An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Opportunity zones frequently asked questions

More in credits & deductions.

- Family, dependents and students

- Clean energy and vehicle credits

- Individuals credits and deductions

- Employee Retention Credit

- Forms for business credits

The following questions and answers (Q&As) were prepared in response to inquiries that have been proposed to the IRS. They are intended to provide a basic understanding and awareness of Opportunity Zones.

These Q&As do not constitute legal authority and may not be relied upon as such. They do not amend, modify or add to the Income Tax Regulations or any other legal authority.

- Opportunity Zones — General Information

Designated Qualified Opportunity Zones

Qualified opportunity funds (qof).

- Deferral of Eligible Gain

- 180-Day Investment Period

- Basis Questions

- Inclusion of Deferred Gain

- Qualified Opportunity Funds

- Qualified Opportunity Zone Property

- Qualified Opportunity Zone Business Property

- Purchase Requirement

- Original Use Property

- Substantial Improvement of Property

- “Substantially All” in the definition of QOZ business property

- QOZ Business 50-percent of gross income test

More information

Opportunity zones - general information, q1. what is a qualified opportunity zone (qoz).

A1. A QOZ is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as QOZs if they were nominated for that designation by a state, the District of Columbia, or a U.S. territory and that nomination was certified by the Secretary of the U.S. Treasury via his delegation of authority to the Internal Revenue Service (IRS).

Q2. How were QOZs created?

A2. QOZs were added to the tax code by the Tax Cuts and Jobs Act on December 22, 2017.

Q3. Have QOZs been around a long time?

A3. No. The first set of QOZ designations, covering parts of 18 states, were designated on April 9, 2018. QOZs have been designated to cover parts of all 50 states, the District of Columbia, and 5 U.S. territories.

Q4. What is the purpose of QOZs?

A4. QOZs are an economic development tool—that is, they are designed to spur economic development and job creation in distressed communities.

Q5. How do QOZs spur economic development? (updated October 20, 2021)

A5. QOZs are designed to spur economic development by providing tax incentives for investors who invest new capital in businesses operating in one or more QOZs.

- First, an investor can defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF). The deferral lasts until the earlier of the date on which the investment in the QOF is sold or exchanged, or December 31, 2026. If the QOF investment is held for at least 5 years, there is a 10% exclusion of the deferred gain. If held for at least 7 years, the 10% exclusion becomes 15%.

- Second, if the investor holds the investment in the QOF for at least 10 years, the investor is eligible for an adjustment in the basis of the QOF investment to its fair market value on the date that the QOF investment is sold or exchanged. As a result of this basis adjustment, the appreciation in the QOF investment is never taxed. A similar rule applies to exclude the QOF investor’s share of gain and loss from sales of QOF assets. See Q&A 26 , below.

Q6. Do I need to live in a QOZ to take advantage of these tax incentives?

A6. No. You can take advantage of these tax incentives even if you don’t live, work, or have an existing business in a QOZ. All you need to do is invest the amount of a recognized eligible gain in a QOF and elect to defer the tax on that gain.

Q7. I am interested in knowing where the QOZs are located. Is there a list of QOZs available?

A7. Yes. The list of each QOZ can be found in IRS Notices 2018-48 PDF and 2019-42 PDF . Further, a visual map of the census tracts designated as QOZs may be found at Opportunity Zones Resources .

Q8. What do the numbers mean on the QOZ list in Notices 2018-48 and 2019-42?

A8. The numbers are identifiers for the population census tracts developed by the U.S. Census Bureau that are designated as QOZs.

Q9. How can I find the census tract number for a specific address? (updated October 20, 2021)

A9. You can find 11-digit census tract numbers, also known as GEOIDs, using the U.S. Census Bureau’s Geocoder . After entering the street address, select Public_AR_Current in the Benchmark dropdown menu and Census2010_Current in the Vintage dropdown menu, and click Find. In the Census Tracts section, you’ll find the number after GEOID.

Investor questions

Q10. what is a qof.

A10. A QOF is an investment vehicle that files either a partnership or corporate federal income tax return and is organized for the purpose of investing in QOZ property.

Deferral of eligible gain

Q11. what types of gains are eligible for deferral if i invest in a qof.

A11. Gains that may be deferred are called “eligible gains.” They include both capital gains and qualified 1231 gains, but only gains that would be recognized for federal income tax purposes before January 1, 2027, and that are not from a transaction with a related person. For you to obtain this deferral, the amount of the eligible gain must be timely invested in a QOF in exchange for an equity interest in the QOF (qualifying investment). Once you have done this, you can claim the deferral on your federal income tax return for the taxable year in which the gain would be recognized if you do not defer it.

Q12. What are qualified 1231 gains?

A12. In general, qualified 1231 gains are gains reported on Form 4797, Part I. For additional information, see instructions for Forms 8949 and 4797.

Q13. I sold some stock for a capital gain, and during the 180-day period beginning on the date of the sale, I invested the amount of the gain in a QOF. Can I defer paying tax on that gain? (updated October 20, 2021)

A13. Yes, this gain is an eligible gain. You may elect to defer the tax on the amount of the eligible gain invested in a QOF. If you only invest part of your eligible gain in a QOF, you can elect to defer tax on only the part of the eligible gain that was invested in this way. See Notice 2021-10 PDF for a special rule if the last day of your 180-day period was on or after April 1, 2020, and before March 31, 2021.

Q14. How do I elect to defer my eligible gain?

A14. You may make an election to defer the gain, in whole or in part, when filing your federal income tax return. That is, you may make the election on the return on which the tax on that gain would be due if you do not defer it. For additional information, see How To Report an Election To Defer Tax on Eligible Gain Invested in a QOF in the Form 8949 instructions.

Q15. Can I defer 1231 gain for a taxable year under the QOZ rules?

A15. Yes. You can elect to defer the amount of 1231 gain if the amount of the gain was invested in a QOF during the 180-day period that begins on the day the 1231 gain was realized. For proper reporting of this gain, see instructions for Forms 8949 and 4797 . If your 1231 gain was realized in 2019, your 180-day period may begin on December 31, 2019.

Q16. Can I still elect to defer tax on that gain if I have already filed my federal income tax return?

A16. Yes, but you will need to file an amended return. An individual or a married couple uses Form 1040-X for this purpose and attaches Form 8949.

Q17. I sold property in 2015 using the installment sale method, and I’m still receiving installment payments. If I invest the amount of the gain from payments received in 2020, can I defer paying tax on that gain?

A17. Yes. All of your eligible gains from installment sales are eligible for deferral, to the extent they are timely invested in a QOF. The 180-day period during which to invest in a QOF begins on the day the installment payment is received, even if the installment sale giving rise to the gain took place prior to December 2017.

