- No category

Case Study 1 - Financial statement analysis

Related documents.

Add this document to collection(s)

You can add this document to your study collection(s)

Add this document to saved

You can add this document to your saved list

Suggest us how to improve StudyLib

(For complaints, use another form )

Input it if you want to receive answer

What are Financial Statements?

- #1 Financial Statements Example – Cash Flow Statement

- #2 Financial Statements Example – Income Statement

- #3 Financial Statements Example – Balance Sheet

Additional Resources

Financial statements examples – amazon case study.

An in-depth look at Amazon's financial statements

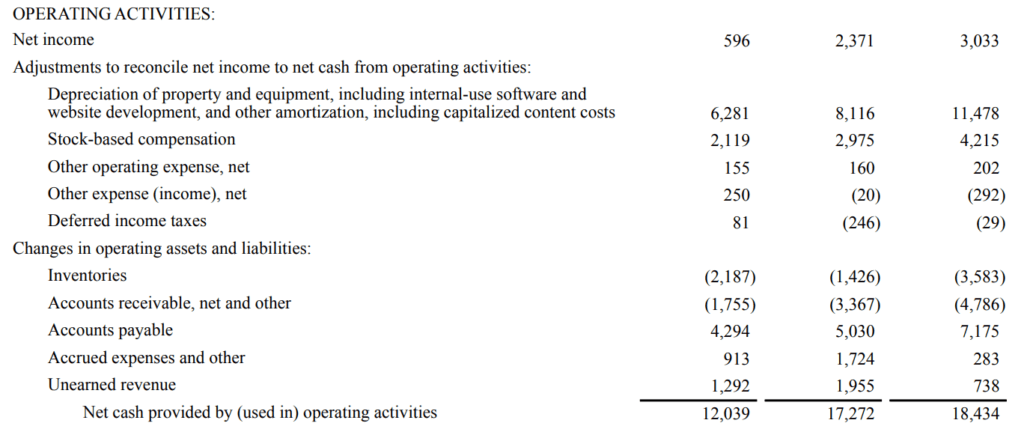

Financial statements are the records of a company’s financial condition and activities during a period of time. Financial statements show the financial performance and strength of a company . The three core financial statements are the income statement , balance sheet , and cash flow statement . The three statements are linked together to create the three statement financial model . The analysis of financial statements can help an analyst assess the profitability and liquidity of a company. Financial statements are complex. It is best to become familiar with them by looking at financial statements examples.

In this article, we will take a look at some financial statement examples from Amazon.com, Inc. for a more in-depth look at the accounts and line items presented on financial statements.

Learn to analyze financial statements with Corporate Finance Institute’s Reading Financial Statements course!

