Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

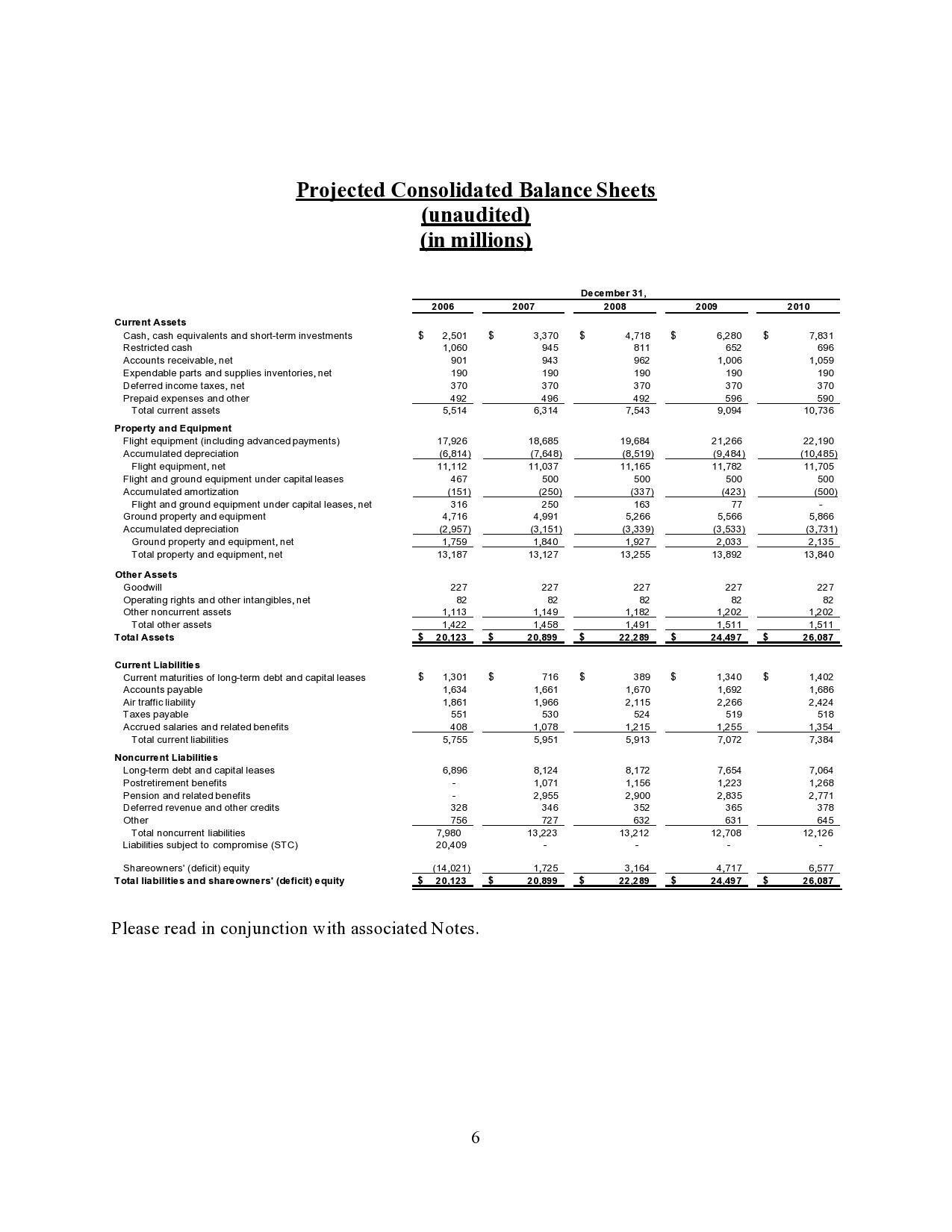

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

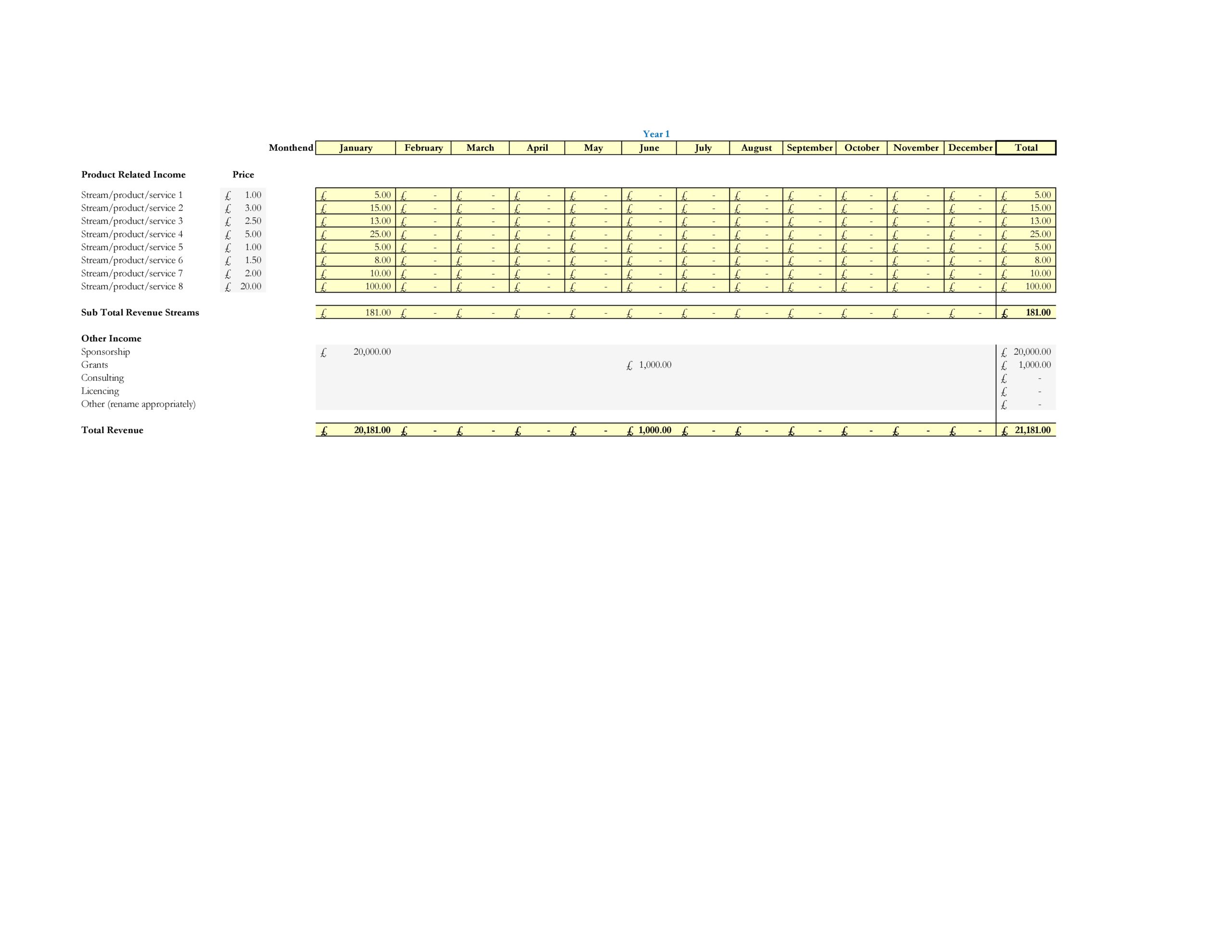

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

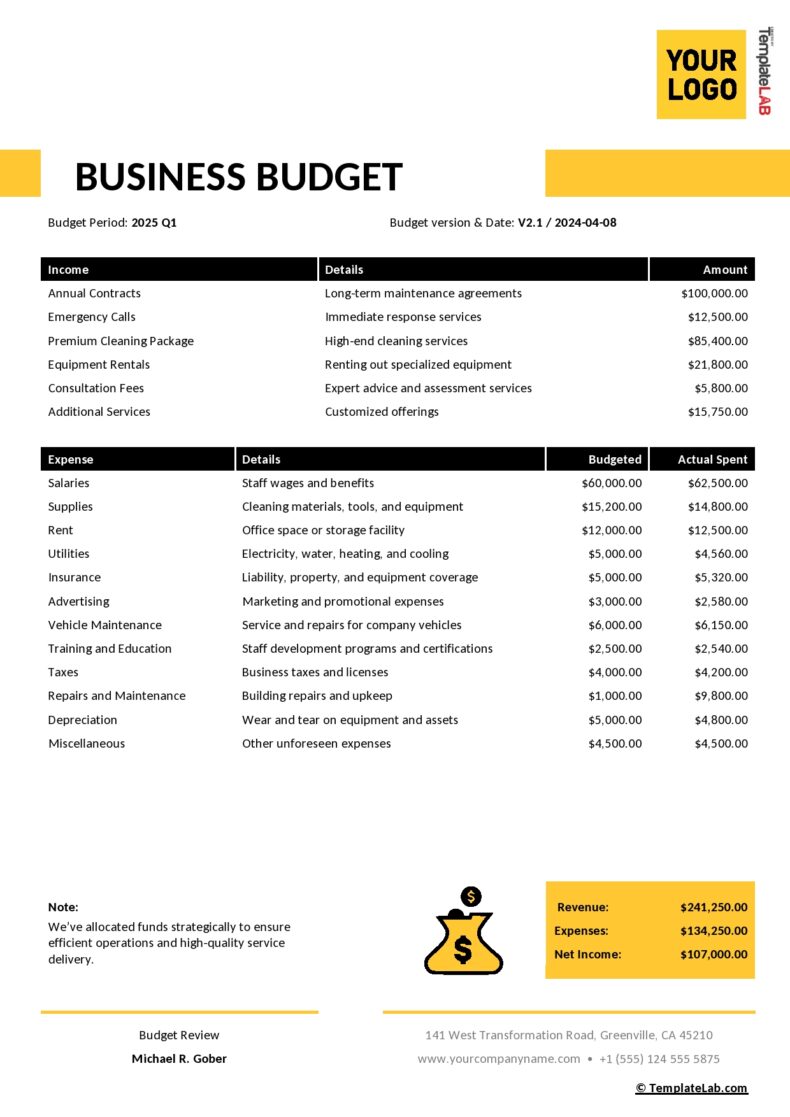

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

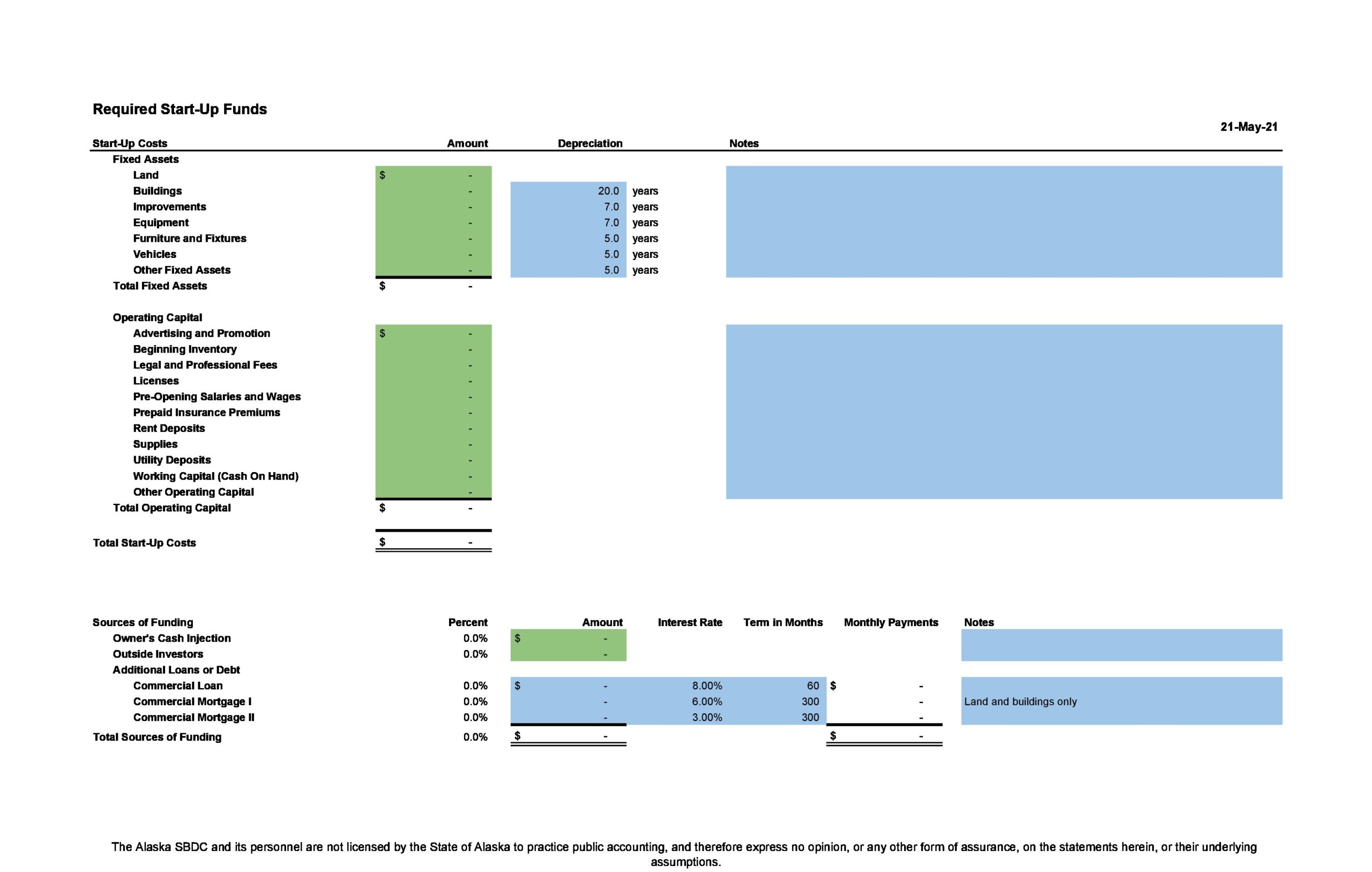

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

How To Create Financial Projections for Your Business Plan

Building a financial projection as you write out your business plan can help you forecast how much money your business will bring in.

Planning for the future, whether it’s with growth in mind or just staying the course, is central to being a business owner. Part of this planning effort is making financial projections of sales, expenses, and—if all goes well—profits.

Even if your business is a startup that has yet to open its doors, you can still make projections. Here’s how to prepare your business plan financial projections, so your company will thrive.

What are business plan financial projections?

Business plan financial projections are a company’s estimates, or forecasts, of its financial performance at some point in the future. For existing businesses, draw on historical data to detail how your company expects metrics like revenue, expenses, profit, and cash flow to change over time.

Companies can create financial projections for any span of time, but typically they’re for between one and five years. Many companies revisit and amend these projections at least annually.

Creating financial projections is an important part of building a business plan . That’s because realistic estimates help company leaders set business goals, execute financial decisions, manage cash flow , identify areas for operational improvement, seek funding from investors, and more.

What are financial projections used for?

Financial forecasting serves as a useful tool for key stakeholders, both within and outside of the business. They often are used for:

Business planning

Accurate financial projections can help a company establish growth targets and other goals . They’re also used to determine whether ideas like a new product line are financially feasible. Future financial estimates are helpful tools for business contingency planning, which involves considering the monetary impact of adverse events and worst-case scenarios. They also provide a benchmark: If revenue is falling short of projections, for example, the company may need changes to keep business operations on track.

Projections may reveal potential problems—say, unexpected operating expenses that exceed cash inflows. A negative cash flow projection may suggest the business needs to secure funding through outside investments or bank loans, increase sales, improve margins, or cut costs.

When potential investors consider putting their money into a venture, they want a return on that investment. Business projections are a key tool they will use to make that decision. The projections can figure in establishing the valuation of your business, equity stakes, plans for an exit, and more. Investors may also use your projections to ensure that the business is meeting goals and benchmarks.

Loans or lines of credit

Lenders rely on financial projections to determine whether to extend a business loan to your company. They’ll want to see historical financial data like cash flow statements, your balance sheet , and other financial statements—but they’ll also look very closely at your multi-year financial projections. Good candidates can receive higher loan amounts with lower interest rates or more flexible payment plans.

Lenders may also use the estimated value of company assets to determine the collateral to secure the loan. Like investors, lenders typically refer to your projections over time to monitor progress and financial health.

What information is included in financial projections for a business?

Before sitting down to create projections, you’ll need to collect some data. Owners of an existing business can leverage three financial statements they likely already have: a balance sheet, an annual income statement , and a cash flow statement .

A new business, however, won’t have this historical data. So market research is crucial: Review competitors’ pricing strategies, scour research reports and market analysis , and scrutinize any other publicly available data that can help inform your projections. Beginning with conservative estimates and simple calculations can help you get started, and you can always add to the projections over time.

One business’s financial projections may be more detailed than another’s, but the forecasts typically rely on and include the following:

