Explore our Core Investments website to learn more about our investment capabilities in fixed income, equities, multi-asset and institutional solutions.

Explore our Alternative Investments website to learn more about our investment capabilities.

Explore our Private Markets and Hedge Funds section to learn more about our comprehensive range of commingled and tailor made private market solutions.

Explore our AXA IM Select website to learn more about our multi-manager solutions for AXA unit-linked and wealth offers, as well as educational content on investment basics.

- Fund Centre

Full-year 2022 earnings

- 23 February 2023

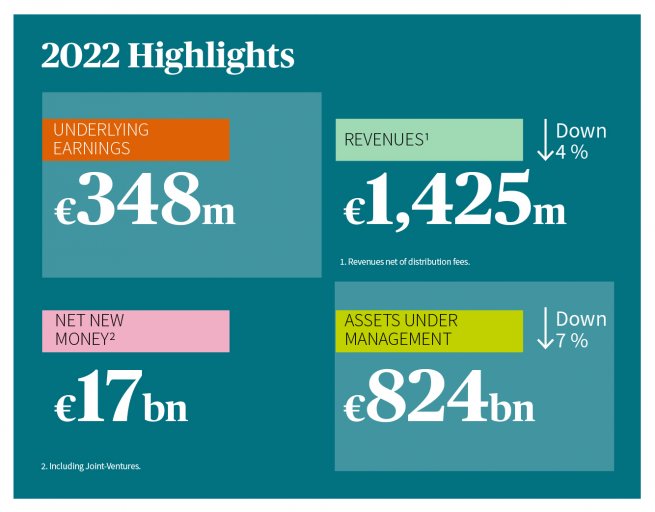

- Net inflows of €17 billion

- Underlying earnings stable at €348 million

- Revenues down 4% at €1,425 million

- “AXA IM for Progress Monitor”, to report on non-financial KPIs related to AXA IM’s responsibility as a business, investor and employer

“AXA IM delivered a robust operational performance in 2022, adapting to market volatility and turmoil successfully navigating a very challenging macroeconomic and geopolitical environment.

With resilient underlying earnings remaining at a historical high and a very good commercial dynamic translating into strong net inflows driven by third-party clients – fuelled by both AXA IM Alts and AXA IM Core – and our joint ventures in Asia, our operational model has proven its relevance and strength.”

“In such market conditions, our focus has been to get closer to our clients, to understand how this unstable environment could affect their needs and then act to provide them with adequate solutions.” said Marco Morelli, Executive Chairman of AXA IM .

“2022 has been a year of instrumental changes for AXA IM. AXA IM Alts has entered a next stage of solid growth, demonstrating suitability of its offering around four business lines: real estate, infrastructure, alternative credit and natural capital & impact investments. Additionally, we have further enhanced our investment range with the creation of AXA IM Prime, a business unit enabling our clients with an access to private markets and hedge funds, as well as the launch of our new ETF business launched by AXA IM Core. Moreover, the creation of the AXA IM Architas business unit is now also effective with a goal to be the single point of contact for AXA clients and other partners regarding Unit-Linked products.”

“In the wake of 2021, we’ve further enhanced our actions and commitments as a responsible investor, business and employer. As we need to bolster our collective and individual efforts to accelerate the transition towards a sustainable world, the recent launch of the AXA IM for Progress Monitor will provide transparency, via set metrics, on the progress against our ambition to be a leading responsible asset manager.”

“AXA IM is now the central hub for asset management within the AXA Group and we are well placed to enter the next phase of our sustainable growth for the benefit of our clients, employees and society, more broadly.” added Marco Morelli .

Full-year 2022 key highlights

All figures are sourced by AXA IM and are as of end 2022, unless otherwise specified.

Underlying earnings are stable at €348 million 1 , as lower revenues were notably offset by efficiency measures undertaken, higher contributions from the JVs as well as positive ones from AXA IM Prime and CAPZA 2 .

Net Revenues are down 4% at €1,425 million 3 , driven by a decrease in recurring fees due to asset drop and financial markets momentum, as well as lower performance fees, partly offset by the increase of transaction fees in real estate, following significative acquisitions realised in 2022.

Net inflows amounted to €17 billion , driven by third-party clients with alternative and fixed income strategies being in high demand.

These net inflows include:

- €17 billion from third-party clients, with positive inflows from both Alts and Core investment business units, partly offset by €-4 billion from AXA Insurance companies, mainly driven by asset allocation decisions.

- €4 billion from joint ventures in Asia.

