.png)

Cash Flow Forecasting: A How-To Guide (With Templates)

Janet Berry-Johnson, CPA

Reviewed by

May 30, 2023

This article is Tax Professional approved

Most small business owners just want their accounting done so they can focus on doing what they love. But tracking and forecasting cash flow—despite the time and effort required—is essential for starting, operating, and expanding a business.

I am the text that will be copied.

In 2018, CB Insights analyzed 101 failed startups and found that running out of cash was the second most common cause of failure, impacting 29% of businesses.

To avoid that fate, you need a cash flow forecast to help you estimate how much your cash outflows and inflows will affect your business.

What is a cash flow forecast?

A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out based on past business performance.

It’s not uncommon for a business to experience a cash shortage, even when sales are good. This usually happens when customers are allowed to pay after the product or service is delivered. In cases like these, a business owner must plan how they will cover costs before receiving the payment.

For example, say Hana Enterprises ships $50,000 worth of security products to customers in January, along with invoices that are due in 30 days. The company will have $50,000 of revenues for the month but won’t receive any cash until February. On paper, the business looks healthy, but all of its sales are tied up in the accounts receivable. Unless Hana Enterprises has plenty of cash on hand at the beginning of the month, they will have trouble covering their expenditures until they start receiving cash from clients.

With a cash flow forecast, you ignore sales on credit, accounts payable, and accrued expenses, instead focusing on the revenue you actually expect to collect and the expenses you actually expect to pay during a given period. You can also use the information provided on past cash flow statements to estimate your expenses for the period you’re forecasting for.

( If you just want to dive into cash flow forecasting, check out our free cash flow forecast template . )

The benefits of cash forecasting

Cash forecasting may sound like something boring that accountants do in big companies. Not so! It’s absolutely essential for every single business. Here’s why:

- It helps you identify potential problems. Cash forecasting can help you predict the months in which you’re likely to experience a cash deficit and make necessary changes, like changing your pricing or adjusting your business plan.

- It decreases the impact of cash shortages. When you can predict months in which you might experience a cash shortage, you can take steps to plan for them. You might save more in months where you have a surplus, step up your receivables collection efforts, or establish a line of credit with your bank to guarantee enough working capital to last the period.

- It keeps suppliers and employees happy. Late payments and missing paychecks damage your reputation with suppliers and employees. When you can predict how much money you’ll have on hand in any given month, you can confirm that you’ll be able to meet your payroll obligations and pay suppliers by the due date.

Free cash flow forecast template

To make this a lot easier, we’ve created a business cash flow forecast template for Excel that you can start using right now.

Access Template

The template has three essential pieces:

- Beginning cash balance. This is the actual cash you expect to have on hand at the beginning of the month. It should include bank accounts, PayPal, Venmo, anything you use that’s currently holding just business funds. This information can be found on your balance sheet .

- Sources of cash. These are all of your cash inflows each month. It can include cash sales, receivables collections, repayments from money you’ve loaned out, etc.

- Uses of cash. This is every expense your business may incur, including payroll, payments to vendors, utilities, rent, loan payments, etc.

Here’s an example of a completed cash flow projection for a three month period:

Hana Enterprises, Inc.

Cash Flow Projection

January to March 2022

| January | February | March | |

|---|---|---|---|

| A. Operating Cash, Beginning | 9,000 | 24,000 | 2,000 |

| Sources of Cash: | |||

| Receivables collections | 60,000 | 50,000 | 55,000 |

| Customer deposits | 10,000 | 3,000 | 5,000 |

| B. Total Sources of Cash | 70,000 | 53,000 | 60,000 |

| Uses of Cash: | |||

| Payroll and payroll taxes | 20,000 | 20,000 | 20,000 |

| Vendor payments | 12,000 | 15,000 | 18,000 |

| Rent | 8,000 | 8,000 | 8,000 |

| Equipment loan payments | 5,000 | 5,000 | 5,000 |

| Purchase of computers | 0 | 15,000 | 0 |

| Other overhead payments | 10,000 | 12,000 | 13,000 |

| C. Total Uses of Cash | 55,000 | 75,000 | 64,000 |

| D. Change in Cash During the Month (B - C) | 15,000 | (22,000) | (4,000) |

| Ending Cash Balance (A + B) | 24,000 | 2,000 | (2,000) |

As you can see from the example above, Hana Enterprises expects to have a cash shortage in March. This results from a negative net cash flow (when more cash goes out than comes in). Knowing that information ahead of time, the company can take steps to prevent the shortage from occurring.

Hana Enterprises has several options to avoid this shortage in March. They might secure a line of credit from the bank, purchase fewer computers in February, negotiate longer payment terms from vendors, contact late-paying customers to speed up the collection of receivables, or take other cost-cutting measures to reduce their overhead expenses.

When you’re ready to get started, download your copy of the cash flow forecasting sheet here .

How Bench can help

Use Bench’s simple, intuitive platform to get all the information you need to project your cash flow. Each month, your transactions are automatically imported into our platform then categorized and reviewed by your bookkeeper. Bench helps you stay on top of your business’s top expenses so you can make informed budgeting decisions on the fly. Explore our platform with a free demo .

Tips for improving your cash flow spreadsheet

Keep in mind: a cash flow forecast isn’t something you create once a year and never look at again. It’s a living, breathing business tool you should review and update on a monthly basis.

Though projections are helpful, they can’t perfectly predict the future. As the months pass, you should expect to see that your projections aren’t quite matching up with your actual results. That means it’s time to re-run your forecast to take into account these differences.

To improve the accuracy of your cash flow worksheet, consider the following:

- Account for extra pay periods. If you pay employees bi-weekly, make sure your projection takes into account any months with three payrolls.

- Remember annual payments. If certain insurance policies, subscriptions, or other expenses are paid annually rather than monthly, be sure to include them in your spreadsheet.

- Remember estimated tax payments. For most calendar-year businesses, estimated tax payments are due on April 15th, June 15th, September 15th, and January 15th.

- Don’t forget about savings. Try to allocate a portion of any cash surpluses to save for lean months.

- Identify seasonal fluctuations. If you’re expecting a period of time with lower sales, make sure your forecast reflects this so you can have enough cash on hand to ramp up when business picks up again.

- Don’t forecast too far out. Creating a rolling 12-month cash flow forecast that you update at the end of each month can help you identify issues before your business faces financial troubles, but don’t try to forecast more than 12 months out. The longer the reporting period you want to forecast, the more likely you’ll end up spending a lot of time creating a cash flow projection that doesn’t provide any useful information.

Your cash flow forecast is key to good cash flow management . Try to account for all cash sources and uses in your projection and maintain an emergency fund or backup plan to ensure you don’t get sidelined by slow-paying customers or unexpected expenses. When you do, this simple but valuable tool can help you keep an eye on cash and ensure you don’t compromise growth or put your business in jeopardy.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Free Cash Flow Forecast Templates

By Andy Marker | June 24, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful free cash flow forecast templates, including those for small businesses, nonprofits, and personal cash flow forecasting, as well tips for performing a cash flow forecast.

Included on this page, you'll find a simple cash flow forecast template and a small business cash flow projection template , as well as the benefits of cash flow forecasting .

What Is a Cash Flow Forecast Template?

A cash flow forecasting template allows you to determine your company’s net amount of cash to continue operating your business. The template provides a way to examine day-by-day, month-by-month, quarter-by-quarter, or year-over-year projected cash receipts and cash payments as compared to your operating expenses and other outflows.

Use the preset criteria in a template to take the guesswork out of cash flow forecast requirements. You can then use the forecast to provide your company (or third parties) with a clear picture of your projected business costs. While cash flow forecasting allows you to look at projected cash flow, you can also track the actual cash flow for any chosen time period (i.e., daily, weekly, monthly, quarterly, or yearly).

To learn more about cash flow forecasting and to view examples, visit " How to Create a Cash Flow Forecast, with Templates and Examples ."

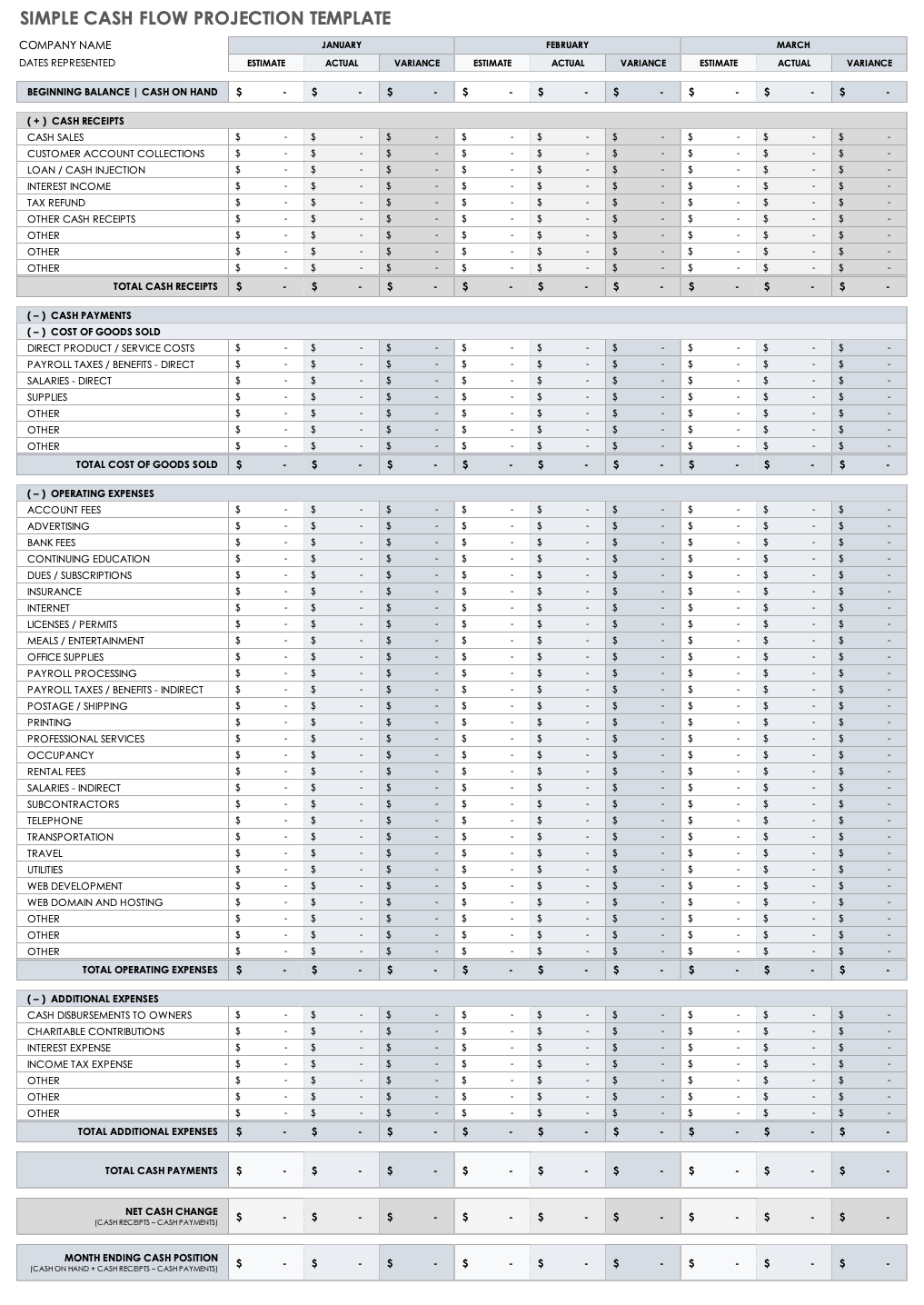

Simple Cash Flow Forecast Template

Use this basic template to gain monthly insight into your company’s cash flow and ensure you have sufficient funds to continue operating. Fill in your information for beginning balance (cash on hand), cash receipts and disbursements (R&D), operating expenses, and additional expenses. The template will auto-tally the monthly net cash change and month ending cash position columns. Use this information to forecast how long your cash will last, and whether you need to obtain additional financing.