True to its name, a cash flow statement shows the money coming into and going out of the business over time: cash outflows and inflows. Cash flows fall into three main categories:

Income statement

Projected income statements, also known as projected profit and loss statements (P&Ls), forecast the company’s revenue and expenses for a given period.

Generally, this is a table with several line items for each category. Sales projections can include the sales forecast for each individual product or service (many companies break this down by month). Expenses are a similar setup: List your expected costs by category, including recurring expenses such as salaries and rent, as well as variable expenses for raw materials and transportation.

This exercise will also provide you with a net income projection, which is the difference between your revenue and expenses, including any taxes or interest payments. That number is a forecast of your profit or loss, hence why this document is often called a P&L.

Balance sheet

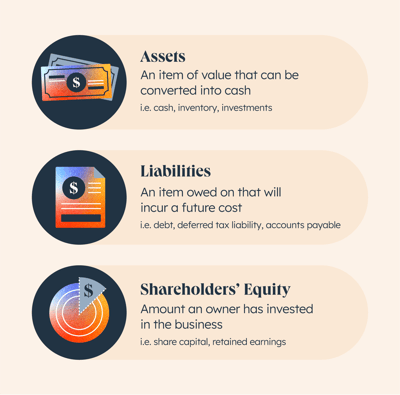

A balance sheet shows a snapshot of your company’s financial position at a specific point in time. Three important elements are included as balance sheet items:

- Assets. Assets are any tangible item of value that the company currently has on hand or will in the future, like cash, inventory, equipment, and accounts receivable. Intangible assets include copyrights, trademarks, patents and other intellectual property .

- Liabilities. Liabilities are anything that the company owes, including taxes, wages, accounts payable, dividends, and unearned revenue, such as customer payments for goods you haven’t yet delivered.

- Shareholder equity. The shareholder equity figure is derived by subtracting total liabilities from total assets. It reflects how much money, or capital, the company would have left over if the business paid all its liabilities at once or liquidated (this figure can be a negative number if liabilities exceed assets). Equity in business is the amount of capital that the owners and any other shareholders have tied up in the company.

They’re called balance sheets because assets always equal liabilities plus shareholder equity.

5 steps for creating financial projections for your business

- Identify the purpose and timeframe for your projections

- Collect relevant historical financial data and market analysis

- Forecast expenses

- Forecast sales

- Build financial projections

The following five steps can help you break down the process of developing financial projections for your company:

1. Identify the purpose and timeframe for your projections

The details of your projections may vary depending on their purpose. Are they for internal planning, pitching investors, or monitoring performance over time? Setting the time frame—monthly, quarterly, annually, or multi-year—will also inform the rest of the steps.

2. Collect relevant historical financial data and market analysis

If available, gather historical financial statements, including balance sheets, cash flow statements, and annual income statements. New companies without this historical data may have to rely on market research, analyst reports, and industry benchmarks—all things that established companies also should use to support their assumptions.

3. Forecast expenses

Identify future spending based on direct costs of producing your goods and services ( cost of goods sold, or COGS) as well as operating expenses, including any recurring and one-time costs. Factor in expected changes in expenses, because this can evolve based on business growth, time in the market, and the launch of new products.

4. Forecast sales

Project sales for each revenue stream, broken down by month. These projections may be based on historical data or market research, and they should account for anticipated or likely changes in market demand and pricing.

5. Build financial projections

Now that you have projected expenses and revenue, you can plug that information into Shopify’s cash flow calculator and cash flow statement template . This information can also be used to forecast your income statement. In turn, these steps inform your calculations on the balance sheet, on which you’ll also account for any assets and liabilities .

Business plan financial projections FAQ

What are the main components of a financial projection in a business plan.

Generally speaking, most financial forecasts include projections for income, balance sheet, and cash flow.

What’s the difference between financial projection and financial forecast?

These two terms are often used interchangeably. Depending on the context, a financial forecast may refer to a more formal and detailed document—one that might include analysis and context for several financial metrics in a more complex financial model.