Assets under management (AUM) amounted to €824 billion , down 7% compared to the end of 2021, reflecting a significantly negative market effect, despite positive net inflows.

AXA IM Prime’s €17 billion of assets previously directly managed by AXA Group are included in AXA IM’s total AUM.

The underlying cost income ratio stands at 68.5% , up 0.4 points as a result of lower revenues, despite lower costs following strengthened efficiency measures undertaken in 2022.

- QXQgY29uc3RhbnQgRlgu

- QVhBIElNIGlzIENBUFpB4oCZcyBtYWluIHNoYXJlaG9sZGVyLiBDQVBaQSBpcyBhbiBlc3RhYmxpc2hlZCBFdXJvcGVhbiBwcml2YXRlIGludmVzdG1lbnQgcGxhdGZvcm0gZm9jdXNlZCBvbiBzbWFsbCAmYW1wOyBtaWQgY2FwIGNvbXBhbmllcy4=

- UmV2ZW51ZXMgbmV0IG9mIGRpc3RyaWJ1dGlvbiBmZWVzLg==

Solid growth of the alternatives business unit demonstrating suitability of its offering in any market environment

AXA IM Alts brings together real estate, infrastructure, alternative credit and natural capital & impact investments expertises of AXA IM.

- The Alternative business unit recorded €15 billion of net new money 4 in total.

- Assets under management now stand at €198 billion , up 8% versus year-end 2021.

- Revenues are up 7% at €631 million .

These achievements in a challenging environment demonstrate the strength of AXA IM Alts’ global offering and its ability to adapt to changing market conditions and evolving investor requirements. 40% of the third-party capital was raised from non-European clients, confirming AXA IM Alts’ position as global leader in alternative investments.

AXA IM Alts raised €7.7 billion of net new money in Private Debt & Alternative Credit , with significant inflows into its real estate debt strategies (€3.5 billion), that offer very good risk return profile within the current higher interest rate environment. AXA IM Alts also collected significant amounts of capital for its Dutch mortgages offering (c. €1.1 billion) and notable flows into its US and European managed CLOs (€0.6 billion) as well as its Senior ABS & CLOs (c. €2.1 billion).

AXA IM Alts raised €3.6 billion of net new money for Real Estate Equity strategies, primarily directed towards AXA IM Alts’ core, logistics and residential real estate open ended fund range for institutional clients, with those three vehicles now exceeding €11 billion in gross AUM.

The business unit also raised €3.5 billion of net new money in Infrastructure , its fastest growing pillar. 2022 was a very active year both in terms of capital raised with institutional and retail clients, and in terms of deployment with strategic investments into Hornsea 2 in the U.K., one of the world’s largest offshore wind farms, as well as Lyntia Networks, Spain’s leading fibre business.

AXA IM Alts also strengthened its Private Equity offering through the launch of its €500 million private equity healthcare strategy, now more than halfway through in terms of capital raised. Additionally, the business expanded its Natural Capital platform with the launch of a €500 million strategy focusing on financing activity that protects vulnerable or high value natural habitats from deforestation.

- SW52ZXN0ZWQgY2FwaXRhbCByYWlzZWQgbW9uZXku

Strong momentum for the Core investment business with third-party clients

AXA IM Core brings together the Fixed Income, Equities, Multi-Asset platforms as well as the ETF business at AXA IM.

- The Core business unit has raised €9 billion of net new money from third-party clients, mainly driven by Fixed Income, more than offset by outflows deriving from the AXA Main Fund.

- Assets under management stand at €482 billion .

- Revenues are down 12% at €774 million .

Implementation of SFDR level II resulted in 78% of eligible funds and strategies being classified as article 8 or 9 5 .

AXA IM Core’s vast majority of AUM are now fully aligned to NZAMI 6 commitments and the development of the ACT range 7 (the most advanced ESG and listed impact strategies) is further prospering, now accounting for €41 billion of AUM.

In a highly volatile environment, Fixed Income gained good momentum from third-party clients with the largest contributions coming from a mix of new portfolios and top ups from institutional clients across a range of strategies. European IG credit strategies were in high-demand, including a new mandate acquisition linked to decarbonisation objectives.

Additionally, green bonds kept traction in both existing strategies and newly launched ones.

Within a risk-off environment impacting inflows, the Equity platform made progress over 2022 with key institutional clients investing in strategies. The thematic range welcomed new additions with the launch of the biodiversity and metaverse strategies and accounts for €14 billion of AUM.