Download Simple Cash Flow Projection Template - Excel

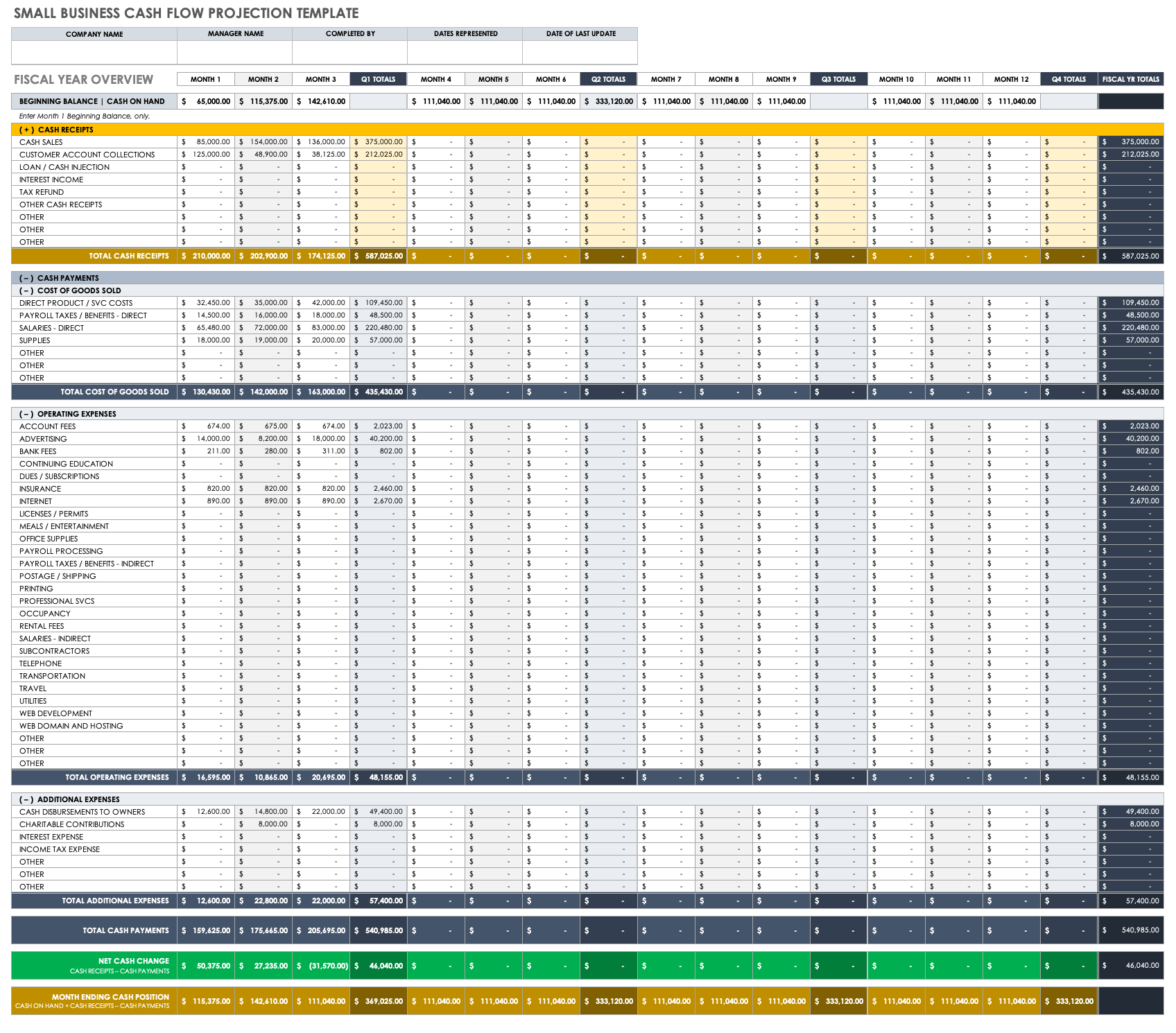

Small Business Cash Flow Projection Template

Use this cash flow projection template, designed for small businesses, to determine whether or not your business has adequate cash to meet its obligations. The monthly columns provide a big picture of how long funds should last, and the tallies for cash receipts, cash paid out, and other operating figures allow you to identify any potential shortfalls of your cash balances. This small business cash flow template also works with projected figures for a small business plan.

Download Small Business Cash Flow Projection Template - Excel

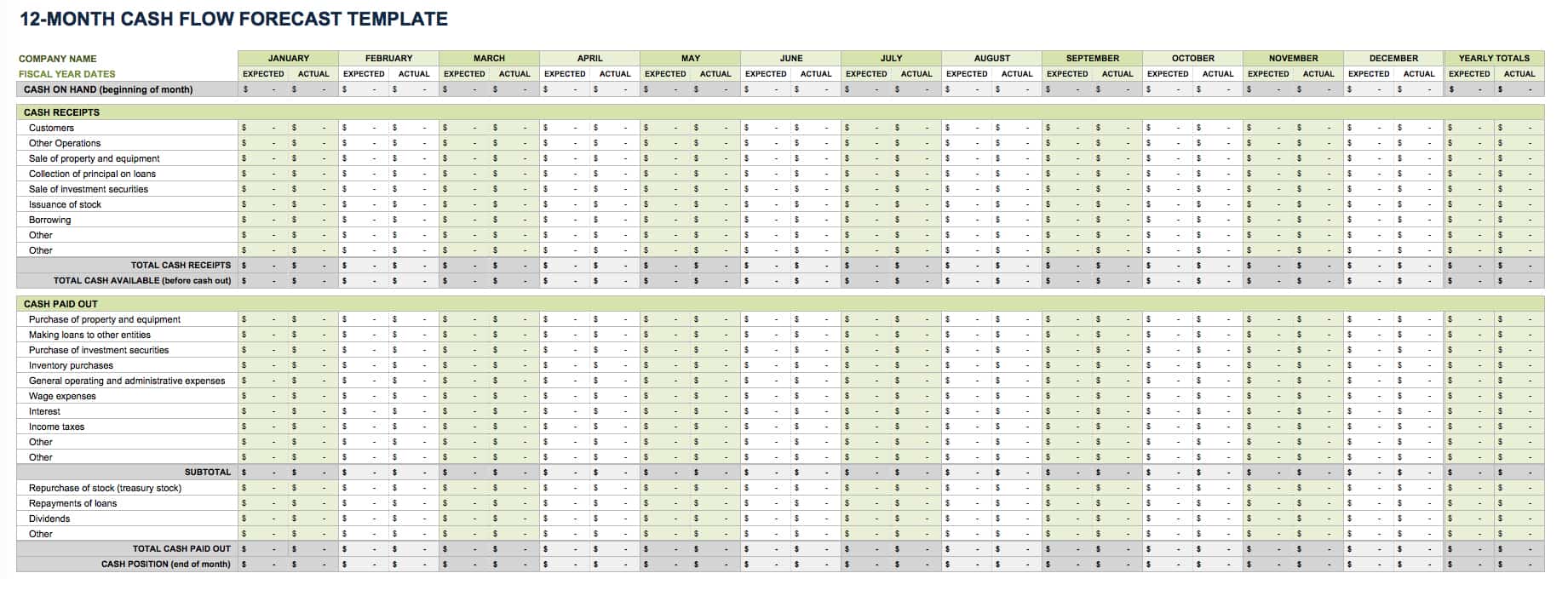

12-Month Cash Flow Forecast Template

Track your company’s overall cash flow with this easily fillable 12-month cash flow forecast template. This template includes unique expected and actual cash-on-hand details for the beginning of each month, which you can use to ensure that you can pay all employees and suppliers. Enter cash receipts and cash paid out figures to determine your end-of-month cash position. The monthly details of this forecast template allow you to track — at a glance — any threats to your company’s cash flow.

Download 12-Month Cash Flow Forecast Template

Excel | Smartsheet

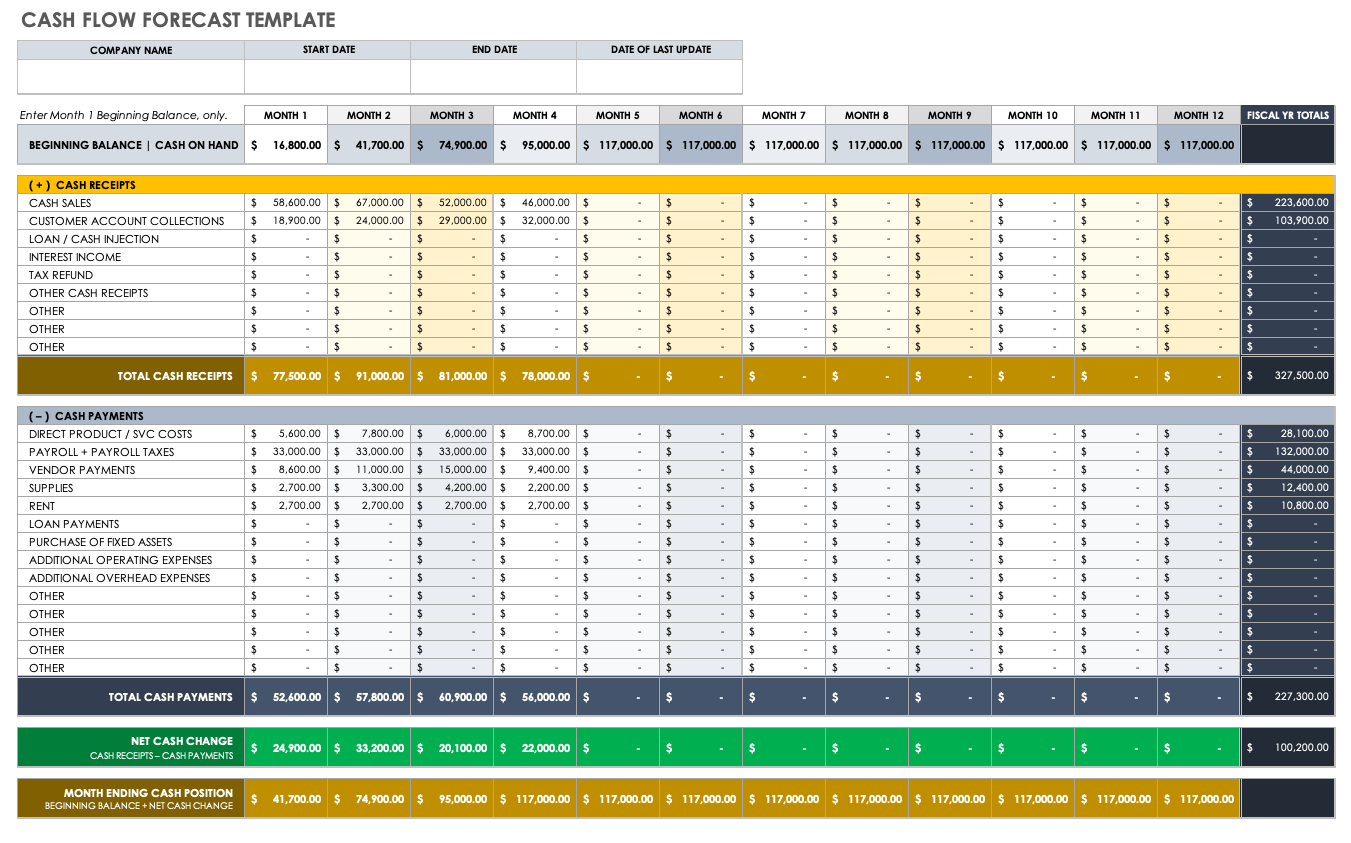

Cash Flow Forecast Template

This simple cash flow forecast template provides a scannable view of your company’s projected cash flow. Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. These details provide an accurate picture of your company’s projected month-by-month financial liquidity. Ultimately, this template will help you identify potential issues that you must address in order for your business to remain on sound fiscal footing.

