing customer disputes. I have a deep understanding of the financial industry and I am knowledgeable in credit compliance and risk management.

I am also highly skilled in problem-solving and decision-making. I have excellent communication and interpersonal skills, which I have utilized to effectively build relationships with customers and colleagues. I am comfortable working in a fast-paced and highly-regulated environment, as I have demonstrated the ability to multi-task and prioritize tasks according to deadlines.

I have also earned my Bachelor’s Degree in Business Administration. This has enabled me to develop my understanding of financial accounting, economics, and other related topics. I am also certified by the Association of Credit Management (ACM) and have been a member for four years.

I am confident I can bring my knowledge and experience to the role of Credit Manager and make a positive contribution to [Company Name]. I am eager to further discuss my qualifications and how I can help your team reach its goals. Please do not hesitate to contact me if you have any questions or would like to schedule an interview.

Sincerely, [Your Name]

Why Do you Need a Credit Manager Cover Letter?

- A Credit Manager cover letter is a great way to show employers that you are the right candidate for the job.

- It allows you to showcase your abilities and experience in the field, as well as demonstrate your passion for the role.

- Your cover letter also provides an opportunity to explain why you are the best choice for the job, and how you can help the company reach its goals.

- It will also help to highlight any special qualifications you have that may not be apparent from your resume.

- Finally, a Credit Manager cover letter can help you stand out from other applicants, making it easier to get noticed by employers.

A Few Important Rules To Keep In Mind

- Keep the cover letter short and to the point. Aim for a maximum of one page.

- Avoid using cliches such as "I'm the perfect candidate for the job". Instead, focus on specific qualities and experience that you possess.

- Address the letter to a specific contact in the company, either by name or title.

- Make sure to reference the position you are applying for in the first sentence.

- Mention relevant experience that you have that directly relates to the job you are applying for.

- Emphasize any unique traits that make you stand out from other applicants.

- Include your contact information at the top of the letter.

- Proofread the letter for any spelling or grammar errors.

- End the letter on a positive note, thanking the recipient for their time and consideration.

What's The Best Structure For Credit Manager Cover Letters?

After creating an impressive Credit Manager resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Credit Manager cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Credit Manager Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

As a Credit Manager, I have a strong understanding of the financial and credit policies and procedures necessary for successful operations. My experience includes overseeing accounts receivable, managing credit policies, and minimizing risk. I have a proven track record of success in identifying and mitigating risk, while maintaining a high level of customer satisfaction.

I am a highly organized professional with strong communication, interpersonal, and problem-solving skills. I am confident I can bring the same level of excellence to your organization. I have the knowledge and experience needed to effectively manage credit and collections, as well as the ability to foster strong relationships with clients and vendors.

My key qualifications include:

- Risk Management: I have extensive experience in assessing, monitoring, and mitigating risk. I am adept at identifying potential risks and implementing strategies to reduce them.

- Financial Analysis: I am skilled in analyzing financial information to ensure accuracy and timeliness of payments. I also have experience in preparing financial reports.

- Credit and Collections: I have a strong understanding of credit and collections policies and procedures. I am adept at managing customer accounts and establishing payment plans.

- Customer Service: I am an excellent communicator, and I am committed to providing the highest level of customer service. I am experienced in resolving customer disputes and ensuring customer satisfaction.

I am a highly motivated professional with the experience and skills to be an asset to your organization. I am confident that I can help you achieve your goals. I look forward to discussing this opportunity further and thank you for your consideration.

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Credit Manager Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not customizing the cover letter to the job posting.

- Including irrelevant information.

- Focusing too much on your qualifications and not enough on the company’s needs.

- Using a generic salutation.

- Writing a cover letter that is too long.

- Using incorrect grammar and spelling mistakes.

- Not proofreading the cover letter.

- Failing to follow up after submitting the cover letter.

Key Takeaways For a Credit Manager Cover Letter

- Demonstrate a thorough understanding of the role of a credit manager and how it contributes to the success of the company.

- Highlight any relevant experience managing credit and collections, including any key successes.

- Showcase strong analytical and organizational skills.

- Mention any experience in financial analysis, budgeting and forecasting.

- Discuss any experience in performing credit and risk analysis.

- Highlight any knowledge of legal aspects of credit and collections.

- Emphasize excellent communication skills, both written and verbal.

- Discuss any proficiency in using computer systems and software related to managing credit and collections.

Cover Letter Templates and Guide for Writing a Credit Manager Cover Letter

In the competitive world of credit management, a stellar cover letter can be the key to unlocking career opportunities. Don't leave your application to chance—click on our templates to edit them with AI and ensure your cover letter gives you the credit you deserve.

All cover letter examples in this guide

Comprehensive Template for Crafting a Credit Manager Cover Letter

[Your Full Name]

[Your Phone Number]

[Your Email Address]

[Employer's Name] [Employer's Title] [Company Name] [Company Address] [City, State, ZIP Code]

Dear [Employer's Name],

I am writing to express my interest in the Credit Manager position at [Company Name], as advertised on [where you found the job posting, e.g., the company’s website, LinkedIn, etc.]. With a robust background in credit management, financial analysis, and customer relations, I am excited about the opportunity to contribute to your esteemed organization.