Sustainable Equities strategies from the Equity QI platform recorded good inflows, while product development continued with a new strategy dedicated to the plastic and waste transition.

The Multi-Asset platform has enhanced its operating model including more quant input. Commercial success was registered with retail clients as well as institutional on global overlays and total return strategies.

Leveraging all its investment expertise, the ETF business was launched in 2022 and its AUM now exceeds €1 billion following the launch of three vehicles.

- RWxpZ2libGUgZnVuZHMuIFRoZSBjbGFzc2lmaWNhdGlvbiB1bmRlciBTRkRSIG1heSBiZSBzdWJqZWN0IHRvIGFkanVzdG1lbnRzIGFuZCBhbWVuZG1lbnRzLCBzaW5jZSBTRkRSIGhhcyBjb21lIGludG8gZm9yY2UgcmVjZW50bHkgb25seSBhbmQgY2VydGFpbiBhc3BlY3RzIG9mIFNGRFIgbWF5IGJlIHN1YmplY3QgdG8gbmV3IGFuZC9vciBkaWZmZXJlbnQgaW50ZXJwcmV0YXRpb25zIHRoYW4gdGhvc2UgZXhpc3RpbmcgYXQgdGhlIGRhdGUgb2YgdGhpcyBwcmVzcyByZWxlYXNlLiBBWEEgSU0gcmVzZXJ2ZXMgdGhlIHJpZ2h0LCBpbiBhY2NvcmRhbmNlIHdpdGggYW5kIHdpdGhpbiB0aGUgbGltaXRzIG9mIGFwcGxpY2FibGUgcmVndWxhdGlvbnMgYW5kIG9mIHRoZSBGdW5kcyBsZWdhbCBkb2N1bWVudGF0aW9uLCB0byBhbWVuZCB0aGUgY2xhc3NpZmljYXRpb24gb2YgdGhlIEZ1bmRzIGZyb20gdGltZSB0byB0aW1lIHRvIHJlZmxlY3QgY2hhbmdlcyBpbiBtYXJrZXQgcHJhY3RpY2UsIGl0cyBvd24gaW50ZXJwcmV0YXRpb25zLCBTRkRSLXJlbGF0ZWQgbGF3cyBvciByZWd1bGF0aW9ucyBvciBjdXJyZW50bHktYXBwbGljYWJsZSBkZWxlZ2F0ZWQgcmVndWxhdGlvbnMsIGNvbW11bmljYXRpb25zIGZyb20gbmF0aW9uYWwgb3IgRXVyb3BlYW4gYXV0aG9yaXRpZXMgb3IgY291cnQgZGVjaXNpb25zIGNsYXJpZnlpbmcgU0ZEUiBpbnRlcnByZXRhdGlvbnMuIEludmVzdG9ycyBhcmUgcmVtaW5kZWQgdGhhdCB0aGV5IHNob3VsZCBub3QgYmFzZSB0aGVpciBpbnZlc3RtZW50IGRlY2lzaW9ucyBvbiB0aGUgaW5mb3JtYXRpb24gcHJlc2VudGVkIHVuZGVyIFNGRFIgb25seS4=

- TmV0IFplcm8gQXNzZXQgTWFuYWdlcnMgSW5pdGlhdGl2ZS4=

- VGhlIEFDVCByYW5nZSAoaW50ZXJuYWwgY2xhc3NpZmljYXRpb24pOiB0aGVzZSBhc3NldHMgaW52ZXN0IHdpdGggYSBwdXJwb3NlIHRvIHN1cHBvcnQgdGhlIHRyYW5zaXRpb24gdG8gYSBtb3JlIHN1c3RhaW5hYmxlIGVjb25vbXkuIEZ1bmRzIGhhdmUgYmVlbiBhc3NpZ25lZCB0aGVtYXRpY3MgYWxpZ25lZCB0byBFU0cgYW5kL29yIFVO4oCZcyBTdXN0YWluYWJsZSBEZXZlbG9wbWVudCBHb2FscyAoU0RHcykgb2JqZWN0aXZlcy4gQWN0aXZlIHN0ZXdhcmRzaGlwIGlzIGEga2V5IGZvY3VzIGZvciB0aGlzIHJhbmdlLCB3aXRoIHZvdGluZyBhbmQgZW5nYWdlbWVudCByZXBvcnRpbmcgYXZhaWxhYmxlIGF0IGZ1bmQgbGV2ZWwuIFRoaXMgcmFuZ2UgZW5jb21wYXNzZXMgc3VzdGFpbmFibGUgYW5kIGxpc3RlZCBpbXBhY3QgZnVuZHMu

AXA IM Prime, the new Private Market Enabler and Hedge Funds platform

The AXA IM Prime business unit is now operating within AXA IM’s ecosystem, now with €30 billion 8 of AUM and €5 billion of commitments to be deployed over the next three years.