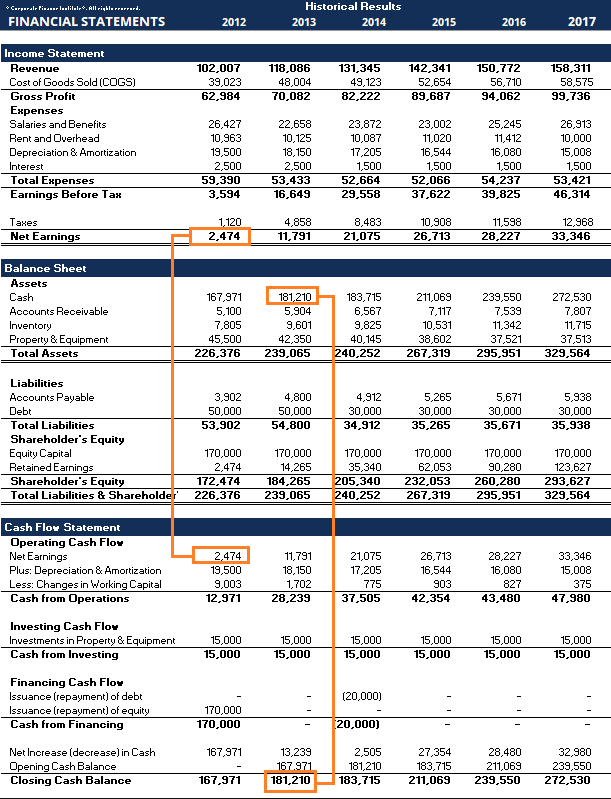

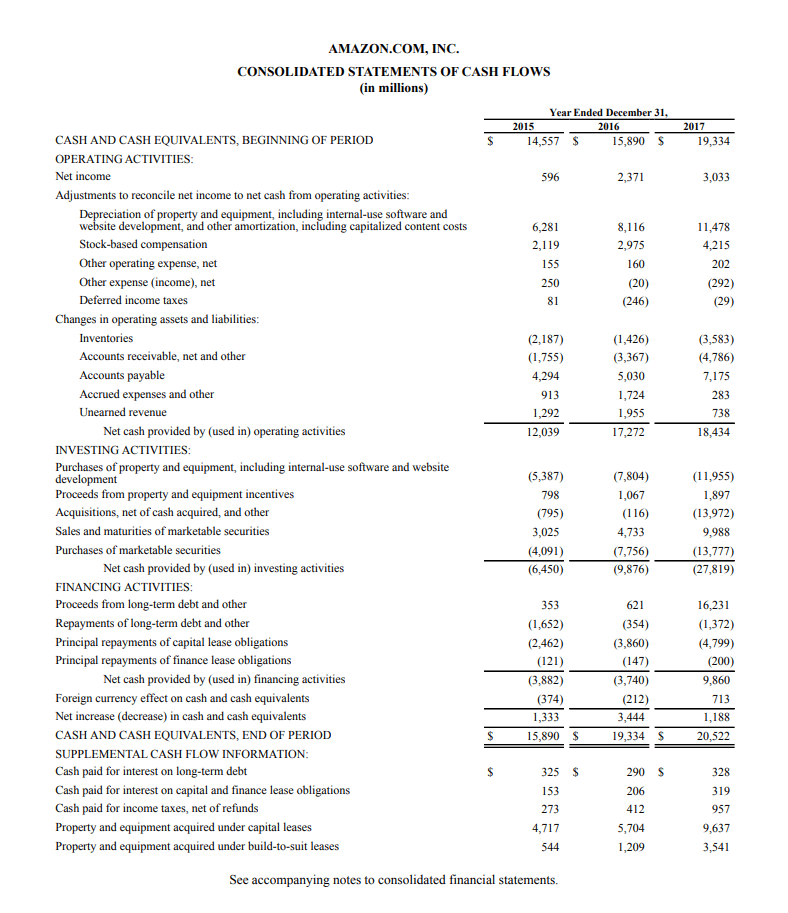

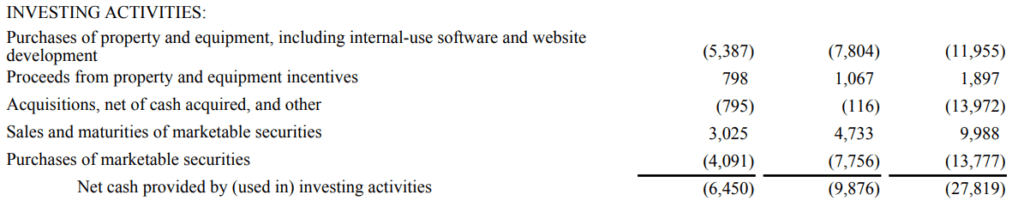

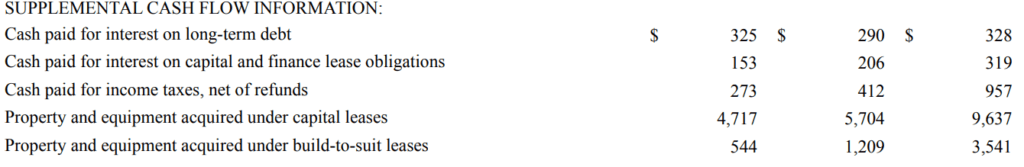

#1 Financial Statements Example – Cash Flow Statement

The first of our financial statements examples is the cash flow statement. The cash flow statement shows the changes in a company’s cash position during a fiscal period. The cash flow statement uses the net income figure from the income statement and adjusts it for non-cash expenses. This is done to find the change in cash from the beginning of the period to the end of the period.

Most companies begin their financial statements with the income statement. However, Amazon (NASDAQ: AMZN) begins its financial statements section in its annual 10-K report with its cash flow statement.

The cash flow statement begins with the net income and adjusts it for non-cash expenses, changes to balance sheet accounts, and other usages and receipts of cash. The adjustments are grouped under operating activities , investing activities , and financing activities .

The following are explanations for the line items listed in Amazon’s cash flow statement. Please note that certain items such as “Other operating expenses, net” are often defined differently by different companies:

Operating Activities:

Depreciation of property and equipment (…) : a non-cash expense representing the deterioration of an asset (e.g. factory equipment).

Stock-based compensation : a non-cash expense as a company awards stock options or other stock-based forms of compensation to employees as part of their compensation and wage agreements.

Other operating expense, net: a non-cash expense primarily relating to the amortization of Amazon’s intangible assets .

Other expense (income), net: a non-cash expense relating to foreign currency and equity warrant valuations.

Deferred income taxes : temporary differences between book tax and actual income tax. The amount of tax the company pays may be different from what it shows on its financial statements.

Changes in operating assets and liabilities : non-cash changes in operating assets or liabilities. For example, an increase in accounts receivable is a sale or a source of income where no actual cash was received, thus resulting in a deduction. Conversely, an increase in accounts payable is a purchase or expense where no actual cash was used, resulting in an addition to net cash.

Investing Activities:

Purchases of property and equipment (…): purchases of plants, property, and equipment are usages of cash. A deduction from net cash.

Proceeds from property and equipment incentives: this line is added for additional detail on Amazon’s property and equipment purchases. Incentives received from property and equipment vendors are recorded as a reduction in Amazon’s costs and thus a reduction in cash usage.

Acquisitions , net of cash acquired, and other: cash used towards acquisitions of other companies, net of cash acquired as a result of the acquisition. A deduction from net cash.

Sales and maturities of marketable securities : the sale or proceeds obtained from holding marketable securities (short-term financial instruments that mature within a year) to maturity. An addition to net cash.

Purchases of marketable securities: the purchase of marketable securities. A deduction from net cash.

