- Log in Sign up Members get daily listing updates

- Find an Agent

- Redfin Premier

- Sell My Home

- List My Home for Rent

- Saved Searches

- Why Sell with Redfin?

- Owner Dashboard

- Open House Schedule

- Appointments

- Be a Redfin Agent

- Notification Settings

- Homes for sale

- Condos for sale

- Land for sale

Open houses

- Buy with Redfin

- Affordability calculator

- Home buying guide

- Find lenders & inspectors

- Free home buying classes

- US housing market

- Rental market tracker

- How much rent can I afford?

- Should I rent or buy?

- Renter guide

- List my home for rent

- Rental Tools dashboard

- Should I sell or rent my home?

- What's my home worth?

- My home dashboard

- Why sell with Redfin?

- Redfin Full Service

- Find an agent

- Home selling guide

- Will selling pay off?

- Find handypeople and stagers

- Home improvement trends

- Get pre-approved

- Today's mortgage rates

Payment calculator

- Join as a Redfin Agent

- Join our referral network

- Agent Resource Center

- Property details

- Sale & tax history

3839 71st St N , SAINT PETERSBURG , FL 33709

About this home

Under Construction. NEW CONSTRUCTION, NO HOA FEE'S OR CDD'S! This beautiful architecturally designed home features 4 Bedrooms/3.5 baths, 2-covered balcony's. Engineered hardwood flooring, crown molding, gourmet kitchen that has a large oversized island that is perfect for entertaining. The gorgeous flooring compliments the expansive luxury of this home. Upstairs there are 3 bedroom, a jack and jill bath, and a master bedroom with a master bath that anyone would love with a spa like feel to it. There is also a loft upstairs and a laundry room! Too much to list. Excellent location, close to shopping, beaches and airport. Schedule your showing today! Solar by Sunnova.

Additional resources

View down payment assistance programs for this home.

View current mortgage rates for this home

View estimated energy costs and solar savings for this home

View Internet plans and providers available for this home

Property details for 3839 71st St N

- Garage Spaces: 2

- Has Attached Garage

- Virtual Tour (External Link)

- # of Bedrooms: 4

- # of Full Baths (Total): 3

- # of Half Baths (Total): 1

- Laundry Features: Electric Dryer Hookup, Laundry Room, Upper Level

- # of Rooms: 5

- Heating Information: Electric, Solar

- Cooling Information: Central Air

- Interior Features: Crown Molding, High Ceilings, Kitchen/Family Room Combo, Solid Wood Cabinets

- Window Features: Impact Glass/Storm Windows

- Appliances: Built-In Oven, Cooktop, Dishwasher, Disposal, Electric Water Heater, Microwave, Range, Refrigerator

- Flooring: Hardwood, Tile

- Construction Materials: Metal Siding, Wood Frame

- New Construction

- Roof: Shingle

- Patio And Porch Features: Front Porch, Rear Porch

- Exterior Features: Balcony, Irrigation System, Private Mailbox, Rain Barrel/Cistern(s), Sliding Doors

- Universal Property Id: US-12103-N-063116928620510060-R-N

- Waterfront Feet Total: 0

- Water View Y/N: 0

- Water Access Y/N: 0

- Water Extras Y/N: 0

- Projected Completion Date: 2024-09-30T00:00:00.000

- Homestead Y/N: 0

- Property Type: Residential

- Property Sub Type: Single Family Residence

- Property Condition: Under Construction

- Total Acreage: 0 to less than 1/4

- Lot Size Acres: 0.14

- Road Surface Type: Asphalt

- Lot Size Square Meters: 574

- Permit Number: 22-6000152

- Builder License Number: CGC1523749

- MFR_BuildingAreaTotalSrchSqM: 316.80

- Tax Annual Amount: $1,870.48

- Tax Year: 2023

- Lease Restrictions YN: 0

- Water Source: Public

- Sewer: Public Sewer

- Utilities: Cable Available, Electricity Available, Electricity Connected

- Unit Number YN: 0

- MFR_Association2YN: 0

- Association Approval Required Y/N: 0

- Elementary School: Seventy-Fourth St. Elem-PN

- Middle Or Junior High School: Azalea Middle-PN

- High School: Dixie Hollins High-PN

- Directions: From I-275, exit 25, head west, to 71st Street and turn right to home.

Public facts

- Finished Sq. Ft.: —

- Unfinished Sq. Ft.: —

- Total Sq. Ft.: —

- Lot Size: —

- Style: Single Family Residential

- Year Built: —

- Year Renovated: —

- County: Pinellas County

- APN: 06-31-16-92862-051-0060

| Zone name | Neighborhood Suburban Single Family |

|---|---|

| Zone type | Residential Single Family |

| Zone code | NS-1 |

| Permitted: | Single-Family |

|---|---|

| Multi-Family | |

| ADU | |

| Commercial | |

| Industrial |

| Not Permitted: | Two-Family |

|---|---|

| Short-Term Rentals |

- Accessory use and structure

- Adaptive reuse

- Home occupation

- Accessory dwelling unit

- Accessory living space

- Community residential home 1 to 6 residents

- Single family dwelling

- Passive park

- Public pre k through 12 governmental school

- Family day care home

- Recreation use accessory to residential use

- Recreation use accessory to public park

- Cemetery accessory to a house of worship

- Large tract planned development

- Golf course or country club

- Active park

- Government building and use

- House of worship

- Meeting hall and other community assembly facility

- Private pre k through 12 nongovernmental school

- Post secondary school

- Parking surface accessory

- Utility substation utility storage tanks

- Redevelopment of grandfathered uses

- Accessory dwelling unit owner or manager

- Accessory artist in residence

- Assisted living facility

- Community residential home 7 to 14 residents

- Community residential home more than 14 residents

- Live or work dwelling

- Multifamily dwelling

- Mobile home

- Bed and breakfast

- Nursing home

- Indoor pet care

- Indoor or outdoor pet care

- Bank without drive through

- Bank with drive through

- Neighborhood scale cafe

- Car wash and detailing

- Catering service or food service contractor

- Drive thru facility or use with a drive through

- Drug store or pharmacy

- Gas or fueling station

- Indoor urban vehicle sales

- Microbrewery

- Mixed use mixture of permitted and accessory uses

- Motor vehicle service and repair

- General office

- Medical office

- Temporary labor and day labor office

- Veterinary office

- Accessory use outdoor sales

- Accessory use garden oriented outdoor sales

- Principal use outdoor oriented goods outdoor sales

- Outdoor sales principal use garden oriented

- Accessory commercial outdoor storage

- Brewpub restaurant and bar

- Indoor restaurant and bar

- Accessory outdoor area restaurant and bar

- Indoor and outdoor restaurant and bar

- Retail sales and service

- Retail neighborhood scale

- Service establishment

- Fleet based service

- Service office

- Personal service

- Construction establishment

- Laboratories and research and development

- Light manufacturing assembly and processing

- Heavy manufacturing

- Principal use outdoor storage

- Accessory industrial outdoor storage

- Publishing and printing

- Recycling center

- Salvage yard

- Storage self or mini warehouse

- Towing and freight trucking

- Wholesale establishment

- Adult use establishment

- Adult use business

- Club community service and fraternal

- Indoor commercial recreation

- Outdoor commercial recreation

- Health club 5000 square feet or less

- Health club more than 5000 square feet

- Motion picture theater or cinema 500 seats or less

- Motion picture theater or cinema more than 500 seats

- Outdoor performing arts venue

- Performing arts venue 500 seats or less

- Performing arts venue more than 500 seats

- Adult day care center

- Birthing center

- Child care facility

- Crematorium

- Funeral home mortuary or crematory

- Probation or parole correction office

- All others school

- Social service agencies

- Airports and air transportation

- Heliport accessory

- Mass transit center

- Parking structured

- Parking surface principal use

- Wireless communication antennae

- Wireless communication support facility

- Utility plant and storage

- Third Party YN: 1

- Attribution Contact: 727-316-5100

- Home Warranty YN: Yes

- Status Contractual Search Date: 2024-08-27

- Calculated List Price By Calculated Sq Ft: 392.15

- Green Verification Count: 0

- Direction Faces: West

- Green Energy Generation: Solar

- Living Area: 2471

- Living Area Units: Square Feet

- Living Area Source: Builder

- Living Area Meters: 229.56

- Building Area Total: 3410

- Building Area Units: Square Feet

- Building Area Source: Builder

- Foundation Details: Slab

- Builder Name: DHM

- Builder Model: 3839

- Stories Total: 2

- Levels: Two

Sale and tax history for 3839 71st St N

- Sale History

- Tax History

Public, PreK-5 • Assigned • 0.2mi

Public, 6-8 • Assigned • 1.1mi

Public, 9-12 • Assigned • 1.0mi

Around this home

Transportation near 3839 71st st n, walk score ®, transit score ®, bike score ®.