Do I need accounting or planning software for financial projections?

Not necessarily. Depending on factors like the age and size of your business, you may be able to prepare financial projections using a simple spreadsheet program. Large complicated businesses, however, usually use accounting software and other types of advanced data-management systems.

What are some limitations of financial projections?

Projections are by nature based on human assumptions and, of course, humans can’t truly predict the future—even with the aid of computers and software programs. Financial projections are, at best, estimates based on the information available at the time—not ironclad guarantees of future performance.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The point of sale for every sale.

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Latest from Shopify

Aug 16, 2024

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

- Business Planning

- Cash Flow Forecasting

- Scenario Planning

- Financial Reporting

- Financial Planning & Analysis

- For Enterprises

- For Franchises

- Case Studies

- Partnerships

- Software Integrations

- Templates & Downloads

A large update to Brixx has been released (15.04.24) - read about it here . Please clear cache/cookies in your browser if you encounter difficulties in loading the app.

Financial Forecasting Template for Startups

To begin effective and accurate financial planning for startups , you will need three key reports: a Balance Sheet, a Cash Flow Statement, and a Profit and Loss Statement (sometimes called an Income Statement). From these, you will be able to put together the five main components of your financial projection and use them effectively within your business plan.

They are one of the most important elements of any business plan, so it’s important to get them right. Whether you plan to use them to help you win over investors, obtain bank loans, or produce a long-term growth strategy for your business, financial forecasts can help your business in a number of ways.

Creating financial projections for startups

This post continues on with our topic of creating an effective business plan. Here, we focus on the fact that financial projections are not only essential to a new startup’s business plan. We emphasise that they are also essential to you as a business owner. Financial projections are able to help you gain a solid grasp of your company’s financial health.

As a rule of thumb, your financial projection should be 5 years long, with monthly figures shown for at least the first 12 months. In some cases, you may only be asked for a 12-month projection or a 3-year plan. But you can beat both of these expectations – and there are good reasons to do so.

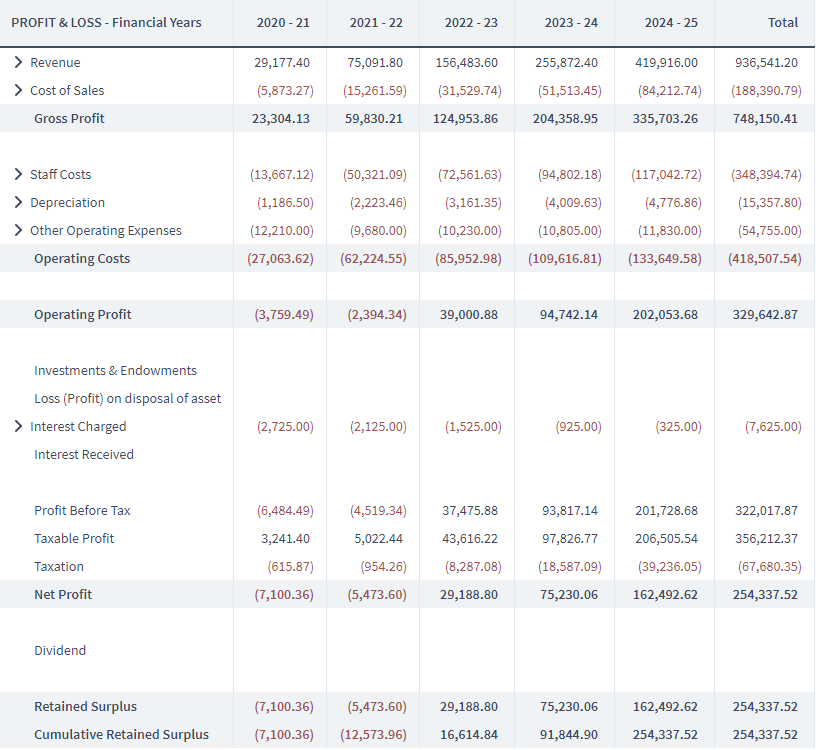

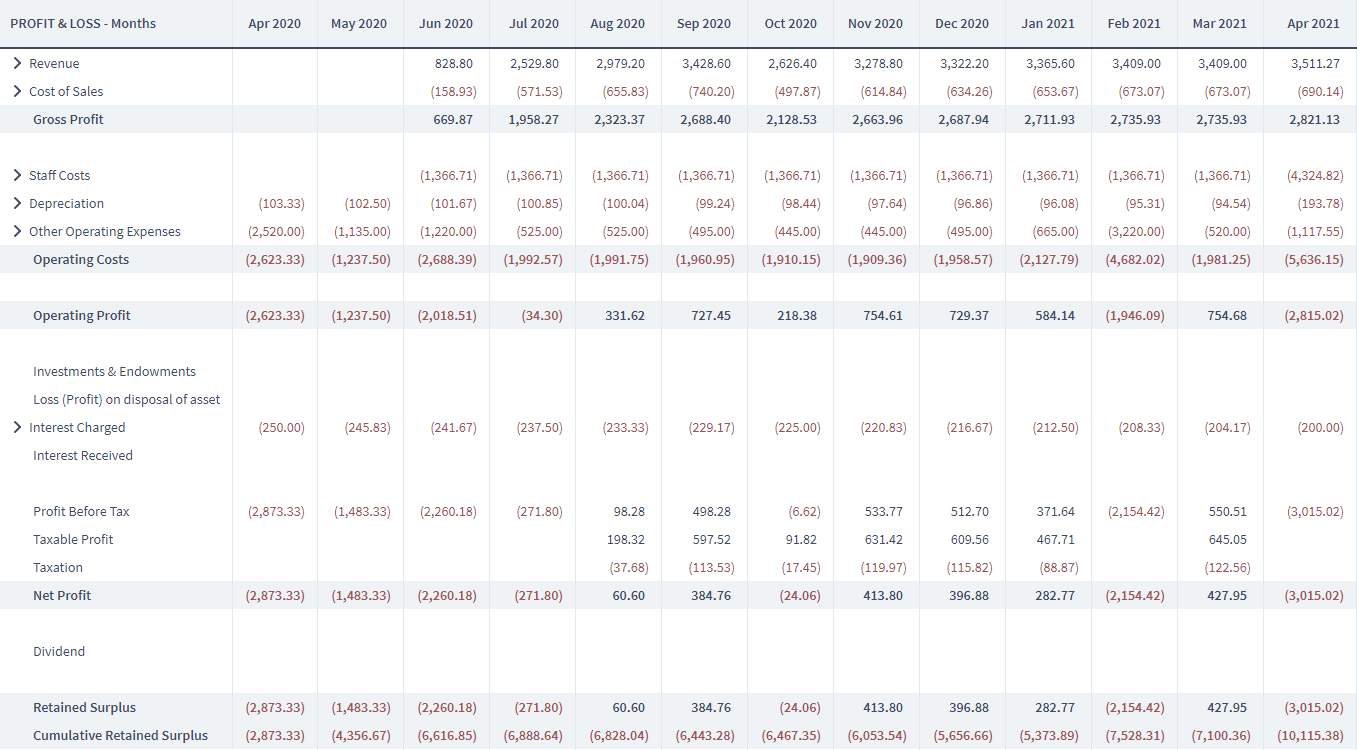

When looking at the above image of a Profit and Loss Statement, it showcases that 5 years is long enough to plan what the business will look like when it has matured, something most startups don’t think about.

Why a 5-year projection?

“But,” I hear you ask, “how can I plan anything accurately over 5 years? I haven’t even started my business yet!”

The answer is – you don’t need to plan accurately that far ahead. Planning accurately more than a few months into the future is impossible. But plans do not need to be 100% accurate – they need to be well informed and grounded in reasonable expectations and research. Any long term plan you make will turn out differently in reality. But right now, making that plan is the only way you can gain insight into what might happen in the future.

A 5-year financial projection gives the business enough time to demonstrate what it will be like after its startup period – when it is fully established and running optimally. 5 years also gives you the potential to look to the future of the business – how it will expand its horizons after getting up and running.

The organisational principles we’ll cover are applicable whether you’re planning in Brixx or creating your own projection from scratch. While Brixx simplifies things for you by completing all of the calculations for your reports and makes it easy to restructure and test your plan, it is entirely your choice whether to use specialised software or spreadsheet for your startup’s financial projections.

What is the aim of using a financial forecast template?

What are we going to get out of it and actually present in our startup business plan? Here’s a quick list.

Three detailed financial reports:

- Cash Flow Forecast

- Profit & Loss Forecast

- Balance Sheet Forecast

And some quick takeaway information:

- General Assumptions

- Sales Forecasting

- Startup Costs

- Running Costs

- Salaries & Contracts

- Funding Requirements

The three financial reports form the backbone of your financial projection, while the quick takeaway information is an easily digestible way of displaying this information.

Now, the three reports I mentioned above may sound intimidating – and the truth is they use language and concepts which can take a little while to pick up! While they seem a bit alien at first, what’s important to understand is that each report is just a different way of viewing what’s going on financially in your business. Each report is made of the data you have gathered, just arranged in a standardised way. With these reports, you can create a comprehensive financial projection that will elevate your business plan or even an investor pitch.

Keep in mind

It is also worth noting that you should be able to test your financial projections. Why? Well, for a start, that’s what a lot of investors will be asking you for! What happens if sales are lower, or a project doesn’t reach completion on time? What happens if a vehicle breaks down and needs repairs or replacement? Can the business handle this – and what are the knock-on effects? All of these questions and more are easy to answer if every element of your financial plan is a modular component that you can add, change or remove without affecting the validity of the projection’s calculations.

It is crucial to keep record of your projections, documents, etc. Depending on your business plan’s audience, you may need to include items that support your statements and/or figures in the plan. These might include important staff member CVs and detailed market/competitor research data, etc. Some information will go in the appendix section, allowing you to expand on the information you’ve supplied throughout.

