- Our Centers Delhi Bhubaneswar Lucknow

CURRENT AFFAIRS FOR UPSC IAS

$ 5 Trillion Economy

Published: 26th Jul, 2019

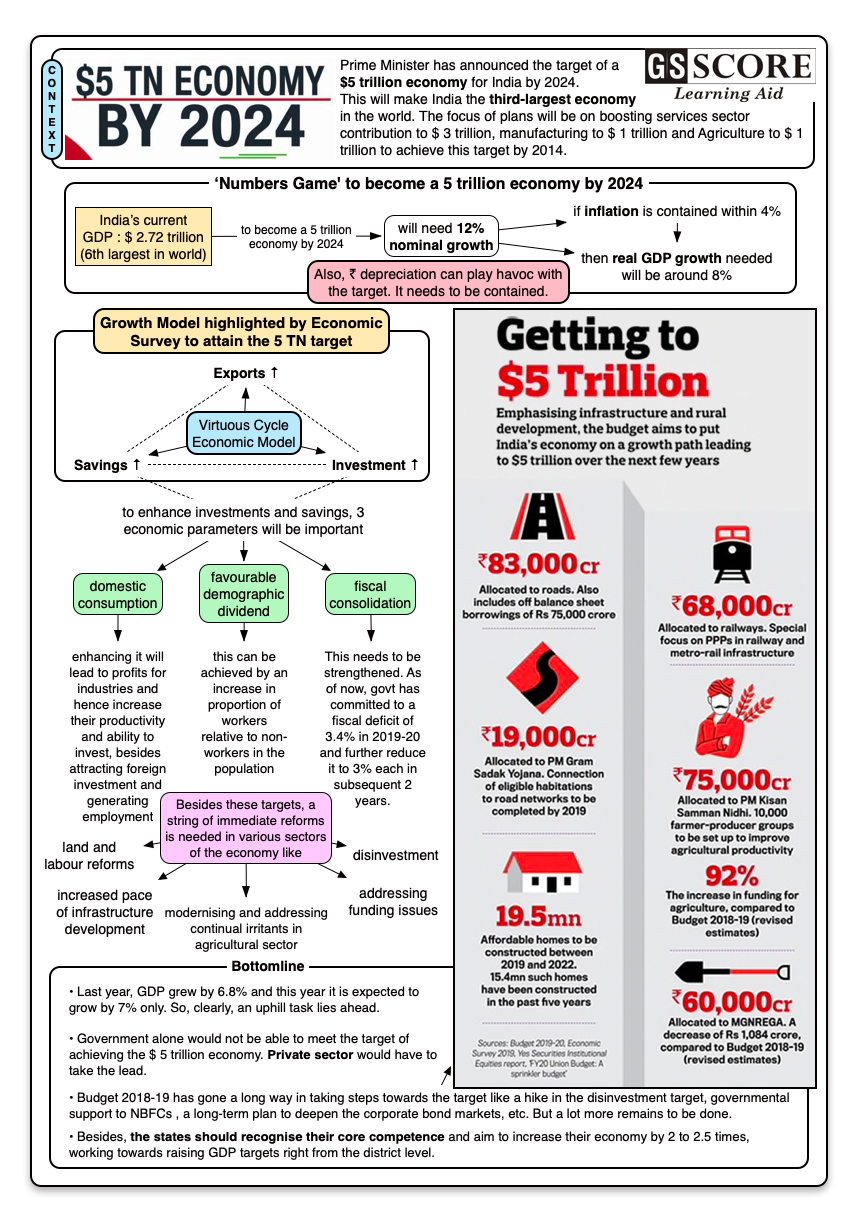

- Prime Minister had announced the target of a $5 trillion economy for India by 2024. This will make India the third-largest economy in the world.

- The focus of plans will be on boosting services sector contribution to $ 3 trillion, manufacturing to $ 1 trillion and Agriculture to $ 1 trillion.

What is a $5-trillion economy?

- Essentially $5-trillion economy is the size of an economy as measured by the annual Gross Domestic Product (GDP).

- The GDP of an economy is the total monetary value of all goods and services produced in an economy within a year.

- GDP is a way among countries (economies) to keep score about who is ahead.

- In 2014, India’s GDP was $1.85 trillion. In 2018, it is $2.7 trillion and India is the sixth-largest economy in the world.

- Apart from the monetary definition, a $ 5 Trillion Economy calls for pulling all the economic growth levers— investment , consumption , exports , and across all the three sectors of agriculture , manufacturing and services .

- It also means improving all three sectors of the economy, India will more likely achieve its ambitious Sustainable Developmental Goals (SDGs) .

- By attaining double-digit growth, India has little hope of employing the roughly one million young people. Favourable demographics will emerge as an upper-middle-income economy with a prosperous and thriving middle class.

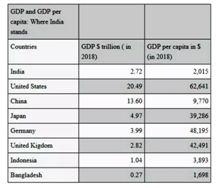

Comparison with Major Economies of the World

- India is the sixth-largest economy does not necessarily means that Indians are the sixth-richest people on the planet. If one wants to better understand the wellbeing of the people in an economy, one should look at GDP per capita.

- The second column of the table reveals a very different, and indeed a more accurate picture of the level of prosperity in the respective economies. For instance, on average, a UK resident’s income was 21 times that of an average Indian in 2018. This wide gap exists even though India’s overall GDP is very nearly the same as UK’s.

Characteristics of a valuable economy

Today the economy must be evaluated in terms of how much it contributes to the ease of our living . So following are some of the characteristics of a valuable economy:

- First, Indians should feel empowered by the economy . But India is placed very low in the United Nations’ World Happiness Report . Happiness is related to being educated and experiencing good health. So, the first attribute of the valuable economy would be access to quality health and education for all.

- Second attribute would be equality of opportunity . According to some measures, India is today more unequal than China , itself a society widely perceived as highly unequal, which is related to unequal distribution of income, gender inequality and sex ratio, already unfavourable to women. Inequality in India can only be ended by equalising capabilities across individuals. Concerted public action via education is the means to this outcome.

- Recently released Global Multi Poverty Index shows that India has lifted 271 million people out of poverty between 2006 and 2016. But still it remains a major issue. As $ 5 Trillion economy is accompanied by job growth, equality of opportunity and better health and education, it will indirectly improve the status of social inequality.

Contribution of Different Sectors in achieving the goal of $5 Trillion Economy

Primary Sector

- Investment is the key for the flourishment of areas like agro-processing, and exports, agri-startups and agri-tourism, where the potential for job creation and capacity utilisation is far less.

- Investment needs to be driven to strengthen both public and private extension advisory systems (educating farmers about technology and management practices) and the quality of agri-education and research through collaboration and convergence.

- It would also serve as a stage to demonstrate resource conservation and sustainable use through organic, natural and green methods, and also zero budget natural farming.

- India has the highest livestock population in the world, investment should be made to utilise this surplus by employing next-generation livestock technology. This would lead to a sustained increase in farm income and savings with an export-oriented growth model.

- Investment in renewable energy generation (using small wind mill and solar pumps) on fallow farmland and in hilly terrain would help reduce the burden of debt-ridden electricity distribution companies and State governments, besides enabling energy security in rural areas.

- A farm business organisation is another source of routing private investment to agriculture. Linking these organisations with commodity exchanges would provide agriculture commodities more space on international trading platforms and reduce the burden of markets in a glut season, with certain policy/procedural modifications.

Manufacturing Sector

- A three-pillar strategy has been suggested to achieve required expansion of output -- focus on existing high impact and emerging sectors as well as MSMEs.

- To boost electronics manufacturing , it said the government should consider offering additional fiscal incentives such as a limited-period tax holiday to players investing more than an identified threshold of investment.

- Similarly for the auto and auto - components sector , it recommended encouragement of global leaders for the identified components to set up manufacturing bases, and incentivising players willing to invest more than a threshold in identified areas.

- The report suggested measures to boost manufacturing in other areas including aeronautical, space, garments, organic/ayurvedic products besides emerging areas such as biotechnology, electric mobility, unmanned aerial vehicles, medical devices, robotics and chemicals.

- For micro, small and medium enterprises , the working group said there is a need to improve access to funding by way of development of SME credit risk databases, SME credit rating, and creation of community-based funds.