6 groceries, 27 restaurants, 3 parks

18, 20, 22, 23, 38, 5, 62, 68, 73, 75, 79

Climate risks

Most homes have some risk of natural disasters, and may be impacted by climate change due to rising temperatures and sea levels.

We’re working on getting current and accurate flood risk information for this home.

We’re working on getting current and accurate fire risk information for this home.

We’re working on getting current and accurate heat risk information for this home.

We’re working on getting current and accurate wind risk information for this home.

We’re working on getting current and accurate air risk information for this home.

Redfin Estimate for 3839 71st St N

Thinking of buying.

It's free, cancel anytime

Nearby similar homes

Nearby recently sold homes

Sorry, we don't have any nearby similar homes to display. See all recently sold homes in 33709

More real estate resources

- New Listings in 33709

- Neighborhoods

- Popular Searches

Find homes faster

Subsidiaries

Copyright: © 2024 Redfin. All rights reserved.

Updated January 2023: By searching, you agree to the Terms of Use , and Privacy Policy .

Do not sell or share my personal information .

REDFIN and all REDFIN variants, TITLE FORWARD, WALK SCORE, and the R logos, are trademarks of Redfin Corporation, registered or pending in the USPTO.

California DRE #01521930

Redfin is licensed to do business in New York as Redfin Real Estate. NY Standard Operating Procedures

New Mexico Real Estate Licenses

TREC: Info About Brokerage Services , Consumer Protection Notice

If you are using a screen reader, or having trouble reading this website, please call Redfin Customer Support for help at 1-844-759-7732 .

1924 15th Ave S, Saint Petersburg, FL 33712

What's special.

Welcome home! Don't miss your opportunity to become a homeowner in the thriving and developing St. Petersburg Florida. Ranked one of the best cities in Florida for Work-Life Balance in 2023. Home of Pinellas County’s Clearwater Beach (named one of 2024’s top beaches in the World) and home to The Tampa Bay Rays! This home is eligible for up to $50,000+ in Down Payment Assistance for first-time home buyers or any eligible veteran (eligibility and restrictions vary). This turn-key, new construction home is nestled in the heart of one of St. Petersburg's emerging neighborhoods with NO HOA or CDD fees. Conveniently a short drive from The City of Gulfport, under 6 miles from Tropicana Field, Downtown St. Pete, St. Pete Pier, Vinoy Park, The Dali Museum, and less than 15 minutes from St. Pete Beach, Clearwater/St. Pete Airport and more! Enter your new home to a fantastic open floor plan that offers 3 bedrooms, 2 bathrooms, high ceilings, and beautiful waterproof luxury vinyl flooring throughout adding a modern touch and easy maintenance. The tray ceiling and crown-molded spacious living area seamlessly connect the dining space and kitchen, creating a welcoming atmosphere for gatherings and entertaining. The open kitchen is highlighted with 42” cabinets, modern hardware, pendant lights, and beautiful quartz countertops featuring an island that provides extra room for the home chef to cook, prepare meals, and later serve as a casual eating space for the family. Walk into the owner's suite and find your dream retreat and ensuite featuring a dual vanity topped with quartz countertops and a tiled walk-in shower. Exploring the rest of the home you will find two additional bedrooms that share a bathroom featuring tiled shower walls, quartz countertop vanity, and modern hardware. Bedrooms provide appropriate space for a secondary/guest bedroom, home office, or kid’s playroom. All bedrooms and living areas have impact-resistant windows that pour in lots of Florida natural light and are equipped with ceiling fans with corresponding remote controls. This home is looking for it's first owner schedule your private showing today so you can start enjoying the Florida living lifestyle! Show more

Travel times

Tour with a buyer’s agent.

We’ll find a local expert to take you on a private tour of 1924 15th Ave S .

Next available tour time: Tomorrow at 11am

Facts & features, bedrooms & bathrooms.

- Bedrooms : 3

- Bathrooms : 2

- Full bathrooms : 2

Primary bedroom

- Features : Ceiling Fan(s), Walk-In Closet(s)

- Level : First

- Dimensions : 12x15

- Dimensions : 12x11

- Dimensions : 12x10

Primary bathroom

- Features : Dual Sinks, En Suite Bathroom, Exhaust Fan, Stone Counters, Linen Closet

- Dimensions : 5x12

- Features : Exhaust Fan, Stone Counters, Tub With Shower

- Dimensions : 8x5

Dining room

- Dimensions : 16x10

- Features : Pantry, Kitchen Island, Stone Counters

- Dimensions : 11x10

Living room

- Features : Ceiling Fan(s)

- Dimensions : 17x15

- Central Air

- Included : Dishwasher, Disposal, Electric Water Heater, Microwave

- Laundry : In Kitchen, Laundry Closet

- Ceiling Fan(s), Crown Molding, Eating Space In Kitchen, High Ceilings, Kitchen/Family Room Combo, Living Room/Dining Room Combo, Open Floorplan, Solid Surface Counters, Solid Wood Cabinets, Stone Counters, Thermostat, Tray Ceiling(s), Walk-In Closet(s)

- Flooring : Vinyl

- Windows : Blinds, Impact Glass/Storm Windows, Window Treatments

- Has fireplace : No

Interior area

- Total structure area : 1,733

- Total interior livable area : 1,369 sqft

Virtual tour

- View virtual tour

- Total spaces : 1

- Parking features : Covered, Driveway

- Attached garage spaces : 1

- Has uncovered spaces : Yes

- Levels : One

- Stories : 1

- Patio & porch : Covered, Front Porch

- Exterior features : Lighting, Private Mailbox, Sidewalk

- Fencing : Vinyl

- Size : 3,942 sqft

- Dimensions : 41 x 88

- Features : Cleared, City Lot, Landscaped, Sidewalk, 0 to less than 1/4 Acre

- Parcel number : 253116115020000140

- Special conditions : None

Construction

Type & style.