Financing Activities:

Proceeds from long-term debt and other: cash obtained from raising capital by issuing long-term debt. An addition to net cash.

Repayments of long-term debt and other: cash used to repay long-term debt obligations. A deduction from net cash.

Principal repayments of capital lease obligations: cash used to repay the principal amount of capital lease obligations. A deduction from net cash.

Principal repayments of finance lease obligations: cash used to repay the principal amount of finance lease obligations. A deduction from net cash.

Foreign currency effect on cash and cash equivalents : the effect of foreign exchange rates on cash held in foreign currencies.

Supplemental Cash Flow Information:

Cash paid for interest on long-term debt: cash usages to pay accumulated interest from long-term debt.

Cash paid for interest on capital and finance lease obligations: cash usages to pay accumulated interest from capital and finance lease obligations.

Cash paid for income taxes , net of refunds: cash usages to pay income taxes.

Property and equipment acquired under capital leases: the value of property and equipment acquired under new capital leases in the fiscal period.

Property and equipment acquired under build-to-suit leases: the value of property and equipment acquired under new build-to-suit leases in the fiscal period.

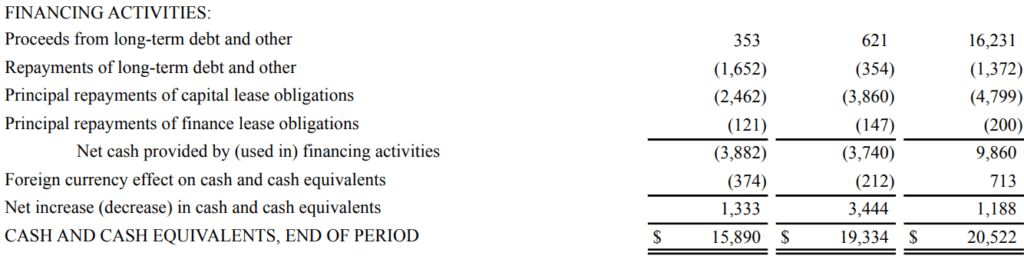

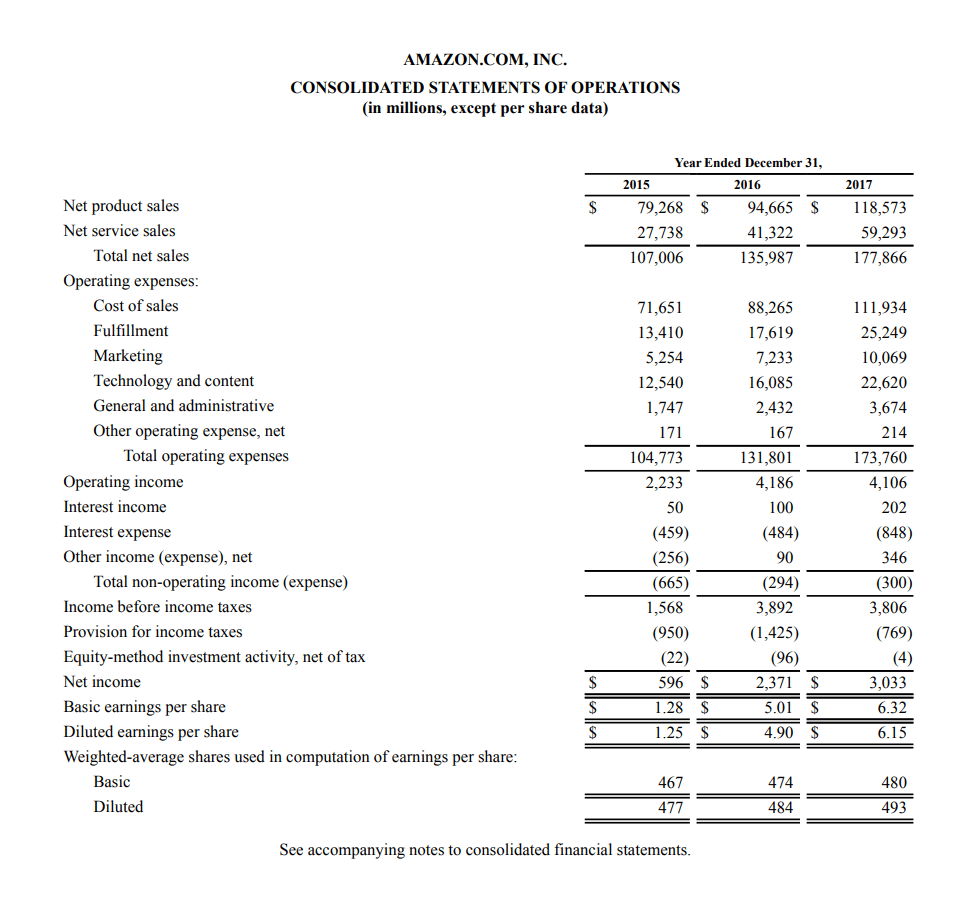

#2 Financial Statements Example – Income Statement

The next statement in our financial statements examples is the income statement. The income statement is the first place for an analyst to look at if they want to assess a company’s profitability .

Want to learn more about financial analysis and assessing a company’s profitability? Financial Modeling & Valuation Analyst (FMVA)® Certification Program will teach you everything you need to know to become a world-class financial analyst!