Download Cash Flow Forecast Template - Excel

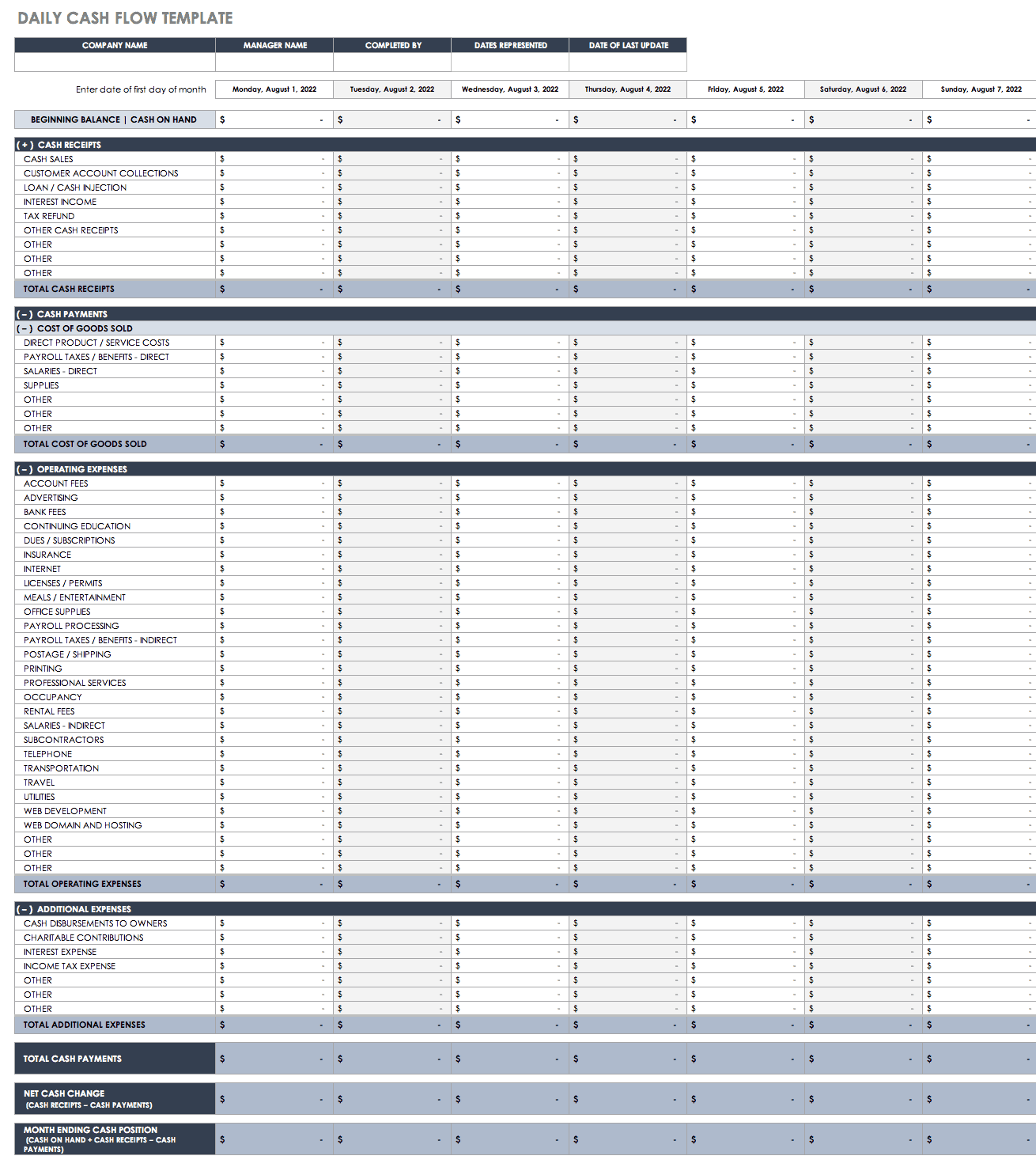

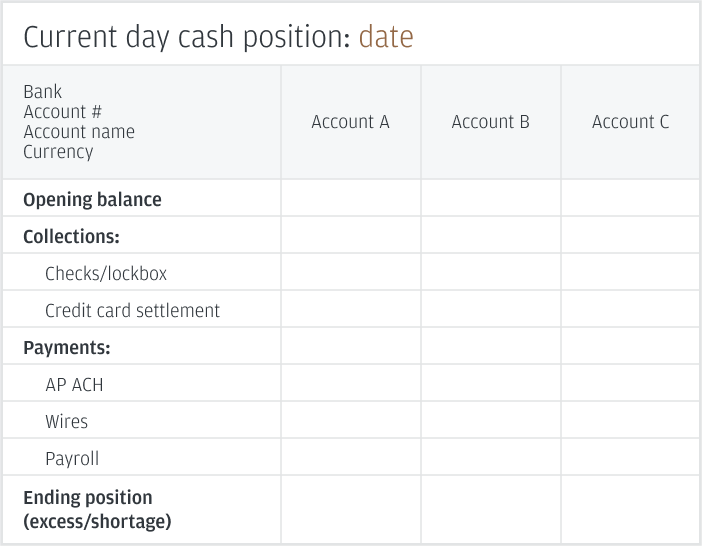

Daily Cash Flow Forecast Template

Use this daily cash flow forecast template to get a pulse on your business’ short-term liquidity. Daily cash flow forecasts are particularly helpful in determining that everything is accounted for and for avoiding any shortfalls. The template calculates cash payments against operating expenses to provide a daily net cash change and month-ending cash positions. This template has everything you need to get a day-by-day perspective of your business’s financial performance and outlook.

Download Daily Cash Flow Forecast Template

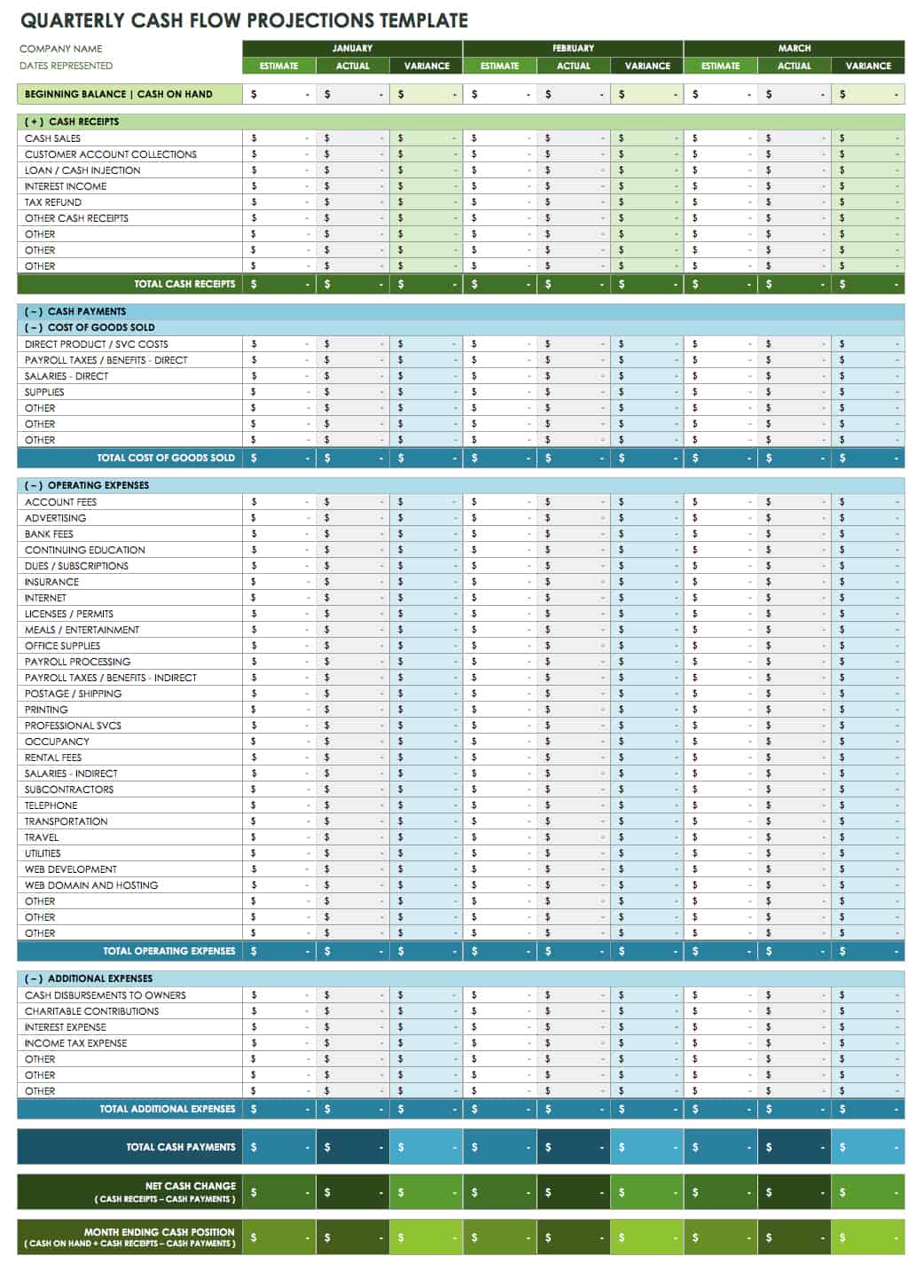

Quarterly Cash Flow Projections Template

Keep quarterly tabs on your cash flow with this customizable template. Use the quarter-by-quarter tabs to quickly detect any problems with a variety of factors, such as late customer payments and their potential impact on your business. This quarterly cash flow projections template is perfect for determining how any given variable might affect future financial planning.

Download Quarterly Cash Flow Projections Template

Excel | Smartsheet

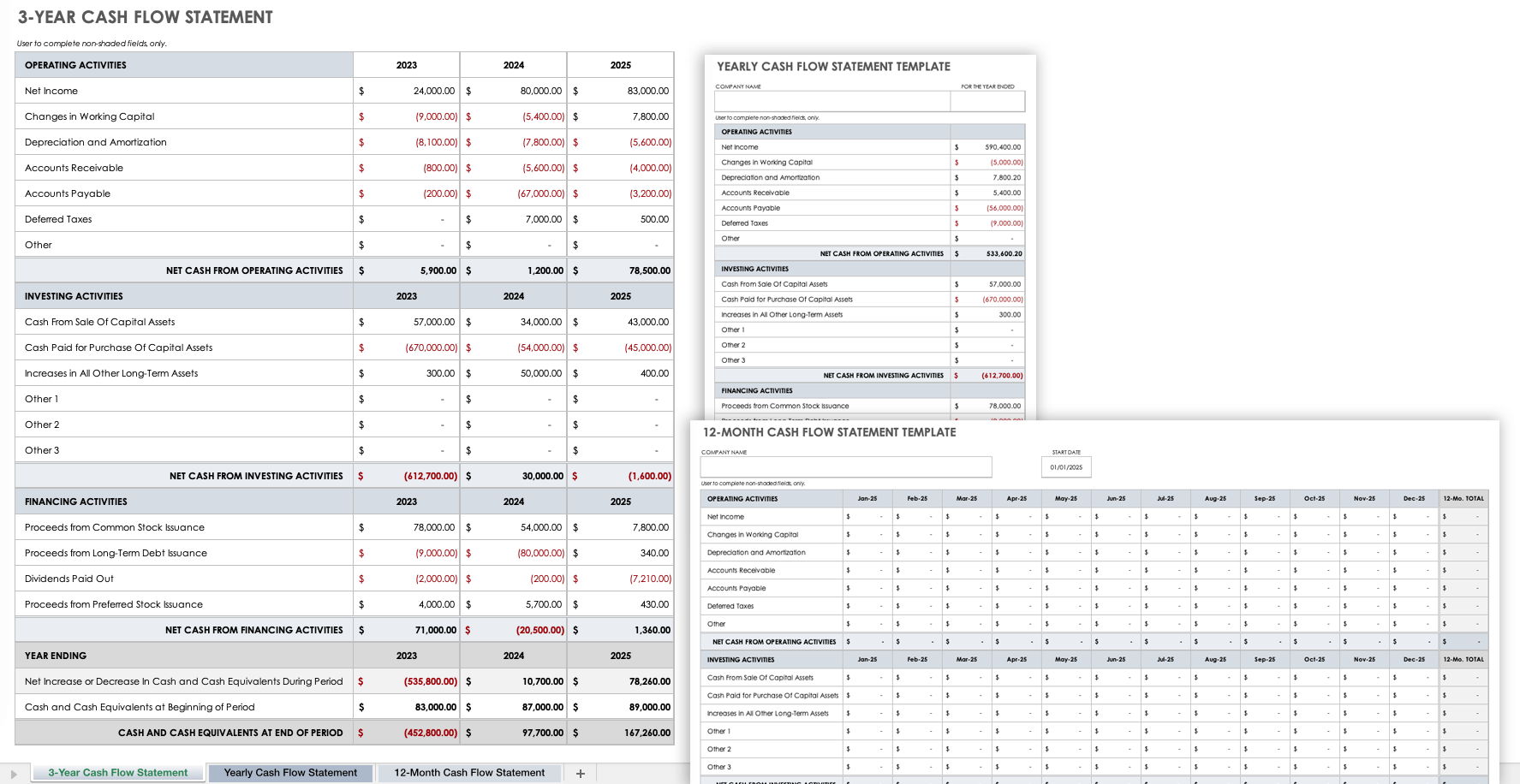

Three-Year Cash Flow Forecast Template

Get the big picture of your company’s long-term cash flow with this three-year cash flow forecast template. The spreadsheet provides separate tabs for a current cash flow statement, as well as 12-month cash flow and three-year cash flow projections. Enter year-by-year operations, investing activities, and financing details to see your year-over-year net increases or decreases. You can save this template as an individual file with customized entries, or share it with other business units or departments that need to provide cash flow details.

Download Three-Year Cash Flow Forecast Template

Discounted Cash Flow Forecast Template

Designed around the concept of discounted cash flow (DCF) valuation based on future cash flows, this template allows you to perform an analysis to determine your business’ true value. You’ll find year-by-year rows, their respective incomes (cash inflow), expenses (fixed and variable), cash outflow, net cash, and DCF details (present value and cumulative present value), and actual present value, all of which culminates in net present value. This DCF forecast template is also ideal for determining the value of a potential investment.