- Home type : SingleFamily

- Property subtype : Single Family Residence

- Foundation : Slab

- Roof : Shingle

- New Construction,Completed

- New construction : Yes

- Year built : 2024

- Builder name : Top 2 Bottom Property Preservation Llc

Utilities & green energy

- Sewer : Public Sewer

- Water : Public

- Utilities for property : Cable Available, Electricity Available, Electricity Connected, Phone Available, Sewer Available, Sewer Connected, Street Lights, Water Available, Water Connected

Community & HOA

- Subdivision : Brightwood

- Has HOA : No

- Pet fee : $0 monthly

- Region : Saint Petersburg

Financial & listing details

- Price per square foot : $275/sqft

- Annual tax amount : $738

- Date on market : 8/8/2024

- Listing terms : Cash,Conventional

- Ownership : Fee Simple

- Lease term : Min (8 to 12 Months)

- Total actual rent : 0

- Electric utility on property : Yes

- Road surface type : Asphalt, Paved

- Pinellas County

- Saint Petersburg

- Jordan Park

- 1924 15th Ave S

Nearby cities

- Clearwater Real estate

- Dunedin Real estate

- Largo Real estate

- Oldsmar Real estate

- Palm Harbor Real estate

- Pinellas Park Real estate

- Safety Harbor Real estate

- Saint Petersburg Real estate

- Seminole Real estate

- Tarpon Springs Real estate

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Newsletters

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

- Labor Day sales

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Balance transfer cards

- Cash back cards

- Rewards cards

- Travel cards

- Online checking

- High-yield savings

- Money market

- Home equity loan

- Personal loans

- Student loans

- Options pit

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

New on Yahoo

- Privacy Dashboard

New US rules try to make it harder for criminals to launder money by paying cash for homes

REHOBOTH BEACH, Del. (AP) — The Treasury Department has issued regulations aimed at making it harder for criminals to launder money by paying cash for residential real estate.

Under rules finalized Wednesday, investment advisers and real estate professionals will be required to report cash sales of residential real estate sold to legal entities, trusts and shell companies. The requirements won't apply to sales to individuals or purchases involving mortgages or other financing.

The new rules come as part of a Biden administration effort to combat money laundering and the movement of dirty money through the American financial system. All-cash purchases of residential real estate are considered a high risk for money laundering.

The Treasury's Financial Crimes Enforcement Network, also known as FinCEN, will administer the rules.

Money laundering in residential real estate can also drive up housing costs – and rising home prices are one of the big economic issues i n this year’s presidential campaign . A 2019 study on the impact of money laundering on home values in Canada, conducted by a group of Canadian academics, found that money laundering investment in real estate pushed up housing prices in the range of 3.7% to 7.5%.

Under the new rules, the professionals involved in the sale will be required to report the names of the sellers and individuals benefitting from the transaction. They will also have to include details of the property being sold and payments involved, among other information.

Treasury Secretary Janet Yellen said in a news release that the new rules address some of the nation's biggest regulatory deficiencies.

“These steps will make it harder for criminals to exploit our strong residential real estate and investment adviser sectors,” she said.

Ian Gary, executive director of the FACT Coalition, a nonprofit that promotes corporate transparency, called the rules “much-needed safeguards” in the fight against dirty money in the U.S.

“After years of advocacy by lawmakers, anti-money laundering experts and civil society, the era of unmitigated financial secrecy and impunity for financial criminals in the U.S. seems to finally be over," Gary said.

Some industry representatives welcome the new rules.

Tori Syrek, a spokesperson for the National Association of Realtors, said FinCEN’s final rule is a pragmatic approach to combating money laundering and other crimes. “Bad actors are exploiting the current vulnerabilities,” Syrek said. “FinCEN’s final rule is a pragmatic, risk-based approach to combating money laundering and these other crimes.”

The Biden administration has made increasing corporate transparency part of its overall agenda, including through creating a requirement that tens of millions of small businesses register with the government as part of an effort to prevent the criminal abuse of anonymous shell companies.

However, an Alabama federal district judge ruled in March that the Treasury Department cannot require small business owners to report details on their owners and others who benefit from the business.

(844) 538-2937 or ( 416) 593-4357

Real Estate Assignment Sales – New Tax Rules

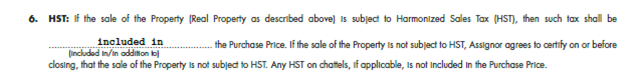

The Federal Budget for 2022 has made amendments to Part IX of the Excise Tax Act (“ETA”). Effective May 7, 2022, all assignment sales in respect of newly constructed or substantially renovated single unit residential complexes or residential condominium units are taxable.

For clarity, with respect to residential housing transactions, the purchaser (assignor) enters into an agreement of Purchase and Sale with the builder and then sells (assigns) their “rights and obligations” in the agreement of Purchase and Sale to another person (assignee).

Typically, the closing date for a pre-constructions residential property can take several months or even years. During this time, purchasers may decide to assign their rights outlined in the Purchase and Sale agreement to an assignee. The Federal Budget for 2022 now imposes GST/HST tax obligations on assignors and assignees. Essentially, an individual assignor of residential real estate now must collect GST/HST remit it to the CRA. This rule is applicable even to those who do not have a GST/HST number and believe that they are not purchasing and assigning in the course of commercial activity. In cases where the assignor is a non-resident, the assignee is obligated to self-assess the GST/HST. Prior to this amendment, the GST/HST liability depended on whether an individual purchased and assigned their rights in the course of commercial activity and if the purchaser’s true intentions were to live in and use the property, then there would be no GST/HST liability.

Deposit Portion of Assignments

Where an assignment agreement is entered into on or after May 7, 2022, the Budget confirms that GST/HST would not be applicable to the deposit portion of the assignment price. However, it must be indicated in writing that a part of the consideration is attributable to the reimbursement of a deposit paid by the assignor to the builder under the Purchase and Sale agreement. This means that an assignor would only be liable for GST/HST on the amount above the deposit. This also eliminates double taxation and is consistent with the holding from current caselaw, Casa Blanca Homes Ltd. v. The Queen , 2013 TCC 338 .

Where an assignment agreement is entered into before May 7, 2022, and the assignment sale is taxable, the total amount payable for the sale is subject to the GST/HST, this includes any amount paid by the assignor as a deposit to the builder, whether or not this amount is separately identified.

“Anti-flipping” Rule

Budget 2022 further proposes that sales of residential properties owned for less than 12 months are deemed to generate business income under the Income Tax Act (“ITA”). These are subject to limited exceptions such as divorce, or relocation for employment purposes. In terms of assignment sales, it has not yet been determined whether the proposed “anti-flipping” rules would apply since taxpayers do not technically “own” the properties. Tax practitioners are carefully monitoring this. For more information see our previous blog discussing this .

If you have questions about the new rules contact us today !

**Disclaimer

This article provides information of a general nature only. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in this article. If you have specific legal questions, you should consult a lawyer.

Related posts:

- Withholding Tax for Non-Residents on Real Estate Sales

- Assigning Property and the GST/HST Implications

- How Real Estate Agents can Incorporate a Company

- Capital Gains – Canadians Selling U.S. Real Estate

- Business Expenses for Real Estate Agents

Jason Rosen

Rafia javaid, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Toronto Tax Lawyer

- Articling Program

- Canadian Tax Lawyers

- Case Results

- Case Studies

- Certified Specialists in Taxation

- Company Profile

- Leadership Team

- Articles & tips

- Canadian Accountant Articles

- Definitions

- Media Appearances

- News Releases

- Related Links

- CRA Tax Audits

- Unfiled Taxes

- Net Worth Audits

- Taxes Owing & Liens

- Tax Minimization

- CRA & Bitcoin Taxation

- Unreported Offshore Assets

- Unreported Offshore Income

- Unreported Foreign Pension

- Unreported Internet Income

- Unfiled GST/HST returns

- Individual & Family Income Tax Planning

- Succession Will, Estate and Tax Planning Ontario

- Tax Problems & Representation

- Tax Shelters

- Corporate Reorganizations

- Butterfly Transactions

- Incorporations

- Business Agreements

- Business Startup Planning

- Tax Consulting & Planning

- CEWS Tax Audit Services

- CERB Tax Audit Services

- CEBA Tax Audit Services

- Contact a Tax Lawyer

Tax Guidance for Assignors in Real Estate Assignment Transactions

Published: November 13, 2020

Last Updated: April 26, 2021

Tax Guidance for Assignors in a Real Estate Assignment Transaction – a Toronto Tax Lawyer Analysis

Introduction – what is real estate assignment.