Q18. I sold property in 2020, and the sales proceeds will be paid to me in installments. What options do I have to make investments in QOFs to defer paying tax on that gain?

A18. Because your installment sale took place after 2017, if you elect installment treatment for your sale, you have two options for how to defer gain.

- First, you may choose to have a single 180-day period for making one or more investments in one or more QOFs. In this case, the first day of the period is the last day of the tax year in which the sale occurred, and you make a single election to defer gain on the sale up to the amount that you invest in QOFs during that period.

- Second, you may choose to have a separate 180-day period for each installment payment. Each such period begins on the day on which the installment payment is received, and the gain with respect to each payment is deferred to the extent that an amount is invested in a QOF and you separately elect to defer that gain.

Q19. Can I elect to defer gain if I transfer property other than cash to a QOF?

A19. Yes. You can transfer property other than cash to a QOF. However, a transfer of non-cash property may result in only part of the investment being a qualifying investment (that is, only part of the investment can benefit from the QOZ tax incentives). Specifically, the amount of gain that can be deferred is limited to the basis of the contributed property, even if a greater value of property is transferred.

Q20. May nonresident alien individuals and foreign corporations elect to defer eligible gain by making an investment in a QOF?

A20. Yes. Nonresident alien individuals and foreign corporations may generally elect to defer eligible gains that are otherwise subject to federal income tax in their hands. For example, this includes gains that are effectively connected to a U.S. trade or business and capital gains from the disposition of a U.S. real property interest by a nonresident alien individual or a foreign corporation. If the gain would be exempt from federal income tax under an applicable income tax treaty, the foreign person must waive any treaty benefits in order to elect to defer the gain.

Q21. When I transfer property to a QOF, does my holding period for the property also transfer to my qualifying investment in the QOF?

A21. No. Your holding period of property transferred to a QOF doesn’t transfer to your qualifying investment in the QOF for purposes of the QOZ tax incentives.

180-day investment period

Q22. when do i have to invest the amount of an eligible gain in a qof to qualify for the qoz tax incentives.

A22. Generally, you have 180 days to invest an eligible gain in a QOF. The first day of the 180-day period is the date the gain would be recognized for federal income tax purposes if you did not elect to defer the recognition of the gain.

Q23. I am a partner in a partnership and the partnership sold assets generating capital gains on July 1, 2019. The partnership did not make an election to defer the eligible gain. The partnership’s taxable year is a calendar year. When does my 180-day investment period begin? Does it matter that on May 1, 2020, I received a K-1 notifying me of the gain?

A23. The date on which you receive a K-1 notifying you of the eligible gain is not relevant. Partners in a partnership, shareholders of an S corporation, and beneficiaries of estates and non-grantor trusts have the option to start the 180-day investment period on any of the following dates:

- the last day of the partnership taxable year (December 31, 2019);

- the same date that the partnership’s 180-day period begins (July 1, 2019); or

- the due date for the partnership’s tax return, without extensions, for the taxable year in which the partnership realized the eligible gain (March 15, 2020).

Q24. On December 10, 2019, I received capital gain dividends from a Regulated Investment Company (RIC) and a Real Estate Investment Trust (REIT). I am a calendar year taxpayer. When does my 180-day investment period start for my capital gain dividend?

A24. For RIC or REIT capital gain dividends, you can choose for the 180-day period with respect to eligible gain to begin either on the last day of your taxable year in which you would otherwise recognize the capital gain dividend (December 31, 2019) or on the date of the dividend distribution, December 10, 2019.

Basis questions

Q25. i made an investment in a qof. after holding it for at least 10 years, i sell or exchange it. can i adjust the basis in the qof interest to its fair market value.

A25. Yes, but only to the extent you made a proper deferral election with respect to your investment (that is, only to the extent that your investment in the QOF is a qualifying investment ).

Q26. In connection with a proper deferral election, I made an investment in a QOF partnership. The QOF subsequently invested cash in another partnership (partnership A). Partnership A is a QOZ business, and the QOF’s investment in partnership A was solely in exchange for the interest in partnership A. After I held my investment in the QOF for 10 years, partnership A sold a building to an unrelated party for a gain. That gain is part of my distributive share with respect to the QOF and is reported to me on a K–1. May I exclude this gain?

A26. Yes. In addition to the basis increase rules for sales of qualifying QOF interests held for at least 10 years, the holder of a qualifying investment (with respect to that investment) may elect to exclude all gains and losses generated from the sales of assets by that QOF or certain lower-tier partnerships owned by the QOF. This is permitted, however, only if all of the following requirements are satisfied:

- First, it only applies to that portion of the investment that was a qualifying investment in a QOF partnership or QOF S corporation that the taxpayer held for at least 10 years.

- Second, there was an election made to exclude all the gains and losses from the sales that are attributable to the qualifying investment on a timely filed federal income tax return. This election to exclude gains and losses may be made for each year during which there are asset sales by the QOF or certain lower-tier partnerships.

- Third, the gain from that sale was not derived from the sale of inventory in the ordinary course of a trade or business.

- Fourth, the QOF must distribute (or be treated as making a distribution of) the net proceeds from the sales within certain time periods.

Q27. I deferred an eligible gain by investing in a QOF partnership. (Thus, my partnership interest in the QOF is a qualifying investment.) The following year, this QOF partnership merged with another QOF partnership. Do I recognize any gain under the QOZ rules due to the merger?

A27. No, provided that you only received a qualifying investment in the new partnership as a result of the merger. There may be gain recognition under the QOZ rules if you received other property as part of the merger.

Q28. I deferred an eligible gain by investing in a QOF partnership and received a qualifying investment. Another partnership in which I am a controlling partner received a profits interest in exchange for services to the same QOF partnership. How does the profits interest affect my qualifying investment?

A28. A profits interest received in exchange for services is not a qualifying investment in a QOF. If the profits interest is held in a separate partnership, even one that is controlled by you, it will not affect your separate qualifying investment.

Q29. I had ordinary gain from the sale of property in 2018. During the 180-day period beginning on the date of the sale, I invested the amount of that gain in a QOF. In 2029, I sell my interest in the QOF. Can I adjust my basis to fair market value?

A29. No. Ordinary gain is not eligible for deferral. Therefore, your QOF investment wasn’t a qualifying investment made in connection with a proper deferral election. For this reason, the basis adjustment to fair market value isn’t available for that investment. This type of investment is called a non-qualifying investment. (It is a mixed-funds investment if the taxpayer directly holds both a non-qualifying investment and a qualifying investment in the same QOF.)

Inclusion of deferred gain

Q30. i deferred an eligible gain by investing in a qof. what ends the deferral.

A30. An investor must include the remaining deferred gain on the earlier of an inclusion event or December 31, 2026. The amount of deferred gain included in income depends on (i) the fair market value of your qualifying investment in the QOF on the date of the inclusion event and (ii) adjustments to the tax basis of that qualifying investment.