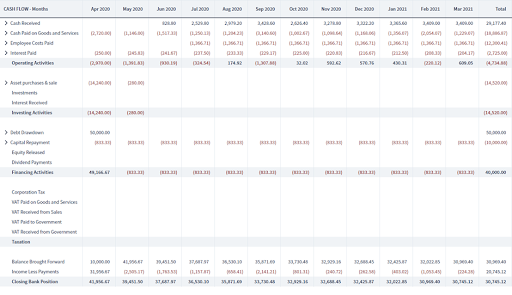

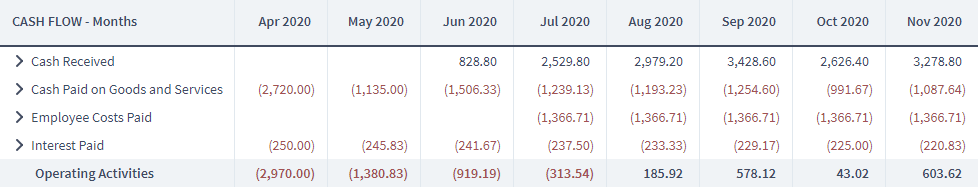

Understanding cash flow in your startup’s financial projection reports

The cash that comes into the business, and the cash that goes out of the business. The Cash Flow shows when cash (digital or physical) actually changes hands in these transactions. To me, cash flow is the simplest report to understand, as it shows what is the case at any given time.

Before we move into the next section, you’re going to need a spreadsheet or a piece of software like Brixx to build your Cash Flow Forecast. If you don’t fancy trying Brixx then we also have a free cash flow template which you can build it in too.

The Cash Flow Report in your financial projections

The Cash Flow Report takes into account when cash actually changes hands. The Profit & Loss Statement accounts for when the transaction agreement takes place. Let’s say you deliver a product/service immediately to your customer and they then pay you a month later. An electrician, for example, might complete some work, and then send an invoice for payment. The electrician’s charge for their work appears on their business’ Profit and Loss Report when they send the invoice, but the cash payment only appears on their business’ Cash Flow Report when they actually get paid by their customers.

This delay between the sale happening and the cash being received is part of what makes the Cash Flow Report so useful. Many businesses, even large and established ones, can suffer from a lack of ready cash. If this business can’t pay its bills this will ultimately lead to the failure of the business. Making a cash flow forecast is a means of looking ahead and trying to foresee and mitigate these problems before they happen. This can be done by identifying the periods and time and areas of the business that are a cause for concern, cash-wise.

Key questions the cash flow can answer:

- How much cash in hand the business has every month

- The consequences of projects, payments or purchases happening at unexpected times

- The toll each type of cash flow has on net cash

- Will the business stay afloat!?

Key cash flow information:

The cash flow is made up of several ‘cash flows’ – each representing different kinds of business activity, as well as ‘bottom line’ totals of these cash flows.

Understanding your Cash Flow Report

Cash flows from operating activities.

The day-to-day operations of the business: income from sales, minus the cost of sales, minus overheads like rent, electricity, paying interest and salaries.

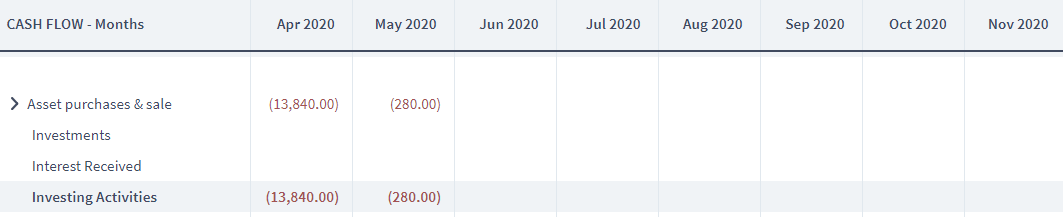

Cash Flows from Investing Activities

The purchase and sale of assets, investments and income gained from interest on savings are recorded here. These are activities that in many cases are outside of the day-to-day running of the business. Initial asset purchases may be necessary to get the business up and running in the first place or replace existing assets that are crucial to the business but they aren’t a regular part of the business’s revenue stream or monthly bills.

Cash Flows from Financing Activities

Financing activities show where the business gets its funding from. Additionally, financing is cash received from sources external to the business, like loans or external investment. These financing cash flows also include dividends the business pays to shareholders and loan repayments to lenders.

Cash Flows from Taxation

The tax you pay and any tax refunds are included here.

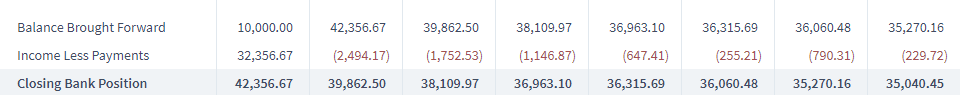

Income Less Payments

This line shows the net cash movement in any given month, that is, the total of all the cash flows mentioned above. This is great for helping you identify problem periods of the year.

Closing Bank Position

The real ‘bottom line’, Closing Bank Position shows the amount of cash in your bank account/s at the end of each month. If this goes negative, the business has serious problems. This is why cash flow forecasting is so important, especially for small businesses. Splitting out these different cash flows makes this report easier to understand. It also allows each flow of cash to be compared to the others. You may find for example that you have a healthy operating cash flow but the business’ investing activities are taking too great a toll on the business’s net cash flow to continue unabated.

An overview of profit and loss in your startup’s financial projections

The P&L records the profits and losses made by the business. How do you make a loss? It’s a way of saying that something the business owns has lost value. The P&L takes into account when, or over how long transactions are agreed, rather than when cash actually changes hands.

Key questions the profit & loss can answer:

- What are the business’ Gross Profit, Operating Profit and Profit for a given period?

- Can the business afford to take on new projects?

- What non-cash losses is the business suffering?

- How are dividends related to profit?

Key information on profit and loss

Gross profit.

Gross profit is revenue from sales minus the direct costs of those sales. This is often formulated as a percentage called gross profit margin, showing the cost of selling as a % of the sale.

Operating Profit

What is Operating Profit? It is Gross Profit, minus any indirect overheads (cost of goods, services and salaries). Operating profit shows how well the business can support itself by its activities alone. Therefore it is useful gauge for whether a business can take on new projects or other costly activities.

Net profit takes into account all of the business’ extra expenditure that is not taken into account under Operating Profit. This includes investments, interest charged, interest received and taxation.

To read more about the Profit and Loss Report – check out this article: A Beginner’s Guide to the Profit and Loss Forecast Report . If you’re still confused, here’s my attempt at busting the confusion! How to understand the Profit and Loss Statement and why it’s confusing .

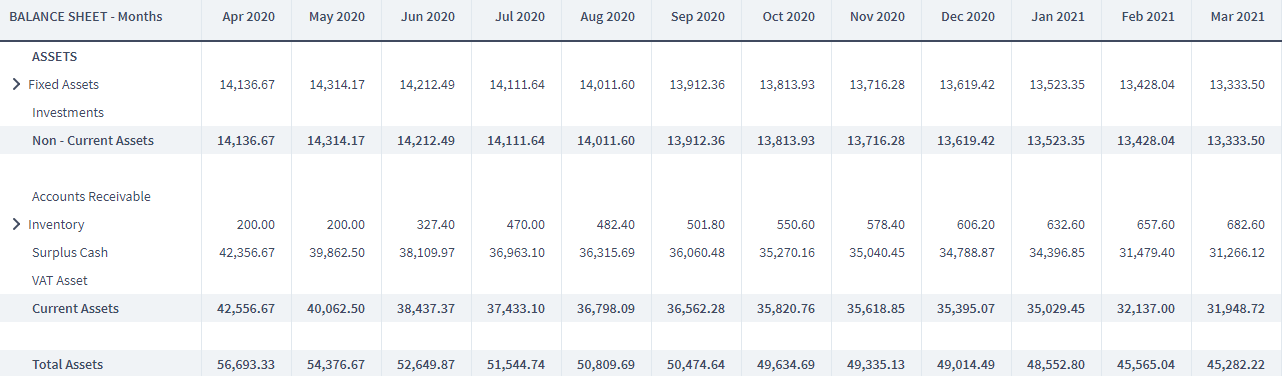

Getting a handle on your financial projection’s Balance Sheet section

The Balance Sheet shows the financial position of the business at any given time. It shows what it owns (assets) balanced with what it owes (liabilities) and the money that has been invested in it (equity).

This all sounds pretty esoteric, but it boils down to “how risky is the business – how much does it own and how much does it owe?”

Key questions the balance sheet can answer:

- Value of the business’s assets

- Size of the business’s debt

- What funds the business, debt or investment?

- How risky is the business for investors?

Information on the Balance Sheet

These are what the business owns. Assets include physical things like cars and computers, and also cash and investments.

Liabilities

Liabilities are what the business owes. A business with a large ratio of liabilities to assets may be seen as risky as it funds itself with debts which must be paid off, no matter the state of the business.

Equity shows the net value of the business. It’s the same figure as net assets – the businesses’ assets minus its liabilities. Breaking down equity further, it shows who owns the business, whether this is a single owner or a group of investors.

From these three core reports, you or an accountant should be able to work out any additional information you may be asked for.

Use financial projection templates for more than just your startup’s business plan

Now that we’ve covered financial projections for your startup’s business plan, be sure to download your free Business Plan Template to help you format your plan correctly.

Remember, financial projections are useful for more than just your startup’s business plan or for seeking funding. These plans are able to help you better understand the potential risks you may face.

There are always risks when starting a new business. Your startup business plan document should be a persuasive tool to help get support for your business. However, it should also be honest. The people who look at your business plan, whether they are investors or future-you, need to have the risks and your plans for mitigating them laid out.

In most cases, these risks will be financial in nature. The business doesn’t make enough money – either because the product is not good enough, it can’t attract enough customers, or there is a misalignment between what the business is offering and what the market requires.

With a comprehensive financial projection for your startup’s business plan, you can more easily see potential risk down the line. Brixx can help you reduce the stress and time wastage of setting up spreadsheets and formulae to keep track of and project your financials.

Related articles

- SWOT Analysis For Startups

- How to Start Your Business Plan Online for Free

- A quick guide to setting up and running your business

- How to easily forecast your startup’s cash flow

Get started with Brixx

Financial Projections 12-Month Template

Identify the scope and objectives for financial projections, gather historical financial data, study company's financial trends, identify relevant economic indicators.

- 1 Inflation rates

- 2 Interest rates

- 3 GDP growth rates

- 4 Industry-specific factors

Prepare sales projections

- 1 Time-Series Analysis

- 2 Regression Analysis

- 3 Market Research

- 4 Expert Opinion

Calculate projected expenses

- 1 Personnel costs

- 2 Operating expenses

- 3 Marketing expenses

- 4 Research and development expenses

Assess potential impact of external factors

- 1 Market conditions

- 2 Regulatory changes

- 3 Competitive landscape

- 4 Technological advancements

Estimate net income

Create projected balance sheet, develop cash flow forecast, draft comparative financial statements, approval: prepared projections.