Buying and Selling real estate assignments is a common form of transaction in the real estate market. An assignment is a transaction of the rights to a property before the legal ownership of the actual property is transferred. In the real estate context, the buyer of an assignment (the “assignee”) would purchase the rights to a real estate property, typically but not always a condo, that is being built under a Purchase and Sale Agreement, between the assignment seller and the builder, from the seller of the assignment (the “assignor”). This transaction would take place before the closing date of the property, and the ownership of the property legally remained with a third party, the builder, throughout the assignment transaction. Hence only contractual rights to a piece of property were assigned from one party to another in an assignment transaction and not the property itself.

Tax Guidance to Reporting Profits from an Assignment Sale – Capital Gains and GST/HST

The two main tax issues associated with the assignor in an assignment transaction are whether the profits from the sales are to be characterized as business income or taxable capital gain and whether the sales of assignments give rise to the obligation for the assignor to collect and remit GST/HST.

While many assignors would report their profits as taxable capital gains as well as taking the position that assignors are exempt from collecting and remitting GST/HST for sales of the assignments, over the past few years, the CRA has been aggressively going after assignment transactions, often auditing Canadian taxpayers for both unreported taxable business income and unremitted excise tax.

Whether a particular assignment sale will give rise to taxable business income will depend on the facts involved in the case. Similarly, whether the assignor has an obligation to collect and remit GST/HST will also depend on the facts. In short, there is no single answer and simple tax guidance as to how to report your taxes on every assignment transaction. We will breakdown the relevant tax factors below

Taxable Capital Gain vs. Taxable Income

The determination of income versus capital gain is a complex tax topic in which the Income Tax Act itself provides no tax guidance. This means the Tax Court will look to case law for a holistic set of relevant tax factors to determine taxable income vs. taxable capital gains. Please see our article on this general topic for a detailed breakdown (https://taxpage.com/articles-and-tips/a-canadian-tax-lawyers-introduction-to-business-income-vs-capital-gains/).

In the leading case on this issue, Happy Valley Farms Ltd v MNR, the Federal Court chose a set of holistic factors based on the principle of circumstantially determining the taxpayer’s intention at the time of the acquisition of the property. When a taxpayer acquired a property with the intention to resell at a higher value, such intention would strongly suggest the taxpayer has been carrying out business. Therefore, the taxpayer’s income should be characterized as taxable business income.

However, the mere fact an assignor ended up selling his or her legal interest in a piece of real estate property does not evidence that he or she had an intention to resell when he or she initially acquired the property. Usually, CRA has to prove an intention to resell through circumstantial evidence to make an inference that the taxpayer had an intention to resell upon acquisition. In the Happy Valley Farm case itself, the Federal Court determined the intention of the taxpayer by looking at his conduct while holding the property as well as his relevant past conducts.

Factors such as frequency or number of other similar transactions by the taxpayer and circumstances that were responsible for the sale of the property are ultimately tools to help the court to determine the taxpayer’s intention at the time of acquisition. No single Happy Valley Farms factor outside the motive factor is determinative, and the determination of taxable business income versus taxable capital gains in assignment transactions will depend on a holistic assessment of the facts.

GST/HST on Assignment Sales

Unlike the income tax implications of assignment sales, the GST/HST implication of assignment transactions is more clear. The seller in an assignment transaction can often be deemed as a “builder” under the Excise Tax Act, which gives rise to the obligation to collect and remit GST/HST upon the sales of the transaction.

However, even if the seller is not deemed to be a builder, an assignment sale is at the very least a transaction involving a “chose in action” which is considered an enforceable legal right in the property itself. A chose in action is specifically mentioned in the definition of “property” under section 123(1) of the Excise Tax Act

property means any property, whether real or personal, movable or immovable, tangible or intangible, corporeal or incorporeal, and includes a right or interest of any kind, a share and a chose in action, but does not include money; On the other hand, the seller of an assignment transaction can also claim Input Tax Credits for his or her initial purchase of the assignment rights from the builder. Since many buyers and sellers of real estate assignments are likely unaware of the GST/HST implications of assignment transactions, a crucial issue to keep in mind is the deadline and extension mechanism for claiming Input Tax Credit under subsection 225(5) of the Excise Tax Act.

Pro Tax Tips – Prepare for Different Tax Implication for Each Assignment Transaction

The tax implication of an assignment transaction for the assignor will depend on whether the assignor was legally engaging in business activities in the course of buying and selling his or her real estate property interest. Such determination will involve holistically looking at all the relevant facts surrounding the transaction. The nature of an assignment sale itself does not determine whether the profit from such sales should be reported as taxable income or taxable capital gains.

As CRA has been going after assignment transactions aggressively and will likely to continue doing so in the foreseeable future, it is important for Canadian taxpayers to be aware of his or her rights to objection under the Income Tax Act in order to make sure his or her right to file a notice of objection is preserved upon being audited by the CRA .

If you have been contacted by the CRA regarding your past assignment transactions or you have questions regarding a specific assignment transaction that you are contemplating and whether (or not) it constitutes a business transaction, please contact our office to speaking with one of our experienced Canadian tax lawyers.

Related Post

Disclaimer:.

"This article provides information of a general nature only. It is only current at the posting date. It is not updated and it may no longer be current. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in the articles. If you have specific legal questions you should consult a lawyer."

About the Author

David j. rotfleisch.

David J. Rotfleisch, a leading Canadian tax lawyer, is not only a certified specialist in taxation but also a chartered professional accountant. Most recently, David is a pioneer in Canadian crypto taxation.

As of April 2020, he was one of 12 Ontario Certified Specialists In Taxation™.

Subscribe to our Newsletter

Looking for tax assistance.

Fill the form and we’ll get back to you.

Additional Areas Served

- Brampton Tax Lawyer

- Hamilton Tax Lawyer

- London Tax Lawyer

- Mississauga Tax Lawyer

- Montreal Tax Lawyer

- Ottawa Tax Lawyer

- Tax Lawyer Calgary

- Vancouver Tax Lawyer

- Winnipeg Tax Lawyer

- Edmonton Tax Lawyer

We are a Toronto tax law firm with a Canada wide full service income tax law practice.

Tax Solutions

- Tax Appeals

- Taxes Owning & Liens

Voluntary Disclosure

- Offshore Assets

- Offshore Income

- Offshore Pension

- Internet Income

Corporate Planning

- Tax Reorganizations

Get your CRA tax issue solved

Address: Rotfleisch & Samulovitch P.C. 2822 Danforth Avenue Toronto, Ontario M4C 1M1

416-367-4222 OR SCHEDULE ASSESSMENT

Copyright © 2024 Rotfleisch & Samulovitch Professional Corporation, Taxpage

New Tax Rules for Real Estate Assignments and Flipping

Written by Sukhman Sandhu

Blog | real estate law, june 6, 2022.

To combat the sharp rise in real estate prices, the Canadian government has proposed new GST/HST rules in relation to Assignments (effective May 7, 2022) and Income Tax rules in relation to flipping real estate in general (effective January 1, 2023).

GST/HST to Apply for all Assignment Sales

As of May 7, 2022, where an individual sells an assignment of a new build or substantially renovated residential property, the transaction will be subject to HST, regardless of original intentions, as per the Canadian Excise Tax Act (“ETA”). Every individual assignor of residential real estate will now have to collect GST/HST on their assignment profit and remit it to the CRA.

Previously, if the original intention of entering the pre-construction Agreement of Purchase and Sale (APS) was for personal use, GST/HST did not apply to the assignment agreement. GST/HST previously only applied if the original intention was to sell for profit or flip the property. Effective May 7, 2022, whatever your intention, GST/HST will apply on the assignment profit.

