Switch language:

FRC publishes 3-Year Plan

- Share on Linkedin

- Share on Facebook

The UK’s Financial Reporting Council (FRC) has published its latest 3-Year Plan , outlining its priorities and objectives for the period 2023-2026. It gives a detailed breakdown of intended expenditure for 2023-24 and a summary of the expected trajectory of overall costs and headcount for the following two years. The plan has been developed following a consultation with stakeholders, and the feedback statement shows respondents were broadly supportive of the FRC’s overall approach to its responsibilities and commitment to delivering the principles outlined in the Government White Paper ‘Restoring trust in audit and corporate governance’.

The FRC anticipates an increase of £6.5m ($7.9) in its overall costs for 2023-24, reflecting a delay in the creation of the Audit, Reporting and Governance Authority (ARGA), and has re-prioritised its work to focus on changes that can be made using its existing powers and remit and where appropriate, planning for the creation of new ARGA powers and functions. Despite these challenges, the FRC has already taken numerous steps towards achieving the goals of the reform program. For example, it has released a consultation on a draft Minimum Standard for Audit Committees, as well as publishing guidance on professional judgement for auditors.

The FRC’s Supervision division has also taken responsibility for Public Interest Entity (PIE) auditor registration, which allows the FRC to act decisively when it identifies systemic issues in an audit firm. And the Enforcement division continues to deliver proportionate sanctions in a timely manner, with Constructive Engagement (CE) an increasingly useful approach to many of the cases it investigates.

FRC CEO, Jon Thompson , said: “We are actively working towards the goals of the reform program, and though the legislation required to establish ARGA has been delayed, the FRC remained busy throughout 2022 by concentrating on the changes we can bring about through our current powers and remit.

This plan shows we are committed to fulfilling our mission of serving the public interest and enhancing the quality of corporate governance and reporting.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

Forvis Mazars responds to the FRC’s market study into sustainability assurance

Frc launches discussion paper on the future of uk digital reporting, hmrc’s football crackdown continues - £67.5m in extra tax recovered in just a year, record number of 676 students named pcaob scholars for the 2024-2025 academic year, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

You are using an outdated browser. Please upgrade your browser to improve your experience.

- Client Services

- Find People

Click here to enter the knowledge section of the site.

- > Germany

- Log in / Register

Click here to open up the search.

- Publications

FRC releases revised 3-year plan following delayed ARGA transition

How would you like your page printed?

- Print web page

- Print as a PDF

The FRC has announced a revised 2023-26 Draft 3-Year Plan which sets out its revised priorities for the next three years and how it will achieve them.

This is the second three-year plan published by the FRC in 2022, following the previous 2022-25 3-Year Plan released on 5 April 2022. Whilst the revised plan re-affirms the FRC’s intentions to transition to the Audit, Reporting and Governance Authority (“ ARGA ”), the anticipated date for the transition has been pushed back from 2023 to 2024, reflecting delays to the necessary legislation to create ARGA. In addition, the revised plan has been published in draft form and, given that a clear timetable for the Audit Reform Bill remains outstanding, it is possible that this date could slip further.

Enforcement priorities and targets

Whilst the revised plan reflects knock-on delays to some activities, the objectives and deliverables for the Enforcement and Corporate Services divisions remain largely unchanged.

The FRC continue to predict that the current volatile economic climate may lead to an increase in enforcement case volumes in the coming years.

The priorities for the enforcement division remain the same as the previous plan, which include:

- embedding of, and training in new enforcement policies to reflect the Audit Enforcement Procedure (“ AEP ”) revisions;

- design and delivery of changes to support the implementation of enforcement aspects of regulatory reform;

- increasing focus on liaison and sharing information across the divisions of the FRC;

- the requirement on the enforcement supervisor liaison to support constructive engagement;

- increasing input from experienced accounting and audit professionals at earlier stages in the enforcement process; and

- increasing case team and operational resourcing.

Share & Connect

Key Contacts

Related Content

- FRC publishes more information on ARGA’s competition powers and invites feedback

- FRC publishes guidance on what makes a good environment for auditor scepticism and challenge

- FRC provides insights into potential future areas of challenge

- The FRC sets out principles for ARGA's public interest test

Close ×

You will need to log in or register to view the content

Linklaters user? Sign In

- 01. Your details

- 02. Your organisation details

Information collected as part of the registration process will be used to set up and manage your account and record your contact preferences.

Further details about how we collect and use your personal data on the Knowledge Portal, including information on your rights, are set out in our Global Privacy Notice and Cookie Notice .

Reset password

If you were registered to the previous version of our Knowledge Portal, you will need to re-register to access our content.

FRC 3-Year Plan: What it means for supervisory intervention and enforcement

United Kingdom | Publication | May 2023

Compliance with the rules is often more difficult in periods of economic volatility giving rise to scenarios in which careful judgement and good governance is required. These are also the conditions in which regulators may apply greater scrutiny to the regulated and in which formal enquiries and investigations are more likely to arise. Our experience of acting for clients on the receiving end of these interventions informs our approach to handling them with a view to assisting clients to achieve the best outcomes. Learning lessons from past enforcement action and looking ahead to likely enforcement developments assists in preparing to meet challenges as they arise.

Following publication of the Financial Reporting Council’s ( FRC ) latest 3-Year Plan for 2023-26 (the 23-26 Plan ), we consider the potential impact of FRC stated enforcement strategy and likely increased ‘constructive engagement’ and enforcement activity that companies can expect to see over the coming period, with additional experienced resource within the FRC focusing on issues arising from increased economic volatility. We also suggest some practical steps that can be taken to prepare for such developments.

Introduction

Frc enforcement strategy, practical steps.

In March 2023, the FRC published the 23-26 Plan which re-prioritises work to reflect the delay in the anticipated legislation to create the Audit, Reporting and Governance Authority ( ARGA ). This is the second 3-Year Plan published by the FRC; the first, the 2022-25 Plan , introduced the four faces regulatory approach:

(a) System Partner

(b) Supervisor

(c) Facilitator

(d) Enforcer

The 23-26 Plan for the FRC’s enforcement division builds on the 2022-25 Plan, in which the FRC committed to new responsibilities in relation to the embedding of, and training in, new enforcement policies to reflect significant revisions to the Audit Enforcement Procedure and the design and delivery of changes to support effective implementation of the enforcement aspects of regulatory reform.

The 23-26 Plan also reiterates the FRC’s continued or increased focus in certain areas of work, including:

(a) supervision liaison to support what the FRC terms as ‘Constructive Engagement’ activities (essentially a process to deal with cases where the audit quality concerns can be appropriately addressed by agreeing remedial action with the firm without the expense of a full investigation) and increasingly sophisticated ‘Non-Financial Sanctions’, such as a prohibition or a notice requiring the respondent to cease or abstain from repetition of the conduct giving rise to the breach;

(b) monitoring of the increasing number of Non-Financial Sanctions already imposed;

(c) further recruitment, including in anticipation of the increase in investigations due to the increased risk on audit reporting quality arising from current geopolitical and economic turmoil;

(d) input from experienced auditing or accounting professionals at an earlier stage in the process;

(e) operational resourcing to accommodate an increase in the size of the division; and

(f) stakeholder engagement with regulated persons.