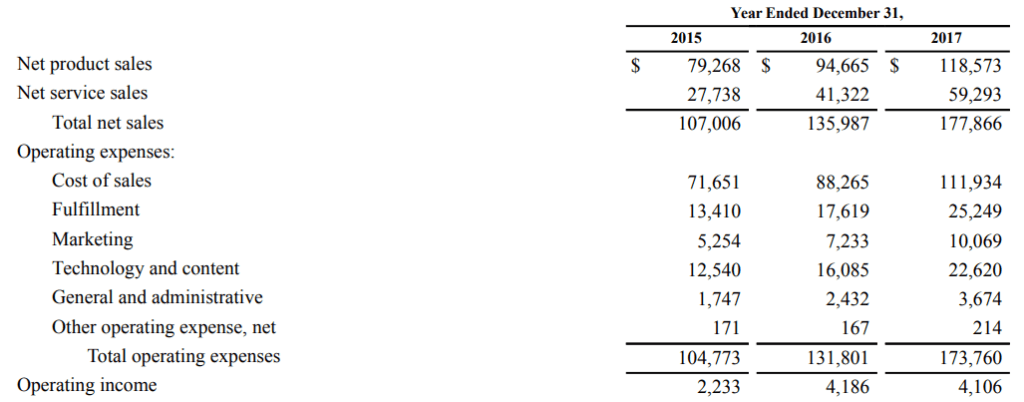

The income statement provides a look at a company’s financial performance throughout a certain period, usually a fiscal quarter or year. This period is usually denoted at the top of the statement, as can be seen above. The income statement contains information regarding sales , costs of sales , operating expenses, and other expenses.

The following are explanations for the line items listed in Amazon’s income statement:

Operating Income (EBIT):

Net product sales: revenue derived from Amazon’s product sales such as Amazon’s first-party retail sales and proprietary products (e.g., Amazon Echo)

Net services sales: revenue generated from the sale of Amazon’s services. This includes proceeds from Amazon Web Services (AWS) , subscription services, etc.

Cost of sales: costs directly associated with the sale of Amazon products and services. For example, the cost of raw materials used to manufacture Amazon products is a cost of sales.

Fulfillment: expenses relating to Amazon’s fulfillment process. Amazon’s fulfillment process includes storing, picking, packing, shipping, and handling customer service for products.

Marketing : expenses pertaining to advertising and marketing for Amazon and its products and services. Marketing expense is often grouped with selling, general, and administrative expenses (SG&A) but Amazon has chosen to break it out as its own line item.

Technology and content: costs relating to operating Amazon’s AWS segment.

General and administrative : operating expenses that are not directly related to producing Amazon’s products or services. These expenses are sometimes referred to as non-manufacturing costs or overhead costs. These include rent, insurance, managerial salaries, utilities, and other similar expenses.

Other operating expenses, net: expenses primarily relating to the amortization of Amazon’s intangible assets.

Operating income : the income left over after all operating expenses (expenses directly related to the operation of the business) are deducted. Also known as EBIT .

Net Income:

Interest income: income generated by Amazon from investing excess cash. Amazon typically invests excess cash in investment-grade , short to intermediate-term fixed income securities , and AAA-rated money market funds.

Interest expense : expenses relating to accumulated interest from capital and finance lease obligations and long-term debt.

Other income (expense), net: income or expenses relating to foreign currency and equity warrant valuations.

Income before income taxes : Amazon’s income after operating and non-operating expenses have been deducted.

Provision for income taxes: the expense relating to the amount of income tax Amazon must pay within the fiscal year .

Equity-method investment activity, net of tax: proportionate losses or earnings from companies where Amazon owns a minority stake .

Net income: the amount of income left over after Amazon has paid off all its expenses.

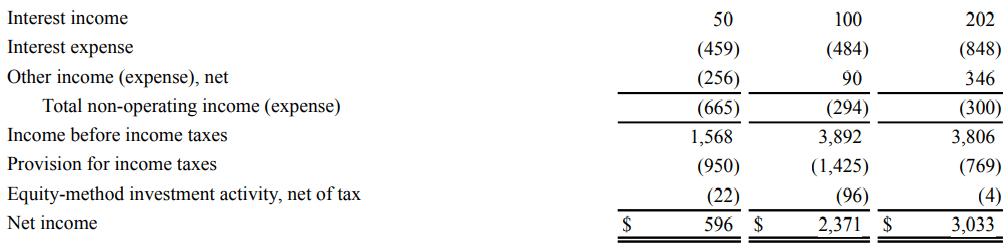

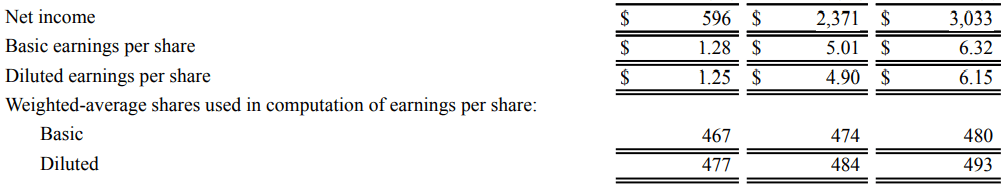

Earnings per Share (EPS):

Basic earnings per share : earnings per share calculated using the basic number of shares outstanding.