Service Sector

- Services sector include improving rail connectivity and seamless connectivity to major attractions; facilitating visa regime for medical travel; allowing expatriate professional to perform surgeries in identified hospitals; and e-commerce policy and regulatory framework for logistics segment.

- This sector contributes significantly to India’s GDP, a goal of around 60 % contribution of services sector has been envisaged for 2024. Exports and job creation, increased productivity and competitiveness of the Champion Services Sectors like IT, tourism, medical value travel and legal will further boost exports of various services from India.

- The Commerce Minister has identified 15 strategic overseas locations where the Trade Promotion Organisations (TPOs) are proposed to be created.

- Multi-Modal Logistics Parks Policy (MMLPs) aims to improve the country’s logistics sector by lowering over freight costs, reducing vehicular pollution and congestion and cutting warehouse costs with a view to promoting moments of goods for domestic and global trade.

- In the defence sector , there is a need to identify key components and systems and encourage global leaders to set up manufacturing base in India by offering limited period incentives; and ensure incentives result in technology/process transfer.

- To promote growth of accounting and financial services , there is a need to FDI in domestic accounting and auditing sector, transparent regulatory framework, and easing restriction on client base in the accounting and auditing sector.

- Measures like exploring introduction of insurance in the film industry, promoting private investments in film schools, exploring franchise business models to exploit film franchise, and promoting gaming industry value chains aims to push audio visual services .

- Foreign universities are allowed to set up campuses in India, easy visa regime for students and education service providers, removing regulatory bottlenecks, providing recognition of online degrees and setting up appropriate evaluation techniques for online courses for the education sector .

INITIATIVES BY INDIA

- The Government has several on-going initiatives across sectors focused on growth. In agriculture the Government is aiming to reorient policy focus from being production-centric to becoming income-centric .

- The Commerce Ministry has formulated India’s first ever Agricultural Export Policy with a focused plan to boost India’s agricultural exports to $ 60 billion by 2022 thereby assisting the Agriculture Ministry in achieving its target of $ 100 billion and to integrate Indian farmers and the high quality agricultural products with global value chains and to double India’s share in world agriculture.

- The emphasis on incomes provides a broader scope towards achieving the needed expansion of the sector. The proposed Industrial Policy 2018 provides an overarching, sector-agnostic agenda for the enterprises of the future and envisions creating a globally competitive Indian industry that is modern, sustainable and inclusive.

- India has improved its rank in Ease of Doing Business Index from 100 in 2017 to 77 in 2018.

- Ministry of Commerce is making all efforts to ensure that in public procurement preference is given to Make in India . Its aim is to make India the hub of manufacturing, India has emerged as one of the fastest growing economies.

- India has jumped 3 places on the Global Innovation Index from rank 60 in 2017 to rank 57 in 2018.

- Start-up India is a flagship initiative of the Government of India, intended to build a strong ecosystem that is conducive for the growth of start-up businesses, to drive sustainable economic growth and generate large scale employment opportunities.

- In Union Budget 2018-19, the Government of India reduced the income tax rate to 25 per cent for all companies having a turnover of up to Rs 250 crore.

- Under the Mid-Term Review of Foreign Trade Policy (2015-20), the Government of India increased export incentives available to labour intensive MSME sectors by 2 per cent.

- The Government of India has launched a Phased Manufacturing Programme (PMP) aimed at adding more smartphone components under the Make in India initiative thereby giving a push to the domestic manufacturing of mobile handsets.

- The Government of India is in talks with stakeholders to further ease foreign direct investment (FDI) in defence under the automatic route to 51 per cent from the current 49 per cent, in order to give a boost to the Make in India initiative and to generate employment.

- The Ministry of Defence, Government of India, approved the “Strategic Partnership” model which will enable private companies to tie up with foreign players for manufacturing submarines, fighter jets, helicopters and armoured vehicles.

- The Champion Services sector initiative is also under way to accelerate the expansion of select service sectors.

- The 2019 Union Budget talks about plans with a pan-India focus to give a further boost to Sagarmala, Bharatmala and UDAN projects , besides the dedicated industrial and freight corridors.

- The budget proposes further opening of FDI in aviation sector, media, animation AVGC and insurance sectors in consultation with all stakeholders. 100 per cent FDI will be permitted for insurance intermediaries.

FEASIBILITY OF BECOMING $5 TRILLION ECONOMY

- If India grows at 12% nominal growth (that is 8% real GDP growth and 4% inflation), then from the 2018 level of $2.7 trillion, India would reach the 5.33 trillion mark in 2024.

- But last year, India grew by just 6.8%. This year, most observers expect it to grow by just 7%. So India must keep growing at a rapid pace to attain this target.

- The Economic Survey 2018-19 highlighted that international experience, especially from high-growth East Asian economies, suggested that such growth can only be sustained by a “virtuous cycle” of savings, investment and exports catalysed and supported by a favourable demographic phase.

- Investment, especially private investment , is the key driver that drives demand, creates capacity, increases labour productivity, introduces new technology, allows creative destruction and generates jobs.

CHALLENGES:

Sectors of Indian Economy

- One of the major problems that this sector faces is the under-employment and the disguised employment . Underemployment accounts for the workers not working to the best of their capabilities while the latter accounts for the workers not working to their true potential.

- The slow-down in agricultural growth has become a major cause for concern. India’s rice yields are one-third of China’s and about half of those in Vietnam and Indonesia. The same is true for most other agricultural commodities.

- Water resources are also limited and water for irrigation must contend with increasing industrial and urban needs

- Poor networks of roads, inadequate air & sea port capacities along with undeveloped railway networks are hindering the growth of this sector. This leads to slow & inefficient delivery of the product to the customers.

- The turnaround times are also high due to heavy congestion on berths and slow evacuation of cargo unloaded at berths. High cost of fuel & high waiting times negatively impact the logistic sector.

- The transportation industry is also severely unorganised. The employees of this sector have inadequate skills which lead to inefficient supply of goods. Low level of technology and poor maintenance of the tools are also responsible for inefficiency of the transportation industry.

- The main problem that this sector is that the jobs which involve lower salaries do not attract much employment. And this remains the future dilemma as India is looking for double-digit growth in the near future.

COMMON CHALLENGES

- Depressing pace in carrying out land and labour reforms : This has been a major turn-off for investors looking at setting shop in the country. Budget talks about narrowing labour laws. This is a step in the right direction but quick execution is important. Since land is a state subject, respective state governments need to work with the Centre to bring about the change. In the past, investors got a shocker from episodes such as Singur.

- Slow pace of infrastructure development in the last decade : India is still at the position where China was 20 years ago in terms of infrastructure development. The plans are ambitious, but the problem is resources.

- Funding Problem : India does not have powerful institutions that can fund long-gestation infrastructure projects. Banks do not have enough long-term liabilities to match such loans. Lenders have gone terribly wrong in the past by not following healthy lending practices.

- India does not have a deep bond market to take up the financing burden. The state-insurer Life Insurance Corporation of India (LIC) has been overexploited to do businesses it has never understood. There aren't many other options left to take up the infra-funding burden. The government's plan to borrow off-budget is risky and unadvisable.

- Government's excessive involvement in businesses : The government remains active participant in several entities including banks, airline, and infrastructure firms. It controls 70 % of the banking industry. This participation has resulted in a lot of money getting stuck in these entities.

- The government will have to exit these businesses backed by a solid, aggressive disinvestment plan to unlock this money.

- Private investors back : This is even more critical now since domestic consumption is dropping to dangerous levels. Investment in new projects plunged to a 15-year low in the quarter ending June 2019. Both private and public sectors announced new projects worth Rs 43,400 crore in June 2019 quarter, 81 % lower than what was announced in the March quarter and 87 % lower than during the same period a year ago.

- According to the finance ministry’s data, projects worth almost Rs 11 lakh crore remain ‘stalled’ or are having issues. Railways, roads, and power sectors account for more than half of these stalled projects.

- Public money: Government spending has largely aided GDP growth. Sure, this was needed at a time when private investors were absent. However, an economy which rides largely on government money for a prolonged period of time does not promise much to the economy in the long run. What is needed is the participation of private investors.

Way Forward

- There is a need to place India’s official statistics on a firmer footing, so that we can be sure that economic policy-making is based on reality. However, getting the numbers right will not ideally end the task.