Download Discounted Cash Flow Template

Excel | Smartsheet

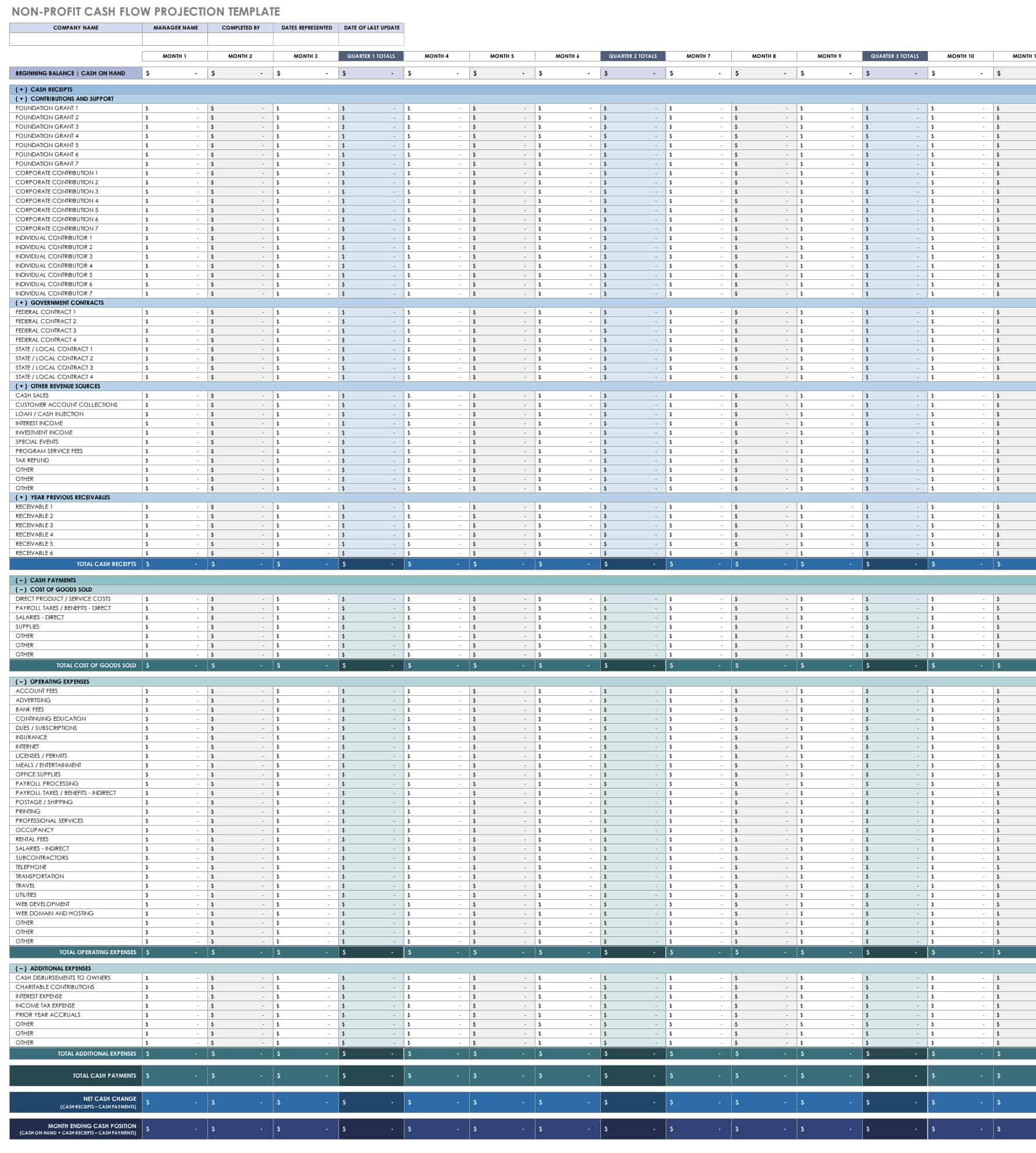

Nonprofit Cash Flow Projection Template

Use this template to determine whether your nonprofit will have enough cash to meet its financial obligations. There are sections for cash receipts, contributions and support, government contracts, other revenue sources, and receivables from previous years. This template is completely customizable, and provides insight into monthly and yearly carryover, so you can keep tabs on your rolling cash balance.

Download Nonprofit Cash Flow Projection Template

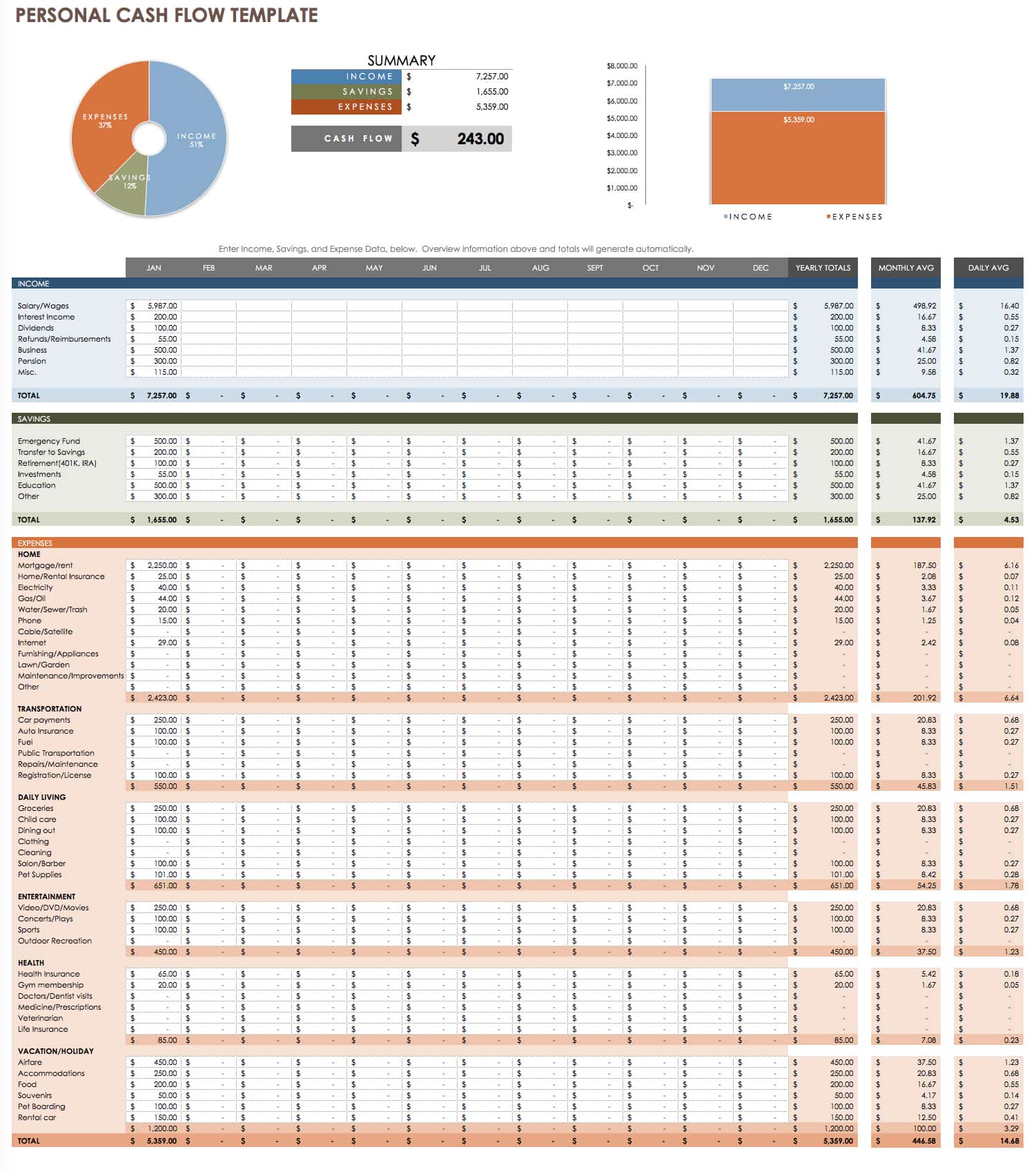

Personal Cash Flow Forecast Template

Manage your financial outlook with this personal cash flow forecast template. Compare your personal income to your expenses, with the additional factor of savings. The automatic pie chart provides insight into whether you’re spending above your means. Enter your income, savings, and expense data to get a comprehensive picture of your short and long-term cash flow.

Download Personal Cash Flow Forecast Template

Creating a Cash Flow Forecast

In order to set yourself up for success, you must be realistic when forecasting cash flows. You can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. For instance, knowing when your business will receive payments and when payments are due to outside vendors allows you to make more accurate assumptions about your final funds during an operating cycle. Estimated cash flows will always vary somewhat from actual performance, which is why it’s important to compare actual numbers to your projections on a monthly basis and update your cash flow forecast as necessary. It’s also wise to limit your forecast to a 12-month period for greater accuracy (and to save time). On a monthly basis, you can add another month to create a rolling, long-term projection.

A cash flow forecast may include the following sections:

- Operating Cash: The cash on hand that you have to work with at the start of a given period. For a monthly projection, this is the cash balance available at the start of a month.

- Revenue: Depending on the type of business, revenue may include estimated sales figures, tax refunds or grants, loan payments received, or incoming fees. The revenue section covers the total sources of cash for each month.

- Expenses: Cash outflows may include your salary and other payroll costs, business loan payments, rent, asset purchases, and other expenditures.

- Net Cash Flow: This refers to the closing cash balance, which reveals whether you have excess funds or a deficit.

Keep in mind that while many costs are recurring, you also need to consider one-time costs. Additionally, you should plan for seasonal changes that could impact business performance, as well as any upcoming promotional events that may boost sales. Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template.

The Benefits of Cash Flow Forecasting

Regardless of the reporting period, or granularity , you choose for your cash flow forecast, you should take into account important cash flow forecast-specific factors, such as seasonal trends, to gain a clear picture of your company’s finances. Accurate cash flow forecasting can enable you to do the following:

- Anticipate any cash-balance shortfalls.

- Verify that you have enough cash on hand to pay suppliers and employees.

- Call attention to customers not paying on time, and eliminate cash flow discrepancies.

- Act proactively, in the event that cash flow issues will adversely affect budgets.

- Notify stakeholders, such as banks, who might require such forecasting for loans.

Tips for Improving Cash Flow Forecasting

Whether you are a large or small business and want a day-by-day or three-year picture of your company’s projected cash flow,keep the following tips in mind:

- Pick the Right Cash Flow Forecasting Template: There are templates available for a variety of forecasting needs, including those for organization size and one that provides short or long-term insights. Select a template that’s suitable to your particular cash flow forecasting needs.

- Use a Discounted Cash Flow (DCF) Template: If you are looking to estimate the current value of your company, based on the time value of money (the benefit of receiving cash infusions sooner than later), you’ll want to do a DCF.

- Enter Variables Accurately: Inflows and outflows can change on a literal dime. Ensure that you tally all beginning balances (cash on hand), cash receipts and disbursements (R&D), and operating expenses correctly. These numbers provide the big-picture net cash change and your ultimate cash position.

- Choose the Right Forecasting Horizon: The margin of error when using a three-year cash flow forecasting template is greater than performing a daily cash flow forecast. When choosing a template, keep in mind the time-period for the forecast.

- Consider Seasonal Fluctuations: If your cash flow fluctuates by season (tax, interest, larger annual payments, etc.), incorporate those details into your cash flow forecast. This will ensure that one quarter’s inflow doesn’t positively or negatively affect another in your forecast.

Discover a Better Way to Manage Cash Flow Forecasts and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Any articles, templates, or information provided by Smartsheet on the website are for reference only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, articles, templates, or related graphics contained on the website. Any reliance you place on such information is therefore strictly at your own risk.

These templates are provided as samples only. These templates are in no way meant as legal or compliance advice. Users of these templates must determine what information is necessary and needed to accomplish their objectives.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Move fast, think slow: How financial services can strike a balance with GenAI

Take on Tomorrow @ the World Economic Forum in Davos: Energy demand

Perspectives from the Global Entertainment & Media Outlook 2024–2028

Climate risk, resilience and adaptation

Business transformation

Sustainability assurance

The Leadership Agenda

Global Workforce Hopes and Fears Survey 2024

The s+b digital issue: Game over to game on

The New Equation

PwC’s Global Annual Review

Committing to Net Zero

The Solvers Challenge

Loading Results

No Match Found

Preparing a cash flow forecast: Simple steps for vital insight

One of the questions we’re often asked by small business owners is, “how do I prepare a cash flow forecast?” It’s an important part of financial planning for any business. But, if you’re an entrepreneur or founder, you may not have an accounting or finance background.

It’s really simple to create your own forecast. And once you know how, it will become one of the most important pieces of insight into your business you have.

Why is a cash flow forecast important?

Cash flow planning is essential: you need cash in the bank to pay your bills. Staying on top of your cash flow will help you see if you’re going to run out of money - and when - so you can prepare ahead of time. Perhaps it will show you that you need to cut overheads, find new investment, or spend time generating sales.

On the flip side, you might be doing well, and you’re considering expanding into new markets, investing in new products, taking on bigger premises, or recruiting new staff. Having accurate cash flow projections will help you see if you can afford to take the plunge.

Four steps to a simple cash flow forecast

One option is to use free financial forecasting software online, which can help you plan ahead for the next week, 30 days, or six weeks. Or you can follow the four steps below to build your own cash flow forecast.

1. Decide how far out you want to plan for

Cash flow planning can cover anything from a few weeks to many months. Plan as far ahead as you can accurately predict. If you’re well-established, you might have a predictable sales pipeline and data from previous years. If you’re a new business, you might not have a huge amount of data - so the further out you go, the less accurate your predictions will be.