AXA IM Prime offers diversified sources of Private Market returns through primaries, secondaries, co-investments, as well as NAV financing and GP minority stakes solutions across private equity, infrastructure equity, private debt and hedge funds.

AXA IM Architas, the single point of contact for AXA clients and partners regarding Unit-Linked products and solutions

The creation of the AXA IM Architas business unit is effective since 1 January 2023, and its integration is progressively taking place.

In 2022 9 , net inflows amounted to €1 billion, with particularly strong commercial success in Asia (€700 million) with the majority of inflows deriving from AXA’s clients in Japan and Indonesia.

AUM now stand at €29 billion.

- QVhBIElNIFByaW1l4oCZcyDigqwzMCBiaWxsaW9uIG9mIGFzc2V0cyB1bmRlciBtYW5hZ2VtZW50IGluY2x1ZGUg4oKsMTcgYmlsbGlvbiBvZiBhc3NldHMgcHJldmlvdXNseSBtYW5hZ2VkIGJ5IEFYQSwgYW5kIOKCrDEzIGJpbGxpb24gb2YgYXNzZXRzIHByZXZpb3VzbHkgbWFuYWdlZCBieSBBWEEgSU0gQWx0cywgdGhhdCBhcmUgYWNjb3VudGVkIGluIEFYQSBJTSBBbHRz4oCZcyBBVU0gZm9yIDIwMjIu

- QVhBIElNIEFyY2hpdGFz4oCZIGZpbmFuY2lhbCBmaWd1cmVzIChhc3NldHMgdW5kZXIgbWFuYWdlbWVudCwgZWFybmluZ3MsIHJldmVudWVzKSB3aWxsIGJlIGludGVncmF0ZWQgaW50byAyMDIzIEFYQSBJTeKAmXMgY29ycG9yYXRlIGZpZ3VyZXMgcHVibGlzaGVkIGluIDIwMjQu

Launch of the “AXA IM for Progress Monitor” to report on non-financial KPIs related to our responsibility as a business, investor and employer

AXA IM has recently launched the “AXA IM for Progress Monitor” 10 , a set of metrics providing transparency and progress towards non-financial targets, contributing to AXA IM’s ambition of becoming a leading responsible asset manager.

In 2022, AXA IM furthered its initiatives pertaining to ESG:

As an investor:

- The voting policy 11 was strengthened, to further integrate ESG issues into voting decision and pay particular attention to climate change issues. Key updates included the integration of meaningful ESG metrics in CEO pay, and ESG capabilities of Boards, which led us to oppose 538 remuneration-related proposals and 24 directors’ re-election.

- New sustainable strategies were launched in fixed income, equities, private equity and through ETF.

- The number of engagement initiatives more than doubled vs 2021 , and the first round of engagement with companies identified as climate laggards was conducted.

- Net zero targets were revised in May as part of its NZAMI commitment, with now 65% 12 of AXA IM’s total assets under management managed to be in line with Net Zero .

As a business:

- The first global carbon footprint reporting was published, including Scope 3 emissions.

- The 2022 AXA IM Research Award was attributed to Dr. Ana Queiros for her work on blue carbon as a nature-based solution.

- The impact philanthropy commitment to donate 5% of the impact range’s fees to several charities supporting education, biodiversity & climate and health initiatives was perpetuated.

As an employer:

- The global EDGE Move certification was received, as a recognition of AXA IM’s progresses towards a more gender-equitable workplace.

- C. 40 positions filled were ESG-related out of the +560 people hired.

- U2VlOiBodHRwczovL3d3dy5heGEtaW0uY29tL2NoYW1waW9uaW5nLXN1c3RhaW5hYmlsaXR5L2F4YS1pbS1wcm9ncmVzcy1tb25pdG9y

- QXBwbGljYWJsZSB0byBsaXN0ZWQgZXF1aXR5IGhvbGRpbmdzLg==

- QVVNIGFzIGF0IGVuZCBvZiAyMDIxLg==

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.