The following key themes appear to prevail throughout the 23-26 Plan:

(a) the FRC’s expectation that there will be an increase in the volume of enforcement cases flowing from current economic volatility; according to the FRC’s website , at the time of writing seven investigations have been announced since the start of this year and given the FRC’s comments in the 23-26 Plan we anticipate that this will steadily increase as we approach the second half of the year. Continuing economic volatility including the effects of inflation will continue to impact audited entities, creating particular challenges (and opportunities) which will need to be navigated carefully with a view to mitigating the risk of an investigation (which can have considerable impact on employees and senior management time and resources, as well as on the reputation of the firm, even if the investigation is ultimately closed with no further action or sanction imposed); and

(b) the intention to continue using Constructive Engagement with firms as an “increasingly useful approach” to dealing with cases where the FRC considers that its concerns can be appropriately and satisfactorily addressed without the time and expense of going through the full investigation process. The case may be referred back to the supervision team to undertake Constructive Engagement which may result in enhanced monitoring and/or agreeing certain remedial action for example, until such time as the FRC considers the risks relating to the audit firm’s poor conduct has been addressed.

(a) fair, robust, timely case closures;

(b) upskilling and training;

(c) collaboration with the Department for Business and Trade on planned legislative change;

(d) upskilling to enable implementation of future powers arising from proposed regulatory reform in 2024 onwards; and

(e) publication of the Annual Enforcement Review to deliver transparency and drive improved behaviours through messaging of case outcomes.

The FRC notes that these deliverables will contribute in particular to the anticipated ARGA directors enforcement regime, perhaps a sign of things to come for the FRC’s future enforcement strategy.

Drawing on experience and our lessons learned from advising clients when responding to supervisory intervention and enforcement proceedings, we have set out below a reminder of some key points to assist firms and senior managers to mitigate against escalation of regulatory intervention and/or manage enforcement investigation by the FRC (and other regulators):

(a) Responding to regulatory enquiries: The timeliness and manner of a firm’s response to an information requirement or query from the regulator can set the tone of the relationship from the outset. The approach taken will clearly need to be tailored to the circumstances of the case, avoiding a one-size-fits-all approach. Where possible, responding in a helpful but proportionate manner and being open about any challenges that the line of enquiry may present (for instance in terms of resourcing or time taken to respond) can assist in narrowing or refining the scope of the enquiry in the first instance.

(b) Consider obligations to notify: In light of a regulatory enquiry and/or an internal escalation or investigation following self-identification of a potential issue or breach, firms must be alive to their potential obligations to make a regulatory notification of matters of material significance as soon as practicable. Notifying early and being open and cooperative with the regulator may mitigate the risk of more muscular supervisory intervention or enforcement action further down the line.

(c) Prioritise governance and appropriate MI: A robust governance framework is key to providing the requisite checks and balances to management and identifying risks early to avoid escalation of detriment to the firm and its clients; whilst it may seem obvious that sufficiently quantitative and qualitative management information ( MI ) are intrinsic to good reporting and governance arrangements, firms may wish to consider (to the extent they do not do so already) including recent FRC enforcement trends and “lessons learned” in the collation and reporting of their MI. Monitoring enforcement action published against others can be a helpful tool in identifying potential gaps or early warning signs in firms’ own systems and controls and considering appropriate remedial action or any enhancements that may need to be made (before it comes to the attention of the FRC or becomes significant enough to merit a regulatory notification).

(d) Privilege: Regulators may request a waiver of privilege over material they consider relevant to their investigation, for example in relation to legal advice that the firm has received in relation to the matters under investigation. A decision to waive privilege needs to be weighed carefully with the benefit of advice as there can be both advantages and risks in doing so.

(e) Record keeping: Firms should keep records of decisions and steps taken both during and following any regulatory intervention or enquiry, ensuring all of the points set out above are documented appropriately including any communication (whether oral or in writing) with the regulator and/or other law enforcement authorities.

- Financial institutions

Practice areas:

- Financial services and regulation

- Regulation and investigations

Recent publications

Publication

Shareholder inspections of corporate books and records

On suspicion of corporate misconduct or mismanagement, shareholders of a corporation will often begin their investigation by seeking the books and records of the corporation to determine whether they have a valid claim.

United States | August 20, 2024

DOJ Corporate Whistleblower Awards Pilot Program pits whistleblowers versus companies

On August 1, 2024, the US Department of Justice (DOJ) officially rolled out its Corporate Whistleblower Awards Pilot Program (Awards Program). The program is focused on financially incentivizing whistleblowers to report allegations of corporate crime.

United States | August 06, 2024

Compliance Quarterly Türkiye

In this fifth issue of our Compliance Quarterly, we continue to inform our clients about the global and local compliance rules and regulations which impact Turkish businesses.

Global | August 05, 2024

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023

- Canada (English)

- Canada (Français)

- United States

- Deutschland (Deutsch)

- Germany (English)

- The Netherlands

- Türkiye

- United Kingdom

- South Africa

- Hong Kong SAR

- Marshall Islands

- Nordic region

- Market Insight

- Pricing and Fees

- X (formerly Twitter)

FRC publishes draft 3-year Plan for 2023-26

The Financial Reporting Council (FRC) has announced its 2023-2026 draft 3-Year Plan which sets out its priorities for the next three years and the resources it will need to achieve them .

The plan incorporates a balanced yet assertive approach and reflects the delay of anticipated legislation to create the Audit, Reporting and Governance Authority (ARGA), which has had an impact on the associated increase in capacity, cost and headcount previously expected to occur in 2023.

Overall, the budgeted cost of the FRC and the UK Endorsement Board will increase to £67.9m, up from £59.8m last year, with a 9.7% increase in budgeted headcount by March 2024.

The FRC has used 2022 to focus on the changes it can make with the powers it already has. The 2023-26 plan includes the completion of activities we publicised in our July Position Paper as well as looking ahead to the creation of new statutory powers and functions for ARGA, which we currently assume will occur in 2024.

Sir Jon Thompson, Chief Executive of the FRC, said: “Despite the continued delay to the legislation required to create ARGA, 2022 was another busy period for the FRC as we continue to focus on the changes we can make using our existing powers and remit. … “This plan will enable us to deliver on our mission to serve the public interest and improve the quality of corporate governance and reporting and continue to work towards the aspirations of the reform programme.”

The 2023/26 Strategy and Plan & Budget consultation will run until 27 January 2023 . Respondents should submit their comments to [email protected] by close of business on that date.

Source: FRC

At LS Consultancy our accountancy services provide you with over 15 years’ experience in various industries and multi-national organisations.

Our range of innovative solutions can be tailored to suit your unique requirements, no matter whether you’re currently working from home, or are continuing to go into the office. Our services can be deployed individually or combined to form a broader solution to release your energies and focus on your clients.

Contact us today for a chat or send us an email to find out how we can support you in meeting your current and future challenges with confidence.

Explore our full range today .

Why Not Download our FREE Brochures! Click here .

Call us today on 020 8087 2377 or send us an email ..

Connect with us via social media and drop us a message from there. We’d love to hear from you and discuss how we could help.

Facebook Instagram LinkedIn Twitter YouTube

- Sign in to your personal account

- Not registered? Sign up for a personal account

- Have an access token?

- How to use this site

FRC publishes draft 3-year Plan for 2023-26

Tax and Accounting Update

If you would like to access this content, but you are not currently a subscriber, please sign up for a free trial here . If you already subscribe to this service please login here .