Don’t worry too much if you can’t plan far ahead. Your cash flow forecast can change over time. In fact, it should. As things change, or you get more exact estimates, you can update your plan.

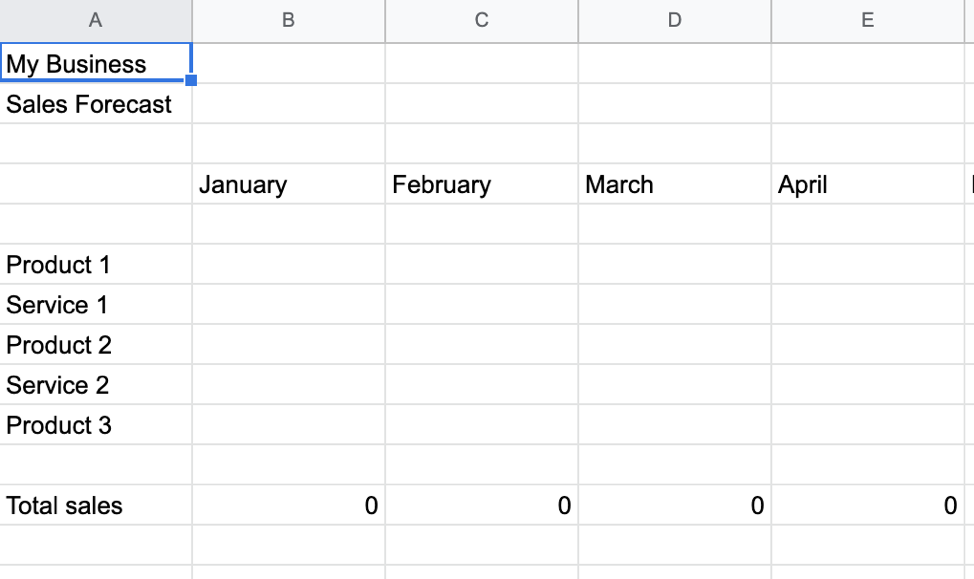

2. List all your income

For each week or month in your cash flow forecast, list all the cash you’ve got coming in. Have one column for each week or month, and one row for each type of income.

Start with your sales, adding them to the appropriate week or month. You might be able to predict this from previous years’ figures, if you have them. Remember though, this is about when the cash is actually in your bank account. Put the figures in for when you know clients will pay invoices, or bank payments will clear.

Also remember to include all non-sales income, for example:

- Tax refunds

- Investment from shareholders or owners

- Royalties or licence fees

Add up the total for each column to get your net income.

3. List all your outgoings

Now you know what’s coming in, work out what you’ve got going out. For each week or month, make a list of all the money you’ll be spending, for example:

- Raw material

- Bank loans, fees and charges

- Marketing and advertising spend

Once you’ve listed everything you spend, add up the total for each column to get your net outgoings.

4. Work out your running cash flow

For each week or month column, take away your net outgoings from your net income. That will give you either a positive cash flow figure (you’ve got more cash coming in than you’re spending) or a negative cash flow figure (you’re spending more than you’ve got coming in).

You can then keep a running total, from week to week, or month to month, to get a picture of your cash flow forecast over time. Too many negative weeks might spell trouble, and you’ll need to do some forward-planning to make sure you can meet your commitments - e.g. paying salaries, loan payments, and rent. Equally a few positive months might signal that you’ve got money to expand or invest.

Jenni Chance

Senior Manager, Entrepreneurial & Private Business, PwC United Kingdom

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Legal notices

- Cookie policy

- Legal disclaimer

- Terms and conditions

Back to business! Launch Your New Business with 10% Off — Start Now

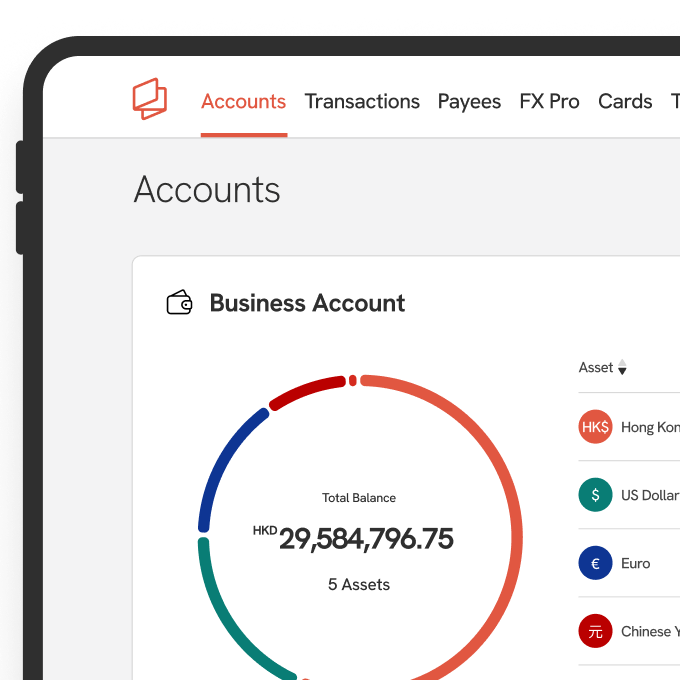

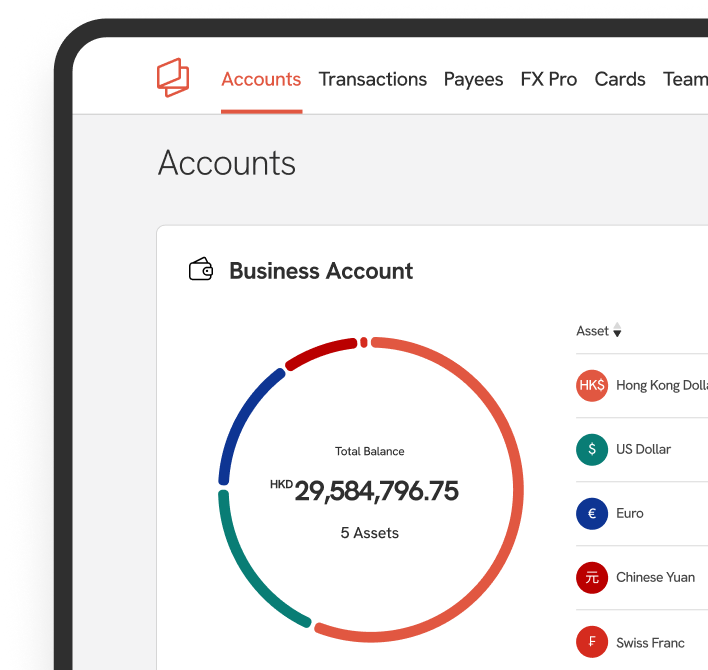

Hong Kong Business Account

International and local payments

Payment Cards

Foreign Exchange

Get rewarded

Business Guides

Business Account Reviews

Comparisons

Company Secretary Reviews

Whitepapers & E-Books

Industry Newsletters

PayPal Fee Calculator

Stripe Fee Calculator

Invoice Generator

About Statrys

Customer reviews

Partner Programs

What Is Cash Flow Forecasting? Templates & How To Do It

7 minute read

Key Takeaways

Cash flow forecasting is a method for estimating cash inflows and outflows over a future specific period of time.

A cash flow forecast is created by having an opening cash balance, calculating the predicted net cash flow, calculating the ending balance, and doing this for each chosen month on the forecast.

Forecasting provides clarity for the next 3-6 months, guiding decisions related to investments, company expansion, and strategic planning for various financial scenarios.

Did you know that only 27% of businesses have prepared a cash flow forecast? This explains why 82% of small businesses fail because of cash flow problems, and it suggests that understanding and managing cash flow plays a key role in achieving success in running a business.

So, what makes cash flow forecasting so difficult that business owners want to avoid it so much? This article will explain what cash flow forecasting is and provide the necessary steps, requirements, and templates for entrepreneurs so you don't fall into the same trap as other entrepreneurs.

What is Cash Flow Forecasting?

Cash flow forecasting, also known as cash flow projection, is a method of estimating the number of cash inflows and outflows of a given business across a future, specific amount of time. Conducting a cash flow forecast allows businesses to plan for cash deficits further and manage risk effectively.

A typical cash flow forecast might take anywhere from a few weeks to several months to complete, depending on the time interval chosen.

The primary goal of cash flow forecasting is to provide insight into a company's liquidity, allowing for better decision-making and strategic planning. By analyzing expected cash movements, businesses can identify potential cash shortages or surpluses, enabling them to take proactive measures to address any financial challenges or capitalize on opportunities.

Which Businesses Should Conduct Cash Flow Forecasting?

A common question that gets asked is whether conducting a cash flow forecast is worthwhile for companies and what type of businesses can benefit from a cash flow forecast.

All types of businesses can benefit from a cash flow forecast, however, those that experience fluctuations in income & expenses, such as SMEs, seasonal market changes, such as those in hospitality, and newer companies that involve risk, such as startups, tend to benefit the most.

In addition, forecasting in businesses that experience significant upfront costs, such as manufacturing and construction, is a fundamental practice to help with cash flow management.

Here are other sectors that can benefit from a cash flow forecast.

High-growth tech startups - Cash flow forecasting is crucial for high-potential tech startups, as its goal will always be rapid growth. A tech startup needs to plan for research and development costs and attract investors by demonstrating financial prudence. A cash flow forecast aids in this endeavor.

Healthcare - Healthcare organizations, including hospitals and clinics, rely on cash flow forecasting to manage operational costs, plan for capital expenditures, and navigate the complexities of insurance reimbursements.

Agriculture - Agricultural businesses benefit from cash flow forecasting to manage planting and harvesting cycles, purchase necessary equipment, and navigate the impact of weather conditions on crop yields and revenues.

The Importance of Cash Flow Forecasting

Why is cash flow forecasting important? Here are a variety of reasons:

Improved Financial Planning

Cash is the lifeblood of all businesses. Without a clear overview of the cash that’s coming in and out of a business at any given time, a company may run into unforeseen financial challenges, cash bottlenecks, and increased debt levels. On the other hand, strong financial planning will result in high business liquidity, stronger team morale, and better investment opportunities.

Forecasting can help financial reporting by giving businesses an accurate lens of potential operational challenges that may come up in the case of low cash flow. Through a forecast, a company can also make better decisions such as choosing to cut budgets in the case where cash flow is tight or allocate funds in the case of healthy cash flow.

Risk Management

During periods of low liquidity, forecasting allows businesses to better plan for economic downturns. While in periods where cash flow is predicted to be strong, a business can pre-plan business expansion activities.

This early identification of potential cash bottlenecks can help avoid situations where the business may struggle to meet its financial obligations.

Compliance and Reporting

A cash flow statement is a type of financial statement required for GAAP compliance. GAAP, abbreviated as “generally accepted accounting principles,” is a set of principles that provide a standardized framework for financial reporting, helping ensure consistency and comparability across different organizations.

These statements are mandatory for GAAP compliance, while forecasts are only relevant for internal planning and decision-making. However, they contribute to compliance by creating a clear understanding of a company’s financial position. This can help entities fulfill regulatory filings, making sure tax obligations are paid for when due, and also aid meet debt obligations.

Further Enhanced Decision Making

Forecasting can help drive decision-making because forecasts can provide much-needed clarity for the next 3-6 months of a given firm. This enhances decision-making in the following ways:

- Dictates investment and company expansion opportunities.

- Business decisions are made based on informed selections.

- Decision-makers can use forecasts to plan to prepare for different potential financial scenarios in the case of an economic downturn. Or the case of a bull market, to plan to take advantage of economic upswings.

How to Create a Cash Flow Forecast?

1. determining your objective.

The first step is to determine your objective and what purpose are you creating a forecast. We will list a few examples:

Interest and debt reduction . The purpose of interest/debt reduction is to ensure that a business has enough cash on its hand to pay out debts and loans.

Growth planning. The purpose of growth planning is to ensure that a business has enough working capital to fund business expansion needs.

Short-term liquidity planning. Short-term liquidity involves overseeing the daily cash availability to guarantee that your business can fulfill its immediate financial responsibilities.

2. Selecting Your Interval

Cash flow forecasts can be long-term or short-term. There are three time frames you must choose from before conducting a cash flow forecast:

Short term forecast

A short-term forecast typically lasts less than 3 months. A general principle is that the shorter a forecast, the more accurate the forecast is. Therefore, short-term forecasts last no more than 3 months. This is optimal for short-term liquidity planning.

Mid-term forecast

Mid-term forecasts can make you look between 2 months to 12 months.

Long term forecast

Long-term forecasts last over a year and can play a role in long-term budgeting and financial planning. A comment to make is that the longer a forecast is, the less likely the accuracy of the forecast will be.

3. Direct Method or Indirect Method

There are two common ways of forecasting cash flows: the direct method and the indirect method . The direct method is suited for daily cash management, while the indirect method provides a better basis for strategic planning:

Direct method - focused on cash receipts and transactions. The direct method is transparent.