- Create projected balance sheet Will be submitted

- Develop cash flow forecast Will be submitted

- Draft comparative financial statements Will be submitted

Perform sensitivity analysis

- 1 Sales volume

- 2 Sales price

- 3 Variable cost

- 4 Fixed cost

- 5 Interest rate

Adjust projections based on sensitivity analysis results

- 1 Scenario Analysis

- 2 Financial Modeling

- 3 Expert Opinion

Present finalized financial projections to stakeholders

Approval: final projections.

- Perform sensitivity analysis Will be submitted

- Adjust projections based on sensitivity analysis results Will be submitted

- Present finalized financial projections to stakeholders Will be submitted

Documentation of the entire financial projections

Filing and secure data storage, take control of your workflows today., more templates like this.

Plan Projections

ideas to numbers .. simple financial projections

Home > Financial Projections Template Excel

Financial Projections Template Excel

This free 4 page Excel business plan financial projections template produces annual income statements, balance sheets and cash flow projections for a five year period for any business.

Financial Projections Template Download

What’s included in the financial projection template, 1. income statements.

The first page of the financial projection template shows income statements for the business for 5 years.

2. Balance Sheets

3. Cash Flow Statements

The third page provides the cash flow statements for 5 years.

4. Ratios and Graphs

The final page of the financial projections template contains a selection of useful financial ratios for comparison purposes. In addition it shows revenue, net income, cash balance, and cumulative free cash flow by year in graph form for easy reference.

How to use the Financial Projections Template

If you want to know how to use the financial projections template, then we recommend reading our How to Make Financial Projections post, which explains each step in detail.

More Financial Projections Templates and Calculators

Select a category from the menu to the right or chose one of the templates or calculators below.

Popular Revenue Projection Templates

- Retail Store Revenue Projection

- Drop Shipping Business Revenue Projection

- Sandwich Shop Revenue Projection

- Salon Business Plan Revenue Projection

- Microbrewery Business Plan Revenue Projection

Popular Calculators

- Days Sales Outstanding Calculator

- Return on Investment Calculator

- Sales Forecast Spreadsheet

- Gross Margin Calculator

- Business Operating Expenses Template

Financial projections are critical to the success of your business plan, particularly if the purpose is to raise finance. Accordingly we have designed our financial projection for startup template to help you test your business idea and create a five year business plan financial projection.

The financial projection template will help you to carry out your own financial projections and test your business idea. Therefore simply amend the highlighted input elements to suit your purposes, and the financial projection template does the rest.

Alternatively, you can use our online calculator to provide a quick and easy way to test the feasibility of your business idea.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. Michael has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a BSc from Loughborough University.

How To Create Startup Financial Projections [+Template]

Businesses run on revenue, and accurate startup financial projections are a vital tool that allows you to make major business decisions with confidence. Financial projections break down your estimated sales, expenses, profit, and cash flow to create a vision of your potential future.

In addition to decision-making, projections are huge for validating your business to investors or partners who can aid your growth. If you haven’t already created a financial statement, the metrics in this template can help you craft one to secure lenders.

Whether your startup is in the seed stage or you want to go public in the next few years, this financial projection template for startups can show you the best new opportunities for your business’s development.

In this article:

- What is a startup financial projection?

- How to write a financial projection

- Startup expenses

- Sales forecasts

- Operating expenses

- Income statements

- Balance sheet

- Break-even analysiFinancial ratios Startup financial

- rojections template

What is a financial projection for startups?

A financial projection uses existing revenue and expense data to estimate future cash flow in and out of the business with a month-to-month breakdown.

These financial forecasts allow businesses to establish internal goals and processes considering seasonality, industry trends, and financial history. These projections cover three to five years of cash flow and are valuable for making and supporting financial decisions.

Financial projections can also be used to validate the business’s expected growth and returns to entice investors. Though a financial statement is a better fit for most lenders, many actuals used to validate your forecast are applied to both documents.

Projections are great for determining how financially stable your business will be in the coming years, but they’re not 100% accurate. There are several variables that can impact your revenue performance, while financial projections identify these specific considerations:

- Internal sales trends

- Identifiable risks

- Opportunities for growth

- Core operation questions

To help manage unforeseeable risks and variables that could impact financial projections, you should review and update your report regularly — not just once a year.

How do you write a financial projection for a startup?

Financial projections consider a range of internal revenue and expense data to estimate sales volumes, profit, costs, and a variety of financial ratios. All of this information is typically broken into two sections:

- Sales forecasts : includes units sold, number of customers, and profit

- Expense budget : includes fixed and variable operating costs

Financial projections also use existing financial statements to support your estimated forecasts, including:

- Income stateme

- Cash flow document

Gathering your business’s financial data and statements is one of the first steps to preparing your complete financial projection. Next, you’ll import that information into your financial projection document or template.

This foundation will help you build the rest of your forecast, which includes:

- Cash flow statements

- Break-even analysis

- Financial ratios

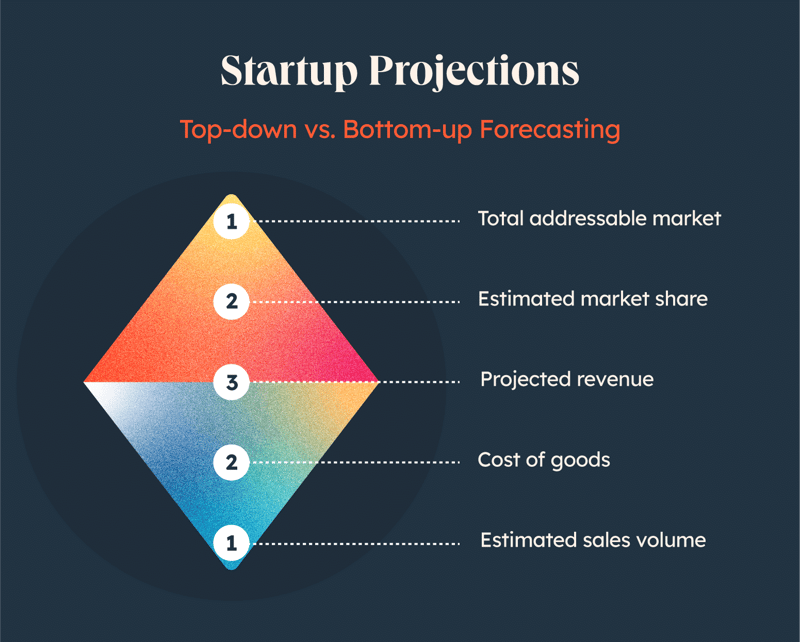

Once all of your data is gathered, you can organize your insights via a top-down or bottom-up forecasting methods.

The top-down approach begins with an overview of your market, then works into the details of your specific revenue. This can be especially valuable if you have a lot of industry data, or you’re a startup that doesn’t have existing sales to build from. However, this relies on a lot of averages and trends will be generalized.

Bottom-up forecasting begins with the details of your business and assumptions like your estimated sales and unit prices. You then use that foundation to determine your projected revenue. This process focuses on your business’s details across departments for more accurate reporting. However, mistakes early in forecasting can compound as you “build up.”

1. Startup expenses

If your startup is still in the seed stage or expected to grow significantly in the next few quarters, you’ll need to account for these additional expenses that companies beyond the expansion phase may not have to consider.

Depending on your startup stage, typical costs may include:

- Advertising and marketing

- Lawyer fees

- Licenses and permits

- Market research

- Merchandise

- Office space

- Website development

Many of these costs also fall under operating expenses, though as a startup, items like your office space lease may have additional costs to consider, like a down payment or renovation labor and materials.

2. Sales forecasts

Sales forecasts can be created using a number of different forecasting methods designed to determine how much an individual, team, or company will sell in a given amount of time.

This data is similar to your financial projections in that it helps your organization set targets, make informed business decisions, and identify new opportunities. A sales forecast report is just much more niche, using industry knowledge and historical sales data to determine your future sales. Gather data to include:

- Customer acquisition cost (CAC)

- Cost of goods sold (COGS)

- Sales quotas and attainment

- Pipeline coverage

- Customer relationship management (CRM) score

- Average Revenue Per User (ARPU), typically used for SaaS companies

Sales forecasts should consider interdepartmental trends and data, too. In addition to your sales process and historical details, connect with other teams to apply insights from:

- Marketing strategies for the forecast period

- New product launches

- Financial considerations and targets

- Employee needs and resources from HR

Your sales strategy and forecasts are directly tied to your financial success, so an accurate sales forecast is essential to creating an effective financial projection.

3. Operating expenses

Whereas the costs of goods solds (aka Cost of Sales or COGS) account for variable costs associated with producing the products or services you produce, operating expenses are the additional costs of running your startup, including everything from payroll and office rent to sales and marketing expenses.

In addition to these fixed costs, you’ll need to anticipate one-time costs, like replacing broken machinery or holiday bonuses. If you’ve been in business for a few years, you can take a look at previous years’ expenses to see what one-time costs you ran into, or estimate a percentage of your total expenses that contributed to variable costs.

4. Cash flow statements

Cash flow statements (CFS) compare a business’s incoming cash totals, including investments and operating profit, to their expected expenses, including operational costs and debt payments.

Cash flow shows a company’s overall money management and is one of three major financial statements, next to balance sheets and income statements. It can be calculated using one of two methods:

- Direct Method : calculates actual cash flow in and out of the company

- Indirect Method : adjusts net income considering non-cash revenue and expenses

Businesses can use either method to determine cash flow, though presentation differs slightly. Typically, indirect cash flow methods are preferred by accountants who largely use accrual accounting methods .

5. Income statements

Your income statement projection utilizes your sales forecasts, estimated expenses, and existing income statements to calculate an expected net income for the future.

In addition to the hard numbers available, you should apply your industry expertise to consider new opportunities for your business to grow. If you’re entering Series C, you should anticipate the extra investments and big returns that you’re aiming to experience this round.

Once you’ve collected your insights, use your existing income statement to track your estimated revenue and expenses. Total each and subtract the expenses from the revenue projections to determine your projected income for the period.

6. Balance sheet

Your balance sheet is the final of the big three financial documents needed to establish your company’s financial standing. The balance sheet makes a case for your company’s financial health and future net worth using these details:

- Company’s assets

- Business’s liabilities

- Shareholders’ equity

This document breaks down the company’s owned assets vs. debt items. It most directly tracks earnings and spendings, and it also doubles as an actual to establish profitability for prospective investors.