Q31. What is an inclusion event?

A31. An inclusion event, in general, is an event that reduces or terminates your qualifying investment in a QOF.

Q32. I elected to defer eligible gain after I made a qualifying investment in a QOF, and now that QOF has liquidated before December 31, 2026. What happens to my deferred gain?

A32. When the QOF liquidated, the deferral period ended. You must include the deferred gain in the taxable year during which your QOF liquidated. When you file your federal income tax return for that year, you must report the gain on Form 8949 and must reflect the change to your QOF investment on the Form 8997 . See instructions for Forms 8949 and 8997 .

Q33. I elected to defer eligible gain after I made a qualifying investment in a QOF and, before December 31, 2026, I gave the qualifying investment to my child. Is there anything that I need to do?

A33. Yes. Giving away your qualifying investment in the QOF is an inclusion event, which ends the deferral period. When you file your federal income tax return, you must report the deferred gain related to the QOF investment. Your child has a non-qualifying investment. See instructions for Forms 8949 and 8997 .

Q34. If I give my qualifying investment in a QOF to my revocable grantor trust, does that end the deferral of my eligible gain?

A34. No. Because you are treated as the owner of the trust for federal income tax purposes (that is, because it is a grantor trust), the transfer is not an inclusion event and so does not end the deferral period. A transfer of a qualifying investment to a non-grantor trust is an inclusion event, which ends the deferral period.

Q35. In 2018, I elected to defer eligible gain after I made a qualifying investment in a QOF. In 2020, my spouse and I divorced and, pursuant to the divorce decree, I transferred the qualifying investment to my spouse. What happens to my deferred gain?

A35. Transferring your qualifying investment to your spouse was an inclusion event, which ended the deferral period. When you file your federal income tax return for the year of the divorce, you must report the gain and the change to your qualifying investment. Your spouse has a non-qualifying investment in the QOF. See instructions for Forms 8949 and 8997 .

Q36. I am a partner in a partnership that is certified as a QOF. The QOF partnership made an actual or deemed distribution of property (including cash) to me with respect to my qualifying investment on or before December 31, 2026. This distributed property has a fair market value in excess of my basis in my qualifying investment. Is this an inclusion event?

A36. Yes. Subject to an exception for certain partnership merger transactions, the distribution that you received from your QOF partnership is an inclusion event to the extent that the distributed property has a fair market value in excess of your basis in your qualifying investment. However, this inclusion event does not prevent you from excluding from gross income any gains with respect to the remaining qualifying investment if you hold it for at least 10 years and subsequently make an election with respect to that investment. See Q&As 5 and 26 .

Qualified Opportunity Funds questions

Q37. what is a qof.

A37. A QOF is an investment vehicle that files either a partnership or corporate federal income tax return, is organized for the purpose of investing in QOZ property and elects to self-certify as a Qualified Opportunity Fund.

Q38. How does a corporation or partnership become certified as a QOF?

A38. To become a QOF, an eligible corporation or partnership elects to self-certify by annually filing Form 8996 with its federal income tax return. See Form 8996 instructions. The return with the Form 8996 must be filed timely, taking extensions into account.

Q39. Can a limited liability company (LLC) be a QOF?

A39. Yes. An LLC that chooses to be treated either as a partnership or corporation for federal income tax purposes and is organized for the purpose of investing in QOZ property can be a QOF.

Qualified Opportunity Zone property

Q40. what is qoz property.

A40. QOZ property is a QOF’s qualifying ownership interest in a corporation or partnership that operates a QOZ business in a QOZ or certain tangible property of the QOF that is used in a business in the QOZ. To be a qualifying ownership interest in a corporation or partnership,

- the interest must be acquired after December 31, 2017, solely in exchange for cash;

- the corporation or partnership must be a QOZ business; and

- for 90% of the holding period of that interest, the corporation or partnership was a QOZ business.

See Form 8996 instructions.

Q41. For a QOF, does working capital qualify as QOZ property? (added October 20, 2021)

A41. No. For a QOF, working capital is not QOZ Stock, QOZ Partnership interest or QOZ Business Property and therefore it is not QOZ property.

Q42. The QOF recently received a large equity contribution consisting of cash. Does this cash qualify as QOZ property?

A42. No. However, for a cash contribution received in the 6 month period before a QOF property testing date that is held in cash or cash equivalents, the QOF may choose to exclude from both the numerator and denominator of the first investment standard test calculation following the contribution.

Qualified Opportunity Zone business property

Q43. when is tangible property qoz business property.

A43. Tangible property is QOZ business property if--

- it is used in a trade or business of the QOF or in a QOZ business;

- it was purchased after December 31, 2017;

- the original use of the property in the QOZ commenced with the QOF or QOZ business OR

- the property was substantially improved by the QOF or QOZ business; and

- during substantially all of the time the QOF or QOZ business held the property, substantially all of the use of the property was in a QOZ.

Purchase requirement

Q44. i contributed land located in a qoz to a qoz business. the qoz business plans to construct a new building on the contributed land. can the new building satisfy the requirement that it be acquired by purchase.

A44. Yes. The building is QOZ business property, if it meets the following requirements:

- It is intended to be used in a trade or business in a QOZ;

- The materials used to construct the new building were QOZ business property; and

- It is treated as acquired after 2017. For this purpose, the newly constructed building is acquired on the date significant physical work begins.

The contributed land on which the building is located, however, is not QOZ business property because it was not purchased by the QOF.

Q45. When does significant physical work begin?

A45. This depends on the facts and circumstances. In this regard, significant physical work does not include preliminary activities such as planning or designing, securing financing, exploring, or researching. For example, if a factory is to be constructed on a site, preliminary activities include clearing or testing of soil condition. On the other hand, significant physical work begins, for example, when work starts on the excavation of footings or the pouring of pads for the factory.

Q46. Instead of purchasing equipment to use in my QOZ business, I wish to lease equipment. Can leased property qualify as QOZ business property?

A46. Yes. If the parties to the lease are unrelated, the leased property can qualify as QOZ business property only if—

- The lease for the property is entered into after December 31, 2017; and

- The terms of the lease are market rate (that is, the terms reflect common, arms-length market pricing in that location).

In addition, if the parties to the lease are related—

- There must be no prepayment in connection with the lease that exceeds 12 months, and

- If the leased property had been previously used in the QOZ, then, before the earlier of the last day of the lease, or 30 months after the receipt of tangible personal property under the lease, the business must freshly purchase for use with the leased property QOZ business property equal in value to the leased property.

Original use property

Q47. what is “original use” of tangible property.