Accompanied with some good news, the new rules do clarify that HST is no longer charged on recovered deposits. Prior to May 7, 2022, despite the court ruling against the CRA in a previous case dealing with this issue, the CRA continued to represent to tax payers that if the assignment is subject to GST/HST, the amount provided from the assignee (new buyer) to the assignor (original buyer) which reimburses the assignor for the assignor’s deposit to the builder is also subject to GST/HST. This created double taxation as the deposit that the assignor paid to the seller/builder is already subject to GST/HST.

For illustration purposes, envision Carrol purchased a new construction residential property for $1,200,000 and paid the builder’s lawyer a deposit of $200,000. Subsequently, Carrol entered into an assignment agreement for the assignment sale price of $1,500,000. Carrol in this situation is known as the ‘assignor’ and the individual who purchased from her is known as the ‘assignee’. The assignee must pay $500,000 to Carrol ($300,000 for the difference between assignment sale price of $1,500,000 and original purchase price of $1,200,000 + $200,000 to reimburse the assignor for assignor’s previous deposit to builder/builder’s lawyer) and $1,000,000 to the builder to complete the purchase (not including any closing/miscellaneous fees).

Prior to May 7, 2022, if Carrol’s original intention was to purchase for personal use, she would not be responsible to pay any HST/GST in relation to the assignment sale.

Prior to May 7, 2022, If Carrol’s original intention was not for personal use (i.e. investment property), then she would be liable to pay GST/HST on $500,000 (both the profit and deposit) which at the rate of 13% would have equaled $65,000. It is important to note that Carrol, on advise of her accountant, could have only paid GST/HST on $300,000 (avoiding any tax on deposit) by only remitting $39,000 and citing previous case ruling against double taxation on recovered deposit to the CRA.

As of May 7, 2022, regardless of Carrol’s original intention, she is liable to pay GST/HST on $300,000 which at the rate of 13% would equal $39,000.

Business Income instead of Capital Gains for Residential Property Flipping

Effective January 1, 2023, a new residential property flipping rule will classify the appreciation amount of all residential properties that are owned for less than 12 months to be business income under the Canadian Income Tax Act (“ITA”). This new legislation change will be subject to limited “life events” exceptions, such as the growth of a household, separation, a disability or illness, an employment change, insolvency, or an involuntary disposition.

Prior to January 1, 2023, investment properties (i.e. rentals) sold within or after 12 months of ownership are subject to capital gains tax which is 50% of business income tax and principal residence properties (owner-occupied) sold within or after 12 months of ownership are entirely exempt from tax.

Growing commentators believe that this proposed Residential Property Flipping Rule may also result in assignment sales treated as business income as opposed to capital gains. This would result in the assignor not only paying GST/HST on the portion of their assignment profit but also adding 100% of the assignment profit amount (minus remitted GST/HST) onto their annual personal income amount. We look forward to receiving further clarification in the near future.

If you are buying or selling investment properties, or have questions or concerns about residential or commercial real estate law in general, contact us at Sukh Law .

Sukh Law publishes articles for information purposes only and is not intended to constitute legal advice.

Related Resources…

Understanding the Ontario Securities Commission Role in Business Compliance

Aug 28, 2024

The Ontario Securities Commission (OSC) is a cornerstone of Ontario's financial regulatory framework, ensuring that...

Exploring the Legalization of Rooming Houses in Toronto

Aug 23, 2024

The recent legalization of rooming houses in Toronto marks a significant shift in the city's approach to affordable...

Legal Tips for First-Time Condo Buyers in Ontario

Aug 16, 2024

Buying a condo in Ontario is an exciting venture, especially for first-time buyers. However, it involves a unique set...

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

Tax on Assignment Sales: What You Need to Know

Real estate assignment sales and flipping pre-construction condos have become popular strategies for investors looking to make a quick return. And CRA has noticed. In this blog, I will explain two ways CRA is cracking down on pre-construction investors and what you can do to minimize your tax paid on assignment sales.

#1 – CRA May Tax Assignment Sales as Business Income

Similar to selling a resale home, you are required to report an assignment sale on your tax return and pay the necessary tax. Many real estate investors are quick to assume that the profit from an assignment sale is a capital gain.

However, CRA may tax assignment sales in two ways:

- Capital gain – where only 50% of the profit is taxable

- Business income – where 100% of the profit is taxable

To make its determination, CRA will consider factors such as:

- What was your motive or intention in buying the property?

- How long did you hold the property before selling?

- Do you have a history of similar transactions?

- What is your reason for selling?

Based on past court cases, we know that CRA will generally consider the profit from assignment sales to be business income unless you have a compelling explanation.

With the potential to double its tax collection, you can bet that CRA is watching this closely!

#2 – CRA May Assess GST/HST on Assignment Sales

This is probably one of the most overlooked tax implications when it comes to assignment sales.

While resale homes are generally exempt from GST/HST, you may be surprised to learn that this may not be the case with assignments.

Similar to income tax, CRA will look at your intentions in buying the property to determine whether GST/HST applies to you.

For example, you are likely considered a “builder” and will have to charge GST/HST if you assign a pre-construction unit that you bought for the purpose of flipping to make a quick profit.

And it gets worse:

Not only do you have to charge GST/HST on your profit, you also have to charge GST/HST on the deposit you recoup from the buyer!

Since most real estate contracts embed GST/HST into the sales price, this cost will likely be borne by the assignor.

Let’s look at an example:

Scenario Luca purchased a pre-construction condo unit for $450,000 a couple of years ago. He paid a deposit of $90,000 to the builder. The unit is currently worth $575,000. Luca had always planned to buy this unit as an investment and assign it for a profit. He has a personal tax rate of 50%.

On the surface, it looks like Luca stands to make a great profit. But, let’s see how that holds up:

What Can You Do to Save Tax on Assignment Sales?

Firstly, if you are unsure whether you have a capital gain or business income, you should reach out to a tax professional for advice.

Secondly, if the profit on your assignment sale is in fact business income because of the factors discussed above, then you should consider incorporating.

The benefit here is that business income is usually taxed at low rates inside a corporation (about 12.2% in Ontario and 11% in British Columbia). This is much lower than the the top tax rate of 53% paid by individuals.

Now be warned:

Setting up a corporation for real estate investing is not for everyone. Be sure to consult with a tax professional before implementing this strategy.

Lastly, it is important to work with an experienced real estate lawyer to discuss your GST/HST options. In my experience, it may be possible to restructure an assignment sale to reduce the GST/HST you pay as an assignor.

In Luca’s case, with the right professionals on his team, he was able to restructure the deal to reduce his taxes by about 38% (50% less 12.2%), pay less GST/HST and put this money into his next real estate project.

Have qu estions about flipping pre-construction real estate? Contact us for a consultation.

The content of this blog is intended to provide a general guide to the subject matter. Professional advice should be sought about your specific circumstances.

95 Mural St., Suite 600, Richmond Hill, ON L4B 3G2

905.731.8108

- Login / Register

- (778) 909-1305

- Professional Advice

What Is an Assignment Sale? Understanding the Ins and Outs of This Real Estate Process

An assignment sale occurs when the original buyer of a property (the assignor) transfers their rights and obligations of the property contract to another buyer (the assignee) before the official closing of the sale.

This process allows the assignee to step into the original purchaser's shoes, taking on the commitments of the property purchase, which could be a pre-construction condo, house, or any other form of real estate.

Now, let's delve deeper into understanding how assignment sales work, their intricacies, and what they mean for buyers and sellers in the real estate market.

Demystifying the Elements of an Assignment Sale

Embarking on a real estate journey often introduces many terms and processes that may seem complex at first glance, with 'assignment sales' leading the pack in complexity and confusion.

Whether you're the original buyer looking to navigate away from closing costs or a savvy purchaser hunting for a valuable investment, understanding the nuts and bolts of assignment sales is an invaluable asset in the dynamic landscape of real estate.