With over [number] years of experience in the financial sector, I have honed my skills in credit assessment, risk management, and team leadership. My background includes overseeing credit operations, developing credit policies, and managing a diverse portfolio of clients. These experiences have equipped me with the ability to evaluate creditworthiness, mitigate risks, and enhance profitability, which align perfectly with the core requirements of the Credit Manager role at [Company Name].

In my previous position as a Senior Credit Analyst at [Previous Company], I successfully reduced the delinquency rate by [percentage] through the implementation of a comprehensive credit risk assessment framework. Additionally, I spearheaded a project that streamlined the credit approval process, reducing approval times by [percentage], which led to increased customer satisfaction and retention. I am confident that my proven track record of achieving significant improvements in credit operations will be a valuable asset to your team.

I have long admired [Company Name] for its commitment to innovation and excellence in the financial services industry. Your dedication to providing top-tier customer service and fostering a collaborative work environment resonates with my professional values and aspirations. I am particularly impressed by [specific project, award, or initiative by the company], and I am eager to bring my expertise in credit management to such an inspiring organization.

I am enthusiastic about the possibility of joining [Company Name] and contributing to its continued success. I welcome the opportunity to discuss how my background, skills, and achievements align with the needs of your team. Thank you for considering my application. I look forward to the opportunity to speak with you further.

The Importance of Structure in Crafting a Standout Cover Letter for a Credit Manager Position

Are you looking to find a job as a Credit Manager? A cover letter is essential to get an interview, so make sure to read our guide to know how to create a strong one.

In addition to the Credit Manager Cover Letter Template, we have a variety of other similar templates you might find useful.

- Bookkeeper interview questions

- Private Equity Associate interview questions

- Tax Preparer interview questions

- Billing Specialist interview questions

- Quantitative Analyst interview questions

Key Salutations in a Credit Manager's Cover Letter

When applying for a Credit Manager position, have you ever wondered what the best way to address the hiring manager is? Finding the name of the recruiter can be as simple as checking the job listing or company website, or even reaching out to the company's HR department. If you know the name of the hiring manager, here are some appropriate salutations:

- Dear Mr. [Last Name],

- Dear Ms. [Last Name],

- Dear Dr. [Last Name],

If you do not know the name of the hiring manager, these general salutations can be effective:

- Dear Hiring Manager,

- To Whom It May Concern,

- Dear [Company Name] Recruitment Team,

Using the right salutation sets a professional tone and shows your attention to detail, which are crucial qualities for a Credit Manager.

Crafting a Compelling Opening Paragraph for a Credit Manager's Cover Letter

In the opening paragraph of a cover letter for a Credit Manager, you should express your interest and enthusiasm for the position.

Mention the company by name to show you are genuinely interested.

Say something eye-catching and memorable that shows your passion for the role.

This helps create legitimacy and catches the reader's attention.

- Mention a specific achievement of the company and how it inspires you.

- Share a personal story that connects you to the role and the company's values.

Essential Elements of Body Paragraphs in a Credit Manager's Cover Letter

Do you know what to put after the introduction on your Credit Manager cover letter? It's about the history and qualifications paragraph.

When writing the history and qualifications part of a cover letter for a Credit Manager position, it is crucial to highlight specific experiences and skills that directly align with the job requirements, demonstrating how past roles have equipped you for this opportunity. Emphasize your contributions to previous employers' successes, particularly in tasks related to credit management, to showcase your effectiveness and value.

- Clearly illustrate how your previous experience in credit management roles directly relates to the responsibilities listed in the job description, using specific examples.

- Highlight any significant achievements or successes in past positions, such as reducing credit risk, improving collections processes, or enhancing client relationships.

- Provide details on any relevant certifications or specialized training that bolster your qualifications for the Credit Manager role.

- Discuss how your skills in financial analysis, risk assessment, and team leadership have contributed to the success of your previous employers, using quantifiable metrics where possible.

When writing the Values and Goals section of a cover letter for a Credit Manager position, focus on aligning your professional values and career objectives with the company's mission and strategic goals. Demonstrate a deep understanding of the company's culture and how your skills and experiences can contribute to their success.

- Research the company's mission statement, recent achievements, and future goals to tailor your cover letter to reflect their values.

- Identify key staff members and their professional backgrounds to understand the team dynamics and how you can complement their efforts.

- Highlight specific company objectives that resonate with your career aspirations and explain how your skills can help achieve these goals.

- Clearly articulate your shared values with the company, emphasizing your commitment to their mission and how it aligns with your professional ethos.

Crafting the Perfect Closing Paragraph for a Credit Manager's Cover Letter

When writing the closing part of a cover letter for a Credit Manager position, ensure to reiterate your enthusiasm for the role and highlight how your skills align with the company's needs. Conclude by expressing your eagerness to discuss further how you can contribute to the organization's success.

- Summarize your interest: Reiterate your enthusiasm for the Credit Manager position and briefly mention how your qualifications make you an ideal fit.

- Express interest in discussing: Indicate your eagerness to discuss your application in more detail during an interview.