- Government alone would not be able to meet the target of achieving the $ 5 trillion economy. Private sector would have to take the lead. Budget 2018-19 included a hike in the disinvestment target, governmental support to NBFCs and a long-term plan to deepen the corporate bond markets.

- Structural reforms in the agriculture sector would also have to carry out. There is a need to modernise the farm sector.

- The States should recognise their core competence and aim to increase their economy by 2 to 2.5 times, working towards raising GDP targets right from the district level. States to focus on their potential to grow exports.

Manufacturing Sector

Service Sector

- Development should be seen right when a child is born, this attitude can make a real change in the field of Human development Hence, it shall ultimate help the real economic growth.

- Global healthcare and wellness is a $8 trillion industry, need to convert India’s 600 district hospitals as medical, nursing and paramedical schools to train 5 million doctors, nurses, and paramedics to meet the global requirement.

Learning Aid

More Articles

Verifying, please be patient.

Our Centers

DELHI (Karol Bagh)

GS SCORE, 1B, Second Floor, Pusa Road, Karol Bagh, New Delhi - 110005 (Beside Karol Bagh Metro Station Gate No. 8)

Get directions on Google Maps

BHUBANESWAR (Jaydev Vihar)

GS SCORE, Plot No.2298, Jaydev Vihar Square, Near HCG Day Care, BBSR - 751013

LUCKNOW (Aliganj)

GS SCORE, 2nd Floor, B-33, Sangam Chauraha, Sector H, Aliganj, Lucknow, UP - 226024

Delhi (Karol Bagh) Centre

GS SCORE, Second Floor, Metro Tower, 1B, Pusa Road, Karol Bagh, New Delhi - 110005 (Beside Karol Bagh Metro Station Gate No. 8)

Email: [email protected]

Phone: +91 8448496262

Classroom / online / Live programs

- Mains Classes

- Mains Advance Classes

- Ethics & Essay Classes

- IAS Foundation

- Aadhar:NCERT Foundation

- Target PT:Prelims Classes

- Current Affairs Mentorship Program

- Optional Classes

- Optional Q&A (TEST SERIES & Mentorship)

- Mains Previous Year Questions

TEST SERIES/ MENTORSHIP

- ITS:Integrated Test Series & Mentorship

- GS Mains Q&A (Mentorship & Test Series)

- GS Test Series

- Ethics & Essay Test Series

- Samarth - Mains Answer Writing

STUDY MATERIAL

- Prelims Study Material

- Mains Study Material

- Mains Answer Writing Workbook

- Meet the Mentor

- Terms & Conditions

- © 2024 - IAS SCORE

All Rights Reserved.

Welcome to our secure login portal. Access your account with ease.

- Using Password

Not registered yet? register here!

Welcome to our secure register portal. For a brighter future, register now and unlock endless learning opportunities.

User Register

Already have an account? Login

Oops, forgot your password? Don't worry, we've got you covered. Reset it here

Lost your login details? No problem! forgot your password in just a few clicks

Forgot Password

Verify your mobile number, you have successfully logged in.

Join Us on WhatsApp

The Working Group tasked to develop a roadmap towards achieving a 5 trilliondollar economy by 2025has prepared its report and it is being circulated to the stakeholders for further suggestions.The Working Group was constituted by the Department of Industrial Policy and Promotion in the Ministry of Commerce and Industry with participation from government and industry. The Group held extensive and broad-based consultations with stakeholders to better understand the aspirations and the potential.The sectoral sub-groups were also formed to take the task forward.

India is one of the fastest growing major economies and is currently ranked as the world’s sixth largest economy. Projections of growth, over the medium term, remain encouraging and optimistic for India. The underlying strengths are indicative of the potential of India to achieve a USD 5 trillion economy by 2025. The current structure of the economy and the emerging dynamics provide us grounds to target achieving 1 trilliondollarfrom agriculture and allied activities, 1 trillion from manufacturing and 3 trillionfrom services.

The Government has several ongoing initiatives across sectors focused on growth. In agriculture the Government is aiming to reorient policy focus from being production-centric to becoming income-centric. The emphasis on incomes provides a broader scope towards achieving the needed expansion of the sector. The proposed Industrial Policy 2018 provides an overarching, sector-agnostic agenda for the enterprises of the future and envisions creating a globally competitive Indian industry that is modern, sustainable and inclusive.

The Champion Services sector initiative is also under way to accelerate the expansion of select service sectors. The Working Group has accounted for these initiatives and encourages a fresh impetus to achieve the target of a five trillion economy.

Civilsdaily

No. 1 UPSC IAS Platform for preparation

Economic Indicators and Various Reports On It- GDP, FD, EODB, WIR etc

A $5 trillion economy, but for whom.

From UPSC perspective, the following things are important :

Prelims level: Pradhan Mantri Garib Kalyan Ann Yojna.

Mains level: India's ambitious pursuit of a $5 trillion GDP by 2028

Central idea

The article critically examines India’s ambitious pursuit of a $5 trillion GDP by 2028, juxtaposing it with Japan’s economic trajectory. It highlights concerns about wealth disparity, inclusivity in high-tech sectors, and questions the impact on marginalized citizens.

Key Highlights:

- Extension of Welfare Scheme: Prime Minister Modi’s announcement to extend the Pradhan Mantri Garib Kalyan Ann Yojna by five years.

- Concerns about Hunger: Raised concerns about persistent hunger despite the ambitious target of achieving a $5 trillion GDP by 2028.

- Japan’s Economic Challenges: Comparison with Japan’s economic growth and the social challenges faced, including suicide rates and social withdrawal.

- Reliance on GDP Growth: Emphasis on India’s economic growth relying on capital, productivity, and labor.

- Wealth Disparity: Identification of significant wealth disparity, with 1% of the population owning a substantial portion of the nation’s wealth.

- Government’s Economic Tools: Government’s identification of sectors and tools, such as the digital economy, fintech, and climate change initiatives.

Key Challenges:

- Impact on Marginalized Citizens: Expressing concerns about the potential adverse impact on marginalized citizens in the race towards a $5 trillion economy.

- Wealth Inequality: Highlighting the wealth disparity issue, with 1% of the population owning a significant portion of the nation’s wealth.

- Inclusivity in High-Tech Sectors: Concerns about the ability of a large segment of the population to participate in cutting-edge sectors such as AI, data science, and fintech.

- Lack of Per Capita Income Estimates: Criticism regarding the absence of estimates on India’s per capita income at the $5 trillion GDP mark.

Key Terms and Phrases:

- Pradhan Mantri Garib Kalyan Ann Yojna: Specific welfare scheme providing free foodgrains.

- Hikikomori: Term referring to severe social withdrawal in Japan.

- Kodokushi: Japanese term for lonely deaths.

- GST (Goods and Services Tax): Mention of the significant contribution from the bottom 50% of the population.

- Inclusive Growth: Government’s emphasis on growth that includes all segments of society.

- Insolvency and Bankruptcy Code: Part of the identified tools for achieving the $5 trillion goal.

- Make in India: Mention of one of the identified sectors for economic growth.

- Start-Up India: Highlighting a sector emphasized for achieving economic targets.

- Production Linked Incentives: Part of the government’s strategy for economic growth.

Key Examples and References:

- Japan’s Societal Challenges: Referring to suicide rates, social withdrawal, and lonely deaths in Japan as examples.

- Wealth Distribution Statistics: Citing wealth distribution statistics from Oxfam.

- Minister Chaudhri’s Identification: Referring to the government’s identification of tools and sectors for achieving the $5 trillion goal.

- Per Capita Income Comparison: Comparing per capita income between Japan, China, and India.

Key Facts and Data:

- Welfare Scheme Extension: Mentioning the extension of the Pradhan Mantri Garib Kalyan Ann Yojna.

- Japan’s Economic History: Referring to Japan’s economic history and challenges post-2008.

- Wealth Distribution Data: Citing wealth distribution data from Oxfam.

- GST Contribution: Highlighting the significant contribution of different income groups to GST.

Critical Analysis:

- Societal and Economic Impact: Analyzing the potential impact of the $5 trillion goal on marginalized citizens and society.

- Wealth Disparity and Inclusive Growth: Critical evaluation of wealth distribution and the need for inclusive economic policies.

- Capability Mismatch: Examining the mismatch between targeted sectors/tools and the capabilities of a significant population segment.

- Per Capita Income Concerns: Critically assessing the absence of estimates on per capita income and concerns about the inequality index.