7. Break-even analysis

Launching a startup or new product line requires a significant amount of capital upfront. But at some point, your new endeavor will generate a profit. A break-even analysis identifies the moment that your profit equals the exact amount of your initial investment, meaning you’ve broken even on the launch and you haven’t lost or gained money.

A break-even point (BEP) should be identified before launching your business to determine its viability. The higher your BEP, the more seed money you’ll need or the longer it will be until operations are self-sufficient.

Of course, you can also increase prices or reduce your production costs to lower the BEP.

As your business matures, you can use the BEP to weigh risks with your product decisions, like implementing a new product or removing an existing item from the mix.

8. Financial ratios

Financial ratios are common metrics that lenders use to check financial health using data from your financial statements. There are five core groups of financial ratios used to evaluate businesses, as well as an example of each:

Efficiency ratios : Analyze a company’s assets and liabilities to determine how efficiently it manages resources and its current performance.

Formula : Asset turnover ratio = net sales / average total assets

Leverage ratios : Measure a company’s debt levels compared to other financial metrics, like total assets or equity.

Formula : Debt ratio = total liabilities / total assets

Liquidity ratios : Compare a company’s liquid assets and its liabilities to lenders to determine its ability to repay debt.

Formula : Current ratio = current assets / current liabilities

Market value ratios : Determine a public company’s current stock share price.

Formula : Book value per share (BVPS) = (shareholder’s equity - preferred equity) / total outstanding shares

Profitability ratios : Utilize revenue, operating costs, equity, and other other balance sheet metrics to asses a company’s ability to generate profits.

Formula : Gross profit margin = revenue / COGS

Graphs and charts can provide visual representations of financial ratios, as well as other insights like revenue growth and cash flow. These assets provide an overview of the financial projections in one place for easy comparison and analysis.

Startup Financial Projections Template

As a startup, you have some extra considerations to apply to your financial projections. Download and customize our financial projections template for startups to begin importing your financial data and build a road map for your investments and growth.

Plan for future success with HubSpot for Startups

A sound financial forecast paves the way for your next moves and reassures investors (and yourself) that your business has a bright future ahead. Use our startup financial projections template to estimate your revenue, expenses, and net income for the next three to five years.

Ready to invest in a CRM to help you increase sales and connect with your customers? HubSpot for Startups offers sales, marketing, and service software solutions that scale with your startup.

Get the template

- TemplateLab

Financial Projections Templates

34 simple financial projections templates (excel,word).

A financial projections template is a tool that is an essential part of managing businesses as it serves as a guide for the various team to achieve the desired goals. The preparation of these projections seems like a difficult task, especially for small businesses. If you can come up with financial statements , then you can also make financial projections.

Table of Contents

- 1 Financial Projections Templates

- 2 When do you need a financial projections template?

- 3 Business Projections Templates

- 4 What to include in financial projections?

- 5 Financial Forecast Templates

- 6 How do I make a financial projection?

- 7 Revenue Projection Templates

When do you need a financial projections template?

A financial projections template uses estimated or existing financial information to forecast the future expenses and income of your business. These projections don’t just consider a single scenario but different ones so you can determine how the changes in one part of your finances might affect the profitability of your company.

If you have to create a financial business projections template for your business, you can download a template to make the task easier. Financial projection has become an important tool in business planning for the following reasons:

- If you’re starting a business venture, a financial projection helps you plan your start-up budget.

- If you already have a business, a financial projection helps you set your goals and stay on track.

- If you’re thinking about getting outside financing, you need a financial projection to convince investors or lenders of the potential of your business.

Business Projections Templates

What to include in financial projections?

A financial projections template usually includes a few financial statements that will help you achieve better financial performance for your business:

- Income Statement Also called the Profit and Loss Statement , this focuses on your company’s expenses and revenues generated for a specific period of time. A typical income statement includes expenses, revenue, losses, and gains. The sum of all these is the net income, a measure of your company’s profitability.

- Cash Flow Statement Taking a look at a cash flow statement makes you understand how your company’s operations work. The statement explains in detail how much money goes in and out of your business in the form of either expense or income. This document includes the following: Operating Activities The cash flow from operating activities reports cash outflows and inflows from your company’s daily operations. This includes changes in accounts receivable, cash, inventory, accounts payable, and depreciation. Investing Activities You use the cash flows from investing activities for your company’s investments into the long-term future. This includes cash outflows for purchases of fixed assets like equipment and property and cash inflows for sales of assets. Financing Activities The financial activities in a cash flow statement show your business’ sources of cash from either banks or investors along with expenditures of cash you have paid to your shareholders. Total these at the end of each period to determine either a loss or a profit. The cash flow statement gets connected to the income statement through net income. To make this document, it requires the reconciliation of the two documents. You can calculate net profitability or income in the income statement which you then use to start the cash flow from the operations category in your cash flow statement.

- Balance Sheet This is a statement of your business’ liabilities, assets, and capital at a specific point in time. It details the balance of expenditure and income over the preceding period. This document provides you with a general overview of your business’ financial health. Here is an overview of these components: Assets These are your business’ resources with economic value that your business owns and which you believe will provide some benefit in the future. Examples of such future benefits include reducing expenses, enhancing sales, or generating cash flow. Assets typically include inventory, property, and cash. Liabilities In general, these refer to the obligations of your business to other entities. In more common terms, these are the debts that your business incurs in your daily operations. It typically includes loans and accounts payable. You can classify liabilities either as short-term or long-term. Owner’s Equity This is the amount you have left after you have paid off your liabilities. It is usually classified as retained earnings – the sum of your net income earned minus all the dividends you have paid since the start of your business.

Together with your break-even analysis and financial statements, you can include any other document that will help explain the assumptions behind your cash flow and financial forecast template.

Financial Forecast Templates

How do I make a financial projection?

The creation of a financial projections template requires the same information to use whether your business is still in its planning stages or it’s already up and running. The difference is whether you’re creating your revenue projection template using historical financial information or if you need to start from scratch.

This includes the creation of projections based on your own experiences or by conducting market research in the industry in which your business will operate. Here are some tips for creating an effective business plan financial projections template:

- Create the sales projection An important component of your business projections template is the sales projections. A business that’s already running can base its projections on its past performance, which you can derive from financial statements. When creating your sales projections, you must consider some external factors like the projected and current health of your company, if your inventory will get affected by additional tariffs, or if there is a downturn in your industry. Even if you want to remain optimistic about your business, you have to make realistic plans.

- Create the expense projection At the onset, the creation of an expense projection seems simpler because it’s much easier to predict the possible expenses of your business than it is to predict potential customers or their buying habits. If you have experience working in a certain industry, you can predict with some degree of accuracy what your fixed expenses are and any recurring expenses. But when it comes to one-time expenses that have the potential to bring down your business, these are much harder to predict. The best thing you can do in this scenario is to project expenses to the best of your ability then increase this value by 15%.

- Come up with a balance sheet for your financial projections template If you have a business that has been in operation for a couple of months, you can come up with a balance sheet using accounting software. The balance sheet shows your business’ financial status, listing its liabilities, equity, and assets balance for a certain time period. Use the current totals in your balance sheet when making your financial projections, In doing so, you will make better predictions on where your business will be a few years in the future. If you’re still in the planning stage of a business, you can create a balance sheet based on the data you’ve gathered from industry research.

- Create the income statement projection If you have a business that is currently in operation, you can create an income statement projection using your existing income statements to create an estimate of your business’ projected numbers. This is a logical move since an income statement provides a picture of your business’s net income after subtracting things like taxes, cost of goods, and other expenses. One of the main purposes of the income statement is to provide an idea of your business’ current performance. It also serves as the basis for estimating your net income for the next couple of years. If your business is still in the planning stages, the creation of a potential income statement shows that you have conducted extensive research and created a diligent and well-crafted estimate of your income in the next couple of years. If you have uncertainties on how to start creating an income statement projection, you can consult with market research firms in your locale. They can provide you with an overview of your targeted industry which includes target markets, expected and current industry growth levels, and sales.

- Come up with a cash flow projection The creation of this document is the final step leading to the completion of your financial projection. The cash flow statement is directly connected to the balance sheet and the net income statement, showing any cash-related or cash activities that can affect your industry. One of the purposes of this statement is to show how much money your business spends. This is a must for businesses obtaining financing or looking for investors. You can use this cash flow statement if your business has been in operation for a minimum of six months, but if your business is still in the planning stages, you can use the information you have gathered to create a credible projection. To make things easier for you, consider using spreadsheet software. Chances are, you’re already using spreadsheets. Using a spreadsheet will be the starting point for your financial projections. In addition, it offers flexibility that allows you to quickly judge alternative scenarios or change assumptions. Be as clear and reasonable as possible with your financial projections. Remember that financial projection is as much science as art. At some point, you will have to make assumptions on certain things like how administrative costs and raw materials will grow, revenue growth, and how efficient you will be at gathering accounts receivable for your business.