- Provide contact information: Ensure you include a way for the employer to easily reach you, such as your phone number or email address, and mention your availability for a meeting or call.

Effective Complimentary Closes for a Credit Manager's Cover Letter

When applying for a Credit Manager position, selecting an appropriate complimentary close is crucial as it reflects your professionalism and leaves a lasting impression on the potential employer. The complimentary close should be respectful and align with the formal tone of your application. It signifies the end of your communication and can reinforce your candidacy by demonstrating attention to detail and professionalism. Here are some sample professional closing phrases that are suitable for such an application:

- Best Regards

- Yours Faithfully

- Respectfully

- Kind Regards

- Warm Regards

- With Best Regards

Each of these closings conveys a sense of respect and professionalism, making them appropriate choices for concluding your cover letter or email application for a Credit Manager position.

Highlighting My Signature Role as a Credit Manager in My Cover Letter

For a Credit Manager cover letter, incorporating a handwritten signature can add a more personal touch, showcasing attention to detail and a commitment to authenticity, which are crucial traits for managing credit and financial relationships. However, a digital signature ensures a polished, professional appearance and can be more practical for electronic submissions, aligning with the modern financial sector's reliance on efficient digital processes; choose based on the submission method and the company's culture.

Essential Tips for Crafting an Effective Credit Manager Cover Letter

When writing a cover letter for a Credit Manager position, it's crucial to effectively showcase your skills and experience while avoiding common pitfalls. Here are some key DO and DON'T:

- Tailor your cover letter: Customize your cover letter to the specific company and role to demonstrate genuine interest and understanding.

- Highlight relevant experience: Clearly mention your experience in credit management and any achievements that illustrate your expertise.

- Showcase soft skills: Emphasize skills such as analytical thinking, communication, and problem-solving, which are vital for a Credit Manager.

- Use professional language: Maintain a formal tone and professional language throughout your cover letter to reflect your suitability for the role.

- Include quantifiable results: Mention specific numbers or metrics to highlight your impact, such as reduced delinquency rates or improved credit approval processes.

- Be generic: Avoid using a one-size-fits-all cover letter. Generic letters can come across as disinterested and unprofessional.

- Overlook proofreading: Spelling and grammatical errors can undermine your credibility. Always proofread your cover letter before sending.

- Focus only on duties: Don’t just list job duties. Instead, focus on achievements and how your actions positively impacted previous employers.

- Neglect company research: Failing to research the company can result in a cover letter that lacks relevance and fails to connect with the employer.

- Exceed one page: Keep your cover letter concise and to the point. A cover letter longer than one page can lose the reader's interest.

Perfect Cover Letter for Credit Manager: Final Thoughts

In conclusion, crafting an ideal cover letter for a Credit Manager position involves several key elements. First, it's crucial to tailor your letter to the specific job description, showcasing your relevant skills and experiences. Highlight your expertise in credit analysis, risk management, and financial reporting, demonstrating how you can contribute to the organization's success. Emphasize your problem-solving abilities, attention to detail, and capacity to work under pressure, qualities that are indispensable in a Credit Manager role.

Reiterate the unique value you bring to the table—whether it's your proven track record of improving credit policies, your knack for reducing delinquency rates, or your ability to foster strong relationships with clients and stakeholders. These aspects not only underline your qualifications but also set you apart from other candidates.

A strong cover letter can significantly impact your job search, serving as a powerful tool to make a memorable first impression. It’s your opportunity to convey enthusiasm, professionalism, and a clear understanding of the role, all while aligning your career goals with the company's objectives.

Finally, while templates can offer a solid foundation, it’s essential to adapt them to reflect your unique experiences and voice. Personalizing your cover letter ensures it resonates with hiring managers and authentically represents your career journey. Embrace this chance to tell your story and make a compelling case for why you are the ideal candidate for the Credit Manager position.

Tasuta allalaetav kaaskirja mall

Motivatsioonikiri, millele on enamikul juhtudel lisatud CV, on iga töötaotluse põhielement. Seda tüüpi kiri peab lühidalt kirjeldama oskusi, võimeid ja teadmisi, mis teil on ja mis on teatud huviga seoses otsitava ametikohaga. Selles mõttes peab kaaskiri lihtsalt sisaldama sellele ametikohale kandideerimise motivatsiooni ja põhjendusi. See peab äratama värbajas huvi ja panema ta pidama teid selle töö jaoks parimaks võimaluseks.

Kuidas koostada lihtsat kaaskirja

- 1 Valige oma valitud CV mall.

- 2 Austab ühtset struktuuri. Näiteks kasutage kaaskirja struktuuriga "Sina-Mina-Meie".

- 3 Lisage järgmised osad, apellatsioonivorm, lühitutvustus, kirja sisu ja järeldus

- 4 Ärge unustage viimast viisakusvalemit. Vaadake kaaskirja viisakusvalemite näiteid.

- 5 Isiklikuma ja formaalsema ilme lisamiseks lisage lehe allossa oma allkiri

- 6 Kui soovite saata selle meili teel, eksportige oma kaaskiri PDF-vormingus.

Teised kaaskirjade näidised

Kaaskirja struktureerimise nõuanded.