How Assignment Sales Work

Assignment sales introduce a unique dynamic in real estate transactions, particularly in bustling markets like Vancouver Island and the Sunshine Coast .

When you buy a pre-construction unit, the property is yours, albeit not immediately ready for occupation. Life changes or financial circumstances sometimes evolve between the original purchase agreement and the final closing, necessitating a shift in plan.

Here's where assignment sales come into play. The original buyer can sell their interest in the property before the final sale, sidestepping typical hurdles like mortgage payments or land transfer taxes that come with a regular sale. This method provides a strategic avenue for purchasers to hand over their contractual obligations to another party without waiting for the property's completion.

The Assignment Clause: A Vital Cog in the Wheel

The assignment clause in the original contract is central to these types of transactions. This clause allows the transfer of the buyer's rights and responsibilities to another person.

It's crucial to understand that not all pre-construction sales agreements have an assignment clause, and most builders or developers might impose restrictions or require consent before any assignment deal can proceed.

Understanding the Financials: Costs and Fees

Engaging in assignment sales tends to involve several costs that both the buyer and seller must anticipate.

These include the assignment fee charged by the developer, legal fees for contract transfer, and possibly higher legal fees due to the complexity compared to a resale property. There could also be tax implications depending on the nature of the transaction and the parties involved.

Navigating Through the Interim Occupancy Period

A common scenario in assignment sales, especially in pre-construction condos, is dealing with the interim occupancy period.

This period arises when the assignee can take possession (though not ownership) of the unit while the property is not officially registered. During this phase, the assignee pays occupancy fees, akin to rent, which don't go towards mortgage payments.

Understanding this period helps both parties make an informed decision and prepare for the financial responsibilities it entails.

The Pros and Cons of Assignment Sales

Navigating assignment sales requires a balanced understanding of its advantages and drawbacks. While these transactions open avenues for lucrative deals and flexible arrangements, they also carry inherent risks and complexities that can impact buyers and sellers.

This exploration will provide clear insights, aiding your decision-making in the vibrant real estate market.

The Bright Side: Benefits of Assignment Sales

- Less Competition, More Opportunities: One advantage that makes assignment sales attractive, particularly in areas prone to bidding wars like Vancouver Island , is less competition. Fewer buyers are willing or informed about engaging in this kind of sales transaction, reducing the frenzy often seen in hot real estate markets. This situation can present a more favourable buying environment for those ready and willing to proceed with an assignment purchase.

- Potential for a Better Deal: For buyers, assignment sales sometimes offer the opportunity to get into a brand-new unit at a potentially lower cost. Since the assignee is stepping into an existing agreement, they might benefit from the original purchase price, which could be lower than current market rates, especially in fast-growing communities.

- Flexibility for the Original Buyer: For the original buyer, an assignment sale offers a way out, potentially recouping the deposit paid and avoiding financial penalties that might come with breaking a purchase agreement. This strategy can be particularly advantageous if the purchaser's circumstances change and needs to free up cash or avoid taking on a mortgage.

The Flip Side: Challenges and Risks of Assignment Sales

- Complexity and Higher Legal Fees: Assignment sales are not your straightforward real estate transaction. They require additional steps, such as securing the developer's consent, and the legal process is more complex than purchasing resale properties. As a result, both parties might incur higher legal fees to facilitate the transaction.

- Financial Overheads and Closing Costs: For the assignee, the initial cost outlay can be substantial for the assignee. They must reimburse the original buyer's deposit, pay the assignment fee, cover land transfer taxes, and prepare for other closing costs. These expenses require careful consideration and financial planning.

- Uncertainties and Marketing Restrictions: In some cases, developers impose marketing restrictions, making it challenging to advertise the assignment sale. Additionally, the assignee, now the new buyer, takes on certain risks like development charges or changes in market conditions, which could affect the property's value upon final closing.

Making the Move: Deciding If an Assignment Sale Is Right for You

Deciding to engage in an assignment sale is a pivotal moment, requiring a blend of financial foresight and market understanding.

As we delve into this decision-making process, we'll consider critical personal and economic factors that ensure you're making a choice that aligns with your real estate ambitions and lifestyle aspirations.

Conduct Due Diligence: Know What You're Getting Into

Involving real estate agents experienced in assignment sales is a prudent step for guidance through the intricacies of these transactions.

Also, consulting with a real estate lawyer ensures you understand the legalities, your rights, and any potential liabilities you might be assuming.

Consider Your Financial Standing and Long-Term Goals

Reflect on your current financial health and future plans.

For original buyers, if life changes dictate a change in your real estate investments, an assignment sale could be a viable exit. For potential assignees, consider whether this buying pathway aligns with your investment strategy and if you're comfortable with the associated risks.

Stay Informed About Market Conditions

Market dynamics greatly influence real estate valuations. A clear picture of current trends, especially in your buying area (like Fort St John or cities in the Okanagan ), helps make an informed decision.

Understanding these trends could offer insights into whether you're setting yourself up for a profitable investment or a potential financial misstep.

Bringing It All Home with LoyalHomes.ca

Navigating the world of assignment sales can be a complex journey, laden with opportunities and pitfalls. Whether you're considering selling your contractual rights or stepping into an existing purchase agreement, the route is layered with legal, financial, and market considerations.

At Loyal Homes, we understand that your real estate journey is more than just a transaction; it's a pivotal chapter in your life story. We're here to guide you through each step, ensuring you're equipped with the local, accurate, and relevant information to make decisions confidently. Our team is committed to providing a service that stands a notch above the rest, focusing on relationships and community at its core.

Ready to take the next step in your real estate adventure in British Columbia? Whether it's finding the perfect neighbourhood, exploring investment opportunities, or seeking your dream home, we're here to assist.

For a personalized experience tailored to your unique needs, consider our Personalized Home Search . If you're on the selling side and need to understand your property's current market standing, request a Free Home Valuation . Or, for any other inquiries or guidance, feel free to contact us . Your journey to a successful real estate experience in British Columbia starts with LoyalHomes.ca, where your peace of mind is our highest priority.

Frequently Asked Questions

Is it good to buy an assignment sale.

Buying an assignment sale can be advantageous, offering lower purchase prices compared to current market rates for similar properties, especially in hot real estate markets. However, this venture also requires thorough due diligence to ensure that the agreement terms, property details, and financial implications align with your investment goals.

Can You Make Money on an Assignment Sale?

Yes, there is a potential to make money on an assignment sale, particularly if the property's value has increased since the original purchase date. This profit occurs due to appreciation over the period, especially in high-demand areas, but it's crucial to factor in any assignment fees, legal costs, and tax implications to understand the net gainfully.

What Are the Risks of Buying an Assignment Sale?

The risks include a lack of guarantees on the final product as specifications might change, potential delays in construction, and complexities in financing, often requiring a more substantial initial deposit. These elements underscore the importance of legal counsel to navigate contract specifics and to prepare for any contingencies or additional costs.

How Do I Sell My Pre-Construction Assignment?

Selling a pre-construction assignment involves marketing to potential buyers, typically requiring the developer's consent and possibly entailing a fee. Engaging with a real estate professional who understands the local market nuances and legalities of assignment sales is essential to ensure a smooth, compliant transaction.

Do I Pay Tax on Assignment Sale?

Tax implications on assignment sales can be multifaceted, potentially involving income tax on profits and GST/HST on the purchase, depending on factors like the property type and the seller's tax status. It's advisable to consult with a tax professional to accurately determine specific obligations and strategize for tax efficiency based on your circumstances.

What Is the Difference Between a Transfer and an Assignment?

A transfer and an assignment differ significantly; a transfer involves changing property ownership after a project's completion, whereas an assignment sells one's interest in a property before it's finished. Understanding this distinction is crucial as it affects the contractual obligations, rights transferred to the new buyer, and the legal and financial processes involved in the transaction.