Diluted earnings per share: earnings per share calculated using the diluted number of shares outstanding.

Weighted-average shares used in the computation of earnings per share: a weighted average number of shares to account for new stock issuances throughout the year. The way the calculation works is by taking the weighted average number of shares outstanding during the fiscal period covered.

For example, a company has 100 shares outstanding at the beginning of the year. At the end of the first quarter, the company issues another 50 shares, bringing the total number of shares outstanding to 150. The calculation for the weighted average number of shares would look like below:

100*0.25 + 150*0.75 = 131.25

Basic: the number of shares outstanding in the market at the date of the financial statement.

Diluted : the number of shares outstanding if all convertible securities (e.g. convertible preferred stock, convertible bonds ) are exercised.

#3 Financial Statements Example – Balance Sheet

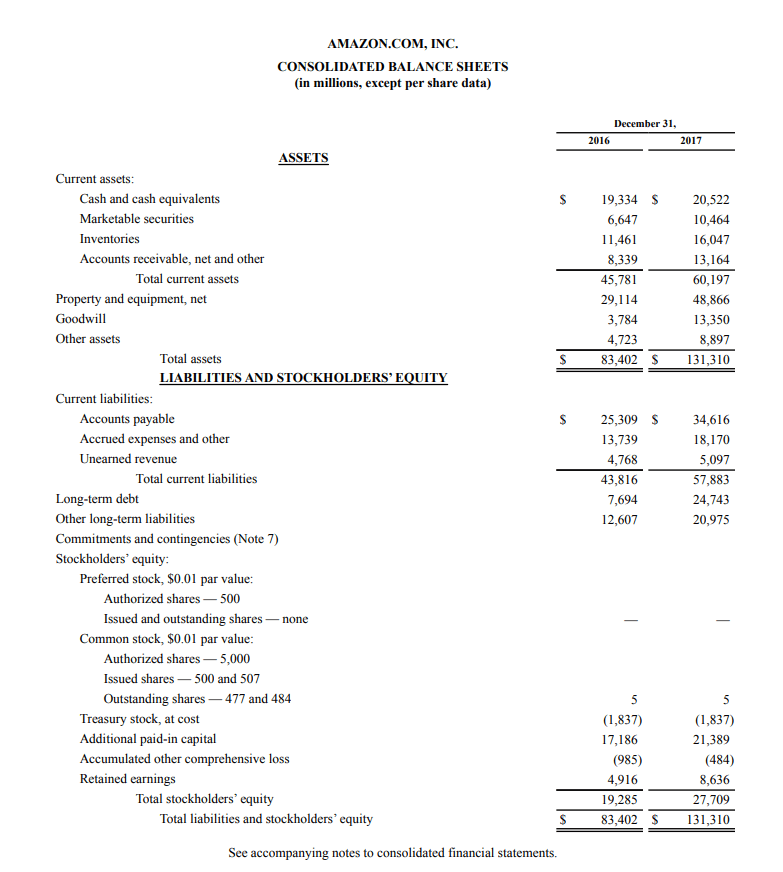

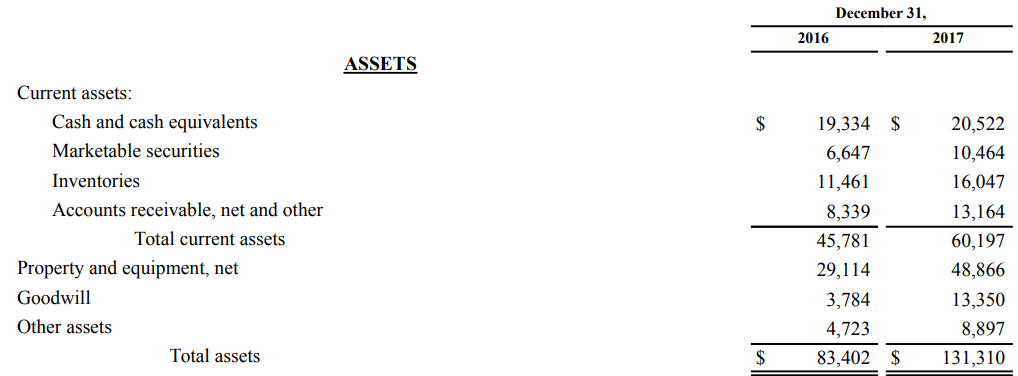

The last statement we will look at with our financial statements examples is the balance sheet. The balance sheet shows the company’s assets , liabilities , and stockholders’ equity at a specific point in time.

Learn how a world-class financial analyst uses these three financial statements with CFI’s Financial Modeling & Valuation Analyst (FMVA)® Certification Program !

Unlike the income statement and the cash flow statement, which display financial information for the company during a fiscal period, the balance sheet is a snapshot of the company’s finances at a specific point in time. It can be seen above in the line regarding the date.

Compared to the Cash Flow Statement and Statement of Income, it states ‘December 31, 2017’ as opposed to ‘Year Ended December 31, 2017’. By displaying snapshots from different periods, the balance sheet shows changes in the accounts of a company.