Indirect method - net income and adjusts it for non-cash items and changes in working capital to derive the cash flow from operating activities. The indirect method is less detailed.

Alignment - Companies may choose the method that aligns with their reporting preferences and regulatory compliance.

We will cover the indirect method in this article in the section “cash flow forecast templates.”

4. Sourcing the Data Needed to Conduct a Forecast.

You can pull data from your account payables, account payables, bank accounts, and accounting software that you use. You will need three pieces of data.

- Opening cash balance.

- Cash inflows for the forecasting period.

- Cash outflows for the forecasting period.

A comment to make here is that the forecast cash inflows and outflow predictions will be made based on your current financial statements.

5. Making a Forecast

A forecast sheet is created. Please refer to the section on cash flow forecast templates for further details.

6. Regular Review

Once a forecast has been completed, it’s crucial that ongoing monitoring is done to make sure that results and the forecast match up, to ensure relevance and accuracy. Depending on the outcome, businesses may need to update their forecasts.

Best Cash Flow Forecast Templates for Free

Standard 1-year forecast using excel.

Here's an explainer video from " The Finance Story Teller " to walk you through the step-by-step process.

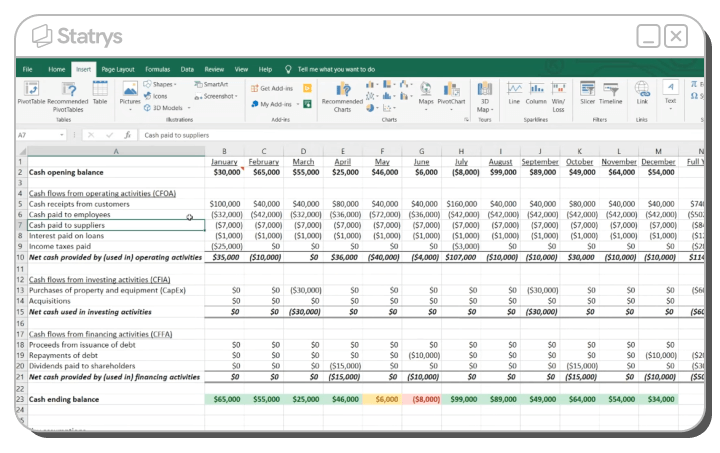

Many cash flow forecast templates are created through Excel. Here’s an example of a forecast. Let’s break down each section:

In the case of a 12-month interval

Months - This denotes the chosen cash flow forecast interval.

Cash opening balance - this denotes the amount of cash a business has at the beginning of each month.

Net cash used in operating activities - this denotes the amount of cash a business is producing or losing from its core business operations.

Net cash used in investing activities - this denotes the amount of cash a business is producing or losing from its financial activities.

Net cash used in financing activities - this denotes the amount of cash a business is producing or losing from its investing activities.

Cash ending balance - this denotes the predicted ending cash balance from each month.

Using a cash flow forecast template in Excel is one of the many ways businesses can project and manage their financial liquidity.

A well-constructed cash flow forecast template not only aids in financial planning but also serves as a crucial tool for monitoring and managing the overall financial health of a business.

💡 Note: Excel is one of the methods of conducting a cash flow forecast. However, you can also produce a forecast using accounting software.

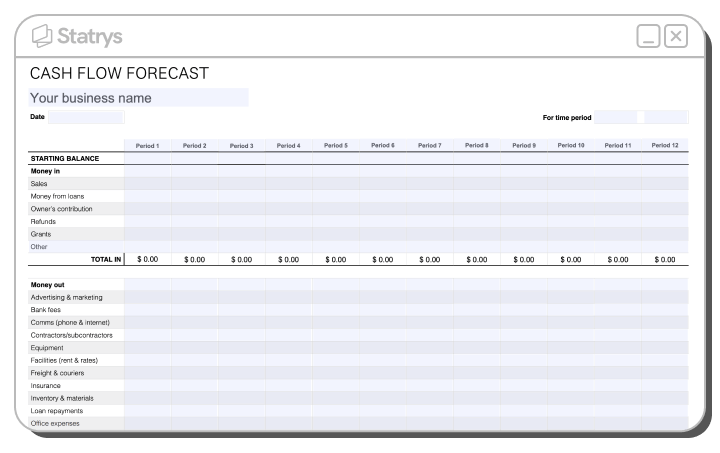

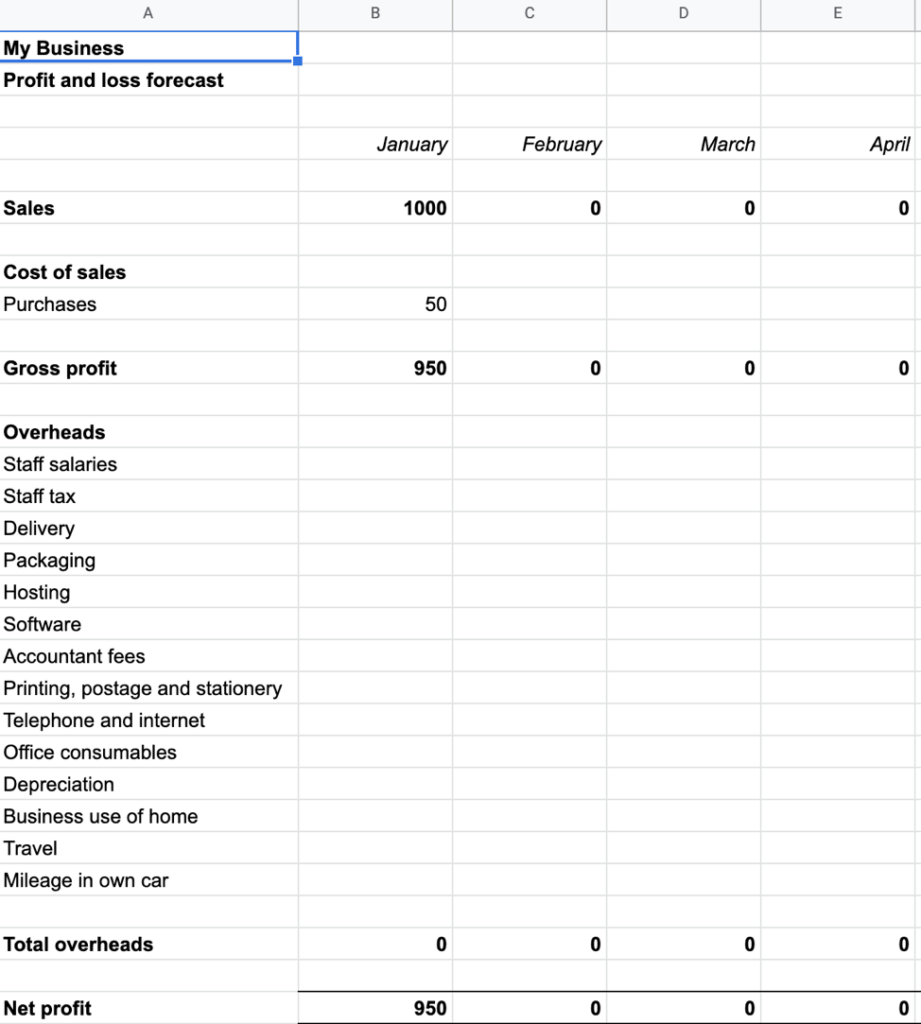

Xero’s Cash Flow Forecast Template

Xero, a popular accounting software, has cash flow forecasting built into one of its features, but it also gives a free template that anyone can use. Xero’s cashflow forecast template uses a simple layout to help you predict your upcoming business costs.

Unlike a standard cash flow template where operating cash flow, financing cash flow, and investing cash flow are calculated - the template is split into two categories: “cash in” and “cash out” for simplicity.

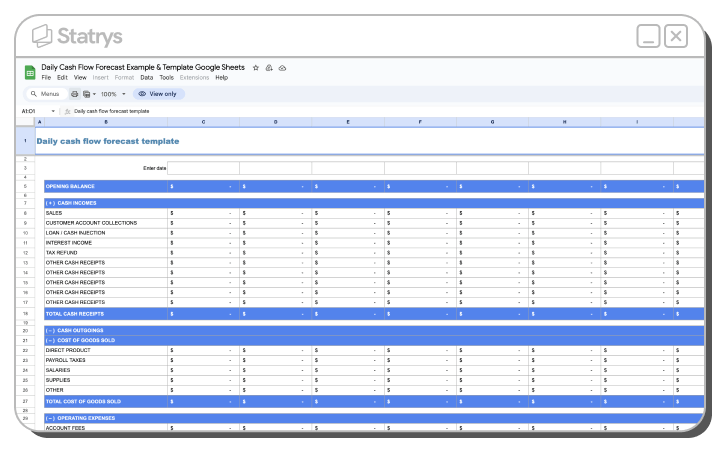

Creating a Cash Flow Forecast Using Google Sheets

Google Sheets are more commonly used than Excel spreadsheets because of their sharing features across teams, making it a much more accessible option. Here’s a template created by Coupler.io that encompasses a short-term cash flow forecast.

For this template specifically, they are more focused on operating cash flow, splitting its categories into cash incomes, cash outgoings, and operating expenses.

You can also create your own Google sheet template using the information shared on creating a forecast using Excel by breaking up the categories into opening cash balance, operating cash flow, and finally, the ending cash balance.

Information to Look Out for During a Forecast:

While analyzing your data, you should take note of the two following areas to prepare for scenarios:

Months with low net cash balance or negative cash flow. This means that there will be foreseen challenges regarding cash flow during the months that show a low net cash balance. Businesses can use this information to prepare for future events.

Months with high net cash balance or strong cash flow. This means that businesses can use this interval to invest in activities such as hiring more staff, investment opportunities, and repaying debt.

Advantages & Limitations of Cash Flow Forecasting

There are several reasons to conduct a forecast on an interval basis. (bi-monthly or bi-yearly)

- Foresight/Strategic planning. Businesses with a clear understanding of expected cash inflows and outflows can allocate resources more strategically. This also allows businesses to anticipate potential challenges, such as delayed payments, cash shortages, and unexpected expenses, to proactively address issues before they occur.

- Keeps finances organized. Forecasting assists in the creation of comprehensive budgets. This organized financial planning helps businesses manage their finances more effectively.

- Early identification of issues. Early detection of potential cash flow issues allows businesses to implement proactive measures to mitigate risks in the case of months with negative cash flow.

- Builds investor confidence. Regular and accurate forecasts provide investors with transparent insights into a company's financial health. This transparency builds trust and confidence among existing and potential investors.

- Liquidity management. Forecasting helps businesses maintain optimal cash reserves to cover operational needs and capitalize on strategic opportunities. This is crucial for avoiding liquidity crises and taking advantage of favorable market conditions, such as during which there's a positive cash flow figure predicted.

- Suitable for businesses with lots of transactions. Businesses with a high volume of transactions benefit significantly from forecasting, as it helps manage the complexity associated with numerous financial interactions.

- Facilitates better budgeting and planning. Forecasting allows businesses to conduct scenario analysis, evaluating the impact of different variables on their financial position. This enables more informed decision-making and the development of resilient budgets that can adapt to changing circumstances.

Limitations

There are also several limitations of a forecast that you should be aware of.

- Does not account for market and economic volatility. Cash flow forecasts may not fully capture the impact of sudden market fluctuations or economic downturns. Unforeseen external events can significantly deviate actual cash flows from forecasted values.

- Not flexible. Some forecasting models may lack flexibility, making it challenging to adapt to changing business conditions. This inflexibility can result in inaccurate predictions if the business environment evolves differently than expected.

- It may be prone to human error. Forecasts often involve manual data entry and calculations, increasing the likelihood of human error. Inaccuracies in input data or formulae can lead to unreliable forecasts.

- It may be time-consuming, but other pressing matters may take priority. Developing and maintaining accurate forecasts can be time-consuming. In fast-paced business environments, other urgent matters may take precedence, leading to less attention to the forecasting process.

- Difficult for startups. Startups often lack a substantial historical financial record, making it challenging to develop accurate forecasts. The absence of reliable data can hinder businesses' forecasting process.

- Requires specialized skills/software. Effective forecasting may require specialized financial knowledge and the use of sophisticated software tools. Small business owners with limited financial expertise may find it challenging to implement and maintain such systems.

- Based on estimates and assumptions. Forecasts heavily rely on estimates and assumptions about future business activities. If these estimates prove to be inaccurate or assumptions change, the forecasted cash flows may deviate from actual results.

The Role of Automation in Cash Flow Forecasting

There are a multitude of ways you can automate your cash flow forecasting process, from the simple: integration with popular apps such as Xero, Quickbooks & Freshbooks, to the complicated - using machine learning tools and AI to analyze financial data.

To what degree of automation you do in your cash flow forecast will depend on your business size, resources, and time available.

Automation in Cash Flow Forecasts Helps Save Time

For finance teams, setting up a cash flow forecast takes time away from other work activities. Therefore, setting up an automation system can help save time. There are two types of ways you can automate your forecasting.