Subscriber Login

ICAEW users please register or login here »

- Login with Shibboleth »

- Privacy and Cookie Policy

- Terms & Conditions

- Accessibility Statement

- Bloomsbury Professional

- Bloomsbury.com

© Bloomsbury Publishing Plc 2023

- [185.80.151.41]

- 185.80.151.41

Resources Helpful Sections for the FIRST Community

- Resources Overview

- Helpful Documents

- Helpful Links

- Award Submissions

- AdamBots Logo

- Business Plan

- Creating a FIRST Team Website

AdamBots Business Plan

“The Entrepreneurship Award sponsored by Kleiner Perkins Caufield & Byer celebrates the entrepreneurial spirit by recognizing a team that, since inception, has developed the framework for a comprehensive business plan to scope, manage, and achieve team objectives. This team displays entrepreneurial enthusiasm and the vital business skills for a self-sustaining program. In 2023, this award was replaced with the Sustainability Award sponsored by Dow. In order to be considered for this award, a formal business plan must be completed and a copy given to the judges during the Pit interview process.” – firstinspires.org

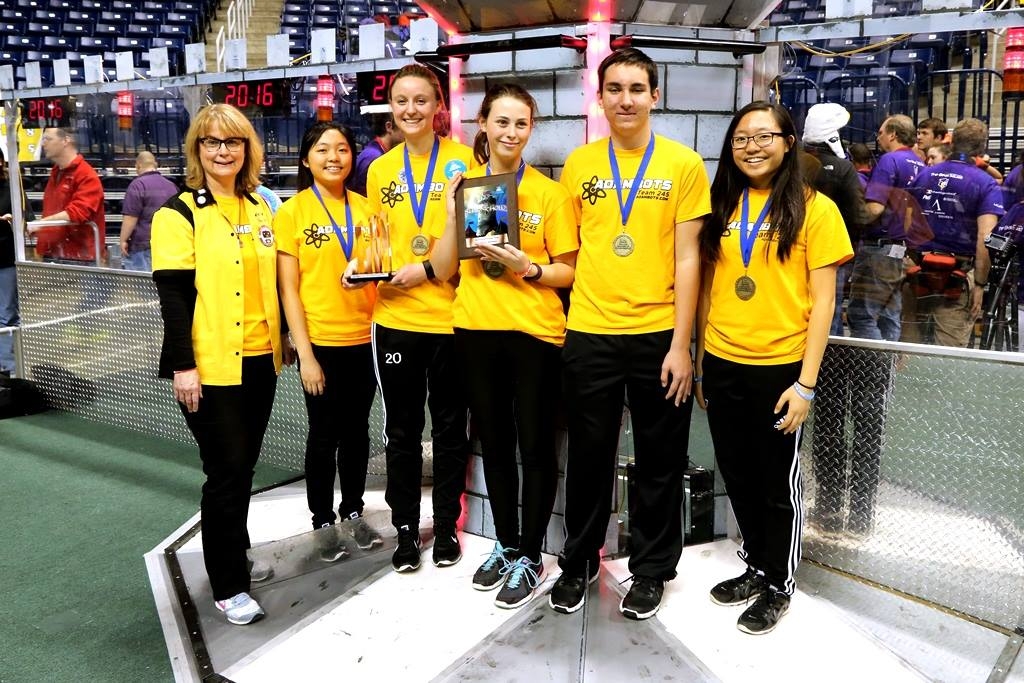

Our team first developed a comprehensive business plan during the 2011 FIRST season. Six students and one mentor wrote and developed a plan for sustainability, continuity, and impact as a FIRST team. Our entrepreneurial spirit was awarded at the 2011 FIRST Troy District as we were awarded the Entrepreneurship Award sponsored by Kleiner Perkins Caufield & Byer for the first time in our team’s history. Each year, we have continued to build upon the strong foundation laid out in 2011 by continuously adding and updating to our Business Plan.

2024 AdamBots Business Plan

2023 AdamBots Business Plan

2022 AdamBots Business Plan

2021 AdamBots Business Plan

2020 AdamBots Business Plan

2019 AdamBots Business Plan

2018 AdamBots Business Plan

2017 AdamBots Business Plan

2016 AdamBots Business Plan

2015 AdamBots Business Plan

2014 AdamBots Business Plan

- Sub-Team Summaries

2013 AdamBots Business Plan

2012 AdamBots Business Plan

- Continuity of Operations Plan

- Balanced Scorecard

- Team Structure Diagram – Engineering

- Team Structure Diagram – Non-Engineering

2011 AdamBots Business Plan

- One Page Plan

Business Planning Resources

To support other FIRST teams, we’ve written some resources on how we do business planning and entrepreneurship. Here are our guides and presentations, including those done in partnership with other FIRST teams.

NOTE: Entrepreneurship Award Guide is written for the pre-2019 criteria, which has since been adjusted.

Writing a Business Plan

Entrepreneurship Award Guide

Business Planning Presentation

2019 Michigan State Championship – Dow Division Entrepreneurship Award

2016 Queen City Regional Entrepreneurship Award

2014 Howell District Entrepreneurship Award

2011 Troy District Entrepreneurship Award

Entrepreneurship Awards:

- 2019 – Michigan State Championship – Dow Division

- 2019 – Kettering 1 District

- 2018 – Michigan State Championship – Ford Division

- 2018 – Escanaba District

- 2017 – Michigan State Championship – Dow Division

- 2017 – Escanaba District

- 2016 – Queen City Regional

- 2016 – Centerline District

- 2014 – Howell District

- 2013 – Grand Blanc District

- 2012 – Michigan Championship

- 2012 – Troy District

- 2012 – Alamo Regional

- 2011 – Troy District

- Project Managment

How to Create a Winning FRC Business Plan

Introduction.

FRC Business Plan is a comprehensive guide to help entrepreneurs and business owners create a successful business plan. It provides step-by-step instructions on how to develop a business plan, from researching the market and industry to creating a financial plan and marketing strategy. It also includes tips and advice on how to make the most of your business plan and how to ensure it is successful. With the help of this guide, you can create a business plan that will help you achieve your goals and objectives.

Creating a winning FRC business plan requires careful consideration of the goals and objectives of the organization, as well as a thorough understanding of the competitive landscape. The following steps will help guide you in creating a successful business plan for your FRC team.

1. Define Your Goals and Objectives : Before you begin writing your business plan, it is important to define the goals and objectives of your FRC team. Consider the long-term vision of the organization and the short-term goals that will help you achieve that vision.

2. Research the Competition : It is important to understand the competitive landscape in order to create a successful business plan. Research the other FRC teams in your area and analyze their strategies and successes. This will help you identify areas where you can differentiate your team and create a competitive advantage.

3. Develop a Business Model : Once you have identified your goals and objectives, and researched the competition, it is time to develop a business model. This should include a detailed description of the products and services you will offer, the target market, pricing strategy, and marketing plan.

4. Create a Financial Plan : A financial plan is essential for any business plan. This should include a detailed budget, cash flow projections, and a break-even analysis.

5. Write the Plan : Once you have developed your business model and financial plan, it is time to write the business plan. This should include an executive summary, company overview, market analysis, competitive analysis, product/service description, marketing plan, operations plan, and financial plan.

By following these steps, you can create a winning FRC business plan that will help your team achieve its goals and objectives. Good luck!

The Benefits of Developing an FRC Business Plan

Developing a business plan for a First Responder Corporation (FRC) is an important step in ensuring the success of the organization. A business plan provides a roadmap for the organization to follow and helps to ensure that all stakeholders are on the same page. It also serves as a tool to help the organization secure funding and resources.