The following are explanations for the line items listed in Amazon’s balance sheet:

Cash and cash equivalents : cash or highly liquid assets and short-term commitments that can be quickly converted into cash.

Marketable securities: short-term financial instruments that mature within a year.

Inventories : goods currently held in stock for sale, in-process goods, and materials to be used in the production of goods or services.

Accounts receivable , net and other: credit sales of a business that have not yet been fully paid by customers.

Goodwill : the difference between the price paid in an acquisition of a company and the fair market value of the target company’s net assets.

Other assets: Amazon’s acquired intangible assets, net of amortization. This includes items such as video, music content, and long-term deferred tax assets.

Liabilities:

Accounts payable : short-term liabilities incurred when Amazon purchases goods from suppliers on credit.

Accrued expenses and other: liabilities primarily related to Amazon’s unredeemed gift cards, leases and asset retirement obligations, current debt, acquired digital media content, etc.

Unearned revenue : revenue generated when payment is received for goods or services that have not yet been delivered or fulfilled. Unearned revenue is a result of revenue recognition principles outlined by U.S. GAAP and IFRS .

Long-term debt: the amount of outstanding debt a company holds that has a maturity of 12 months or longer.

Other long-term liabilities: Amazon’s other long-term liabilities, which include long-term capital and finance lease obligations, construction liabilities, tax contingencies, long-term deferred tax liabilities, etc. (Note 6 of Amazon’s 2017 annual report).

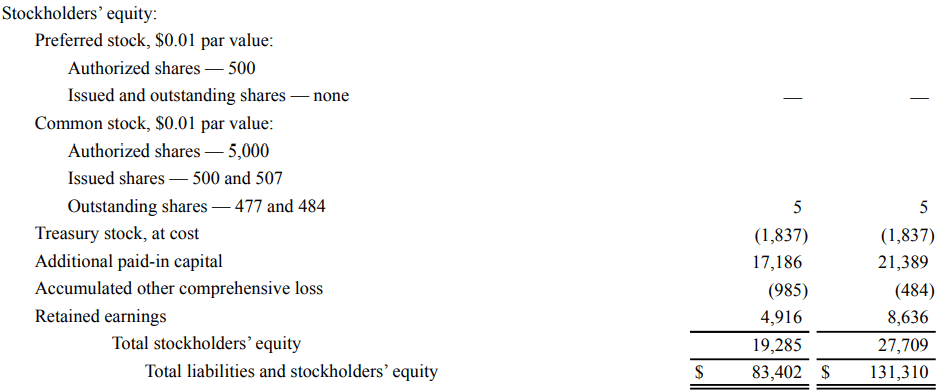

Stockholders’ Equity:

Preferred stock : stock issued by a corporation that represents ownership in the corporation. Preferred stockholders have a priority claim on the company’s assets and earnings over common stockholders. Preferred stockholders are prioritized with regard to dividends but do not have any voting rights in the corporation.

Common stock : stock issued by a corporation that represents ownership in the corporation. Common stockholders can participate in corporate decisions through voting.

Treasury stock , at cost: also known as reacquired stock, treasury stock represents outstanding shares that have been repurchased from the stockholder by the company.

Additional paid-in capital : the value of share capital above its stated par value in the above line item for common stock ($0.01 in the case of Amazon). In Amazon’s case, the value of its issued share capital is $17,186 million more than the par value of its common stock, which is worth $5 million.

Accumulated other comprehensive loss: accounts for foreign currency translation adjustments and unrealized gains and losses on available-for-sale/marketable securities.

Retained earnings : the portion of a company’s profits that is held for reinvestment back into the business, as opposed to being distributed as dividends to stockholders.

As you can see from the above financial statements examples, financial statements are complex and closely linked. There are many accounts in financial statements that can be used to represent amounts regarding different business activities. Many of these accounts are typically labeled “other” type accounts, such as “Other operating expenses, net”. In our financial statements examples, we examined how these accounts functioned for Amazon.

Now that you have become more proficient in reading the financial statements examples, round out your skills with some of our other resources. Corporate Finance Institute has resources that will help you expand your knowledge and advance your career! Check out the links below:

- Financial Modeling & Valuation Analyst (FMVA)® Certification Program

- Financial Analysis Fundamentals

- Three Financial Statements Summary

- Free CFI Accounting eBook

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

|

|

If you do not like the background color, you can change it by highlighting the color you prefer in the scroll box below.

White Aquamarine Azure Bisque Cadetblue Coral Cornflowerblue Cornsilk Darkorange Darkseagreen Forestgreen Gold Honeydew Indianred Lavender Lemonchiffon Lightgreen Lightpink Lightsteelblue Limegreen Linen Mediumslateblue Mediumspringgreen Mintcream Mistyrose Olivedrab Orange Orangered Palevioletred Papayawhip Peachpuff Rosybrown Seashell Silver Skyblue Snow Tomato Thistle Turquoise Violet Wheat White Whitesmoke Yellow

|

|

|

|

|

|

|

|

|

Case Studies in Business Finance and Financial Analysis

- © 1971

- K. Midgley ,

- R. G. Burns

You can also search for this author in PubMed Google Scholar

327 Accesses

11 Citations

This is a preview of subscription content, log in via an institution to check access.