Way Forward:

- Addressing Wealth Disparity: Emphasizing the need to address wealth disparity through inclusive economic policies.

- Ensuring Inclusive Growth: Focusing on ensuring that economic growth benefits all segments of the population.

- Skill Development and Education: Highlighting the importance of skill development and education to enable participation in emerging sectors.

- Regular Assessment and Recalibration: Emphasizing the need for regular assessment and recalibration of economic goals to align with societal well-being.

Get an IAS/IPS ranker as your 1: 1 personal mentor for UPSC 2024

JOIN THE COMMUNITY

Join us across social media platforms., your better version awaits you.

How India Can Become a $5 trillion Economy by 2029?

Government's roadmap to making India a $5 trillion economy comprises measures like focusing on inclusive growth. Check How India can become a $5 trillion economy by 2029?

Table of Contents

How India can become a $5 trillion Economy by 2029?

With an average growth rate of 6.8 per cent for the medium term, India presents a significant economic opportunity. India has a history of accelerating its growth. Prior to the Covid-19 outbreak, the average annual GDP growth rate was 6.6% as opposed to 6.3% in the decade before. India has seen periods of growth at or around 8% annually, most notably between the fiscal years 2004 and 2008. However, these were years of “growth sprint”. India is anticipated to have the fastest-growing large economy in fiscal 2023, rising at a rate of 7% per year.

5 trillion-dollar Economy Relevance For UPSC Exam

The applicants have up to this point read a significant number of papers discussing how to grow India’s economy to a 5 trillion dollar one. For the UPSC mains, it is a crucial subject, hence candidates should thoroughly prepare for it. We will give you enough material to use as practice in this article so you can do well on the UPSC main examination GS paper 3.

Indian Economy Growth Expectations in 2023

The Indian economy is expected to grow at a 6.8 per cent annual rate during the next five years, with labour contributing 10%, capital 52%, and efficiency 38% of the increase. The need for capital will be crucial, and the odds are in favour of a sustained uptick in the private sector investment cycle. By the end of the fiscal year 2023, investment as a percentage of GDP had already risen to a decade-high 34%.

The government has been in charge of raising the investment ratio thus far. Infrastructure and manufacturing are becoming more important in the new growth paradigm. The Union Budget increased capital spending in high-multiplier infrastructure segments by roughly a third. However, due to pressures for fiscal reduction, this support for capex will start to decline in the years to come. With improved bank sheets, cash reserves, and low leverage, the private sector’s contribution to investments is expected to increase.

Is India still on track to becoming a $5 trillion Economy?

India should be quite proud of itself. When the $5 trillion goal was first proposed in 2019, it felt like a far-off fantasy. Now, it appears as though India is eager to accomplish it despite adversity like never before. The country’s economy has grown to be the fifth largest in the world, with a GPD of $3.5 trillion in 2022.

There may be some speed bumps on the next road. The International Monetary Fund (IMF) has lowered its earlier forecast of 7.4% GDP growth for India for the fiscal year 2023 to 6.8%. The World Bank and the OECD are two such major organisations that have revised their growth forecasts. The impact of the global economic slowdown, according to Japanese brokerage company Nomura, might cause India’s economy to grow by roughly 7% in FY23 but decelerate to 5.2 % in FY24.

Factors in Favour of India’s Growth

India has proven to be resilient in the face of these difficulties. There are numerous things that are in its favour.

Strong relationships and a diversified economy : Over the past 50 years, India’s economy has expanded steadily. The economy is broadly diversified, and it has productive trade ties with other nations.

Technology adoption : India has a huge thirst for embracing new technologies. The adoption rate has increased in the manufacturing and finance industries. This increased output while lowering production costs and raising production quality. These elements boosted profitability, which led to higher investments in innovation.

Offshoring opportunity : Covid-19 sparked a long-term movement towards remote teams in the workplace ethos. This benefits India because it is more affordable for corporations from developed countries to collaborate with Indian citizens.

Young population : With 356 million young people, India has the greatest youth population in the world. With a working population of 64%, India not only has a growing GDP and per capita income but also a sizable client base that businesses may successfully target.

Renewable energy : India’s installed electrical capacity already derives about 40% of its power from non-fossil fuel sources. With this conversion to renewable energy, both businesses and consumers will pay less, and the nation will be less dependent on imports.

According to many experts, India is best positioned to weather the economic headwinds predicted for the world in 2023. Despite revised growth estimates, India is still expected to have the fastest-growing economy in 2023 and will continue to confidently work towards the $5 trillion goal.

Indian Economy in 2023

In fiscal 2023, India is expected to grow at a pace of 7%, making it the major economy with the fastest rate of growth. We’ve quite effectively recovered from the pandemic. However, the economy is hampered by the looming global recession and the full manifestation of the lag impact of interest rate hikes since May 2022. CRISIL predicts that India will consequently slow down and see 6% growth in fiscal 2024. Below is a discussion of the suggested activities for the primary, secondary, and tertiary sectors of the economy.

Primary Sectors of Indian Economy

Indian economy is, predominantly, an agricultural economy. According to the Economic Survey 2020-21, 60% of the people are still engaged in the agriculture sector, but the agricultural GVA hovers around 18%. However, in these trying times of COVID, agriculture is the only silver lining showing a growth of 3.4%. Agriculture, broadly, has 3 stages—pre-production, production, and, post-production. Check here for detailed information about the Primary Sectors of the Indian Economy .

Pre-production

In the pre-production stage, the focus should be on:

Increasing the number of farmers who are members of FPOs (Farmer Producer Organisations), as 86% of our farmers fall into the small and marginal categories; Providing affordable and high-quality seeds through programmes like Kharif Strategy 2021; Providing irrigation facilities through river interlinking projects and programmes like PMKSY (Pradhan Mantri Krishi Sinchai Yojana); Providing price assurance through programmes like PM-AASHA (Pradhan Mantri Annadata Aay Sanrakshan Abhi.

During the production phase, focus should be placed on:

- Reducing the use of fertilisers by implementing programmes like the Paramparagat Krishi Vikas Yojana;

- The mechanisation of farms through programmes like SMAM (Sub-Mission on Agricultural Mechanisation);

- Crop insurance provided by programmes like the Pradhan Mantri Fasal Bima Yojana (PMFBY);

- Using precision farming and other climate-resilient agriculture techniques.

Post-production

In the post-production stage, the focus should be on:

- Implementing the Shanta Kumar Committee’s recommendation to build storage facilities;

- Improving forward and backward linkages through the use of programmes like PM-FME and SAMPADA;

- Concentrating on agricultural exports through the adoption of the Agricultural Export Policy, 2018;

In addition, through programmes like the National Livestock Mission, Mission for Integrated Development of Horticulture, and PMMSY (Pradhan Mantri Matsya Sampada Yojana), the focus should be on animal husbandry, horticulture, and pisciculture.

Secondary Sectors of Indian Economy

Since the LPG reforms , our nation’s manufacturing industry has had problems. The PMI indicator clearly shows how terrible reality is. The MSME sector, which accounts for the majority of employment in our nation, is experiencing numerous difficulties and requires an urgent update.

Steps like CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) are the right way to aid the cash-starved MSME. Additionally, measures like the Marketing Assistance Scheme must be strengthened to promote local products. The 4Ms — materials, machines, personnel, and methods — should serve as the foundation for the manufacturing sector’s revival.

- Material : India needs to develop into a global industrial powerhouse on the material front, but this would require persistent government action.

- Machine : On the machine front, the world is embracing Industry 4.0, therefore we must take action to convert our conventional factories into smart ones.

- Manpower : In today’s technologically advanced culture, having a trained workforce is now a requirement, which emphasises the significance of programmes like SANKALP and STRIVES.

- Methods : To enable the standardisation of products with lower manufacturing costs, traditional and antiquated methods need to be updated. These actions will boost our investment ratio while concurrently lowering the incremental capital-output ratio or ICOR.

Tertiary Sectors of Indian Economy

The government must also support the services sector. Prompt Corrective Action and the EASE agenda are two strategies that should be used to get the banking industry back on track. Additionally, we must work to integrate technical and vocational education and make it applicable to the workplace. In order to lower people’s out-of-pocket expenses, the National Health Policy recommends raising health spending to 2.5% of GDP.