First is through the inputs you insert into your sheets. For example, you can automate the input of data into the cash flow forecast sheet. You can also set up notifications that notify teams when a cash flow forecast needs to be made and automate the input process using software.

The second way you can automate a cash flow forecast is through its output. Automation can be done through automatic reporting and analytics. Many cloud-based accounting software have pre-built features for cash flow forecasting and forecasting, which you can use to generate automated reports.

You can also automate outputs to integrate with CRM (Customer Relationship Management) systems, payment processors, and banking platforms to consolidate financial data automatically.

Artificial Intelligence and Machine Learning in Cash Flow Forecasts

Using machine learning, teams can create an accurate cash flow forecast based purely on artificial intelligence calculating the output. There are a variety of ML models teams can use, such as neural networks, random forests, and Autoregressive Integrated Moving Averages.

A recent article by cfo.com shows that JPMorgan has 150 data scientists and engineers working with payment-flow data to refine its ML solution for cash-flow forecasting. Many major banks, such as Bank of America, Wells Fargo, and Citi Bank, also utilize artificial intelligence to automate their forecasting processes .

Using Data Analytics for Pattern Identification

Business analytics plays a role during the data consolidation phase in a cash flow forecast. You can use many statistical and mathematical models to generate a cash flow forecast, which is called predictive analysis.

There are also analytic tools to help you present & visualize the data you have from a cash flow forecast; this information can be used to be presented to stakeholders and potential investors of your company.

Here are business intelligence tools that can be employed to visualize cash flow forecasts:

- Microsoft Power BI

- XLReporting

While Excel’s core features also allow you to visualize the information in the form of line graphs and charts. Finally, you can also use Python - a popular programming language data scientists use to visualize data using its libraries such as Numpy, Pandas, and Matplotlib. Which data analytic tool you use will depend on your current situation and the resources available.

Automation Reduces Human Error

Automated systems reduce human error because technology is consistent and able to run without fatigue, whereas a human being is prone to make mistakes.

Automation in a cash flow forecast streamlines the workflow by automating approval processes, invoicing, and other financial tasks. This reduces delays and errors that may occur in manual workflows, ensuring a more efficient process.

It's common for analysis to be done manually with a finance team. However, bigger corporate companies teams with better access to resources tend to rely on automation to reduce the human error involved. Though budgets may vary, we would recommend using accounting software to generate your own cash flow forecast as a baseline.

Open a Business Account with Statrys

No minimum deposit. No maximum transaction. Support from an account manager.

Does forecasting differ in terms of startup and corporate companies?

Yes, startups work with financial data on a smaller scale, so their forecasting methods will be more straightforward. While larger corporate companies are dealing with more complex structures, with diverse revenue streams. This means that larger corporate companies will need more sophisticated forecasting models.

Should I outsource my forecast or do it in-house?

For smaller-sized companies, outsourcing to a firm that specializes in cash flow forecasting can provide access to expertise and experience that you might not have in-house.

Do I need an emergency fund when my forecast shows challenges ahead?

If a forecast indicates challenging times ahead, it’s wise to start saving for a rainy day so that you will have peace of mind.

What if my projections don’t match up with the present?

It’s not uncommon for the predictions to be different from the actual outcomes coming from a cash flow forecast, as no model is 100% perfect in predicting something. Always be pivoting & revising your business plan, while revisiting your forecasts from time to time.

How often should I update my forecast?

For many companies, forecasts are updated on a monthly, or quarterly basis. But this still varies on a case-by-case basis depending on your unique situation and the current economic environment.

Axel has built a distinguished career in project management, focusing on the finance and insurance sectors. He started his career in 2011 in Japan, where he honed his skills at a prominent French Investment Bank, working with both the Finance and Ope...

Read full Bio

Related articles

5 Best Accounting SaaS Solutions for Small Businesses in 2024

Accounting Tips

What is Accounts Receivable (AR)? How Businesses Use Them

The Ultimate Cash Flow Analysis Guide in 2024

Managing Cash Flow: 10 Practical Tips For A Business

Browse Accounting Tips

Looking for a business account.

100% online application

No account opening fee, no initial deposit

Physical and virtual cards

Cash Flow Forecasting Best Practices: What You Need to Know

February 1, 2024

If you’re looking to gain critical insights into where your business’s finances are headed, our cash flow forecasting best practices will help you do just that.

Much like a ship relies on its captain to navigate treacherous waters and ensure smooth sailing, a business counts on cash flow forecasting to identify risks and better plan for the future.

The benefits of a cash flow forecast are many. It enables you to predict your business's financial future so you can plan for cash shortages, make the most of cash surpluses and measure performance against plans.

With the right cash flow analysis tools, you can work out if you need to reduce expenses or focus more time on generating sales. You can even see how specific changes – like launching a new product or entering a new market – will impact your finances.

In this guide, we share the most useful cash flow forecasting best practices to help you get started. You’ll learn about the essential factors to consider when forecasting sales and tracking expenses, as well as how cash flow forecasting tools can simplify the process.

What is the purpose of a cash flow forecast?

Let’s first start with the definition of cash flow forecasting. Put simply, it’s a financial process that allows businesses to project future cash inflows, outflows and balances over a specified period.

This entails estimating future sales and expenses as well as accounts receivable and accounts payable figures. Cash flow forecasts can focus on a future period ranging from the upcoming month to the next 12 months and beyond.

The purpose of a cash flow forecast is to provide a snapshot of your business’s future liquidity to anticipate cash movements and make better strategic decisions. It helps businesses avoid cash shortfalls, honour debt obligations and wisely invest cash surpluses.

In short, forecasting allows you to enhance future operations, look out for potential pitfalls and plan your business’s growth.

4 components of a cash flow forecast

A comprehensive cash flow forecast typically includes the following fundamental components:

1. Opening cash balance

The opening cash balance reflects the initial amount of cash available at the beginning of the forecast period. This figure reflects your bank balance, whether positive or negative, and serves as the foundation for your cash flow projections .

2. Cash inflows

Cash inflows refer to the money expected to enter your business during the forecast period from a range of sources, including from sales, loans, dividends, tax refunds, corporate funding or rental income.

This component of cash flow forecasting involves projecting how much cash you will receive from each source, as well as when you will receive it. Historic financial and sales data, as well as analysis of market trends, customer behaviour and seasonal fluctuations can be used to inform estimates.

3. Cash outflows

Cash outflows cover the expected expenses and payments exiting your business throughout the forecast period. These can include expenditures like salaries, rent, utilities, taxes, loan repayments, bank charges and interest payments.

It’s important to work out the amount you are likely to spend on these expenses and payments, and when you will need to do so. Invoices, payroll records, payment deadlines and supplier agreements can all be used to inform your projections.

4. Closing cash balance

The closing cash balance provides a view of whether your business has a cash surplus or deficit at the end of the forecast period. This involves adding net cash flow to your opening balance, which will reveal the residual amount of cash available.

With this figure, you gain a snapshot of your business’s financial health to help identify potential cash flow challenges and assess profitability. It also forms the opening cash balance for your next forecasting period.

Best practices for cash flow forecasting

Getting the most accurate results and fully reaping the benefits of cash flow forecasting requires factoring in multiple variables. This includes sales projections, expenses, as well as payments your business owes, and those owed to you, during the forecast period.

Let’s look at how you can best capture this data and integrate it into your cashflow forecast .

1. Performing accurate forecasting

Forecasting involves estimating your business’s expected revenue over a specified period. In simple terms, it helps you predict how mucha business will sell and when.

Forecasting means analysing a range of data concerning historic sales, market and industry conditions, customer behaviour and your current pipeline. It allows you to establish realistic sales goals, optimise inventory, effectively allocate resources and align business strategy with market demands.

To enhance your cash flow forecasting, consider implementing the following best practices:

a) Ensure data integrity

Clean and comprehensive data is essential for accurate forecasting. If you’re a smaller business, you may even rely on data managed in spreadsheets.

Keeping data up-to-date and accurate across all these systems is the responsibility of everyone in your organisation – from sales reps to business leaders. Clearly communicating a culture of data hygiene and establishing robust data standards can help improve data entry practices and ensure regular updates.

You may want to appoint key people within your business to ensure data standards are applied and regular data reviews take place across different teams. All these long-term efforts will ensure your data will provide an accurate picture of the future.

b) Select the right forecasting method

There are a range of methods commonly used by businesses to forecast effectively. Each method has its own advantages and limitations, and choosing the right one depends on your business’s goals, available data and resources. Popular methods include:

- Direct forecasting: Predicts future values of a variable directly based on historical data to help determine short-term trends.

- Indirect forecasting: Generally part of the planning and budgeting process, this long-term forecasting method can help determine broader strategic planning.

c). Account for internal and external factors

While your historical data can lend insights into business trends, it may miss potential factors outside of its scope. It’s important to factor in changes that may not be captured in data and will impact future business trends, including those related to:

- People and policies: New hires or layoffs can divert attention from pursuing prospects, while updates to commission structures or pricing strategies can impact sales performance.

- Market expansion: Venturing into new territories or industries can significantly alter your business dynamics. New markets often demand increased efforts for customer acquisition, potentially prolonging cash flow cycles.

- Product and services: New features, plans or products can disrupt cash flow forecasts by influencing customer demand and behaviour. Even subtle tweaks to product offerings or pricing models can have profound ramifications on your cash flow.

- The economy: Fluctuating inflation, the possibility of recession or global supply chain issues can change market dynamics and customer purchasing behaviour.

- Industry dynamics: Fresh competitors entering your industry, new technology or changes to the supply of materials can all alter customer preferences and behaviors.

d). Regularly review and update forecasts

Cash flow forecasts should not be static documents but dynamic tools that evolve with changing market conditions and business dynamics. It’s important to establish a regular cadence for reviewing and updating forecasts, ideally on a monthly basis. This will help ensure forecasts remain relevant and aligned with current performance and market trends.

2. Ensure detailed expense tracking

Expense tracking is fundamental to gaining visibility of your cash outflows, thereby allowing you to accurately forecast cash flow. This calls for a robust system to keep track of expenses including:

- Operational expenses: The day-to-day expenditures necessary for running the business, like utilities, rent, payroll, office supplies and marketing expenses.

- Capital expenditures: Investments in assets that provide long-term value to the business, such as equipment purchases, property acquisitions or infrastructure upgrades.

- Debt payments: Interest payments and principal repayments on loans or lines of credit.

- Cost of goods sold (COGS): The direct costs of producing goods or services sold by the business, including the likes of raw materials and production overheads.

Tips to help you keep on top of these expenses include:

- Making use of accounting software that streamlines the process of recording and monitoring expenses.

- Regularly analysing historical spending data to identify trends and patterns over time.

- Creating distinct categories for different types of expenses, such as operating costs, marketing expenses, salaries and utilities.

- Implementing a receipt management system that allows employees to digitise receipts using mobile apps or scanners.

3. Managing accounts receivable and accounts payable

To ensure accurate cash flow forecasting, it’s important to effectively manage all the payments owed to your business and those you owe to others. This involves factoring in the following accounts receivable and accounts payable considerations:

- Customer payment terms: The terms you offer customers that can impact the timing of cash inflows. This includes payment due dates, discounts for early payment and billing cycles.

- Supplier agreements: The payment terms you have negotiated with suppliers can affect the timing of cash outflows.

- Outstanding payments: The customer payments that have not been paid by the due date that need to be chased up in the forecasting period, as well as those you may owe to suppliers or other parties.

Tips for improving accounts receivable and accounts payable management include:

- Sending invoices as soon as a product or service is provided to the customer, with payment terms clearly outlined.

- Offering multiple payment options to make it easier for customers to pay.

- Establishing a routine of regularly monitoring the payments owed to you.

- Keeping track of accounts receivable KPIs like Days Sales Outstanding and Average Days Delinquent, ensuring they are maintained at optimal levels.

- Setting credit policies that offer favourable payment terms to customers with good credit ratings, and stricter terms to those with poorer ratings.

- Reviewing aging accounts to ensure there are no outstanding payments.

- Creating a follow-up procedure for chasing late payments.

- Speaking to suppliers to negotiate longer payment terms.

Creating multiple scenarios

Once you have created your cash flow forecast, you can start experimenting with scenario forecasting . This technique involves amending your base level forecast by factoring in different underlying assumptions about future business performance, decisions, initiatives or possible upcoming events.

For example, with the help of cash flow forecasting software , you can create a scenario that factors in expanding into a new territory or launching a new product. You can also create best or worst-case scenarios based on your base level forecast. For instance, a scenario where you assume higher sales and lower expenses.

You can also create scenarios to assess the impact of external influences, like an economic recession, supply chain disruption or the introduction of new technology into your industry.

Tools and technologies for cash flow forecasting

From spreadsheets to sophisticated cash flow forecasting software, there are a range of tools readily available to perform forecasting. Let’s look at some of the most widely used.