A47. Original use of tangible property occurs when the property is first placed in service in a manner that would start depreciation or amortization if the property were being used in a trade or business. The original use of tangible property is in a QOZ if the property has not previously been placed in service in the QOZ. Thus, tangible property that had been placed in service outside of the QOZ (that is, used property) can be original use property if the QOF or QOZ business is the first to place it in service in the QOZ.

Q48. I purchased a building in a QOZ that is currently vacant. Is the building “original use” property?

A48. Vacant property (including a building) is original use property if—

- The property was vacant for an uninterrupted period of three years beginning after the date the IRS designated as a QOZ the census tract that contains the property; or

- The property began to be vacant at least one year prior to the date when the IRS designated that census tract as a QOZ, and the property remained vacant through the date of the purchase.

Substantial improvement of property

Q49. what does it mean for property to be “substantially improved”.

A49. Property is substantially improved if, during any 30-month period beginning after the property is acquired, additions to the basis of the property exceed an amount equal to the adjusted basis at the start of the 30-month period.

Q50. A QOF purchased tangible property in a QOZ, and that property is currently undergoing substantial improvement. Is the property substantially improved as QOZ business property for purposes of the 90% investment standard?

A50. If tangible property is undergoing improvement and its basis has not yet been doubled but the QOF reasonably believes that the property will be QOZ business property after improvements are completed, then during the 30-month substantial improvement period, the property counts as substantially improved.

Q51. My QOF, or QOZ business, purchased a hotel that is located in a QOZ. Does the parcel of land on which my hotel building is located need to be substantially improved?

A51. If a building is used in the active conduct of a trade or business, you generally do not need to substantially improve the parcel of land on which the building is located. However, if the land is unimproved or minimally improved, the land must be substantially improved. Moreover, the land fails to be QOZ business property if it was purchased with an expectation that it would not to be improved by more than an insubstantial amount.

"Substantially all" in the definition of QOZ business property

Q52. the words “substantially all” appear twice in the definition of qoz business property. do these words have the same meaning in both places if not, what are the two meanings, and how do they interact.

A52. QOZ business property is tangible property owned or leased by a QOF or QOZ business that satisfies a variety of criteria. These criteria include requirements that, during substantially all of the time in which the QOF or QOZ business holds or leases the tangible property, substantially all of the use of that property by the QOF or QOZ business must be in a QOZ. The first of these two “substantially all” references means at least 90 percent, and the second means at least 70 percent. Thus, during at least 90 percent of the time in which the QOF or QOZ business holds or leases the tangible property, at least 70 percent of the use of that property by the QOF or QOZ business must be in a QOZ. Applying these two definitions together means that, during the entire time in which the QOF or QOZ business owns or leases tangible property, at least 63% of the use of that tangible property must be in a QOZ.

Q53. I and a few employees operate a landscaping business from a building located in a QOZ. My employees and I meet at our building, receive job instructions for the day, and transport our landscaping equipment to job sites located within QOZs as well as sites that are not located within QOZs. At the end of our job, we transport the equipment back to our building and carry out the rest of our job duties. Can my landscaping equipment qualify as QOZ business property?

A53. Yes. Mobile tangible property, such as your landscaping equipment, can qualify as QOZ business property. Because you use your landscaping equipment in multiple census tracts, you must aggregate the number of days you use the tangible property in various census tracts. Generally, if you used your landscaping equipment at least 70% of the days in QOZs, your landscaping equipment is substantially used in a QOZ. In addition, based on the way you use your landscaping equipment in your business, if you always return your landscaping equipment back to the building at least every 14 days, you qualify for a safe harbor that allows you to exclude up to 20% of your landscaping equipment from this 70% calculation. See Form 8996 instructions.

Q54. Can inventory qualify as QOZ business property?

A54. Yes. Inventory (including raw materials) can qualify as QOZ business property. In addition, you may choose annually to exclude inventory from QOZ business property and from the denominator of the applicable determination (whether 90 percent or 70 percent). During each taxable year, whether you choose to include or exclude inventory from both QOZ business property and the denominator, you must treat all of your inventory consistently during that taxable year.

Q55. Can inventory in transit qualify as QOZ business property? (added October 20, 2021)

A55. Yes. If inventory of a QOF or QOZ business, including raw materials, is in transit, the inventory can qualify as QOZ business property. That is, inventory does not fail to qualify solely because the inventory is in transit from a vendor to a QOF or QOZ business or from a QOF or QOZ business to a customer.

Qualified Opportunity Zone business

Qof 50-percent of gross income test, q56. what is the 50-percent-of-gross-income test.

A56. Each taxable year, a QOZ business must earn at least 50 percent of its gross income from business activities within a QOZ. The regulations provide three safe harbors that a business may use to meet this test. These safe harbors take into account any of the following—

- Whether at least half of the aggregate hours of services received by the business were performed in a QOZ;

- Whether at least half of the aggregate amounts that the business paid for services were for services performed in a QOZ; or

- Whether necessary tangible property and necessary business functions were located in a QOZ.

Q57. Must a QOZ business meet all three safe harbors to satisfy the 50-percent-of-gross income test?

A57. No. A QOZ business satisfies the 50-percent-of-gross income test if it satisfies any one of these safe harbors. For example, if 50 percent or more of all the hours of services that a business receives and uses were performed in one or more QOZs, then the business satisfies the hours of services received test and, therefore, satisfies the 50-percent-of-gross-income test.

Q58. How can I get more information about QOZs?

A58. Find information and resources about Opportunity Zones , investing in a Qualified Opportunity Fund , and certifying and maintaining a Qualified Opportunity Fund .

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

- My Wish List

- Compare Products

- Presentations

Opportunity Zones

You must be logged in to download this file*

item details (12 Editable Slides)

(12 Editable Slides)

Related Products

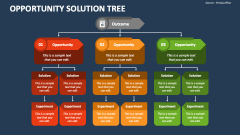

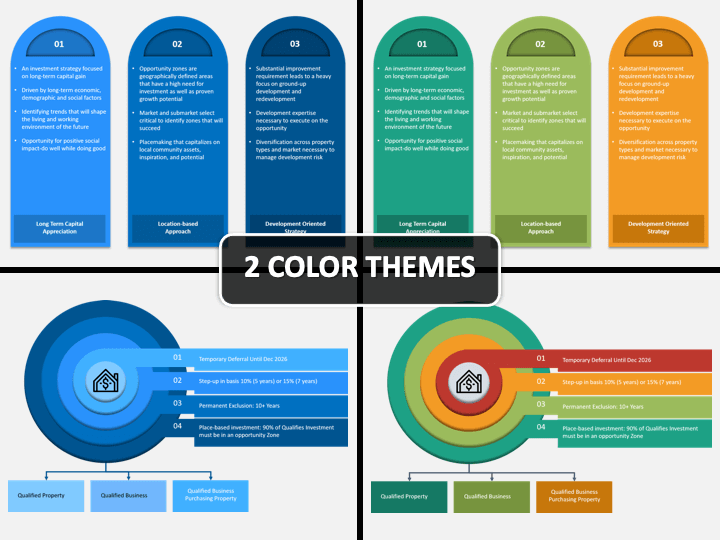

Get our Opportunity Zones presentation template for MS PowerPoint and Google Slides to describe the tax incentives and benefits program that encourages people with capital gains to invest in undercapitalized or low-income communities. Enhance the meaning of your content with these stunning illustrations and graphics!