India is also fortunate to have a vast variety of tourist attractions. Through programmes like PRASAD (Pilgrimage Rejuvenation and Spiritual Augmentation Drive) and HRIDAY (National Heritage City Development and Augmentation Yojana), we must thus reap its benefits without damaging the environment.

Additionally, infrastructure need an upgrade, which the National Infrastructure Pipeline appropriately emphasises. Start-ups urgently require protection and encouragement, and programmes like Start-up India, which exempts angel investors from paying income taxes, and the Start-up India Seed Fund Scheme will help to keep the nation’s economy strong.

Government Initiatives to Make India $5 Trillion Economy

The Government’s roadmap for making India a $5 trillion economy comprises focusing on growth at the macro level and complementing it with all-inclusive welfare at the micro level, promoting digital economy and fintech, technology-enabled development, energy transition and climate action and relying on a virtuous cycle of investment and growth. The Government’s Road Map was put into effect in 2014.

The major reforms including Goods and Services Tax (GST), Insolvency and Bankruptcy Code (IBC), a significant reduction in the corporate tax rate, the Make in India and Start-up India strategies, and Production Linked Incentive Schemes, among others, have been implemented.

The Government has also focused on a capex-led growth strategy to support economic growth and attract investment from the private sector, increasing its capital investment outlay substantially during the last three years. Central Government’s capital expenditure has increased from 2.15 per cent of GDP in 2020-21 to 2.7 per cent of GDP in 2022-23.

The Union Budget 2023-24 has taken further steps to sustain the high growth of India’s economy. These include a substantial increase in capital investment outlay for the third year in a row by 33 per cent to ₹10 lakh crore (3.3 per cent of GDP). Direct capital investment by the Centre is also complemented by Grants-in-Aid to States for the creation of capital assets. The ‘Effective Capital Expenditure’ of the Centre was accordingly budgeted at 13.7 lakh crore (4.5 per cent of GDP) for 2023-24. This strong push given by the government is also expected to crowd in private investment and propel economic growth

Vision of a USD 5 Trillion Indian Economy

By breaking down the drivers of medium-term prospects into the contributions of capital, labour, and efficiency, growth accounting offers a valuable framework for analysing such prospects. We anticipate that the Indian economy will expand at a 6.8% annual rate over the next five years, with 52% of that growth coming from capital, 38% from efficiency, and 10% from labour.

Capital will be the key and stars are aligning for a sustainable lift in the private sector investment cycle. Investment as a percentage of GDP has already touched a decadal high of 34 per cent in fiscal 2023. So far, the onus to lift the investment ratio has been shouldered by the government. The growth model is changing to an infrastructure and manufacturing-driven one.

Sharing is caring!

How India can become a $5 trillion economy by 2029? FAQs

Will india be a $5 trillion economy by 2030.

India will grow at a rate of 6.7 per cent per year from 2023-24 and become a $6.7 trillion economy by 2030-31, research and analytics firm Standard & Poor Global has said. India's Gross Domestic Product (GDP) was $3.4 trillion in 2022-23.

What will be India's economy in 2029?

Given current growth dynamics, India should become a $5 trillion economy by fiscal 2029. Down the road, the impact of climate risk mitigation will be felt across revenue, commodity prices, export markets and capital spending. At present, there is a significant sense of optimism around India.

Is India going to be a $5 trillion economy?

"Soon, India will become a USD 5 trillion economy. There is no doubt that India will be the growth engine of the world in the years to come," Modi said and added that the country converted disasters and hardships into opportunities for economic recovery.

Can India become a $5 trillion economy by 2030?

India has the potential to grow at 6.5-7 per cent and will become a USD 5 trillion economy by 2025-26 and USD 7 trillion by 2030 depending on exchange rate fluctuation, Chief Economic Advisor (CEA) V Anantha Nageswaran said on Tuesday. Indian economy is estimated to touch USD 3.5 trillion mark by March 2023.

Leave a comment

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Trending Event

- TNPSC Group 4 Result 2024

- KPSC KAS Hall Ticket 2024

- MPSC Prelims Admit Card 2024

Recent Posts

- UPSC Online Coaching

- UPSC Exam 2024

- UPSC Syllabus 2024

- UPSC Prelims Syllabus 2024

- UPSC Mains Syllabus 2024

- UPSC Exam Pattern 2024

- UPSC Age Limit 2024

- UPSC Calendar 2024

- UPSC Syllabus in Hindi

- UPSC Full Form

- UPPSC Exam 2024

- UPPSC Calendar

- UPPSC Syllabus 2024

- UPPSC Exam Pattern 2024

- UPPSC Application Form 2024

- UPPSC Eligibility Criteria 2024

- UPPSC Admit card 2024

- UPPSC Salary And Posts

- UPPSC Cut Off

- UPPSC Previous Year Paper

BPSC Exam 2024

- BPSC 70th Notification

- BPSC 69th Exam Analysis

- BPSC Admit Card

- BPSC Syllabus

- BPSC Exam Pattern

- BPSC Cut Off

- BPSC Question Papers

SSC CGL 2024

- SSC CGL Exam 2024

- SSC CGL Syllabus 2024

- SSC CGL Cut off

- SSC CGL Apply Online

- SSC CGL Salary

- SSC CGL Previous Year Question Paper

- SSC MTS 2024

- SSC MTS Apply Online 2024

- SSC MTS Syllabus 2024

- SSC MTS Salary 2024

- SSC MTS Eligibility Criteria 2024

- SSC MTS Previous Year Paper

SSC Stenographer 2024

- SSC Stenographer Notification 2024

- SSC Stenographer Apply Online 2024

- SSC Stenographer Syllabus 2024

- SSC Stenographer Salary 2024

- SSC Stenographer Eligibility Criteria 2024

SSC GD Constable 2025

- SSC GD Salary 2025

- SSC GD Constable Syllabus 2025

- SSC GD Eligibility Criteria 2025

IMPORTANT EXAMS

- Terms & Conditions

- Return & Refund Policy

- Privacy Policy

Employment Type

Most active stocks, bharat electronics, oil & natural gas corporation, bharat petroleum corporation, market snapshot.

- Top Gainers

- 52 Week High

Himadri Speciality Chemical

Fsn e-commerce ventures, elgi equipments, doms industries, trending in market.

- Orient Technologies IPO

- Chandan Taparia recommendations

- NSE new circular

Recommended For You

Gold prices, popular in opinion, the unravelling of a financial titan: ravi parthasarathy and the il&fs scandal, mint quick edit | sovereign gold bonds on the way out savers would be dismayed., wait for it….

Log in to our website to save your bookmarks. It'll just take a moment.

- Entertainment

- Life & Style

To enjoy additional benefits

CONNECT WITH US

India’s journey to the $5 trillion club

This is how pm narendra modi’s government is working to catapult india in the world economy.

Published - January 06, 2021 05:19 pm IST

Working women travelling in an overcrowded Ladies Special local train in Mumbai. Photo. Paul Noronha

Prime Minister Narendra Modi has set a massive target to make India a $5 trillion economy by 2024. While our economy is currently $2.92 trillion, holding sixth place in the world, India needs to produce 9% of GDP growth every year to realise the goal. The precise goals of the Government are to raise the service sector's contribution to $3 trillion, the manufacturing unit’s to $1 trillion, and the agriculture unit’s to $1 trillion as well. The focus is on uplifting the financial condition of the population under the poverty line and as the third-largest economy in the world.

Madhukar Kotawe

Although the COVID-19 pandemic has resulted in a massive crisis and caused a huge economic crisis, there were a few significant measures and projects announced to shape and execute the Government’s vision.

An economic survey was undertaken and a 'Team India' formed to make India a $5 trillion economy. The Government has also taken steps to help NBFCs and HFCs with credit guarantee systems by sanctioning support of ₹5 lakh crore to these firms. It has also approved various proposals worth ₹7,000 crores and more.

On the real estate side, the system has taken steps to support real estate firms, corporate tax, and capitalisation of banks. It has cleared dues worth lakhs of crores to enhance market liquidity. The RBI has sanctioned more than ₹70,000 crore worth of loans under the new regime. The Government is encouraging schemes to boost private investments in the country. The MSMEs marked ₹80,000 crores worth of investments. FDI is missioned to improve exports and boost exchange returns.