Access this book

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

- Case Studies

Table of contents (6 chapters)

Front matter, starting a small business.

- K. Midgley, R. G. Burns

The Effects of Budgetary and Other Governmental Measures on Profitability

Raising long-term capital, evaluating returns from long-term investment, head office integration following a merger, evaluation of an ordinary share, back matter, bibliographic information.

Book Title : Case Studies in Business Finance and Financial Analysis

Authors : K. Midgley, R. G. Burns

DOI : https://doi.org/10.1007/978-1-349-00981-7

Publisher : Palgrave Macmillan London

eBook Packages : Palgrave Business & Management Collection , Business and Management (R0)

Copyright Information : K. Midgley and R. G. Burns 1971

Softcover ISBN : 978-0-333-11624-1 Published: 18 June 1971

eBook ISBN : 978-1-349-00981-7 Published: 18 June 1971

Edition Number : 1

Number of Pages : IV, 128

Topics : Business Finance

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Introduction to Financial Analysis

(0 reviews)

Kenneth S. Bigel, New York City, New York

Copyright Year: 2022

Publisher: Open Touro

Language: English

Formats Available

Conditions of use.

Table of Contents

- About the Author

- Author's Acknowledgements

- Open Touro Acknowledgements

- Chapter 1: Introduction

- Chapter 2: Financial Statement Analysis: The Balance Sheet

- Chapter 3: Financial Statements Analysis: The Income Statement

- Chapter 4: Financial Statements and Finance

- Chapter 5: Financial Ratios and Forecasting; Liquidity and Solvency Ratios

- Chapter 6: Profitability and Return Ratios, and Turnover

- Chapter 7: Market Ratios

- Chapter 8: Cash Flow, Depreciation, and Financial Projections

- Chapter 9: Corporate Forecasting Models

- Chapter 10: The Time Value of Money: Simple Present- and Future-Values

- Chapter 11: The Time Value of Money: Annuities, Perpetuities, and Mortgages

- Chapter 12: Fixed Income Valuation

- Chapter 13: Interest Rates

- Chapter 14: Equity Valuation and Return Measurement

Ancillary Material

About the book.

This Open Textbook is a dynamic guide incorporating the essential skills needed to build a foundation in Financial Analysis . Students and readers will learn how to insightfully read a Financial Statement, utilize key financial ratios in order to derive forward-looking investment-related inferences from the accounting data, engage in elementary forecasting and modeling, master the theory of the Time Value of Money , and learn to price stocks and bonds in an environment in which interest rates constantly change. Ample problems and solutions, and review questions are provided to the student so that s/he can gauge his/her progress. This text will be continually updated in order to provide novel information and enhance students’ experiences.

About the Contributors

Dr. Bigel was formerly a fixed income analyst in the International Banking Department of the Bankers Trust Company (now DeutscheBank), analyzing international wholesale loans and debt instruments, and a graduate of its Institutional Credit Training Program. He later was affiliated with the Ford Motor Company, conducting investment analysis and planned car profits analysis, annual budgeting, and strategic planning. Subsequently, he worked as a senior portfolio manager attached to the wealth management division of Prudential Securities. He was formerly registered under Series 3, 7, 15, 24, 63, and 65.

As an independent consultant, he was involved in numerous high-profile cases including Enron. Dr. Bigel has conducted executive education programs for Morgan Stanley Capital Markets, Merrill Lynch Capital Markets, UBS, Lehman Brothers, CIBC, G.X. Clarke & Co. (now part of Goldman Sachs), and China CITIC Bank. He currently serves on the Financial Industry Regulatory Association’s Board of Arbitrators.

His extensive published research relates to Financial Ethics and Moral Development, Behavioral Finance, and Political Economy. He has been teaching college and graduate level finance courses since 1989.

Dr. Bigel has been interviewed on American radio, was a visiting scholar at Sichuan University and at Xi’an Jiaotong University in China, and appeared on Chinese television. At Touro University, he is a member of the Faculty Senate, The Touro Academy of Leadership and Management, The Assessments Committee, and The Promotions Committee. He chairs the Integrity Committee at LCM.

His wife and their three children reside in New York City. He enjoys reading, playing 60’s guitar, seeing his students succeed professionally, and watching his kids grow.

Educational Background:

- Ph.D., (high honors) New York University, Steinhardt School of Culture, Education, and Human Development (Business Education and Financial Ethics)

- M.B.A., New York University, Stern School of Business (Finance)

- B.A. (honors), Brooklyn College of the City University of New York (Philosophy and Mathematics)

- CFP™, International Board of Standards and Practices for Certified Financial Planners

- Hebrew University of Jerusalem (one-year program)

Dr. Bigel welcomes questions and constructive suggestions. He can be reached at <[email protected]>.

Contribute to this Page

IMAGES

VIDEO

COMMENTS

Financial statement is the process of selection, relation and evaluation. Feature of Financial Analysis:- 1 To present a complex data contained in the financial statement in simple and comprehensible form. 2 To classify the items contained in the financial statement uncomfortable and rational groups.