Revenue Projection Templates

More Templates

Business Budget Templates

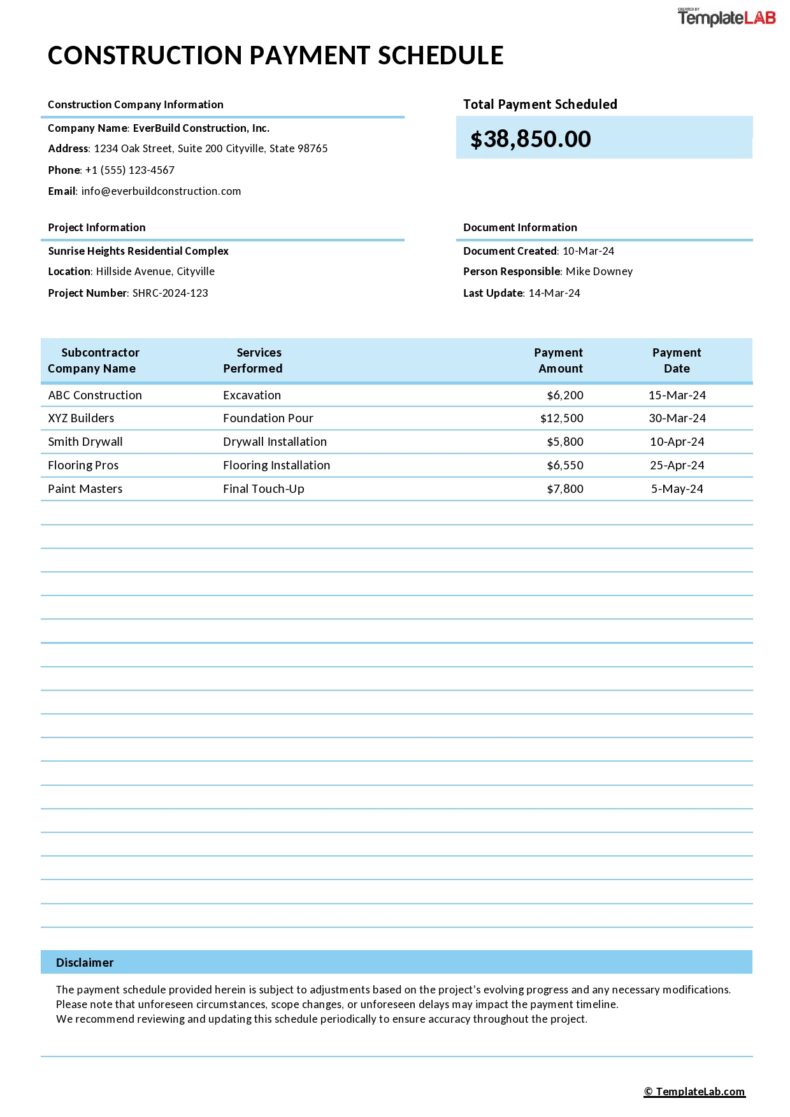

Payment Schedule Templates

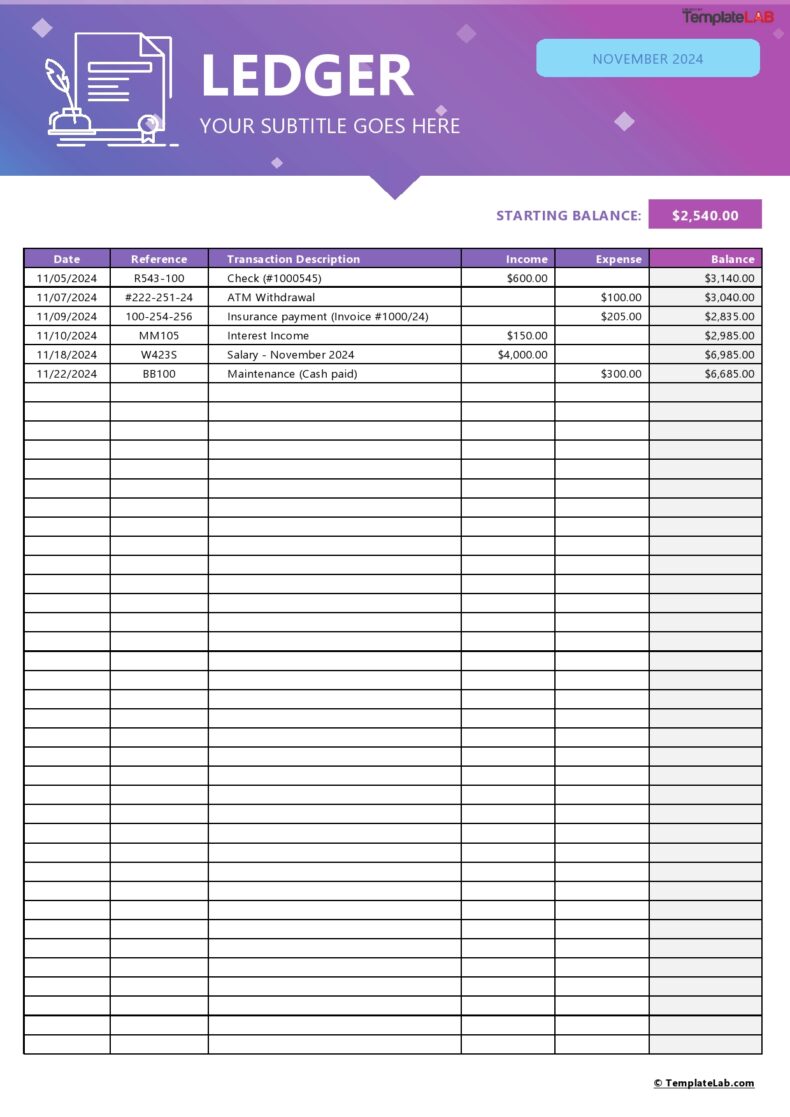

General Ledger Templates

Bill Pay Checklists

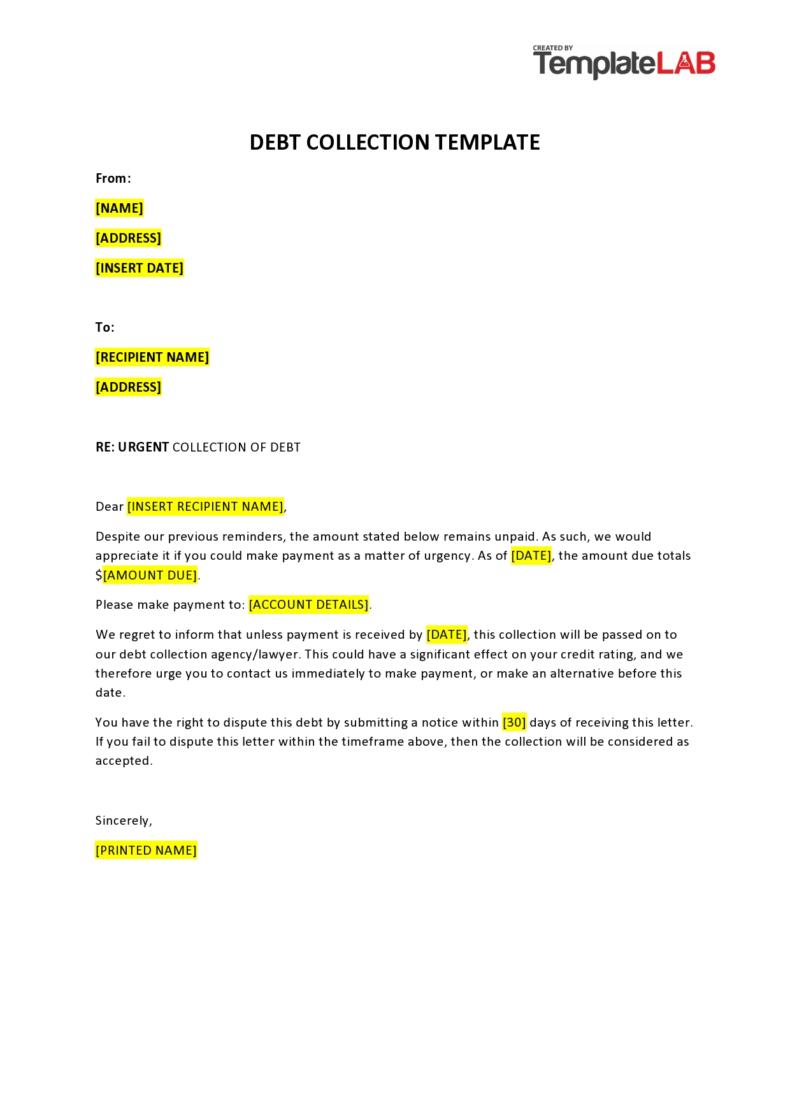

Collection Letter Templates

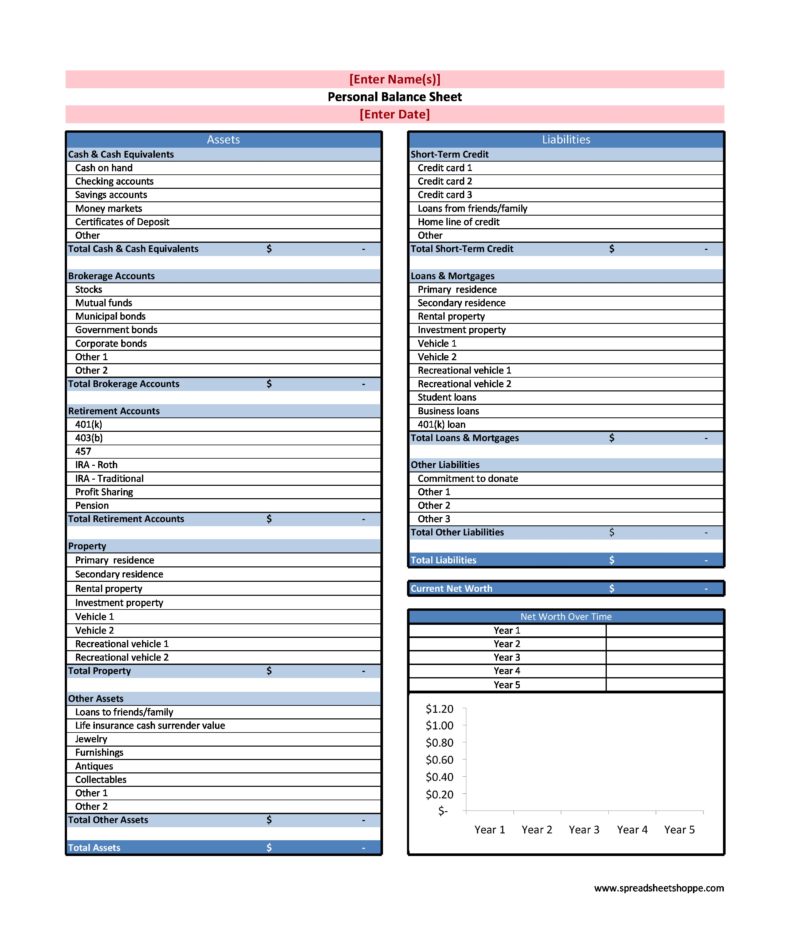

Personal Balance Sheets

Free 1-year Financial Projection Template

Complete the form to get your copy of this free resource!

Free excel template to create financial projections for any business startup and first year. Forecast revenue, expenses, employee costs and generate an income statement, balance sheet, and cash flow pro forma automatically

Join 15,000+ founders and consultants who have used our free resources and tools

Free 1 Year Pro Forma Template

Download our 12 months financial projection template for free. This tool will allow you to:

- Forecast startup costs

- Project your first 12 months of product or service revenue

- Forecast your operating expenses

- Add Salary Forecasts for your employees

Once you have input all of your own assumptions, you will be able to generate:

- 12 month pro forma income statement

- 12 month cash flow forecast

- 12 month balance sheet projection

- Basic graphs and charts

This free financial model is industry agnostic. If you need an industry specific financial model you can check out ProjectionHub’s premium pro forma templates .

Below you will be able to see some examples of the input and outputs of the projection spreadsheet.