Women driving growth

India cannot witness wholesome growth if it leaves half of its valued population behind. It is reported that only 26% of the women population is working, and the others are either underpaid or unemployed, thereby becoming victims of gender disparity. While the world’s average working population is approximately over 50%, this huge difference will drive us backwards in terms of development. Therefore, implementation of policies that benefit men and women in the workplace can help put both women and the country’s economy on the path to success.

The stereotypical notion that married women and mothers can never strike a work-life balance and are made to compromise in case of family emergencies usually puts women on a backfoot. Unless they are given opportunities to participate, sustainable growth will be a myth for half of the country’s population. Women need to be given the power to influence and uphold the economic potential so as to drive significant changes.

When women are allowed to stay active in the workplace, they will eventually earn more money, invest better, and create a measurable impact on the economy. Because every single person’s contribution matters, every woman’s worth matters too. It is after all in our hands to grow collectively, to empower or to hold the power.

This weekly column for civil services aspirants is brought to you by Unacademy. Send your subject specific queries to [email protected]

Click to enroll for the free live on ‘$5 Trillion Economy and Women Empowerment’ on Jan 5 at 7 PM .

Use code UPSCCSE

The opinions, beliefs, and viewpoints expressed by the author are his/her own and do not necessarily reflect the opinions, beliefs, viewpoints, or official policies of Unacademy or The Hindu.

Top News Today

- Access 10 free stories every month

- Save stories to read later

- Access to comment on every story

- Sign-up/manage your newsletter subscriptions with a single click

- Get notified by email for early access to discounts & offers on our products

Terms & conditions | Institutional Subscriber

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of The Hindu and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.

- Insights IAS Brochure |

- OUR CENTERS Bangalore Delhi Lucknow Mysuru --> Srinagar Dharwad Hyderabad

Call us @ 08069405205

Search Here

- An Introduction to the CSE Exam

- Personality Test

- Annual Calendar by UPSC-2025

- Common Myths about the Exam

- About Insights IAS

- Our Mission, Vision & Values

- Director's Desk

- Meet Our Team

- Our Branches

- Careers at Insights IAS

- Daily Current Affairs+PIB Summary

- Insights into Editorials

- Insta Revision Modules for Prelims

- Current Affairs Quiz

- Static Quiz

- Current Affairs RTM

- Insta-DART(CSAT)

- Insta 75 Days Revision Tests for Prelims 2024

- Secure (Mains Answer writing)

- Secure Synopsis

- Ethics Case Studies

- Insta Ethics

- Weekly Essay Challenge

- Insta Revision Modules-Mains

- Insta 75 Days Revision Tests for Mains

- Secure (Archive)

- Anthropology

- Law Optional

- Kannada Literature

- Public Administration

- English Literature

- Medical Science

- Mathematics

- Commerce & Accountancy

- Monthly Magazine: CURRENT AFFAIRS 30

- Content for Mains Enrichment (CME)

- InstaMaps: Important Places in News

- Weekly CA Magazine

- The PRIME Magazine

- Insta Revision Modules-Prelims

- Insta-DART(CSAT) Quiz

- Insta 75 days Revision Tests for Prelims 2022

- Insights SECURE(Mains Answer Writing)

- Interview Transcripts

- Previous Years' Question Papers-Prelims

- Answer Keys for Prelims PYQs

- Solve Prelims PYQs

- Previous Years' Question Papers-Mains

- UPSC CSE Syllabus

- Toppers from Insights IAS

- Testimonials

- Felicitation

- UPSC Results

- Indian Heritage & Culture

- Ancient Indian History

- Medieval Indian History

- Modern Indian History

- World History

- World Geography

- Indian Geography

- Indian Society

- Social Justice

- International Relations

- Agriculture

- Environment & Ecology

- Disaster Management

- Science & Technology

- Security Issues

- Ethics, Integrity and Aptitude

- Insights IAS Brochure

- Indian Heritage & Culture

- Enivornment & Ecology

EDITORIAL ANALYSIS : A $5 trillion economy, but for whom?

Source: The Hindu

- Prelims: Indian Economy(GDP, BOP, GVA, Economic reforms, Pradhan Mantri Garib Kalyan Anna Yojana(PMGKY) , etc

- Mains GS Paper III: Indian economy and issues related to planning, mobilization of resources, Effect of liberalization on the economy etc

ARTICLE HIGHLIGHTS

- Scheme providing 5 kg of foodgrains free every month to beneficiaries of the National Food Security Act.

INSIGHTS ON THE ISSUE

Pradhan Mantri Garib Kalyan Anna Yojana(PMGKY):

- PMGKAY was part of the Centre’s initial COVID-19 relief

- Its nodal Ministry is the Ministry of Finance.

- It provides for 5 kg of rice or wheat per person per month to be distributed free of cost

- This is over and above the 5 kg already provided to ration card holders at a subsidized rate

- e. 35 kg per month per family for AAY(Antyodaya Anna Yojana) and 5 kg per month per person for Priority Households(PHH).

- The 80 crore cap on NFSA beneficiaries and state ration card quotas are based on 2011 census data.

- Initially : One kg of pulses was also provided under the scheme, which was later restricted to chana dal only , and then discontinued in later phases.

Japan’s growth background:

- Japan is the third largest economy by GDP in the world.

- For 40 years, Japan was the world’s second largest economy , powered by manufacturing and exports.

- China enjoyed a manufacturing boom and dislodged Japan to become the world’s second-largest economy by GDP.

- China is Japan’s largest trading

- Japan has held on to the third position in world GDP rankings for the last 14 years.

India’s case(2021):

- 50% owned 3% of its wealth, according to Oxfam .

- approx 64% of the total Goods and Services Tax (GST) came from the bottom 50% of the population

- The top 10% contributed 3% of GST.

- The contribution of labour is nullified due to dubious educational and skill attainments and halting digital literacy.

International Monetary Fund (IMF) projections:

- India is currently the fifth largest economy in the world in U.S. dollar terms

- It projects that India will be the third-largest economy by 2027.

- India has registered the highest growth rate amongst G20 countries, surpassing China’s for two successive years.

- It took India just seven years to become a $2 trillion economy in 2014.

- It added another $1.2(one point two)trillion by 2021.

- If India hits the IMF’s projected figure of $5.2(five point two)trillion by 2027: It would be adding $2 trillion in just six years.

GDP and per capita GDP in purchasing power parity (PPP)

- It determines what a US dollar can buy in that country.

- China is at the top ($ 33 trillion , PPP)

- The US is second ($ 9(twenty six point nine)trillion) .

- The price levels of goods and services could differ significantly.

- Example : If a US dollar can buy a burger in its home country, the currency can buy 3.5 burgers in India and 1.7 burgers in China.

- India’s per capita income is the lowest in G20 countries i n both dollar ($2,601) and PPP terms ($9,073)

- The US is at the top with a per capita GDP of $80,035.

Way Forward

- This will bolster upscale India’s influence and power abroad.

- They are prefaced by the mandatory mantra “inclusive growth”.

- They cannot seize the opportunities on offer in Artificial Intelligence or data science or robotics or fintech — either now or in the next five years.

- A high value indicates a more egalitarian society.

- The values of both China and Japan are more than 50.

- Average Japanese at $34,000 i s considered better off than the average Chinese at $13,000

- Even though China has outstripped Japan in world GDP rankings.

QUESTION FOR PRACTICE

Do you agree that the Indian economy has recently experienced recovery ? Give reasons in support of your answer.(UPSC 2021) (200 WORDS, 10 MARKS)

- Our Mission, Vision & Values

- Director’s Desk

- Commerce & Accountancy

- Previous Years’ Question Papers-Prelims

- Previous Years’ Question Papers-Mains

- Environment & Ecology

- Science & Technology

Please rotate your device

We don't support landscape mode yet. Please go back to portrait mode for the best experience

India @ 2030: India's journey to become $5 trillion economy will depend on the pace of reforms

- Byline: Surabhi

- Producer: Arnav Das Sharma

As India strives to become a $5-trillion economy by 2030, more inclusive reforms will be necessary for faster growth. The next five years are exciting for the economy—providing both fresh possibilities and new challenges

Five years is not a very long time. But neither is it too short. It’s roughly the same time span in which a teenage child transforms into an adult or certain trees take to mature and bear fruit. For democracies too, five years means new governments, new policies and economic cycles.