Financial advisors and investment experts can illustrate different types of qualified zones of opportunity. Harness this deck to deliver a compelling presentation explaining the working process and advantages of opportunity zones tax incentives. You can present a clear and concise overview of the opportunity zones program and how it benefits stakeholders. You can educate the audience on the differences between traditional and opportunity zones investment.

Sizing Charts

| Size | XS | S | S | M | M | L |

|---|---|---|---|---|---|---|

| EU | 32 | 34 | 36 | 38 | 40 | 42 |

| UK | 4 | 6 | 8 | 10 | 12 | 14 |

| US | 0 | 2 | 4 | 6 | 8 | 10 |

| Bust | 79.5cm / 31" | 82cm / 32" | 84.5cm / 33" | 89.5cm / 35" | 94.5cm / 37" | 99.5cm / 39" |

| Waist | 61.5cm / 24" | 64cm / 25" | 66.5cm / 26" | 71.5cm / 28" | 76.5cm / 30" | 81.5cm / 32" |

| Hip | 86.5cm / 34" | 89cm / 35" | 91.5cm / 36" | 96.5cm / 38" | 101.5cm / 40" | 106.5cm / 42" |

| Size | XS | S | M | L | XL | XXL |

|---|---|---|---|---|---|---|

| UK/US | 34 | 36 | 38 | 40 | 42 | 44 |

| Neck | 37cm / 14.5" | 38cm /15" | 39.5cm / 15.5" | 41cm / 16" | 42cm / 16.5" | 43cm / 17" |

| Chest | 86.5cm / 34" | 91.5cm / 36" | 96.5cm / 38" | 101.5cm / 40" | 106.5cm / 42" | 111.5cm / 44" |

| Waist | 71.5cm / 28" | 76.5cm / 30" | 81.5cm / 32" | 86.5cm / 34" | 91.5cm / 36" | 96.5cm / 38" |

| Seat | 90cm / 35.4" | 95cm / 37.4" | 100cm / 39.4" | 105cm / 41.3" | 110cm / 43.3" | 115cm / 45.3" |

- Business Directory

- Become a Member

- Opportunity Zones

- Doing Business

- Target Industries

- Sites and Buildings

- Entrepreneurship

- Downloads & Resources

- Access & Infrastructure

- Airport District

- Existing Business Services

- Major Employers

Leveraging Fort Wayne’s Opportunity Zones

The Tax Cuts and Jobs Act of 2017 established the Opportunity Zones (OZ) program, an economic development tool aimed at catalyzing new, long-term investments and development in economically challenged urban and rural communities across the country.

There are three types of eligible Opportunity Zone investments:

Equity Investing in a qualified business located within an Opportunity Zone, in exchange for stock.

Partnership Taking a partnership interest in a Qualified Opportunity Zone partnership.

Property Business property used within Qualified Opportunity Zones, meeting thresholds for substantial improvement.

Fort Wayne / Allen County includes 10 Qualified Opportunity Zones. Learn more about investment possibilities:

Leveraging Opportunity Zones presentation

Presentation sponsored by

Federally designated Opportunity Zone census tracts within Fort Wayne / Allen County

Building permit valuations in Allen County (2019-2023)

People living within a 60-mile radius of Fort Wayne

FOR INSIGHTS AND INFO, CONTACT:

Ellen Cutter

Chief Economic Development Officer

200 E. MAIN STREET, SUITE 800 FORT WAYNE, INDIANA 46802 (260) 203-5728

- Economic Development

- Chamber Membership

- Talent & Leadership

- Bold Projects

200 E. Main Street, Suite 800 Fort Wayne, IN 46802 | 260 420-6945 [email protected]

© 2024 Greater Fort Wayne Inc. All Rights Reserved Privacy Policy | Sitemap

OZ Pitch Day - Nov 14th

List of Moscow, Idaho Opportunity Zones & OZ Funds

The city of Moscow, Idaho has 2 designated Opportunity Zones.

In total these Opportunity Zones have a population of approximately 14,000. That represents 57% of the city’s total population of 25,000.

The median household income for Moscow Opportunity Zones ranges from approximately $37,000 to $39,000 .

The adjacent map shows all Opportunity Zones in Moscow. Click on any Opportunity Zone for additional information.

List of All Moscow OZs

The table below lists all 2 Opportunity Zones in Moscow. The first two rows reflect average values for the state of Idaho and the Opportunity Zones in the state.

| Name | County | Median Household Income | Below Poverty Line | Median Home Value | Edu High School | Median Age |

|---|

There are no Opportunity Zones in Moscow.

Idaho OZ Funds

There are 4 QOZ Funds in the OpportunityDb database with an investment objective that specifically identify Idaho as a target market. Additional OZ funds may also invest in Idaho; see a complete list of Opportunity Zone Funds here .

| Fund Name | Asset Classes | Property Types | Fund Size |

|---|

There are no Opportunity Zone Funds in the OpportunityDb database with a focus specifically on Idaho properties.

Recent Posts

The Premiere Episode Of “Opportunity Zones Office Hours”

OpportunityDb Seeking Input For 2024 Opportunity Zones Survey

OZ NewsHour: Opportunity Zones Go Mainstream

Miami Opportunity Zone Investing, With Liam Krahe & David Cohen

Oz newshour: a political earthquake for opportunity zones, featured webinar.

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Exclusive access to over 200,000 completely editable slides.

- Diagram Finder

- Free Templates

- Human Resources

- Project Management

- Timelines & Planning

- Health & Wellness

- Environment

- Cause & Effect

- Executive Summary

- Customer Journey

- 30 60 90 Day Plan

- Social Media

- Escalation Matrix

- Communication

- Go to Market Plan/Strategy

- Recruitment

- Pros and Cons

- Business Plan

- Risk Management

- Roles and Responsibilities

- Mental Health

- ISO Standards

- Process Diagrams

- Puzzle Diagrams

- Organizational Charts

- Arrow Diagrams

- Infographics

- Tree Diagrams

- Matrix Charts

- Stage Diagrams

- Text Boxes & Tables

- Data Driven Charts

- Flow Charts

- Square Puzzle

- Circle Puzzle

- Circular Arrows

- Circle Segments

- Matrix Table

- Pillar Diagrams

- Triangle Puzzle

- Compare Diagrams

- Ladder Diagrams

- Google Slides

- North America Maps

- United States (US) Maps

- Europe Maps

- South America Maps

- Apple Keynote

- People & Objects

- Trending Products

- PowerPoint Templates

Opportunity Zones PowerPoint and Google Slides Template

(13 Editable Slides)

Download Now

This template is part of our Pro Plan.