The benefits of developing an FRC business plan are numerous. First , it provides a clear vision for the organization and its goals. It outlines the mission, objectives, and strategies of the organization, as well as the resources needed to achieve them. This helps to ensure that all stakeholders are working towards the same goals and that the organization is on track to meet its objectives.

Second , a business plan helps to identify potential risks and opportunities. It provides a framework for assessing the organization’s strengths and weaknesses, as well as potential threats and opportunities. This helps to ensure that the organization is prepared for any potential challenges that may arise.

Third , a business plan helps to secure funding and resources. It provides a detailed overview of the organization’s financial needs and how they will be met. This helps to ensure that the organization has the necessary resources to achieve its goals.

Finally , a business plan helps to ensure that the organization is well-managed. It outlines the roles and responsibilities of each stakeholder, as well as the processes and procedures that will be used to ensure that the organization is running smoothly. This helps to ensure that the organization is operating efficiently and effectively.

In conclusion , developing an FRC business plan is an important step in ensuring the success of the organization. It provides a roadmap for the organization to follow, helps to identify potential risks and opportunities, and helps to secure funding and resources. It also helps to ensure that the organization is well-managed and operating efficiently and effectively.

Tips for Writing an Effective FRC Business Plan

1. Begin with an Executive Summary : Provide a brief overview of the business plan, including the purpose of the plan, the company’s mission and vision, and the key points of the plan.

2. Describe the Company : Provide a detailed description of the company, including its history, products and services, and competitive advantages.

3. Outline the Market : Describe the target market, including the size of the market, the customer base, and the competition.

4. Develop a Marketing Plan : Outline the strategies and tactics that will be used to reach the target market, including advertising, promotions, and public relations.

5. Establish Financial Goals : Set financial goals for the company, including sales, profits, and cash flow.

6. Create a Financial Plan : Develop a financial plan that includes a budget, cash flow projections, and a break-even analysis.

7. Identify Risks and Opportunities : Identify potential risks and opportunities that could affect the success of the business.

8. Outline the Management Team : Describe the management team and their qualifications.

9. Include Supporting Documents : Include any supporting documents, such as resumes, financial statements, and contracts.

10. Proofread and Edit : Carefully proofread and edit the business plan to ensure accuracy and clarity.

The Role of Financial Forecasting in an FRC Business Plan

Financial forecasting is an essential component of any FRC business plan. It is a critical tool for predicting the future performance of a business and helps to inform decisions about the allocation of resources and the development of strategies. Financial forecasting helps to identify potential risks and opportunities, and provides a basis for setting realistic goals and objectives.

Financial forecasting involves the use of historical financial data to project future performance. This data is used to create financial models that can be used to estimate the future cash flow, profitability, and other financial metrics. The models are based on assumptions about the future economic environment, the competitive landscape, and the company’s own performance.

Financial forecasting is an important part of the FRC business plan because it helps to identify potential risks and opportunities. It can be used to assess the impact of changes in the external environment on the business, and to identify areas where additional resources may be needed. It can also be used to develop strategies for managing cash flow and profitability.

Financial forecasting is also important for setting realistic goals and objectives. By understanding the potential risks and opportunities, the business can set realistic goals and objectives that are achievable and that will help to ensure the long-term success of the business.

In summary, financial forecasting is an essential component of any FRC business plan. It helps to identify potential risks and opportunities, and provides a basis for setting realistic goals and objectives. Financial forecasting is an important tool for predicting the future performance of a business and helps to inform decisions about the allocation of resources and the development of strategies.

How to Use Market Research to Create an FRC Business Plan

Creating a business plan for an FRC (Family Resource Center) requires a thorough understanding of the market and the needs of the target population. Market research is essential to ensure that the FRC is able to meet the needs of the community and to develop a successful business plan.

The first step in using market research to create an FRC business plan is to identify the target population. This includes understanding the demographics of the area, such as age, gender, income level, and education level. It is also important to understand the needs of the target population, such as health care, education, and employment.

Once the target population has been identified, the next step is to conduct market research. This includes gathering data on the current services available in the area, the demand for services, and the competition. This data can be gathered through surveys, interviews, focus groups, and other methods.

The next step is to analyze the data gathered from the market research. This includes understanding the needs of the target population, the services that are currently available, and the competition. This analysis will help to identify gaps in the services available and potential opportunities for the FRC.

Once the analysis is complete, the next step is to develop a business plan. This includes creating a mission statement, setting goals, and outlining strategies for achieving those goals. The business plan should also include a budget and a timeline for implementation.

Finally , the business plan should be reviewed and revised as needed. This includes making sure that the plan is realistic and achievable. It is also important to ensure that the plan is in line with the mission and goals of the FRC.

By using market research to create an FRC business plan, the FRC can ensure that it is able to meet the needs of the target population and develop a successful business plan.

The Importance of Strategic Planning in an FRC Business Plan

Strategic planning is an essential component of any successful business plan. It is the process of setting goals, determining actions to achieve those goals, and evaluating the progress of those actions. Strategic planning helps organizations to focus their resources and energy on the most important objectives, while also providing a framework for decision-making.

In an FRC business plan, strategic planning is especially important. FRCs are typically small businesses with limited resources, so it is essential to ensure that resources are allocated in the most effective way possible. Strategic planning helps to ensure that the business is focused on the most important objectives and that resources are used in the most efficient manner.

Strategic planning also helps to ensure that the business is able to respond quickly to changes in the market. By having a plan in place, the business can quickly adjust its objectives and actions to take advantage of new opportunities or to mitigate risks.

Finally , strategic planning helps to ensure that the business is able to measure its progress and make adjustments as needed. By setting measurable goals and tracking progress, the business can identify areas of improvement and make changes to ensure that it is meeting its objectives.

In summary, strategic planning is an essential component of any successful FRC business plan. It helps to ensure that resources are allocated in the most effective way, that the business is able to respond quickly to changes in the market, and that progress is tracked and measured. By taking the time to develop a comprehensive strategic plan, FRCs can ensure that their business is well-positioned for success.

- business plan overview

- FRC Team 568 2020 Business Plan

- AdamBots Business Plan

- Previous How to Create a Comprehensive Flower Farm Business Plan

- Next How to Prepare for the HCC Business Plan Competition

How Critical Path Analysis Can Help Improve Project Management Efficiency

How To Use A Gantt Chart In Project Management

How to Leverage an Executive Development Program in Project Management to Enhance Your Career

Your email address will not be published. Required fields are marked *

- Sample Page

- Updated Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

Biden asks Supreme Court to lift block on student loan repayment plan

A recent poll said that less than half of americans supported student loan forgiveness..

Student loan borrowers enrolled in SAVE won't have to make payments while the courts decide the program's fate. ( iStock )

President Joe Biden's administration has asked the Supreme Court to lift a block on the Saving on a Valuable Education (SAVE) plan , which is designed to ease the burden of student loan debt for millions of borrowers.

Biden introduced SAVE after the Supreme Court struck down Biden's student loan forgiveness plan . The White House said that the SAVE plan could lower borrowers' monthly payments to zero dollars, reduce monthly costs in half and save those who make payments at least $1,000 yearly. Additionally, borrowers with an original balance of $12,000 or less will receive forgiveness of any remaining balance after making 10 years of payments.

Legal challenges from Republican-led states resulted in a temporary block of the program until the litigation concluded. The 8th Circuit Court of Appeals issued a preliminary injunction blocking the SAVE student loan repayment plan. The block prevents the Department of Education from offering the plan while litigation continues. In the meantime, borrowers enrolled in the SAVE Plan are being moved into forbearance while the Biden administration defends the plan in court.