The same holds true for India. As the fastest-growing major economy in the world—with an estimated growth rate of more than 7% over two straight years—it has ambitions of turning into a $5-trillion economy over the next few years. But it has to address a number of challenges—from sustaining economic growth through more policy reforms, creation of adequate physical infrastructure, boosting private sector investments, meeting the health and nutritional needs of a growing population, finding adequate jobs for its workforce, and mitigating the risks of climate change.

Meanwhile, the global geopolitical landscape is in for a reset with national elections in as many as 50 countries this year. According to US-based think tank Integrity Institute, in 2024, as many as 83 elections (national or otherwise) are being held across 78 countries; this means these polls would impact the lives of nearly half the world’s population who collectively reside there. “We won’t see that many again until 2048. What also makes 2024 special is not just the number of countries but the fact that for the first time, you will have a US presidential election in the same year as elections in major countries such as India, Indonesia, Ukraine, Taiwan, Mexico, the UK, and the European Parliament,” it noted. (See graphic ‘Poll Fever’.)

What India will be in 2029 will in a large part be shaped by the next government that comes to power after the General Elections this year; the new government will lay down the key priorities for the next five years as well as the policy prescriptions that are required.

A bright spot

The India story continues to be a bright spot for the international community, which is yet to fully recover from the impact of the pandemic, as well as the two ongoing wars and the Red Sea conflict. (See graphic ‘Shining Bright’.)

According to Christian de Guzman, Senior Vice President at Moody’s Investors Service, the agency expects India to be one of the fastest-growing—if not the fastest—G20 economies over the next five years, largely based on its ability to weather the lacklustre near-term outlook for global growth due to its large consumption-based economy, boosted by the government’s efforts to improve productivity via reforms and infrastructure development. “Over the longer-term, India also stands to benefit from favourable demographics in contrast to the ageing populations in other large economies, including China. At the same time, this relatively favourable view assumes that India will sustain broad financial stability and gradual fiscal consolidation—areas that have previously weighed on the country’s potential growth and sovereign credit profile,” he says.

In a recent report, brokerage Morgan Stanley also highlighted India’s strong fundamentals. It said that the country’s nominal GDP growth will accelerate to 11.6% this year, making it the third consecutive year that India’s nominal GDP growth will be the strongest in Asia. India’s contribution to Asian and global growth will rise to 30% and 17%, respectively, up from 28% and 16% in 2023. “Over the medium term, our Chief India Economist Upasana Chachra forecasts that real GDP growth will average 6.3% until FY32,” it noted. The brokerage expects the investment to GDP ratio to rise to 33.5% by FY25, and to 36% by FY27.

Challenges ahead

However, it’s not all smooth sailing. Despite continuous efforts by successive governments, challenges remain. More reforms are needed to further improve the ease of doing business by ensuring faster regulatory clearances, say experts. The notification of the long-pending four Labour Codes, further land reforms, a national e-commerce policy as well as regulation of the digital economy are some of the pending items on the policy reform table.

Arun Singh, Global Chief Economist at research firm Dun & Bradstreet, points out that India is well on its way to becoming a $5-trillion economy. “We should now target becoming a $10-trillion economy. For this, a lot more capital and reforms are needed to bring in global investors,” he says. India still needs to improve its physical infrastructure and raise the foreign investment ceiling in various sectors as well as privatise the non-performing, non-strategic central public sector undertakings, he says.

Arun Singh Global Chief Economist Dun and Bradstreet

“Land and labour reforms also have to be taken forward. The government needs to review the administrative machinery to ensure faster clearances. The Insolvency and Bankruptcy Code needs to be reviewed for quicker resolutions. We need to create more formal sector jobs and improve the LFPR (labour force participation rate), especially with regard to the female workforce. More MSMEs have to be brought into the formal economy,” says Singh, adding that some of these reforms are structural in nature and could take longer than five years.

According to de Guzman of Moody’s, challenges to the economy include its significant exposure to environmental and social risks. In particular, the relatively large share of the labour force involved in agriculture renders the broader economy susceptible to climate shocks, such as irregular monsoons, flooding, as well as heat and water stress, he says. Low and unevenly distributed incomes, as well as unequal access to high-quality education and other basic services, could also impair progress towards sustaining high growth over the medium- to long term, if not addressed.

“Moreover, India’s investment climate and regulatory quality-while having shown significant improvement over the past decade-remain weak when compared to many of its emerging market peers, although gains in addressing other shortcomings such as poor infrastructure have contributed to the resilience of growth in recent years,” says de Guzman.

India is hoping to significantly raise the share of manufacturing in GDP in the coming years from about 17% at present to 25% in the coming years. Efforts are already underway and some headway seems to have been made through measures such as production-linked incentive (PLI) scheme for 14 sectors. The scheme is yet to fully take off with just Rs 4,415 crore of incentives disbursed and Rs 1.03 lakh crore of investments. Physical infrastructure-in terms of both capacity addition and modernisation as well as new projects-is also a key focus area with a budgeted capex of Rs 10 lakh crore this fiscal.

As many as 248.2 million people have moved out of multidimensional poverty in the nine years to 2022-23, according to a recent NITI Aayog report. However, ensuring adequate social infrastructure-healthcare and education-will remain a key priority for the government as well as further bridging the financial inclusion divide by providing not only banking services, but also adequate credit investment and insurance options to the bottom of the pyramid. Sustainability and green energy are two other areas the government will have to focus on to ensure that India remains ahead in emerging technologies such as green hydrogen. Plus, there are also challenges from emerging digital technologies in the field of AI and machine learning.

The following pages delve into some of these themes to identify and chart out an agenda and aspiration of what India at 2029 should and can be. One thing is for sure: it will be one interesting journey.

UI Developer : Pankaj Negi Creative Producer : Raj Verma Videos : Mohsin Shaikh

The Economic Times daily newspaper is available online now.

India becoming $5 trillion economy by 2025 'impossible' due to pandemic: rangarajan.

Delivering his address at 11th Convocation of ICFAI Foundation for Higher Education, Rangarajan said attempts should be made to curb the adverse impact of a third wave of COVID-19, if it happens and both the coverage of vaccination and the pace of investment in health infrastructure should be accelerated within the strategy of expanding the overall infrastructure investment.

Read More News on

(Catch all the Business News , Breaking News , Budget 2024 Events and Latest News Updates on The Economic Times .)

Subscribe to The Economic Times Prime and read the ET ePaper online.

Zepto to Blinkit, the quick commerce race in India is taking many interesting turns

Key challenges that will welcome CS Setty as he takes the corner office at SBI

Infy tossed it out as a wrong ANSR. It’s now helping Accenture make the right move.

EV Wars: Hero, Bajaj, TVS Rev Up, But Hero's Staggering INR 1.71L Loss Per Vehicle Raises Eyebrows

“Nava Raipur will emerge as IT hub; Maoist influence is waning”: Chhattisgarh CM

Did Google fall behind in the AI race because of WFH? Patent filings tell a different story.

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Stories you might be interested in

- India Today

- Business Today

- Harper's Bazaar

- Brides Today

- Cosmopolitan

- India Today Hindi

- Reader’s Digest

- Aaj Tak Campus

Download App

India could become $55 trillion economy by 2047: Krishnamurthy Subramanian

He highlighted that sustaining an 8% annual real growth rate, coupled with a 5% inflation rate, is key to this long-term growth.

Listen to Story

- India could grow to $55 trillion economy by 2047, said Krishnamurthy Subramanian

- Formalisation, productivity, innovation are crucial for growth, noted the former CEA

- He added that expanding private credit is crucial to achieving this economic target

India could potentially grow into a $55 trillion economy by 2047, said Krishnamurthy Subramanian, executive director at the International Monetary Fund.

Speaking at the BT India@100 event in Delhi, Subramanian shared his vision for the nation's economic future, drawing parallels to the rapid growth of Japan and China.

Subramanian, who served as the 17th Chief Economic Advisor, believes India can achieve a 15-fold increase from its current $3.3 trillion economy, despite setting more modest expectations than Japan and China, which saw their economies expand 22 to 25 times in similar periods of transformation.

Since 2016, India's inflation rate has steadily decreased from 7.5% to 5%, making this target feasible, provided the rate remains within the Reserve Bank of India's inflation-targeting regime of 2% to 6%, he added.

A lower inflation rate could also reduce the rate of currency depreciation, which has historically been around 3% to 3.5% annually, he said.