Tarika Sikarwar. A Handbook of Case Studies in Finance. By Tarika Sikarwar. This book first published 2017. Cambridge Scholars Publishing. Lady Stephenson Library, Newcastle upon Tyne, NE6 2PA, UK. British Library Cataloguing in Publication Data. A catalogue record for this book is available from the British Library.

Summary. This chapter presents four case studies which provide examples of financial information upon which liquidity, leverage, profitability, and causal calculations may be performed. The first two case studies also contain example ratio summary and analysis. Two discussion cases are also provided, followed by questions related to the ...

CFO100 | 1. Case Study - 1: Financial statement analysis. The purpose of this case study is to teach students to analyze financial statements and be able to quickly identify. issues and come up with intelligent questions to explore those issues. BACKGROUND OF THE COMPANY.

case studies that could be used as AML/CFT training materials. He proposed highlighting the best of the BECAs in a publication. With the support of the Egmont Group Secretariat, the first BECA Book was published in 2015, which contained 22 of the best case submissions between 2011 and 2013, and has

ties outside the organization. The purpose of financial statement analysis is to highlight key relationships between various accounting numbers in the financial statements to provide insight into the financial conditi. n and performance of the firm. The objective is to assist analysts in pre-dicting the fut.

PDF | On Jan 1, 2011, Dr. Amalendu Bhunia and others published Financial Performance Analysis-A Case Study | Find, read and cite all the research you need on ResearchGate

customer with one cup of beer. Step 3: The transaction price in this situation is $5 for one cup of beer. Step 4: The transaction price will be allocated to the goods involved in the. performance obligations, which is beer in this case. Step 5: The revenue will be recognized immediately in this case, as the.

This study summarized the financial statement for the four year under review for Nestlé S.A and Mondeléz International Inc. the firm risk manage ment regarding the liquidity, financial and

This paper describes a financial statement analysis project useful in both preparer-based and user-based introductory courses in financial accounting. The project requires students to analyze trends in corporate performance, to evaluate corporate financial decisions, to discuss non-financial statement issues that would be important

contract with the student when the customer orders a beer and the bartender says. it will cost $5. Step 2: Identify the performance obligations in the contract: The performance. obligation in the contract is for the bartender to give the student a beer. Step 3: Determine the contract price: The contract price is $5.

Based on the Costco's financial statement on August 31, 2019, the study performed ratio analysis, forecasting free cash flow (FCF) for the next five years (from August 2020 to August 2024 ...

This thesis examines the financial performance of three airlines: Finnair, Lufthansa, and KLM Royal Dutch airlines. The study covers the years 2019-2022, and due 2022 being the current year the author will be examining the first three quarters for this year. The Covid-19 outbreak caused massive losses to industries and businesses all around the ...

Strategic Analysis Of Starbucks Corporation 1) Introduction: Starbucks Corporation, an American company founded in 1971 in Seattle, WA, is a premier roaster, marketer and retailer of specialty coffee around world. Starbucks has about 182,000 employees across 19,767 company operated & licensed stores in 62 countries.

The first of our financial statements examples is the cash flow statement. The cash flow statement shows the changes in a company's cash position during a fiscal period. The cash flow statement uses the net income figure from the income statement and adjusts it for non-cash expenses. This is done to find the change in cash from the beginning ...

Financial Analysis Case Study. USING DOW JONES INTERACTIVE. TO PERFORM FINANCIAL RATIO ANALYSIS. by H. Christine Hsu. H. Christine Hsu [email protected] is a Professor of Finance in the Department of Finance and Marketing, College of Business, California State University, Chico. If you do not like the background color, you can change it by ...

Download book PDF. Case Studies in Business Finance and Financial Analysis Download book PDF. Overview Authors: K. Midgley, R. G. Burns; K. Midgley. View author publications. You can also search for this author in ...

ALEXANDER PIERCE WATKINS: An Analysis of Case Studies Related to the Field of Financial Reporting in Accounting (Under the Direction of Dr. Victoria Dickenson) The following thesis provides answers and descriptions to questions posed in various case. studies that have to do with financial accounting,.

FINANCIAL RATIO ANALYSIS : CASE STUDIES 25 4.1 RATIO ANALYSIS 25 4.1.1 ACC Ltd. 25 4.1.1.1 Ratio Analysis for 2009 27 4.1.1.2 Ratio Analysis for 2008 30 4.1.1.3 Ratio Analysis for 2007 33 4.1.1.4 Summary for Balance Sheet and Profit & Loss Statement 36 4.1.2 Jindal Steel & Power Limited 37

This Open Textbook is a dynamic guide incorporating the essential skills needed to build a foundation in Financial Analysis. Students and readers will learn how to insightfully read a Financial Statement, utilize key financial ratios in order to derive forward-looking investment-related inferences from the accounting data, engage in elementary forecasting and modeling, master the theory of the ...

Introduction. Financial analysis is the process of examining a company's performance in the context of its industry and economic environment in order to arrive at a decision or recommendation. Often, the decisions and recommendations addressed by financial analysts pertain to providing capital to companies—specifically, whether to invest in ...

Step 1: Quantitative analysis different financial analysis techniques. approach in lending activities at theoretical level and their applicability; Step 2: Point out in details on the Vietcombank's credit evaluation. al analysis;Step 3: Based on analyses at step 1 and 2, the study willre.