"We remain committed to supporting borrowers and fighting for the most affordable repayment options possible for millions of people across the country," U.S. Secretary of Education Miguel Cardona said in a statement. "Already, we've approved $169 billion in relief for nearly 4.8 million Americans entitled to relief under various programs, including teachers, veterans, and other public servants; students who were cheated by their colleges; borrowers with disabilities; and more. President Biden, Vice President Harris, and I are committed to fighting for college affordability for all."

Private student loan borrowers can't benefit from federal loan relief. But you could lower your monthly payments by refinancing to a lower interest rate. Visit Credible to speak with an expert and get your questions answered.

PRIVATE STUDENT LOAN FORGIVENESS: 7 OPTIONS

Less than half of all borrowers make payments

Roughly 40% of borrowers are current on their student loan payments since they resumed in October following a three-year pause due to the COVID-19 pandemic, according to a recent Government Accountability Office report .

As of January 31, 2024, nearly a quarter of borrowers in repayment (7.3 million) were enrolled in the SAVE repayment plan. Because of the court order injunction, these borrowers will not have to make payments on their student loans while the litigation is ongoing and will not accrue interest on their loans during the forbearance.

However, the time spent in forbearance won't count towards Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) forgiveness. PSLF forgives federal student loans after 10 years of qualifying payments, or 120 payments, for borrowers who work full-time for a qualifying government or nonprofit organization. IDR plans have a loan forgiveness benefit after a required repayment term of 20 or 25 years, depending on the plan.

"This injunction, if allowed to stand, would harm borrowers who have dutifully repaid their loans for up to 25 years by denying forgiveness that has been available under law for three decades," Cardona said.

If you're having trouble making payments on your private student loans, you won't benefit from federal relief. However, you could consider refinancing your loans for a lower interest rate to lower your monthly payments. Visit Credible to get your personalized rate in minutes.

HOW MUCH CAN I BORROW IN STUDENT LOANS?

Poll shows fewer adults support debt forgiveness

According to a recent AP-NORC Center for Public Affairs poll , less than half of Americans (39%) said they supported federal student debt cancellation.

Americans were more likely to support forgiveness of some or all of a student loan debt in certain situations, like if the borrower was defrauded or misled by their school or in cases where the borrower made on-time payments for 20 years or the loans accrued more interest than originally borrowed. Other reasons Americans may support debt cancellation is if the borrowers attended school at an institution that left them with a large amount of debt compared to their income or if they are experiencing financial hardship.

"In recent years, more than a million borrowers who were defrauded by the schools they attended have received debt relief from the government, and the survey shows that forgiveness under such circumstances is supported by a majority of Americans," University of Chicago Harris School of Public Policy Associate Professor Lesley Turner said. "Although existing forgiveness policies may receive less attention than broad-based student loan forgiveness plans, such as the one overturned by the Supreme Court in 2023, they are an important source of relief for the most vulnerable borrowers – those who took on debt but did not necessarily benefit from their investment in the ways they hoped."

If you hold private student loans, you could lower your monthly payments by refinancing to a lower interest rate. Visit Credible to speak with an expert and get your questions answered.

HOW TO PAY FOR COLLEGE: 8 STRATEGIES TO SAVE MONEY

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.

More From Forbes

Comparing franchise vs. independent restaurants for 2023.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Robin Gagnon is the CEO and Co-Founder of We Sell Restaurants , a business broker franchise focused on the sale of restaurants.

Restaurant industry sales are expected to reach $855 billion in 2023 , returning to near pre-pandemic, 2019 levels and demonstrating healthy recovery for the industry. Profits, on the other hand, are challenging as operators deal with inflationary pressure on food and labor costs along with supply chain issues and attracting employees. In surveying operators, the National Restaurant Association found that 50% of operators surveyed expect to make less profit in 2023 . Based on these key factors, will franchise or independent restaurants be better positioned in 2023? Here is a comparison.

When it comes to running a successful restaurant in today’s challenging environment, efficiency is key. Managing food costs, adjusting labor hours and controlling operations are critical elements to deliver every dime to the bottom line of a restaurant operation.

Franchised restaurants often have an advantage over independent restaurants when it comes to successfully executing in a streamlined and effective way. Countless articles point to the many ways the franchise industry is employing technology to increase efficiences at the unit level. The fundamentals of a franchise model require repeatable and trainable systems that maximize efficiency in delivery of a similar experience for the consumer across multiple units.

What franchisors gain in efficiency may be lost in the creativity of the menu, a key driver for many customers. Independent operators can seize on the fresh catch of the day to offer the latest palate-pleasing dishes at the spur of the moment. This is a more labor-intensive and less efficient approach, but one that can win over customers and bring them back to sample the latest creations. That's an advantage that can't be matched in a franchise opportunity, which must conform to a single menu nationwide.

Business Models

For entrepreneurs just breaking into the business, franchises offer a great way to start. From fast food restaurants to full-service and quick casual, franchising gives startup businesses access to an existing business model and brand strategies that help them succeed in their industry. Recent data indicates that around 50% of franchisors anticipate growth of 10% or more in 2023 . With established systems, marketing strategies and tried-and-true products and services, entrepreneurs can have the best of both worlds: They get to be their own boss while taking advantage of established infrastructure already in place.

Independent restaurant owners, on the other hand, get the freedom of creating their own concept. In addition, they have the agility to adapt amid changing business conditions without taking changes to Corporate for approval by the brand.

Brand Recognition In A Competitive Climate

With inflation hitting families hard and multiple signs on the horizon of a looming recession , it is unknown whether having brand name recognition may mean the difference for a family dining out. Households pulling back on spending could be less likely to take risks trying new or unknown concepts. But while franchises have great name recognition, the local operator may be extremely well known within the market.

What is certain is that if money is tight, families will search for less expensive dining options. In Q3 2022, YELP reported that searches for budget dining and groceries were up by 11% from the previous quarter and 9% compared to Q3 2021.

Access To Capital And Resources That Help Growth

Franchise restaurants have ready access to capital and resources. In a tightening lending market with deals stress-tested at higher than ever interest rates, lenders may be more willing to fund start-up and resale franchise locations than independent small unit operators.

Prime Locations That Drive Foot Traffic

Establishing a successful business requires strategic planning, and location plays a significant role. All businesses understand the importance of location and focus their resources on securing prime locations that will drive traffic. Increased visibility makes it easier to draw customers in with favorable advertising and promotional activities.

For franchise restaurants, there are typically full leasing departments, sophisticated software platforms and mapping applications working to find the best possible store locations. Independent concepts generally rely on local commercial brokers for access to location and may not have the same resources available to franchises for identifying target sites.

Ability To Adapt To Change

The pandemic forced brands into warp speed in terms of adaptation, and many still have their foot firmly on the pedal as they innovate and adapt. Technology continues to be cited as a major way to overcome staffing challenges of the restaurant model . Franchisors are driven to adopt technology rapidly and implement ahead of the curve, and many franchise agreements are now including technology fees to ensure important initiatives remain funded for the future.

Independent operators are generally unable to leverage the scale of large systems to adopt technological changes. They can still implement new technology, however, so long as they plan for the cost and potential reduced speed at which they adapt.

Ability To Leverage Economies Of Scale On Supply Chain

Franchise restaurants leverage the supply chain of their franchisor to minimize disruptions that could impact independent operators. All signs indicate that supply chain shortages are far from over . Franchises benefit from the economies of scale of the franchisor. Through bulk purchases, franchises can save on operating costs and can pass down lower prices to customers.