Gain access to over 200,000 slides with pro plan..

Upgrade Now

Already a Pro customer? Login

Related Products

Business Opportunity PowerPoint and Google Slides Template

(11 Editable Slides)

Opportunity Identification PowerPoint and Google Slides Template

Opportunity Matrix PowerPoint and Google Slides Template

Opportunity Sizing PowerPoint and Google Slides Template

Opportunity Costs PowerPoint and Google Slides Template

Opportunity Assessment PowerPoint and Google Slides Template

Opportunity Management PowerPoint and Google Slides Template

Opportunity Canvas PowerPoint and Google Slides Template

We, at SketchBubble, have come up with this versatile Opportunity Zones PPT template. You can explain to your employees about the tax benefits using investments. Undoubtedly, most of them would surely be unfamiliar with it. Thus, help economically distressed communities of your company by knowing the tax advantages. This presentation consists of multiple slides; you can use any of them for your pre-made PPT or the whole set. And if you’re getting worried about how you would match its theme with your presentation, then don’t worry. This is 100% editable. You can change the color, scale, and other elements.

Although it can be used by anyone, it is best for the people from a Finance background, Investment bankers, HR managers, team leaders, even a Startup owner.

Know What You Can Explain

Since it is a complex topic, it is very necessary to provide every intricate detail regarding it to the audience. And for that, our Opportunity Zones PowerPoint template would be the best suited.

- How does the opportunities zones tax incentive work?

- Long-term capital appreciation

- Location-based approach

- Development oriented strategy

- Tax benefits of opportunities zones

- Qualified opportunities zones

- Opportunities zone program

- Desperate stakeholders for mutual benefits

- Benefits of opportunity-zone tax incentives

- Timeline of opportunity-zone investment

Providing this much information would always be helpful. However, this is just a reference content; if you want to add or remove anything, you can do that. This PPT template is 100% customizable and editable.

Opportunities You’ll Get

- Only professional designers prepare this customized slideshow, so there is no chance of poor quality. They use vector-based graphics. So, you can resize, recolor, enlarge, reduce, replace the content as per your requirement. The best part is visual output will remain intact.

- Since it consists of multiple slides, you can explain every relevant information regarding the topic.

- The use of multi-colored graphics will make it easier for you to mark an impact.

- The presentation is designed in two themes: Blue and Multi-color. You can pick the one which you find appealing.

Additional Features to Make It Different

- We understand that not everyone uses Microsoft PowerPoint; therefore, we have designed it for Google Slides and Apple Keynote also.

- It is 100% editable, so you don’t have to spend a hefty amount of time editing it.

- It’s easy to edit or modify, so you won’t require any prior designing skills.

- The presence of eye-catching infographics, icons, and graphs makes its visuals appealing.

So, what are you waiting for? Download and make an impact.

Create compelling presentations in less time

Alexander Temkin , JSC “Special Economic Zones” Moscow 2011

Apr 02, 2019

90 likes | 284 Views

a. RUSSIAN SPECIAL ECONOMIC ZONES: NEW INVESTMENT OPPORTUNITIES . Alexander Temkin , JSC “Special Economic Zones” Moscow 2011. Special economic zones in Russia. Industrial zones. Touristic and recreational zones. Technology and innovation zones. Port zones.

Share Presentation

- pilot training

- total zones area

- buryatia republic

- tourist zones

- 290hectares

- petrochemical industry

Presentation Transcript

a RUSSIAN SPECIAL ECONOMIC ZONES: NEW INVESTMENT OPPORTUNITIES Alexander Temkin, JSC “Special Economic Zones” Moscow 2011

Special economic zones in Russia • Industrial zones • Touristic and recreational zones • Technology and innovation zones • Port zones Kaliningrad Region MoscowRegion Sverdlovsk Region Moscow Ulyanovsk Tomsk Murmansk Moscow Republic of Tatarstan Togliatti Russkiy island St. Petersburg Republic of Buryatia Republic of Altai Irkutsk Region Lipetsk Region Altai Region Khabarovsk Region The North Caucasian federal district Stavropol Region

Key terms and conditions for Russian SEZ resident investors

Special economic zones in RussiaIndustrial zones • Lipetsk Region • Total area – 1 027hectares • Focus industries: • chemical industry • construction materials • electric and energy machinery construction • domestic appliances and trade equipment • Key advantages: • situated in the center of most developed European part of Russia • situated in the center of Russia’s largest steel production and metal-processing cluster • Republic ofTatarstan • Total area – 1 997 hectares • Focus industries: • automotive industry • construction materials • FMCG • chemical and petrochemical industry • Key advantages: • advantageous geographical and transport location • situated in the centre of Russia’s largest automotive cluster • Samara Region • Total area – 660 hectares • Focus industries: • automotive industry • transportation equipment • machine tool building • precision engineering • Key advantages: • long-time traditions of machinery & equipment construction • highly-qualified workforce • Sverdlovsk Region • Total area – 721 hectares • Focus industries: • automotive industry • medical technologies • chemical industry • aircraft construction, shipbuilding, rocket science • Key advantages: • industrialized region • rich natural resources

Special economic zones in RussiaInnovation zones • St. Petersburg • Total area – 129hectares • Focus industries: • instrument engineering • medical technologies • electronics • nanotechnologies • information and communication technologies • Key advantages: • Saint-Petersburg – Russia’s second largest city • high concentration of scientific and educational institutions • Dubna • Total area – 188hectares • Focus industries: • nanotechnologies • biotechnology • nuclear technologies • information technologies • electronics & communication • Key advantages: • proximity to Moscow • high degree of education: 30% population involved in science-related sectors • Zelenograd • Total area – 147hectares • Focus industries: • information technologies • nanotechnologies • microelectronics and optoelectronics • bioengineering and biosensor technologies • Key advantages: • proximity to Moscow in an established science centre • access to ample supply of highly-qualified labor force • Tomsk • Total area – 207hectares • Focus industries: • communication equipment • medical technologies • information technologies • electronics & instrument engineering • Key advantages: • one of the largest educational centers of Russia • a diversified science centre