Subramanian anticipates this rate will decline to 1%, in line with stable inflation, further strengthening the rupee's value.

This economic framework would support 12% nominal growth per year (8% real growth plus 5% inflation, minus 1% for currency depreciation), allowing India's GDP to double every six years and reach $55 trillion by 2047, he said.

Subramanian stressed that achieving this ambitious goal requires more than just maintaining growth and inflation targets.

The ongoing formalisation of India's economy, coupled with investments in productivity and innovation, will be critical drivers of this growth. He pointed out that India's formal sector is far more productive than the informal one, and digital infrastructure development is playing a pivotal role in this transformation.

Improving productivity within Indian firms, which currently lag behind global competitors, is another essential factor. Innovation and entrepreneurship, which have been accelerating in recent years, can help close this gap.

Advertisement

Supported by

What We Know About Kamala Harris’s $5 Trillion Tax Plan So Far

The vice president supports the tax increases proposed by the Biden White House, according to her campaign.

- Share full article

By Andrew Duehren

Reporting from Washington

In a campaign otherwise light on policy specifics, Vice President Kamala Harris this week quietly rolled out her most detailed, far-ranging proposal yet: nearly $5 trillion in tax increases over a decade.

That’s how much more revenue the federal government would raise if it adopted a number of tax increases that President Biden proposed in the spring . Ms. Harris’s campaign said this week that she supported those tax hikes, which were thoroughly laid out in the most recent federal budget plan prepared by the Biden administration.

No one making less than $400,000 a year would see their taxes go up under the plan. Instead, Ms. Harris is seeking to significantly raise taxes on the wealthiest Americans and large corporations. Congress has previously rejected many of these tax ideas, even when Democrats controlled both chambers.

While tax policy is right now a subplot in a turbulent presidential campaign, it will be a primary policy issue in Washington next year. The next president will have to work with Congress to address the tax cuts Donald J. Trump signed into law in 2017. Many of those tax cuts expire after 2025, meaning millions of Americans will see their taxes go up if lawmakers don’t reach a deal next year.

Here’s an overview of what we now know — and still don’t know — about the Democratic nominee’s views on taxes.

Higher taxes on corporations

The most recent White House budget includes several proposals that would raise taxes on large corporations . Chief among them is raising the corporate tax rate to 28 percent from 21 percent, a step that the Treasury Department estimated could bring in $1.3 trillion in revenue over the next 10 years.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in .

Want all of The Times? Subscribe .

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

India’s economic growth and inequality- A $5 trillion economy, but for whom?

ForumIAS announcing GS Foundation Program for UPSC CSE 2025-26 from 10th August. Click Here for more information.

Source : The post on India’s economic growth and inequality has been created based on the article “A $5 trillion economy, but for whom?” published in “The Hindu” on 24th November 2023.

UPSC Syllabus Topic: GS Paper3- Indian Economy- Issues relating to planning, growth, development and employment; Inclusive growth and issues arising from it.

News : The article discusses India’s economic growth and inequality. It compares India’s situation to Japan’s economic history, highlighting issues like wealth distribution and social challenges. It questions if India’s growth will benefit all citizens or just a few.

What is India’s current economic plan?

Aim for a $5 Trillion Economy: India’s goal is to become the world’s third-largest economy by 2028 with a GDP target of $5 trillion.

Emphasis on Advanced Sectors: The Indian government has identified key sectors for growth, including the digital economy, fintech, energy transition, and addressing climate change.

Reforms and Incentives: The government has implemented reforms like GST, the Insolvency and Bankruptcy Code, and reduced corporate taxes. It also promotes initiatives like Make in India, Start-Up India, and Production Linked Incentives.

Focus on Inclusive Growth: The government’s plan is anchored around the concept of “inclusive growth,” ensuring the economic development benefits a wide range of citizens.

What are India’s economic challenges?

Significant Wealth Inequality: In India, the richest 1% own about 41% of the country’s wealth, while the poorest 50% have only a 3% share.

High Tax Burden on Poor Population: Around 64% of the total Goods and Services Tax (GST) is paid by the bottom half of the population, while the top 10% contribute only 3%.

Limited Benefits from Economic Growth: Despite India’s push for a $5 trillion economy, most benefits seem skewed towards the affluent. This is reflected in India’s low inequality index score of 21.9, indicating a large disparity in wealth distribution and economic gains.

Challenges in Capital, Productivity, and Labor: India’s economic growth faces hurdles due to uneven capital distribution, questionable educational and skill levels, and nascent digital literacy.

Gap in Per Capita Income: India’s per capita income, a key indicator of well-being, is low. In 2022, India ranked 149th among 194 countries, with a per capita income of $2,400, far below that of countries like Japan ($34,000) and China ($13,000).

Continued Need for Food Security: The extension of the Pradhan Mantri Garib Kalyan Ann Yojna until 2028 underscores the persistent challenge of food security in India.

What can India learn from Japan’s experience?

Importance of Economic Diplomacy: When Japan dropped to the world’s third largest economy, it adopted ego-free economic diplomacy. By embracing China as a key trading partner, Japan demonstrated the benefits of positive international relations for economic progression.

Balancing Industrial Growth with Social Stability: Japan’s transition to a high-value industrial economy played a role in the emergence of hikikomori phenomenon , where individuals isolate themselves from society. This phenomenon is characterized by people staying indoors for long periods, often in their homes. This situation underscores the importance of adopting a balanced approach to industrialization, one that takes into account its effects on personal and social relationships.

Inclusive Economic Strategies: Japan’s experience emphasizes the importance of growth strategies that include all societal segments. Despite facing social issues and rank demotion, Japan’s high per capita income, at $34,000, compared to China suggests a relatively broad distribution of economic benefits. This highlights the need for policies that ensure economic gains reach beyond just the wealthy or technologically advanced sectors.

Question for practice:

Examine India’s economic goals and challenges in light of Japan’s economic history and its approach to wealth distribution and social stability.

Type your email…

Search Articles

Prelims 2024 current affairs.

- Art and Culture

- Indian Economy

- Science and Technology

- Environment & Ecology

- International Relations

- Polity & Nation

- Important Bills and Acts

- International Organizations

- Index, Reports and Summits

- Government Schemes and Programs

- Miscellaneous

- Species in news

All India Open Test(Simulator X)

- Work & Careers

- Life & Arts

Democrats on defensive after Kamala Harris’s economic plans poorly received

To read this article for free, register now.

Once registered, you can: • Read free articles • Get our Editor's Digest and other newsletters • Follow topics and set up personalised events • Access Alphaville: our popular markets and finance blog

Explore more offers.

Then $75 per month. Complete digital access to quality FT journalism. Cancel anytime during your trial.

FT Digital Edition

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- Global news & analysis

- Expert opinion

Standard Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- FT App on Android & iOS

- FT Edit app

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

Try AI-powered search

- What to make of America’s topsy-turvy economy

Don’t panic just yet

Your browser does not support the <audio> element.

D on’t blame American investors for feeling seasick. The past few weeks have brought a swirl of contradictory economic news: stock prices sank and then rebounded; jobs figures were weaker than predicted but retail sales were much stronger. Chatter about an immediate emergency interest-rate cut by the Federal Reserve built up and then died down. After the exuberance of the first half of 2024, economy-watchers are anxiously poring over each new data release. The utterances of Jerome Powell, the Fed’s chairman, at the Jackson Hole gathering of central bankers on August 23rd, after we published this, will be examined even more closely than usual.

What is going on? Economic data can often be volatile around turning-points, and several oddities are obscuring the picture. Take a step back, though, and America’s economy seems poised for a gradual slowdown, not a crash.

The most marked area of weakness so far has been the labour market. Unemployment jumped to 4.3% in July, a big enough leap to invoke the Sahm Rule, an indicator based on the rise in joblessness that has identified every American recession since 1960 (but which has a patchier record in other countries). Another rule, which uses both unemployment and job-vacancy figures, implies that a recession might have begun as early as March. Markets nervously await the next jobs release on September 6th.

Dig into the data, though, and it looks as if this weakness may be overstated. Much of the rise in unemployment in the latest figures came from temporary lay-offs, which tend to be volatile. America’s recent surge in immigration might also be influencing the data; new migrants are often not in work until a little after their initial arrival. Some of the rise in unemployment, therefore, may be short-term.