An independent operator is on their own to purchase supplies and food. In 2021, it was widely reported that North America’s largest wholesale food distributor was pausing service to “a limited number of customers as they experienced labor shortages. These were primarily independent restaurant concepts. Franchisees of major brands were unaffected as they had contracts in place with vendors. Cost-efficient supply chains support profitability for franchisees, creating an economic edge for the establishments.

Signs point to a continued tough year for the restaurant industry in 2023. But for entrepreneurs breaking into the business game or seeking a business to acquire from the robust resale market, there is still opportunity among both franchise and independent models. Overall, however, franchises may have a competitive edge.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

- Editorial Standards

- Reprints & Permissions

Understanding retirement calculators

How to use a retirement calculator, benefits of using a retirement calculator, accurate retirement calculator: plan your future with ease.

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate investing products to write unbiased product reviews.

- Retirement calculators provide a rough estimate of how your invested savings will grow over time.

- Our retirement calculator tracks your retirement savings progress and shows if you might fall short.

- Compare the estimated retirement funds with the amount you will need by your desired retirement age.

Taking advantage of the compound growth, tax advantages, and investment opportunities provided by the best retirement plans is the first step in building long-lasting wealth. But how do you know if you've contributed enough to support yourself during your golden years?

Business Insider's free retirement calculator offers free estimates to help you plan accordingly based on personal details like your life expectancy, income, expected expenses, and estimated retirement age.

Here is how you can use an online retirement calculator and the information you need to generate an accurate estimate.

Retirement Calculator

Use insider’s calculator to see if you’re on your way to a comfortable retirement by answering a few questions about yourself, your savings, and how long you expect to keep working..

70% of pre-retirement income

*Need is based on covering 70% of your annual pre-retirement income and a life expectancy of 100 years.

What is a retirement calculator?

Retirement calculators are free online planning tools that estimate how your invested savings will grow based on personal and economic factors.

"If you start investing in your retirement plans in your early 20s, the more likely you'll have a larger pool of money to support you in retirement than if you start saving and contributing to retirement accounts later in life," says Chloe Wolhforth, financial planner and senior managing director at Angeles Investments .

Business Insider's retirement calculator, above, is designed to track your savings progress with detailed retirement projections. It's based on the idea that Americans generally spend less as they age and can sustain a 30- to 40-year retirement on 70% of their pre-retirement income.

The calculator generates two important numbers:

- The amount you will have by your desired retirement age. By providing your current savings rate and retirement account balances, the retirement calculator can estimate how much money you'll have in savings or investments by retirement.

- The amount you will need by your desired retirement age. Using your current income and expected salary increases, the retirement calculator can estimate how much money you'll need in savings or investments by retirement.

How much you'll need to retire may be more or less than the 70% rule of thumb, depending on your lifestyle. For a more accurate estimate of how much you can expect to spend in retirement, consult a financial advisor .

Why you need a retirement calculator

The best retirement calculators estimate how much you need to save for your future using personal and financial information. A general rule of thumb is that the earlier you start saving, the better.

Investing your savings and accumulating compound interest is the best way to grow long-term wealth. Now is the time to start if you're not already contributing to a retirement savings plan like a 401(k) or IRA.

Inflation is considered when calculating retirement savings. But remember, a retirement calculator can't predict the future, and the actual inflation rates may vary. It can't predict market crashes, failed investments, or future financial hardships. It is only one of many financial planning tools you need to ensure a comfortable retirement.

Input your personal and financial information

For the retirement calculator, we define a comfortable retirement as living on 70% of your pre-retirement income. However, the calculator is customizable. If you're able, incorporate as many specific details as possible.

Here's what you'll need to input:

- Personal information: Current age and the age at which you expect to retire.

- Current retirement balance: The total retirement savings across all your accounts, including 401(k)s and IRAs .

- Current household income: Your annual gross income (the amount you earn before taxes).

- Rate of savings: How much money you save toward retirement each month. You can enter this as a dollar amount or a percentage of your income.

The following inputs are pre-filled, but you can change some to customize your retirement calculation further.

- Expected annual salary increases: How much do you expect your salary to increase each year? The calculator's default is 2%.

- Anticipated monthly spending in retirement: We assume you'll spend 70% of your pre-retirement income (the amount you're projected to earn right before you retire), but you can change that number if you expect to spend more or less.

- Life expectancy: How long do you expect to live? The default calculation uses a life expectancy of 100 years.

- Investment returns: We assume your savings are invested and earn a 5% annual rate of return. If your retirement savings aren't invested, you may be missing out on earnings through capitalizing on compound interest.

Analyze the results of the retirement calculator

Don't be discouraged if the retirement calculator shows you fall short of your financial target. There's still time to adjust your savings rate or investment strategy to meet your goal.

Increasing your income is one of the most effective ways to catch up on retirement savings. If you cannot score a raise in your current position, consider switching jobs for a higher salary or better benefits, such as a more generous 401(k) match, or investing in stocks and similar assets.

Other strategies you can consider are maxing out your 401(k), contributing to a Roth or traditional IRA , or working with a financial advisor to boost your savings further.

"Investing is a critical part of growing wealth. It is important to invest savings that you have identified as long-term so your assets can grow over time," Wolhforth says.

Above all, be flexible. As you approach retirement, consider taking a part-time job, waiting to claim Social Security benefits, downsizing your home, or relocating to a more affordable city.

Using a retirement calculator to see where you stand provides several perks. Here are some of the benefits of retirement calculators:

- Snapshot of your future: A rough estimate of how much money you'll need to retire by a certain age is better than having no estimate.

- Identify shortfalls: The calculator shows if you might fall short of your financial goal, allowing you to plan for a higher savings rate or find supplementary income sources.

- See your options: By adjusting the calculator's inputs — such as changing your savings rate or your planned retirement age — you can see how your overall plan is affected.

"Depending on when you want to retire, your employment, your tax status, and other considerations, a blend of multiple accounts may be suitable," says Jordan Gilberti, senior financial planner at Facet.

FAQs about retirement calculators

The accuracy of a retirement calculator can vary, but it is always a rough estimate. Online calculators cannot predict economic shifts or financial hardships that may impact invested funds. Retirement calculators provide estimates based on your inputs, but their accuracy depends on the data you provide and the assumptions used.

The information you need to use a retirement calculator includes details about your current savings, income, retirement age, expected expenses, and similar data. Retirement calculators also adjust estimations based on predicted inflation and compound growth.

A retirement calculator can help you save more by revealing whether your current contributions and investment strategy are on track. Based on your estimated retirement age and preferred lifestyle, you can better gauge how long your savings will last. It helps to set realistic goals and adjust your retirement saving strategies accordingly.

Many free retirement calculators are reliable financial planning tools using standard financial models. However, retirement calculators only provide estimates, so the generated rate of return may not always be accurate. If you're worried about coming short, consider consulting a financial advisor to help grow your retirement savings.

You should use a retirement calculator on an annual basis or whenever your financial situation changes. It is a good idea to recalculate your estimated retirement savings if you change your salary deferral rate, have increased income, or are considering withdrawing from your retirement savings to afford other expenses.