Special economic zones in RussiaPort zones • Ulyanovsk port zone • Total area – 290hectares • Focus industries: • aircraft MRO • aircraft re-equipment, conversion, assembling • logistics • pilot training (to be considered) • Key advantages: • located in the centre of the European part of Russia • focus on increasing demand for foreign-made aircraft MRO in Russia and CIS countries • well-trained and highly skilled local personnel • Sovetskaya Gavan port zone • Total area – 120hectares • Focus industries: • port operations (cargo handling, • bunkerage, ship repair yards) • logistics • seafood processing • Key advantages: • focus on Asian – Pacific region rapid development • natural harbor and available land plots for development • potential increase of railroad capacities • potential development of mining and wood processing industries in adjacent regions • Murmansk port zone • Total area – 3,050hectares • Focus industries: • port operations (cargo handling, bunkerage, ship repair yards) • logistics • seafood processing • Key advantages: • existing deep-water port with access to North and Trans-Arctic sea routes • natural harbor and available land plots for development • potential demand for port facilities and inland bases for the Arctic oil field development and servicing • potential expansion of railroad connections

Special economic zones in RussiaTouristic and recreational zones Total zones area – 8,262hectares • Key advantages: • unique natural and ecologically clean areas including those in Altai, lakeBaikal and others • consistently increasing flow of domestic tourists • rising interest of foreign tourists to unexplored Russian territories from foreign tourists • Focus industries: • sport and extreme tourism • cultural entertainment • recreational tourism • business tourism • ecological tourism • sea resort • spa resort • balneology resort

Investors in SEZ (total committed investments €7+ bln) Number of investors in special economic zones 31investor in tourist zones Including 34foreign companies from 19 countries 33investors in industrial zones 197investors in innovation zones

Contacts Alexander TemkinDeputy CEO [email protected] JSC “Special Economic Zones” www.oao-oez.ru

- More by User

Foundations of Special Education

Foundations of Special Education. Dr. Thomas G. Ryan 2004. What is Special Education?. Special Education: S pecially designed instruction to meet the unique needs and abilities of exceptional students. Special Education is relatively new.

4.07k views • 51 slides

ALEXANDER CALDER AMERICAN SCULPTOR

ALEXANDER CALDER AMERICAN SCULPTOR. ALEXANDER CALDER 1898 - 1976. Invented the “Mobile” Created 1000’s of sculptures Stationary sculptures: “Stabiles”. “Romulus and Remus” 1928. “Josephine Baker” 1929. “ Goldfish Bowl ” 1929. “Steel Fish ” 1934. “Snake and the Cross” 1936 .

1.89k views • 36 slides

Chapter 1: The Economic Way of Thinking

Chapter 1: The Economic Way of Thinking. The Economic Problem Production Possibilities Economic Analysis. Got stuff?. Who made it? How was it made? How did you get it?. I. The Economic Problem. the basic economic problem is scarcity : -- wants are unlimited, but resources

1.24k views • 65 slides

PAPERS EXPLAINING DIFFEREING PERFORMANCE OF TRANSITION ECONOMIES

China’s Rise in the Medium and Long Term Perspective: An Interpretation of Differences in Economic Performance of China and Russia since 1949 ( História e Economia Revista Interdisciplinar , Vol. 3 - n. 1 - 2º semestre 2007) Vladimir Popov New Economic School, Moscow, [email protected].

1.1k views • 98 slides

ECONOMIC OUTLOOK

ECONOMIC OUTLOOK. MAY 2014. Recent Update: 05/22/2014. OUTLINE. A- MACROECONOMIC OUTLOOK B- FOREIGN TRADE OUTLOOK 1) MERCHANDISE 2) SERVICES C- INVESTMENTS , FOREIGN CAPITAL and INCENTIVES D- FREE ZONES in TURKEY E- BILATERAL, REGIONAL, PLURILATERAL and MULTILATERAL TRADE.

869 views • 73 slides

Oceanic Dead Zones

Oceanic Dead Zones. Fall 2012 , Lecture 9. Observing the Ocean. Oceans cover about 70% of the earth’s surface Oceanography, the science of the ocean, has advanced greatly in the last two centuries

1.42k views • 90 slides

Alexander Pope: Solitude: An Ode

Alexander Pope: Solitude: An Ode. I How happy he, who free from care The rage of courts, and noise of towns; Contented breaths his native air, In his own grounds. II

3.51k views • 84 slides

CSE3AGT – Zones Portals and Anti-Portals, Fog and Ray Tracing

CSE3AGT – Zones Portals and Anti-Portals, Fog and Ray Tracing. Paul Taylor 2010. Zones, Portals and Anti-Portals. With Pictures!. Zones. Air-tight areas of your level that constitute different areas. http://www.hourences.com/book/tutorialszoning.htm. Portals.

1.33k views • 107 slides

2011. EHA Monthly Calendar. JANUARY 2011. February 2011. March 2011. April 2011. May 2011 . June 2011. July 2011. August 2011. September 2011. October 2011. November 2011 . December 2011.

1.17k views • 13 slides

Alexander V. Lotov Dorodnicyn Computing Center of Russian Academy of Sciences and

High-order Pareto frontier approximation and visualization: 30 years of experience and new trends Abstract of the paper at MCDM 2011. Alexander V. Lotov Dorodnicyn Computing Center of Russian Academy of Sciences and Lomonosov Moscow State University. Plan of the talk.

876 views • 75 slides

Widescreen Test Pattern (16:9)

Widescreen Test Pattern (16:9). Aspect Ratio Test (Should appear circular). 4x3. 16x9. DXers are a special kind of radio amateur. #1 Honor Roll DXCC DXCC Challenge (Clinton B. DeSota Cup) 160M & 6M All modes from expeditions Worked All Zones It’s a complicated, long game.

1.66k views • 55 slides

African and south african economic history

African and south african economic history. IPSU • 2011. Johan Fourie. Geography and luck. IPSU • 2011. Johan Fourie. Die origin of man. Anatomically modern humans migrated out of Africa between 100 000 and 50 000 years ago – the so-called “Out of Africa” hypothesis

1.37k views • 109 slides

Ministry of Economic Development Macro Action Plan 2011-2015

Ministry of Economic Development Macro Action Plan 2011-2015. Presented by P B Jayasundera Secretary, Ministry of Economic Development Under the guidance of Hon. Basil Rajapaksa Minister of Economic Development. 1. Making the Vision a Reality. 2. Interfacing Development.

1.51k views • 110 slides

TAX EXEMPTION SCHEME

TAX EXEMPTION SCHEME. Special Economic Zone (SEZ) And Export Oriented Units (EOU) Presentation By: Ankur Shah Partner SNK. SNK. Agenda. Special Economic Zone: Incentives under Income Tax Incentives under Other Acts Other Special Fiscal Provisions Export Oriented Unit:

926 views • 70 slides

ECONOMIC OUTLOOK. MAY 2012. Economic Outlook is revized in the 1st and the 3rd weeks of the month. Recent Update:05/07/2012. OUTLINE. A- MACROECONOMIC OUTLOOK B- FOREIGN TRADE OUTLOOK 1) MERCHANDISE 2) SERVICES C- INVESTMENTS , FOREIGN CAPITAL and INCENTIVES D- FREE ZONES in TURKEY

1.05k views • 68 slides

THE WORLD ECONOMIC

THE WORLD ECONOMIC. OUTLOOK. Sasol Executive Development Programme. (Doha; 3 October 2011). Global Prospects. - A New Recession ?. - Too much debt, too many deficits ?. - Will the Euro survive ?. Emerging Markets. - Eastern Europe, East Asia and Latin. America:.