The pros and cons of spreadsheets

Given their flexibility and familiarity for most people, spreadsheets like Excel are an effective tool for basic cash flow forecasting. You can customise spreadsheets as you see fit, and they make it easy to enter and manipulate data. However, with this simplicity comes drawbacks.

Creating a cash flow forecast in a spreadsheet will require significant time and effort, taking anywhere from hours to days. You will also need to manually manipulate data whenever there’s a change to business circumstances, plus the lack of sophistication of spreadsheets means figures and calculations may include errors.

Cash flow forecasting software

Software for cash flow forecasting like Fathom can provide more sophisticated functionality to create detailed cash flow projections, analyse various scenarios and generate visually appealing reports with ease.

Fathom offers several advantages over traditional spreadsheet-based forecasting methods:

- Automated updates: Unlike static spreadsheets, Fathom automatically updates your cash flow forecast as your financials change.

- Clear and actionable insights: Visualisations help you understand where your cash has gone and assess the quality, sustainability and fluctuations of your cash flow.

- Accuracy: You can trace the source of every figure in your forecast to ensure accurate and reliable projections.

- Flexibility: You can easily customise cash flow forecasts to account for various possibilities and changes with features like scenario planning.

- Advanced reporting: Comprehensive reporting capabilities make it easy to perform a variance analysis between actuals and your forecast.

- Integration: Fathom seamlessly pulls data from your accounting software, offering integration with the likes of Xero, Quickbooks and MYOB.

- Collaboration: Multiple users can work on cash flow forecasts simultaneously, eliminating the need for multiple versions of the same file.

You can gain an idea of how easily you can customise a cash flow forecast with Fathom in the video below.

Recap of takeaways

Cash flow forecasting is a powerful tool to help your business plan for potential cash shortages and identify areas where you can really move the needle in terms of financial performance.

To truly get the most out of forecasting and simplify the process, make sure to:

- Structure your forecast around the four fundamental components – opening cash balance, cash inflows, cash outflows and closing cash balance.

- Create a robust system to forecast sales that ensures it is based on complete and accurate data, utilises the forecasting method best suited to your goals, and accounts for factors not captured in your data.

- Continually monitor cash outflows from operational, capital, debt and cost of goods sold expenses.

- Factor in all the cash you will owe, and that owed to you, during the forecasting period, and implement measures to ensure you get paid faster.

- Experiment with different forecasting scenarios to see the impact of specific variables, like increased sales, new product launches or economic conditions.

- Consider how cash flow forecasting tools can help you save time, automate the process and quickly implement the best practices we’ve shared.

How you can start building your cash flow forecast today

If you want to avoid the complexities and limitations of spreadsheets, why not see how you can simplify cash flow forecasting with a free 14-day trial of Fathom ? Test out its features for yourself and see why it's trusted by over 80,000 businesses worldwide.

Fathom is designed with specific cash flow forecasting functionality that allows you to visualise your planning, test different scenarios and forecast up to five years into the future.

Live forecasts mean you’ll never have to worry that your data is out of date, and you can even create multiple forecasts for your different business units or departments.

You can discover more about Fathom’s cash flow forecasting features in our help centre , while our blog contains a range of tutorial webinars and customer stories to explore.

Two of our most popular introductory webinars include our cash flow forecasting overviews for businesses and accountants.

Fathom is a cloud-based financial intelligence and management reporting app trusted by more than 50,000 companies worldwide.

- 1 (720) 278-7838

- October 23, 2023

- No Comments

Cash Flow Forecasting: A Guide with Examples & How To’s

Want help with your bookkeeping? We make it easy. Get started , Speak w/ a Founder , or Schedule a Callback .

Cash flow is the lifeblood of any business. The ability to accurately forecast cash flow is crucial for maintaining financial stability, making informed decisions, and ensuring your business’s long-term success.

In this comprehensive guide, we will explore cash flow forecasting in detail, including what it is, its benefits, types of forecasts, components, step-by-step instructions on how to forecast cash flow, real-world examples, common challenges, and tips for improvement.

What is Cash Flow Forecasting?

Cash flow forecasting is a financial management practice that involves estimating the future cash inflows and outflows of a business over a specified period. It helps businesses predict how much cash they will have on hand in the coming weeks, months, or years. Cash flow forecasts provide critical insights into a company’s ability to meet its financial obligations, fund operations, and make strategic decisions.

What Are the Benefits of Cash Flow Forecasting?

Cash flow forecasting offers numerous advantages for businesses, such as:

1. Financial Planning:

It enables businesses to plan for their financial future, set goals, and allocate resources effectively.

2. Improved Decision-Making:

Cash flow forecasts help in making informed decisions about investments, expenses, and debt management.

3. Risk Management:

Forecasting allows businesses to identify and mitigate potential cash shortages or surpluses, reducing financial risk.

4. Performance Evaluation:

Regularly comparing actual cash flow to forecasts helps assess a company’s financial performance and adjust strategies accordingly.

Types of Cash Flow Forecasts

Cash flow forecasts can be categorized based on their time horizon:

1. Short-Term Cash Flow Forecast:

Short-term forecasts typically cover the immediate future, ranging from a few days to a few months. They are crucial for managing day-to-day cash needs, such as payroll and operational expenses.

2. Medium-Term Cash Flow Forecast:

Medium-term forecasts extend for several months to a few years. They are often used for capital expenditure planning, budgeting, and assessing working capital needs.

3. Long-Term Cash Flow Forecast:

Long-term forecasts look beyond a few years and are essential for strategic planning, such as expanding operations, launching new products, or securing long-term financing.

4. Mixed Period Cash Flow Forecast:

Mixed period forecasts combine elements of short, medium, and long-term forecasts to cater to various financial planning needs.

What Are the Components of Cash Flow Forecasting?

A comprehensive cash flow forecast includes the following components:

1. Cash Inflows:

This section outlines all the sources of cash coming into the business, including sales revenue, investments, loans, and any other sources of income.

2. Cash Outflows:

Here, businesses list all the expenses and payments they expect to make during the forecast period, including operating costs, loan repayments, taxes, and other expenditures.

3. Opening Cash Balance:

The opening cash balance represents the amount of cash on hand at the beginning of the forecasting period.

4. Closing Cash Balance:

The closing cash balance is the projected cash balance at the end of the forecasting period, taking into account all inflows and outflows.

How Do I Forecast Cash Flow?

Effective cash flow forecasting requires a structured approach. Here’s a step-by-step guide on how to forecast cash flow:

1. Determine Your Forecasting Objective(s):

Before you start, decide why you need a cash flow forecast. Are you creating it for short-term operational planning, long-term growth strategies, or debt management?

2. Choose Your Forecasting Period:

Select the appropriate forecasting period based on your objectives. Short-term forecasts are best for daily operations, while long-term forecasts are ideal for strategic planning.

3. Choose a Forecasting Method:

There are various methods to forecast cash flow, including direct cash flow forecasting, indirect forecasting, and the use of financial software or tools. Choose the method that suits your business’s complexity and data availability.

4. Source the Data You Need for Your Cash Flow Forecast:

Gather accurate and up-to-date financial data, including historical cash flow statements, sales records, expense reports, and any other relevant financial information.

Cash Flow Forecast Example

To illustrate how a cash flow forecast works, let’s consider a simplified example for a small retail business.

This business wants to create a short-term cash flow forecast for the next three months to ensure it has enough cash to cover expenses and meet supplier payments. Here’s the forecast:

- Opening Cash Balance: $10,000 (cash on hand at the beginning of the month)

- Sales Revenue: $30,000 (expected monthly sales)

- Loan Proceeds: $5,000 (loan received)

- Rent: $2,000

- Payroll: $8,000

- Inventory Purchase: $10,000

- Utilities: $500

- Loan Repayment: $1,000

- Closing Cash Balance: $13,500 (calculated as opening balance + inflows – outflows)

This simplified example demonstrates how a business can project its cash position over a short period by estimating cash inflows and outflows.

What Challenges Can Businesses Face When Forecasting Cash Flow?

Forecasting cash flow can be challenging due to several factors, including:

1. Uncertainty:

Economic conditions, unexpected expenses, and fluctuating sales can introduce uncertainty into forecasts.

2. Data Accuracy:

Relying on inaccurate or incomplete data can lead to inaccurate forecasts.

3. Complexity:

Businesses with multiple income streams, expenses, and financial products may face more complex forecasting challenges.

4. Market Changes:

Rapid changes in the market can disrupt forecasts, making it difficult to anticipate future cash flows accurately.

Frequently Asked Questions:FAQs

1. how often should a business update its cash flow forecast.

The frequency of cash flow forecasting depends on the business’s needs and industry. Some businesses update their forecasts weekly, while others do it monthly or quarterly. During periods of significant change, more frequent updates may be necessary.

2. Can cash flow forecasting help with managing debt and loans?

Yes, cash flow forecasting is a valuable tool for managing debt and loans. It helps businesses plan for loan repayments, assess their ability to take on additional debt, and avoid cash flow crises that could lead to default.

3. How can businesses improve their cash flow forecasting accuracy?

To enhance accuracy, businesses can:

- Use historical data and real-time information.

- Consider various scenarios and sensitivity analysis.

- Continuously monitor and adjust forecasts as new data becomes available.

- Seek professional guidance from financial experts or consultants.

4. How can businesses adjust their operations based on cash flow forecasts?

Cash flow forecasts can inform decisions such as delaying non-essential expenditures, negotiating extended payment terms with suppliers, or pursuing short-term financing options during cash flow shortages. Conversely, surpluses can be invested or used to pay down debt.

What Is EcomBalance?

EcomBalance is a monthly bookkeeping service specialized for eCommerce companies selling on Amazon, Shopify, Ebay, Etsy, WooCommerce, & other eCommerce channels.

We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month.

You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so you and your business partners can make better business decisions.

Interested in learning more? Schedule a call with our CEO, Nathan Hirsch.

And here’s some free resources:

- Monthly Finance Meeting Agenda

- 9 Steps to Master Your Ecommerce Bookkeeping Checklist

- The Ultimate Guide on Finding an Ecommerce Virtual Bookkeeping Service

- What Is a Profit and Loss Statement?

- How to Read & Interpret a Cash Flow Statement

- How to Read a Balance Sheet & Truly Understand It

Conclusion:

Cash flow forecasting is a vital financial management practice that empowers businesses to plan for their financial future, make informed decisions, and navigate economic challenges with confidence.

Whether it’s for short-term operational planning or long-term strategic growth, the ability to forecast cash flow accurately is essential for financial stability and business success. By following the steps outlined in this guide and addressing common challenges, businesses can master the art of cash flow forecasting and secure their financial well-being.

Want bookkeeping off your plate? We’ve got you! Get started , Speak w/ a Founder , or Schedule a Callback .

Recent Posts

How AI Algorithms Transform Ecommerce Product Recommendations

Image source Suppose you are in a physical store where a sales assistant will look at you and immediately understand your preferences as you

Organic vs Paid Traffic for Accountants: Navigating SEO Strategies for Growth

Accountants face the ongoing challenge of bringing potential clients to their websites, where they can highlight their services and convert visitors into lasting business

Chart of Accounts for Ecommerce Business: How to Set It Up Correctly

What does a chart of accounts for ecommerce business look like? Is it any different from a regular chart of accounts? What are those

Navigating Tax Changes in the eCommerce World

When regulations shift – especially in the realm of taxation – eCommerce businesses face the complex challenge of adapting swiftly, all while maintaining profitability

The Impact of Mobile Apps on E-commerce Businesses

Shopping, selling, and brand interactions – e-commerce has thrown open the doors to a whole new way of doing things in today’s fast-moving world.

The Ultimate Guide to Developing a User-Friendly eCommerce App

Digital technology applications are nowadays an essential part of our daily lives, fundamentally altering the world and the way we engage with businesses and

Kayla Bloom

Browse the Blog

Bookkeeping

Partner Spotlights

EcomBalance News

Free Resources

- Finance Meeting Agenda

- Ecom Bookkeeping Guide

- Ecom Mistakes Ebook

Amazon Accounting Guide

Shopify Bookkeeping Guide

Guide to Find Ecommerce Bookkeeper

Profit & Loss Statement

Cashflow Statement

Balance Sheet

Avoid the Most Common Ecommerce Bookkeeping Mistakes

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

EcomBalance

We help ecommerce businesses master their finances..

- [email protected]

- Denver, CO, USA

- Get a Callback

- AccountsBalance

- Monthly Bookkeeping

- Catch Up & Clean Up

- Amazon Bookkeeping

- Shopify Bookkeeping

- Ebay Bookkeeping

- Bookkeeping Case Study

- Why eCommerce?

- Etsy Bookkeeping

- Partner Program

- Partner Directory

- Become an Affiliate

- Terms of Use

Want better bookkeeping?

It's possible subscribe below & we'll send you our bookkeeping packet . a pack of resources to teach you about bookkeeping..

You’ll get our Ecommerce Bookkeeping Guide, The 10 Ecommerce Bookkeeping Mistakes Ebook, our Monthly Finance Meeting Agenda, & a few surprises!

- Asia Pacific

- Latin America