- Credit cards

- Investing apps

- Retirement savings

- Cryptocurrency

- The stock market

- Retail investing

- Real estate/mortgages

- Retirement planning

- Small business finances

- Main content

- News and events

FRC publishes 3-Year Plan with continued growth ahead

News types: Generic Announcement

Published: 27 March 2023

The Financial Reporting Council (FRC) has published its latest 3-Year Plan , outlining its priorities and objectives for the period 2023-2026. It gives detailed breakdown of intended expenditure for 2023-24 and a summary of the expected trajectory of overall costs and headcount for the following two years. The plan has been developed following a consultation with stakeholders, and the feedback statement shows respondents were broadly supportive of the FRC’s overall approach to its responsibilities and commitment to delivering the principles outlined in the Government White Paper ‘Restoring trust in audit and corporate governance,’. The FRC anticipates an increase of £6.5m in its overall costs for 2023-24, reflecting a delay in the creation of the Audit, Reporting and Governance Authority (ARGA), and has re-prioritised its work to focus on changes that can be made using its existing powers and remit and where appropriate, planning for the creation of new ARGA powers and functions. Despite these challenges, the FRC has already taken numerous steps towards achieving the goals of the reform program. For example, it has released a consultation on a draft Minimum Standard for Audit Committees, as well as publishing guidance on professional judgement for auditors. The FRC's Supervision division has taken responsibility for Public Interest Entity (PIE) auditor registration, which allows the FRC to act decisively when it identifies systemic issues in an audit firm. And the Enforcement division continues to deliver proportionate sanctions in a timely manner, with Constructive Engagement (CE) an increasingly useful approach to many of the cases it investigates. Sir Jon Thompson, CEO of the FRC, said:

"We are actively working towards the goals of the reform program, and though the legislation required to establish ARGA has been delayed, the FRC remained busy throughout 2022 by concentrating on the changes we can bring about through our current powers and remit. This plan shows we are committed to fulfilling our mission of serving the public interest and enhancing the quality of corporate governance and reporting."

View the FRC's 3-Year Plan and feedback statement

Explore the topics

- Generic Announcement

Is this page useful?

- Yes this page is useful

- No this page is not useful

Wait, what does 'price gouging' mean? How Harris plans to control it in the grocery aisle

Democratic presidential nominee Kamala Harris is expected to announce plans to fight food inflation with a federal ban on price gouging on groceries , but how much this would help Americans is debatable, economists say.

Over the past few years, President Joe Biden’s administration has blamed corporate greed for the surge in inflation, and Harris is expected to take up that torch in a speech Friday in North Carolina's capital city of Raleigh. Corporations raised prices when snarled supply chains during the pandemic created shortages of nearly everything, and just never stopped or lowered prices again after supply chains stabilized, they argue.

“Some companies are keeping prices high even though input costs are falling, and supply chains are back to normal,” the White House said in a news release in March.

If higher grocery prices are the result of potential mergers between larger supermarkets and food producers and corporate greed, Americans may benefit from Harris' approach. However, many economists have doubts such a policy would be effective for various reasons, including whether price gouging is the root of inflation at all.

Michael Ashton, managing principal at Enduring Investments LLC, who specializes in inflation analysis, questioned the existence of price gouging "in an industry as competitive as grocery."

“Why did the price gouging just start in 2021-22?" he asked. "Did grocers just not realize they had this power before then or did they not get greedy until 2021?”

Profit margins in the food industry already tend to be among the lowest. Net profit margin in 2023 in the grocery industry hit 1.6%, the lowest level since 2019, according to FMI, The Food Industry Association.

What caused food prices to spike?

During the pandemic, economists generally agreed supply chain shortages initially caused price increases.

After supply chains were ironed out, the dispute began. Researchers from the Federal Reserve Bank of Kansas City and former Federal Reserve Chairman Ben Bernanke separately said last year that fast-rising wages when the economy reopened was a major contributor to rising grocery prices.

However, left-leaning government watchdog Accountable.US and former Labor Secretary Robert Reich say companies have been raising prices on Americans to reward stockholders with dividends and stock buybacks.

“Consumers are getting shafted, as corporations tell Wall Street they expect to be able to keep their prices and profits in the stratosphere,” Reich wrote in June .

The Groundwork Collaborative, a nonprofit that earlier this year said "climate change, corporate consolidation, and profiteering" are reasons grocery prices remain high, even quantified in January how much corporate greed contributed to inflation. In the middle of 2023, corporate profit margins accounted for roughly half of inflation and more than a third since the pandemic began, it estimated.

“The industry keeps pushing the envelope to pad profits and bring in enough money for shareholder giveaways, but Americans are fed up,” said Liz Zelnick, director of the economic security & corporate power program at Accountable.US, in a news release.

Inflation's down but prices are high?: Prices don't drop when inflation eases. Why your wallet will be hurting for a while.

Could Harris’ plan work to lower food prices?

Opinions are mixed.

Reich, who sees corporate greed as the root of soaring inflation, advocated for a policy like what Harris is expected to announce.

“Put blame for high prices squarely where it belongs: on big corporations with monopoly power to keep prices high,” he wrote. “And take those corporations on: Condemn them for price gouging. Threaten them with antitrust lawsuits, price-gouging lawsuits, even price controls. Criticize them for making huge profits and giving their top executives record pay while shafting consumers.”

Others, like Sen. Rick Scott , R-Fla . , call the plan “federal price controls,” which he says don’t work.

Harris’ solution to fighting inflation “is big government on steroids – where Washington bureaucrats stick their hands into American businesses and say what they can and can’t sell a product for,” he said in a news release on Thursday. “It never works because it causes companies to make much less of something – destroying supply and causing a mass shortage of goods.”

Such a policy could also be difficult to implement because calculating an appropriate profit margin might be tricky, said James Knightley, Dutch bank ING’s chief international economist.

“It’s critical that we get the economic facts right and avoid political rhetoric," said Sarah Gallo, senior vice president of product policy and federal affairs at the Consumer Brands Association trade group. "The reality is that there are complex economic factors at play."

Is food inflation still even a thing?

Three in 5 Americans said corporate greed was a “major cause” of inflation, according to a poll by left-leaning polling and research group Navigator Research of 1,000 registered voters. However, that was in January when annual inflation was running at a 3.1% pace . Since then, inflation has eased further.

"When looking at the inflation story, it's good now but the perception among consumers is different because prices are still elevated," Knightley said. "We're not returning to 2019 prices," which is what consumers are comparing to.

Since inflation only measures the pace at which prices are changing, actual sticker prices remain high from climbing over the past couple of years. Inflation in the 12 months through July was 2.9%, sharply down from its 40-year high of 9.1% in June 2022 and the lowest since March 2021. Overall, annual food inflation rose a smaller 2.2%, with grocery prices rising at an even slower 1.1% pace.

“Why intervene?” Knightley said. “From an economics perspective, it’s looking like a pretty good place right now. This may be good messaging for the election, but it (inflation) may be falling by the wayside.”

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at [email protected] and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.

IMAGES

COMMENTS

Our two-season 2020-2021 Build Thread ranked #1 in "Most Bookmarked" and "Most Replied" on Chief Delphi, and received well over 51,000 views. Our 2022 Build Thread was also "Most Bookmarked" with more than 45,000 views, and our 2023 Build Thread is on track to do the same. The growth of the Open Alliance to more than 95 teams for ...

Beginning in the 2023 season, this award will only be presented at events with more than 1 Rookie at them. We are hopeful that with these changes, we will continue to improve the team experience. Feel free to reach out to [email protected] with any questions or suggestions. Updates and changes to judging and awards for the 2023 ...

Example Budget - This document shares things to consider when creating your FIRST Robotics Competition budget as well as the median budgets reported to FIRST broken into different categories as a starting point.. Budget Template - Teams can use this Budget Template (file automatically downloads) to create their own team budget.; Business Plan Worksheet - A worksheet, created by The Compass ...