930 views • 78 slides

Maritime zones

Maritime zones. Maritime Zones. Internal waters . Waters on the landward side of the baseline. The coastal state exercises full sovereignty, and these waters form an integral part of the state’s territory. Includes rivers, lakes and bays.

1.91k views • 68 slides

2011 Report 65 - 3rd Quarter Release -

2011 Report 65 - 3rd Quarter Release -. Johannesburg 14 November 2011. Introduction:. General Up-date: Economic Outlook. Global economic climate remains precariously balanced. Impact of Euro zone “bail-out or bankrupt” debates cause uncertainty within in emerging markets such as ours.

811 views • 72 slides

Armen Mulkidjanian

Lomonosov University, Moscow. Anoxic geothermal fields and the early evolution of first cellular organisms. Armen Mulkidjanian. International Conference THE PROBLEM OF THE ORIGIN OF LIFE Moscow – September 22-26, 2014. Merging phylogenomics with geochemistry:. Bioinformatics:.

1.13k views • 84 slides

Zones of Regulation Assistive Technology Overview

Zones of Regulation Assistive Technology Overview. Marcia Obukowicz Marciaoat.wikispaces.com [email protected] 715-453-2141.

1.21k views • 89 slides

COMMENTS

PowerPoint Presentation. Webinar 2: Opportunity Zones and Resources. May 19th, 2021. Welcome. Heidi J. Frechetteserves as the Deputy Assistant Secretary for HUD's Office of Native American Programs. In her capacity, she manages a number of programs dedicated to Native American communities - including one that is the largest source of ...

Background. Authorized by the Investing in Opportunity Act in 2017. Certified by U.S. Treasury on 4/9/18. 879 Opportunity Zone designations in California. Opportunity Zone certifications are valid for 10 years. Federal tax incentive certification managed by the U.S. Department of Treasury and the Internal Revenue Service with federal agencies.

What Are Opportunity Zones Not? • OZ is not a federal grant program • There is not an application for OZ funding • Capital from OZ investors will not be the only source of funding for a project - still need other sources in the capital stack (debt, LIHTC, etc.) • OZ is not only for housing projects - a wide variety of real estate projects and operating businesses

Roughly 12 percent of US census tracts, 8,764 census tracts across all 50 states, Washington, DC, Puerto Rico, and four US territories are Opportunity Zones. Governors nominated Zones from among eligible tracts in 2018, with the US Treasury responsible for reviewing and making final approvals. Being designated a zone does not guarantee investment.

Investing in Opportunity Act (IIOA) , proposing a novel way to encourage investment in startups, small businesses, and other enterprises in capital- starved communities. 2016. 2017. IIOA . passes as part of the . Tax Cuts and Jobs Act of 2017, establishing Opportunity Zones as a new national community investment incentive

Step-Up in Basis - A step-up in basis for the deferred capital gains reinvested in an Opportunity Fund. The basis is increased by 10% if the investment in the Opportunity Fund is held by the taxpayer for at least 5 years and by an additional 5% if held for at least 7 years, thereby excluding up to 15% of the original deferred gain from taxation.

Opportunity Zones | Internal Revenue Service

Opportunity Zones. Creation • The Opportunity Zone Program was created as part of the Federal Tax Bill • It was co-sponsored by Senators Tim Scott and Cory Booker • Purpose • Combat geographical inequality: • In the 1990s, half or more of all counties grew at the national rate. Now only 25% do • More than half of the country's distressed zip codes contained fewer jobs and places ...

Opportunity Zones Frequently Asked Questions

Start exploring the interactive Opportunity Zone map and see where your state, cities and communities lie within the Opportunity Zones. Putting this Opportunity Zone mapping tool to work will truly give you a clear perspective on the numerous designated areas right in your hometown or state. SCHEDULE A CALL WITH AN OZ ADVISOR. Unable to create ...

Opportunity Zones - Map - HUD

A qualified Opportunity Fund is an investment tool organized as a corporation or partnership with the specific purpose of investing in Opportunity Zone assets. Qualified Opportunity Zone Funds can be established by any entity. Funds are self-certifying by completing IRS Form 8996, and submitting with annual federal income tax returns.

Welcome! Welcome to OZ Pitch Day Fall 2024. This online event matches High Net Worth investors who have capitals gains with Opportunity Zone deals that are raising capital. Investing within your 180-day window is of crucial importance for OZ investors. This event can help you find the right deals to invest in before year-end.

Get our Opportunity Zones presentation template for MS PowerPoint and Google Slides to describe the tax incentives and benefits program that encourages people with capital gains to invest in undercapitalized or low-income communities. Enhance the meaning of your content with these stunning illustrations and graphics!

Leveraging Opportunity Zones presentation. Presentation sponsored by. 10. Federally designated Opportunity Zone census tracts within Fort Wayne / Allen County. $9.3B+. Building permit valuations in Allen County. (2019-2023) 1.5M. People living within a 60-mile radius of Fort Wayne.

THE QUALIFIED OPPORTUNITY ZONE PROGRAM Clarence Williams, Senior Government Consultant Becker & Poliakoff PA. The Why… • Created in the 2017 Tax Cuts and Jobs Act • Looks to take advantage of an estimated $6 Trillion in unrealized capital gains • Creates a tremendous investment opportunity to spur the movement of private capital • Opportunity Zones are hoped to be a powerful new tool ...

The city of Moscow, Idaho has 2 designated Opportunity Zones. In total these Opportunity Zones have a population of approximately 14,000. That represents 57% of the city's total population of 25,000. The median household income for Moscow Opportunity Zones ranges from approximately $37,000 to $39,000. The adjacent map shows all Opportunity ...

Create compelling presentations in less time. Exclusive access to over 200,000 completely editable slides. A fully-customized, versatile, and editable Opportunity Zones PowerPoint and Google Slides template is available for download. Give it a try today.

a. RUSSIAN SPECIAL ECONOMIC ZONES: NEW INVESTMENT OPPORTUNITIES . Alexander Temkin , JSC "Special Economic Zones" Moscow 2011. Special economic zones in Russia. Industrial zones. Touristic and recreational zones. Technology and innovation zones. Port zones. Slideshow 2123000 by cisco