This press release should not be regarded as an offer, solicitation, invitation or recommendation to subscribe for any investment service or product and is provided for information purposes only. No financial decisions should be made on the basis of information provided.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM is not responsible for the content of external websites.

You are now leaving the AXA Investment Managers (AXA IM) corporate website to another AXA Group website.

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- NVIDIA CORPORATION

- EQUINIX, INC.

- AMD (ADVANCED MICRO DEVICES)

- THE EDINBURGH INVESTMENT TRUST PLC

- NIPPON ACTIVE VALUE FUND PLC

- SUPER MICRO COMPUTER, INC.

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Yield Curve

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Dividend Kings

- Quality stocks

- Low volatility

- Multibaggers

- Growth stocks at reasonable prices

- Yield stocks

- Israeli innovation

- Millennials

- Powerful brands

- Artificial Intelligence

- In Vino Veritas

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- The genomic revolution

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

FR0000120628

Life & Health Insurance

| Market Closed - Euronext Paris 11:35:01 2024-08-28 am EDT | 5-day change | 1st Jan Change | ||

| 34.31 | +0.76% | +2.51% | +16.34% | |

| Aug. 27 | CF | |

| Aug. 22 | ZD |

- AXA : published an Investor Presentation on its implementation of IFRS 17 and IFRS9

02 Nov 2022 17:45 CET

See attachment(s) / Voir document(s) joint(s) / Zie bijlage / Ver documento(s) em anexo

16165_1115643_20221102__AXA_published_an_investor_presentation_on_IFRS17_and_IFRS9.pdf

Attachments

- Original Link

- Original Document

AXA SA published this content on 02 November 2022 and is solely responsible for the information contained therein. Distributed by Public , unedited and unaltered, on 02 November 2022 16:54:04 UTC .

Latest news about AXA

| CF | ZD | DP | ZD | CF | RE | ZD | ZD | CF | RE | MT | CF | CF | RE | CF | CF | RE | DJ | RE | ZD | ZD | RE |

Company Profile

Income Statement and Estimates

Analysis / opinion.

Weekly market update: Nvidia's Grand (Re-)Entrance

August 23, 2024 at 05:06 pm EDT

AXA : Good H1 results and sale of AXA IM

AXA CEO Thomas Buberl on Climate Change Impact

Analysts' Consensus

Quarterly revenue - rate of surprise.

- Stock Market

COMMENTS

Earnings Presentations. Access the AXA Group's earnings-related financial information: the 1Q and 9M activity indicators but also the half-year and annual results. ... Access the replay of the presentations to: the media; analysts and investors; 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 ...

Welcome to the Investor Relations section. Skip to main content Skip to footer. AXA. 33.950 ( 0.00 %) Axa worldwide. About Us; Commitments; News; Press; Investors; Careers; Investors. Half Year 2024 Earnings. AXA Group has presented its Half Year 2024 Earnings on August 2, 2024. Learn more. Are you a Shareholder yet? Find out everything you ...

AXA. 33.950 ( 0.00 %) Axa worldwide. About Us; Commitments; News; Press; Investors; Careers; view all publications. Reference Documents. 2022 Annual Report (Universal Registration Document) Download. Copy of the official xHTML version (accessible pdf) PDF 4.6 Mb Mar 21, 2023 ...

(the "Half Year 2022 Financial Report") for a description of certain important factors, risks and uncertainties that may affect AXA's business and/or results of operations. AXA undertakes no obligation to publicly update or revise any of these forward-looking statements, whether to reflect new information, future events or circumstances or

A reconciliation from the APM underlying earnings to the most directly reconcilable line item, subtotal or. total in the financial statements of the corresponding period is provided on page 15of AXA's Half-Year 2022 Activity Report. The above mentioned and other non-GAAP financial measures used in this. presentation are defined in the ...

The Group completed, on February 10, 2022, the execution of the €1.7bn share buy-back program announced on November 4, 2021. Up to €0.5bn to neutralize earnings dilution from disposals announced after December 1, 2020. Please refer to the FY21 Earnings press release issued on February 24, 2022 for further details.

statements in the table set forth on page 22 of AXA's Half -Year 2022 Activity Report. The calculation methodology of the debt gearing is set out on page 18 of AXA's Half -Year 2022 Activity Report. The above mentioned and other non-GAAP financial measures used in this press release are defined in the Glossary set forth on pages 56 to 63 of

Moody's: On July 1, 2022, Moody's Investors Service reaffirmed the financial strength rating of AXA's core subsidiaries at 'Aa3', with a stable outlook. Moody's Investors Service also assigned AXA S.A. a financial strength rating at 'Aa3' and upgraded AXA S.A.'s long-term senior debt rating from 'A2' to 'A1'.

financial measures used in this presentation are defined in the Glossary set forth on pages 56 to 63 of AXA sHalf Year 2022 Activity Report. AXA shalf-yearly financial information as of and for the six months ended June 30, 2022 was subject to a limited review by AXA sstatutory auditors, whose report was issued on August 3, 2022.