- Photo: @ irina88w via Canva.com

- Photo: @ AndreyPopov via Canva.com

- Photo: @ putilich via Canva.com

Post a Comment

Related posts.

Unlocking the Potential of a Vendor Take-Back Mortgage: How Seller Financing Works

Vendor Take Back Mortgages (VTB) offers an innovative financing solution that can be a game-changer for buyers and sellers in the real estate market.... Read More

Mortgage Broker or Bank: Navigating Your Best Path in Home Financing

Choosing between a mortgage broker and a bank for your home financing needs is a crucial decision. Whether you're eyeing the vibrant real estate ... Read More

Complexities of a Lien on the House: A Comprehensive Guide

Navigating the complex world of property liens can be daunting. Liens on a house represent a legal claim against a property, often resulting from ... Read More

We're Here to Help

- X (Twitter)

Have a Question or Want a Free Market Report?

- Advanced Search

- Search by Map

- Property Tracker

- Featured Listings

- Vancouver Island Communities

- Lower Mainland Communities

- Sunshine Coast Communities

- Thompson Okanagan Communities

- Kootenay Rockies Communities

- Cariboo Communities

- Northern BC Communities

- Mortgage Calculator

- Mortgage Pre-Approval

- First Time Buyers

- Making an Offer

- What Are Closing Costs?

- Financial Terms Glossary

- Personalized Home Search

- Factors to Consider When Moving to a New City

- Selling a Home

- Pricing Your Home

- Marketing Your Home

- Showing Your Home

- Adding Value

- Free Market Analysis

- Join Our Group

Language selection

- Français fr

Proposed GST/HST Treatment of Assignment Sales

GST/HST Notices - Notice 323 May 2022

On April 7, 2022, the Minister of Finance Canada tabled Budget 2022 which proposed an amendment to Part IX of the Excise Tax Act. The proposed amendment would make all assignment sales in respect of a newly constructed or substantially renovated single unit residential complex or residential condominium unit taxable.

This publication provides questions and answers regarding the proposed amendment. Any commentary in this publication should not be taken as a statement by the Canada Revenue Agency that the proposed amendment will become law in its current form.

Except as otherwise noted, all statutory references in this publication are to the provisions of the Excise Tax Act (ETA). The information in this publication does not replace the law found in the ETA and its regulations.

If this information does not completely address your particular situation, you may wish to refer to the ETA or relevant regulation, or call GST/HST Rulings at 1‑800‑959‑8287 for additional information. If you require certainty with respect to any particular GST/HST matter, you may request a ruling. GST/HST Memorandum 1-4, Excise and GST/HST Rulings and Interpretations Service , explains how to obtain a ruling or an interpretation and lists the GST/HST rulings centres.

If you are located in Quebec and wish to request a ruling related to the GST/HST, please call Revenu Québec at 1‑800‑567‑4692. You may also visit the Revenu Québec website at revenuquebec.ca to obtain general information.

For listed financial institutions that are selected listed financial institutions (SLFIs) for GST/HST or Quebec sales tax (QST) purposes or both, whether or not they are located in Quebec, the CRA administers the GST/HST and the QST. If you wish to make a technical GST/HST or QST enquiry related to SLFIs, please call 1‑855‑666‑5166.

GST/HST rates

Reference in this publication is made to supplies that are subject to the GST or the HST. The HST applies in the participating provinces at the following rates: 13% in Ontario and 15% in New Brunswick, Newfoundland and Labrador, Nova Scotia and Prince Edward Island. The GST applies in the rest of Canada at the rate of 5%. If you are uncertain as to whether a supply is made in a participating province, refer to GST/HST Technical Information Bulletin B-103, Harmonized Sales Tax – Place of Supply Rules for Determining Whether a Supply is Made in a Province .

Table of Contents

Proposed amendment, definitions, questions and answers.

An assignment sale in respect of residential housing is a transaction in which a purchaser (an assignor) that has entered into an agreement of purchase and sale with a builder of a new house sells (assigns) their rights and obligations under the agreement of purchase and sale to another person (an assignee). The agreement that details the terms of the assignment of an agreement of purchase and sale (the assignment sale) is generally referred to as the assignment agreement.

For purposes of this notice, a house includes a detached or semi-detached house, a duplex, a condominium unit, a townhouse, a unit in a co-operative housing corporation, a mobile home (including a modular home) and a floating home.

Under the current GST/HST rules, an assignment sale made by a person that is not an individual in respect of newly constructed or substantially renovated residential housing is generally taxable, whereas an assignment sale made by an individual may be either taxable or exempt. An assignment sale made by an individual is generally taxable if the individual had originally entered into the agreement of purchase and sale with the builder for the primary purpose of selling their interest in the real property. If, on the other hand, the individual had originally entered into the agreement of purchase and sale for another primary purpose (for example, to occupy the house as a place of residence), the assignment sale is generally exempt. Any amount an assignor paid as a deposit to a builder is included in the consideration for a taxable assignment sale. For more information on the current GST/HST rules, refer to GST/HST Info Sheet GI-120, Assignment of a Purchase and Sale Agreement for a New House or Condominium Unit .

The proposed amendment to the ETA would make all assignment sales, including those made by individuals, in respect of newly constructed or substantially renovated residential housing taxable for GST/HST purposes. Furthermore, the proposed amendment would exclude any amount attributable to a deposit paid by an assignor to a builder from the consideration for a taxable assignment sale, when certain conditions are met. The proposed amendment would apply to all assignment agreements entered into after May 6, 2022.

The proposed amendment adds section 192.1 to the ETA. Proposed section 192.1 states that if a taxable supply by way of sale of a single unit residential complex (as defined in subsection 254(1)) or of a residential condominium unit is made in Canada under an agreement of purchase and sale (in this section, referred to as the purchase agreement) entered into with a builder of the single unit residential complex or of the residential condominium unit and if another supply by way of assignment of the purchase agreement is made by a person (other than the builder) under another agreement, then the following rules apply:

- the other supply is deemed to be a taxable supply, by way of sale, of real property that is an interest in the single unit residential complex or residential condominium unit

- the consideration for the other supply is deemed to be equal to the amount determined by the formula:

| Where | |

|---|---|

| A | is the consideration for the other supply as otherwise determined for GST/HST purposes |

| B | is: (i) if the other agreement indicates in writing that a part of the consideration for the other supply is attributable to the reimbursement of a deposit paid under the purchase agreement, the part of the consideration for the other supply that is solely attributable to the reimbursement of the deposit paid under the purchase agreement (ii) in any other case, zero |

Proposed section 192.1 applies in respect of any supply by way of assignment of an agreement of purchase and sale if the supply is made after May 6, 2022.

Proposed section 192.1 applies to a single unit residential complex or a residential condominium unit.

Single unit residential complex means a residential complex that does not contain more than one residential unit, but does not include a residential condominium unit.

For the purposes of the proposed amendment, a single unit residential complex also includes:

- a multiple unit residential complex that does not contain more than two residential units (for example, a duplex)

- any other multiple unit residential complex if it is described by paragraph (c) of the definition of residential complex in subsection 123(1) and contains one or more residential units that are for supply as rooms in a hotel, motel, inn, boarding house, lodging house or similar premises and that would be excluded from being part of the residential complex if the complex were a residential complex not described by that paragraph (for example, a bed and breakfast establishment)

Residential condominium unit means a residential complex that is, or is intended to be, a bounded space in a building designated or described as a separate unit on a registered condominium or strata lot plan or description, or a similar plan or description registered under the laws of a province, and includes any interest in land pertaining to ownership of the unit.