Financial Model Input Examples

Below you will be able to see examples of the input tabs for startup costs, fixed assets, revenue, operating expenses and salaries.

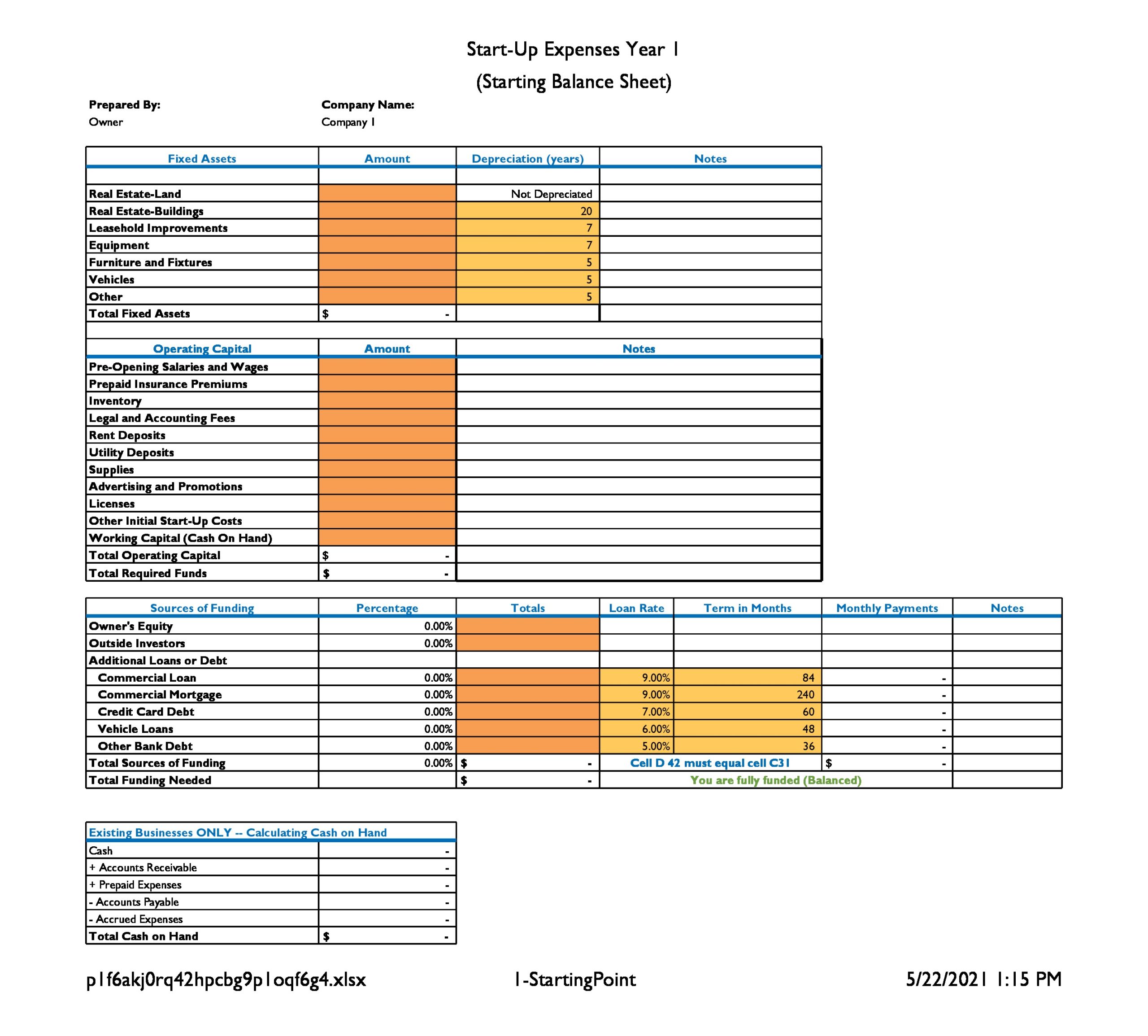

Example of Startup Cost Forecast

The financial model input assumptions tab will include general assumptions and startup costs like your fixed assets like buildings, equipment, leasehold improvements and vehicles. On the input assumptions tab you will also be able to include startup cost assumptions like initial inventory.

12 Month Revenue Forecast Example

Our revenue assumptions tab will allow you to forecast your number of customers, the products or services they purchase, the purchase price and the percentage of total units sold represented by each product. You can see a quick example of our revenue model below:

Startup Operating Expense Projections Example

You can enter in your operating expense projections for your startup in the table below. It will allow you to add expenses as a fixed monthly expense or a percentage of revenue.

Startup Salary Forecasting Example

The last input tab is our salary forecast assumptions. You can set a salary, employer taxes, benefits, the month the employee starts and ends, and the number of the particular employee.

Projection Template Output Examples

Our free financial model spreadsheet will produce 12 months of income statement, cash flow and balance sheet projections. You can see examples of each of these outputs below along with some of the basic charts and graphs that will be included.

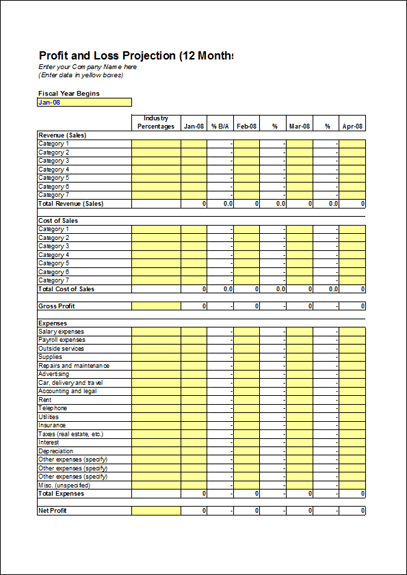

Example of a 12 Month Pro Forma P&L

Below you will see an example of our income statement pro forma output.

Cash Flow Forecast 12 Month Example

Next you will see an example of our cash flow forecast output with cash from operating activities, financing and investing activities.

Balance Sheet Forecast Example for 12 Months

The balance sheet forecast output will include 12 months of forecasted assets and liabilities as seen below:

Pro Forma Graphs

Finally, our free template includes a profit and loss at a glance, a monthly sales forecast and graph to display monthly sales, gross profit and net income.

If you are needing a more tailored template to your industry as well as 5 years of projections, we have 100+ different industry templates to choose from as well:

Examples: Restaurant, Trucking, SaaS, Airbnb, Brewery, Dentist, etc.

Check out our Highly Rated Financial Projection Templates

Cash Flow - Business Plan Forecast Template

Use our business plan financial projections template to create financial projections for a business plan which includes 12 monthly periods and 5 annual periods. The template includes a detailed income statement, cash flow statement and balance sheet in Excel. Cash flow projections are based on user defined turnover, gross profit and expense values and automated calculations based on a series of assumptions.

- Includes 12 monthly & 5 annual periods

- Suitable for service and trade based businesses

- Reporting periods based on a single user input cell

- User input limited to basic template assumptions

- Expense accounts can be customized & more accounts added

- Automated income statement, cash flow statement & balance sheet

- Accommodates loan amortization or interest-only loans

- Includes sales tax, income tax, payroll accruals & dividends

How to use the Cash Flow - Business Plan Forecast template

This template enables users to create cash flow projections for a business plan which includes 12 monthly periods and five annual periods. The template includes a monthly income statement, cash flow statement and balance sheet. The cash flow projections are based on turnover, gross profit and expense values that are entered by the user as well as a number of default assumptions which are used to create an automated balance sheet. These assumptions include opening balance sheet balances, working capital ratios, payroll accruals, sales tax, income tax, dividends and loans. The monthly reporting periods are based on any user defined start date.

Note: We have included 12 monthly and 5 annual reporting periods in this template because this format is frequently required by financial institutions when submitting business plans. If you only require annual cash flow projections, refer to our Annual Cash Flow Projections template and if you only require monthly cash flow projections, refer to our Monthly Cash Flow Projections template.

The following sheets are included in the template: Assumptions - this sheet includes the default assumptions on which the monthly & annual cash flow projections are based. IncState - this sheet includes a detailed monthly income statement for 12 monthly periods and 5 annual periods. All the rows that are highlighted in yellow in column A require user input and the codes in column A are mainly used in the sales tax, receivables & payables calculations. The rows that do not contain yellow highlighting in column A contain formulas and are therefore calculated automatically. CashFlow - as with the income statement, only the rows with yellow highlighting in column A require user input. All the other rows contain formulas and are therefore calculated automatically. BalanceSheet - all balance sheet calculations are based on the template assumptions and the income statement & cash flow statement calculations. No user input is therefore required on this sheet. Loans1 to Loans3 & Leases - these sheets include detailed amortization tables which are used to calculate the interest charges and capital repayment amounts that are included on the income statement and cash flow statement. Each sheet provides for a different set of loan repayment terms to be specified.

Note: If you do not want to include any of the line items that are listed on the income statement, cash flow statement or balance sheet, we recommend hiding these items instead of deleting them. If you delete items which are used in other calculations, these calculations will result in errors which you then need to fix or remove.

Business Name & Reporting Periods

The business name and the start date for the cash flow projections need to be entered at the top of the Assumptions sheet. The business name is included as a heading on all the sheets and the reporting periods which are included in the template are determined based on the start date that is specified. This date is used as the first month and the 11 subsequent months and four subsequent years are added to form the 5 year projection period.

The income statement and cash flow statement only require user input where there is yellow highlighting in column A and the user input only relates to the 12 monthly periods. All annual totals are calculated automatically and all rows without yellow highlighting are calculated automatically in both the monthly and annual columns.

Income Statement

All monthly income statement projections need to be entered exclusive of any sales tax that may be applicable.

Turnover & Gross Profits

Monthly turnover values need to be entered on the IncState sheet for the first 12 months. The projected monthly gross profit percentages also need to be entered on this sheet and are used in order to calculate the gross profit values. The monthly cost of sales projections are calculated by simply deducting the gross profit values from the monthly turnover values.

The year 2 to 5 turnover amounts are calculated based on the totals for the first year and adjusted by the annual turnover growth rates that are specified on the Assumptions sheet. Gross profit percentages for each turnover line need to be entered on the IncState sheet. Gross profit values and cost of sales totals are calculated automatically.

The template includes two default lines in each of these sections - one for a typical product based item and one for a typical service based item. The template can therefore be used for both service and trade based businesses. There are no cost of sales and gross profit values in service based businesses and a gross profit percentage of 100% can therefore be specified. You can also hide the cost of sales and gross profit sections if you do not want to include them in your cash flow projections.