In light of our strong performance in 2022 and a robust balance sheet, the Board of Directors is proposing a dividend of Euro 1.70 per share, up 10%, and has, again, approved a share buy-back up to Euro 1.1 billion," said Thomas Buberl. "We are well positioned to deliver on our "Driving Progress 2023" key targets, and currently expect to ...

The calculation methodology of debt gearing is set out on page 25 of AXA's2022 Activity Report. AXA'sfinancial statements as of and forthe year ended December 31,2022 were examined by the Board of Directors onFebruary 22, 2023 and are subject tocompletion of anaudit procedure by AXA's statutory auditors. A2 Full Year 2022 Earnings

AXA presents today its Half Year 2022 Earnings. You can follow the presentation to the media from 3.30pm CEST and the presentation to analysts and investors from 11.00am CEST.

IFRS17/9 figures in this presentation are figures currently expected to be included in AXA's opening balance sheet under IFRS17/9 as of January 1, 2022. They are preliminary figures that are unaudited and subject to change. All other IFRS17/9-related assessments and expectations are based on AXA's estimates as of today and there can be no ...

Live webcast link and supporting documents will be available from 5:45pm GMT onwards on Wednesday November 2, 2022, on AXA's website 5: AXA Presentation on IFRS17for Analystsand Investors These key highlights and all information in this press release and the related presentation are expressly qualified by the cautionary statements included below

Full-year 2022 key highlights. All figures are sourced by AXA IM and are as of end 2022, unless otherwise specified. Underlying earnings are stable at €348 million 1, as lower revenues were notably offset by efficiency measures undertaken, higher contributions from the JVs as well as positive ones from AXA IM Prime and CAPZA 2.. Net Revenues are down 4% at €1,425 million 3, driven by a ...

The presentation will start at 3:15pm GMT. Live webcast link and supporting documents will be available from 5:45pm GMT onwards on Wednesday November 2, 2022, on AXA's website5: AXA Presentation on IFRS17 for Analysts and Investors. These key highlights and all information in this press release and the related presentation are expressly ...

Disclaimer. AXA SA published this content on 02 November 2022 and is solely responsible for the information contained therein. Distributed by Public, unedited and unaltered, on 02 November 2022 16:54:04 UTC.

AXA cancelled all repurchased shares related to the up to €0.5 billion share buy-back program. AXA announced the successful placement of €1.25 billion dated subordinated notes due 2043 On May 25, 2022, AXA announced the successful placement of €1.25 billion of Reg S subordinated notes due 2043 with institutional investors.

Present in 51 countries, AXA's 145,000 employees and distributors are committed to serving our 93 million clients. Our areas of expertise are applied to a range of products and services that are adapted to the needs of each and every client across three major business lines: property-casualty insurance, life, savings & health and asset management.

Axa Mansard Insurance Plc (MANSAR.ng) listed on the Nigerian Stock Exchange under the Insurance sector has released it's 2022 annual report. For more information about Axa Mansard Insurance Plc (MANSAR.ng) reports, abridged reports, interim earnings results and earnings presentations visit the Axa Mansard Insurance Plc (MANSAR.ng) company ...

an-investor-presentation-on-its-implementation-of-ifrs17-and-ifrs9. In the event of any inconsistency between the transcript and the podcast, the podcast will prevail. In addition, the following transcript is unedited, and ... 2022, AXA will prepare unaudited key financial information under IFRS17/9 for the first half of 2022 and for the full 2022

This presentation sets out management's current expectations of certain performance metrics for 2023 (the "2023 Targets") following the implementation of IFRS17/9 accounting standards, which became effective on January 1, 2023. The 2023 Targets are subject to important assumptions set out in AXA's press release "AXA publishes 1H22 and ...

To enable analysts and investors to better assess the Group's underlying earnings trajectory in 2023 following the implementation of IFRS17 and IFRS9, AXA is exceptionally providing a 2023 Group Underlying Earnings Target, including a breakdown by main lines of business. ... Please refer to slide 17 of the presentation for indicative ...