1. I am an individual who entered into an assignment agreement before May 7, 2022. Is the assignment sale taxable?

If an assignment agreement is entered into before May 7, 2022, the current GST/HST rules apply. This means that the assignment sale may be either taxable or exempt. An assignment sale made by an individual is generally taxable if the individual had originally entered into the agreement of purchase and sale with the builder for the primary purpose of selling their interest in the real property. If, on the other hand, the individual had originally entered into the agreement of purchase and sale for another primary purpose (for example, to occupy the property as a place of residence), the assignment sale is generally exempt.

Under the current GST/HST rules, if an assignor’s sale of their interest in the real property to an assignee is taxable, the total amount payable for the sale of the interest is subject to the GST/HST, including any amount the assignor paid as a deposit to the builder, whether or not such an amount is separately identified.

For more information, refer to GST/HST Info Sheet GI-120 .

2. The assignor already paid a deposit under the purchase and sale agreement. Is the portion of the assignment sale that is attributable to the deposit taxable?

Typically, the consideration for an assignment sale includes an amount attributable to a deposit that had previously been paid to the builder by the assignor. The application of the GST/HST to the amount attributable to the deposit in the context of the assignment sale depends on the date the assignment agreement was entered into and not on the date the deposit was paid to the builder.

Where an assignment agreement is entered into before May 7, 2022, and the assignment sale is taxable, the total amount payable for the sale of the assignor’s interest to the assignee is subject to the GST/HST, including any amount the assignor paid as a deposit to the builder, whether or not such an amount is separately identified.

Where an assignment agreement is entered into on or after May 7, 2022, and the assignment agreement indicates in writing that a part of the consideration is attributable to the reimbursement of a deposit paid by the assignor to the builder under the purchase and sale agreement, the proposed amendment excludes the amount attributable to the deposit from the consideration for a taxable assignment sale.

3. Who is responsible for remitting the tax on the assignment sale under the proposed amendment?

The proposed amendment does not change who is responsible for remitting the tax on the assignment sale. The assignor in respect of a taxable assignment sale would generally continue to be responsible for collecting the GST/HST and remitting the tax to the Canada Revenue Agency (CRA). Where the assignor is a non-resident of Canada, the assignee would continue to be required to self-assess and pay the GST/HST directly to the CRA.

For more information, refer to Guide RC4022, General Information for GST/HST Registrants .

4. Will the proposed amendment affect the new housing rebate?

The amount of a new housing rebate under the GST/HST legislation is determined based, in part, on the total tax paid and the total consideration for a taxable supply of a house, which includes any other taxable supply of an interest in the house (for example, the tax and consideration paid by an assignee for a taxable assignment sale). As a result of the proposed amendment, where an assignment agreement is entered into after May 6, 2022, the GST/HST applies to assignment sales that were not otherwise taxable, and the amount attributable to a deposit is excluded from the consideration for all taxable assignment sales. Consequently, the proposed amendment may have an impact on both the total tax paid and the total consideration for the taxable supply of a new house, which may affect the amount of a GST/HST new housing rebate in respect of the GST or the federal part of the HST, or of a new housing rebate in respect of the provincial part of the HST, that may be available in respect of a new house.

Only one new housing rebate application can be made for each new house. Therefore, an assignee purchaser cannot submit a rebate application through a builder (Builder A) for the tax paid to Builder A on the purchase of the house and submit a second rebate application for the tax paid to the assignor on the purchase of the interest in the house. In such cases, the assignee purchaser may want to file their new housing rebate application directly with the CRA rather than through Builder A. In this way, the assignee purchaser can include in the new housing rebate application the tax paid to Builder A and the tax paid to the assignor in determining the amount of their GST/HST new housing rebate and, where applicable, a provincial new housing rebate.

For more information, refer to Guide RC4028, GST/HST New Housing Rebate .

5. Will the proposed amendment affect the new residential rental property rebate?

The amount of a new residential rental property rebate (NRRPR) under the GST/HST legislation is determined based, in part, on the total tax payable in respect of a residential complex and the fair market value of the qualifying residential unit that forms part of the complex at the time the GST/HST becomes payable on the purchase of the complex. As a result of the proposed amendment, where an assignment agreement is entered into after May 6, 2022, the GST/HST applies to assignment sales that were not otherwise taxable, and the amount attributable to a deposit is excluded from the consideration for all taxable assignment sales. Consequently, the proposed amendment may have an impact on the total tax payable in respect of the complex, which may affect the amount of a GST/HST NRRPR in respect of the GST or the federal part of the HST, or of an NRRPR in respect of the provincial part of the HST.

For more information, refer to Guide RC4231, GST/HST New Residential Rental Property Rebate .

Further information

All GST/HST technical publications are available at GST/HST technical information .

To make a GST/HST enquiry by telephone :

- for GST/HST general enquiries, call Business Enquiries at 1‑800‑959‑5525

- for GST/HST technical enquiries, call GST/HST Rulings at 1‑800‑959‑8287

If you are located in Quebec , call Revenu Québec at 1‑800‑567‑4692 or visit their website at revenuquebec.ca .

If you are a selected listed financial institution (whether or not you are located in Quebec) and require information on the GST/HST or the QST , go to GST/HST and QST - Financial institutions, including selected listed financial institutions or:

- for general GST/HST or QST enquiries , call Business Enquiries at 1‑800‑959‑5525

- for technical GST/HST or QST enquiries , call GST/HST Rulings SLFI at 1‑855‑666‑5166

Page details

ADVO TAX LAW

PROFESSIONAL CORPORATION

- May 11, 2022

Tax Implications of a Real Estate Assignment: a Tax Exposure Calculator

This article provides an overview of GST/HST and Income Tax rules (current and proposed by the Federal Budget 2022) as they apply to real estate assignments sales.

In order to illustrate the points we discuss in the article, we have created a fun and interactive Assignment Tax Exposure Calculator for real estate assignments in Ontario (HST rate 13%) that result in business income for Income Tax purposes . If your assignment sale results in capital gain for Income Tax purposes, this calculator won't work for you (we might create one for our readers, if there is enough interest). Talk to your tax advisor to determine whether your assignment sale would result in business income or in capital gain.

We hope that our readers enjoy testing their business strategies with our Tax Exposure Calculator as they plan their assignment sales, but we caution them not to rely on the calculator in lieu of professional tax, legal or accounting advice.

Federal Budget 2022

A typical purchase agreement for a pre-construction residential property has a closing date scheduled months, often years in advance. As purchasers wait for the construction to complete/the transaction to close, some choose to assign their rights under the purchase agreement for the property for a fee. Federal Budget 2022 proposes new tax rules that will affect both such assignors and assignees.

Take, for example, Rebecca who purchased a pre-construction condominium in Downtown Toronto in 2017 for $300,000 (including HST) with a November 2022 tentative closing date. She provided a deposit of $60,000 to the builder. At the time of purchase, Rebecca’s intention was to live in the condo. As years went by, Rebecca changed her mind about living in Downtown; she decided to live in the suburbs instead. Lucky for Rebecca, the market value of her pre-construction condo surged to $500,000. In June 2022, Rebecca assigns her rights under the purchase agreement for the condo to a new purchaser who is willing to pay $260,000 ($60,000 to reimburse her for the deposit she made + $200,000 on account of the increase in price). Rebecca thinks she made an impressive profit of $200,000 but she did not consider taxes.

If you are like Rebecca, Federal Budget 2022 has some good news and some bad news for you (but mostly bad).

GST/HST to Apply on All Assignment Sales

The bad news is that effective May 7, 2022, under the Excise Tax Act (Canada) (“ETA”) every individual assignor of residential real estate would have to collect GST/HST on their assignment profit and remit it to the CRA. The rule will apply even to those who believe they are unrelated to the business of real estate and did not have a GST/HST number. Where an assignor is a non-resident, the assignee would be required to self-assess and pay the GST/HST to the CRA. In my example, Rebecca would have to remit 13% HST included in the $200,000 assignment profit ($23,008) directly to the CRA.