XXX Business PlanRev. Oct 2019Mission Statement:Please briefly indicate what you b. lieve to be the "driving engine" of y. ur team. Your mission should be clear and concise. It should represent to any r. am strives to accomplish.Team History and Growth:Please briefly highlight where your team is from and how your team has grown and/or.

FRC Plan and Budget 2024-25 draft for consultation: Publication date: 15 December 2023 Format: PDF, 5.3 MB Name: Financial Reporting Council: 3 Year Plan 2023-26: Publication date: 27 March 2023 Format: PDF, 883.1 KB Name: FRC Strategy, Plan & Budget 2022-25: Publication date: 5 April 2022 ...

18 July 2023 Type: Annual report: Format: PDF, 6.7 MB Name: FRC Annual Report and Accounts 2022/23 (Web Accessible Format) Publication date: 18 July 2023 ... FRC Plan and Budget We have published our latest Plan and Budget, outlining our priorities and objectives for the period 2024-2025. ...

The Financial Reporting Council (FRC) today announced its 2023-2026 draft 3-Year Plan which sets out its priorities for the next three years and the resources it will need to achieve them. The plan incorporates a balanced yet assertive approach and reflects the delay of anticipated legislation to create the Audit, Reporting and Governance Authority (ARGA), which has had an impact on the ...

The FRC also sets out its proposed budget for 2023/24 for expenditure and funding. The press release and draft 3-year Plan and Budget 2023-26 is available from the FRC website. The Financial Reporting Council (FRC) has published a consultation on its 3-year plan and budget for 2023-2026. Comments are requested by 27 January 2023.

FRC 8 | 2023 Business Plan Palo Alto Senior High School 50 Embarcadero Rd., Palo Alto, CA 94301 (650) 798-4560 palyrobotics.com. Business Plan Team Mission Statement Paly Robotics is dedicated to enriching the educational experiences of our students and community by increasing STEAM exposure and inspiring

12. It would be helpful for the FRC in its forward plan to frame its priorities within the context of the wider UK economic and business landscape. Looking at 2023, and across the three-year period this plan covers, it is expected that the UK economy will be entering recession. This

The UK's Financial Reporting Council (FRC) has published its latest 3-Year Plan, outlining its priorities and objectives for the period 2023-2026. It gives a detailed breakdown of intended expenditure for 2023-24 and a summary of the expected trajectory of overall costs and headcount for the following two years.

The FRC has announced a revised 2023-26 Draft 3 Year Plan which sets out its revised priorities for the next three years and how it will achieve them. This is the second three-year plan published by the FRC in 2022, following the previous 2022-25 3-Year Plan released on 5 April 2022. Whilst the revised plan re-affirms the FRC's intentions to transition to the Audit, Reporting and Governance ...

Via: [email protected] Dear Sir Jon A RESPONSE TO THE FR'S DRAFT 3 YEAR - PLAN 2023-25 1. CCAB takes the opportunity to comment on the above the FR'S Draft 3 YEAR - Plan 2023-25 issued by the FRC in January. About CCAB 2. The combined membership of the five CCAB bodies - ICAEW, ACCA, ICAS, CIPFA and

The elevator is a single stage chain elevator. The frame is constructed out of 1/16th inch box tubing. The frame is mounted to the boxtube using 2 ¼ inch aluminum plates. Two types of elevator supports. The back brace prevents warping and bowing in the center of the elevator. The poles prevent warping at the top of the elevator.

Introduction. In March 2023, the FRC published the 23-26 Plan which re-prioritises work to reflect the delay in the anticipated legislation to create the Audit, Reporting and Governance Authority (ARGA).This is the second 3-Year Plan published by the FRC; the first, the 2022-25 Plan, introduced the four faces regulatory approach: (a) System Partner (b) Supervisor

The Financial Reporting Council (FRC) has announced its 2023-2026 draft 3-Year Plan which sets out its priorities for the next three years and the resources it will need to achieve them.. The plan incorporates a balanced yet assertive approach and reflects the delay of anticipated legislation to create the Audit, Reporting and Governance Authority (ARGA), which has had an impact on the ...

FRC Plan and Budget We have published our latest Plan and Budget, outlining our priorities and objectives for the period 2024-2025. Annual Reports to the Secretary of State We report annually to the Secretary of State in our role as Independent Supervisor of Auditors General and on our rofessional Oversight Responsibilities. ...

FRC publishes draft 3-year Plan for 2023-26; FRC announces areas of supervisory focus for 2023/24; Periodic Review of financial reporting standards proposes revised revenue and lease accounting amongst other improvements; FRC launches Audit & Assurance Sandbox; FRC Lab - A focus on the year-end

Each year, we have continued to build upon the strong foundation laid out in 2011 by continuously adding and updating to our Business Plan. 2024 AdamBots Business Plan. 2023 AdamBots Business Plan. 2022 AdamBots Business Plan. 2021 AdamBots Business Plan. 2020 AdamBots Business Plan. 2019 AdamBots Business Plan. 2018 AdamBots Business Plan

The Financial Reporting Council (FRC) has published its 3-year plan and budget for 2023-2026. The plan reflects the delay of anticipated legislation to create the Audit, Reporting and Governance Authority (ARGA), which has had an impact on the associated increase in capacity, cost and headcount ...

FRC Business Plan is a comprehensive guide to help teams create a successful business plan for their FIRST Robotics Competition (FRC) team. It covers topics such as budgeting, fundraising, marketing, and more. ... By admin March 7, 2023 Updated: March 7, 2023 No Comments 9 Mins Read. Facebook Twitter Pinterest LinkedIn Tumblr Email. 3 Types Of ...

NYC rolls out plan to convert empty office buildings into 20,000 homes as remote working persists. ... 2023-08-22T12:07:24Z ... tech, and business — delivered daily. Read preview.

The White House said that the SAVE plan could lower borrowers' monthly payments to zero dollars, reduce monthly costs in half and save those who make payments at least $1,000 yearly. Additionally ...

Over 20 million student-loan borrowers are expected to benefit from the new SAVE repayment plan, which would save them about $1,000 a year. ... 2023-08-22T12:35:01Z ... tech, and business ...

A 2024 report from Business Talent Group found that "95% of executives anticipate challenges in securing the balanced mix of skills, capacity, and expertise over the next 3-5 years."

Restaurant industry sales are expected to reach $855 billion in 2023, returning to near pre-pandemic, 2019 levels and demonstrating healthy recovery for the industry.Profits, on the other hand ...

Business Insider's free retirement calculator offers free estimates to help you plan accordingly based on personal details like your life expectancy, income, expected expenses, and estimated ...

Overall, the budgeted cost of the FRC and the UK Endorsement Board will increase to £67.9m, up from £59.8m last year, with a 9.7% increase in budgeted headcount by March 2024. The 2023/26 Strategy and Plan & Budget consultation will run until 27 January 2023. Respondents should submit their comments to [email protected] by close of ...

Published: 27 March 2023. The Financial Reporting Council (FRC) has published its latest 3-Year Plan, outlining its priorities and objectives for the period 2023-2026. It gives detailed breakdown of intended expenditure for 2023-24 and a summary of the expected trajectory of overall costs and headcount for the following two years.

Net profit margin in 2023 in the grocery industry hit 1.6%, the lowest level since 2019, according to FMI, The Food Industry Association. What caused food prices to spike?